A strong rights and royalties capability is key to success in the digital age

4 July 2022

Behind every great digital consumer product, is a great IP Rights operation. In the first of our series on Rights and Royalties, we explore how digital and streaming has transformed the media industry.

High speed internet, digital platforms and new formats have transformed nearly every media sector. Streaming content direct to consumer has long been norm in the music industry. More recently, film and TV have followed suit with upwards of 450 million gross subscriptions forecast in the US alone by 20271. Although there are some signs of market saturation, with Netflix reporting its first quarterly loss in subscribers, overall consumer behaviours have firmly shifted.

The digital revolution is also reshaping the publishing industry. For example, Audible and Pearson+ (Pearson’s eText subscription) have achieved massive growth, and the world’s largest English language news publishers now have more than 30 million digital subscriptions between them2.

This proliferation of digital platforms has opened new ways to deliver and new commercial models to monetise content – such as subscriptions, ad funded models, social platforms and immersive experiences. Now digital start-ups and tech giants have penetrated the market, competition continues to intensify as media companies battle for consumer attention.

What does the modern media consumer want?

Consumers have higher expectations than ever, and whist companies who excite and engage their audiences stand to extend their reach and monetisation options, those who don’t risk becoming irrelevant.

So what do today’s consumers demand?

- An easy way to find and consume relevant, personalised content, in the channels and formats they prefer

- Breadth and ‘best in category’ content – access to relevant content, potentially localised or relevant international content from elsewhere in the world, diverse and inclusive casting, niche content specific to tastes and a blend of creator economy and corporate commissioned content

What happens when these needs are not met? In our post Covid digital subscription and service economy, consumers are readily switching platforms to the services that best meet these needs to indulge in their new habits. Forecasters are lining up to predict global churn rates of over a third in 20223.

For media businesses to succeed in this new landscape, they must master and maximise their IP rights so they can continually launch relevant content that captivates consumer audiences.

A Complex Rights Ecosystem

Launching any new digital product relies on understanding your rights position. You need to be able to answer questions like:

- What content is available?

- Have we exploited all the rights we own?

- Which rights do we need to acquire to reach or retain customers?

- Which products and categories are most profitable?

- Where should we license versus buy content?

Whilst these may seem like simple questions, they are becoming ever more difficult to answer as digital platforms, partnerships, M&A and other seismic shifts have exponentially increased complexity in the rights ecosystem:

- Media companies consolidating their market position through acquisitions of IP or company mergers

For example, Universal Music Group (UMG) purchasing Bob Dylan’s back catalogue or WarnerMedia and Discovery merging to form a new media giant.

This introduces more complexity into the rights landscape – acquiring or merging catalogues means understanding historic contracts and rights positions, rights clearances and royalty positions. - Media companies are expanding their role in the value chain in response to competition

For example Netflix, which launched by licensing legacy catalogues, now makes up 40% of its content, with original hits such as Stranger Things and Squid Game which drive significant audiences.

This means that more companies are owning and managing rights – new capabilities need to be built and integrated into their businesses. - With demand for high quality content so high, more parties are involved in commissioning and production

Increasingly companies are forming partnerships to split production costs, delving into coproductions or enlisting financial investors.

This impacts rights as more contracts need to be understood, and more parties served - which leads to more complexity in rights positions. - Distribution is a changing landscape – and increasingly global

Traditional exploitation windows are changing, particularly in theatrical where a cinematic window of a few months is now condensed into 45 days before being released to digital platforms.

As western markets mature in streaming, companies seek to launch into international markets, acquiring and exploiting rights across geographical barriers.

It has become more essential than ever for sales teams to accurately understand rights, and what is ‘left on the table’ to exploit. Flexibility is key to manage ever changing window, territory and deal structures.

These factors make it harder than ever to understand your rights. But whether you’re acquiring content or producing it, it is essential to gain clear visibility of your IP. This is crucial to knowing what content you have to power your products, measuring performance against commercial targets and using data-driven decision-making in product and commercial strategies. All of these capabilities are particularly important as content budgets become squeezed by economic factors – doing more with what you have becomes critical. IP rights is at the heart of getting all of this right.

Build Rights Operations to Power Consumer Products

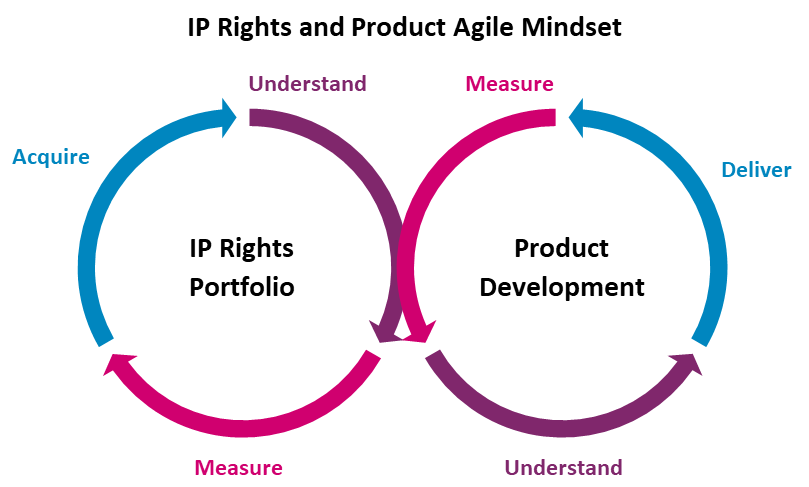

Getting the most value from your rights boils down to two key areas that urgently need investment – and complement each other:

- Rights Operations to continuously grow the value of your IP rights, and support sales and product teams understanding the rights they have to exploit

- Agile product development to create a highly relevant consumer proposition – integrated with understanding your rights positions, testing and iterating based on performance data

Rights Operations

The rights operation is the heart of every media business which owns or exploits IP rights – but it doesn’t stand alone. It must be an integral part of exploitation – whether through sales or direct-toconsumer products.

Understanding – getting the data fundamentals right

Data on contracts, rights and royalties delivers insights and information that supports key business decisions. Imagine if you were unable to see quick and detailed insights into which rights were available to exploit. Going further, trusted data on content and rights underpins some of the technologies which are opening up the ability to automate distribution and programming of digital channels.

Our key recommendations:

- Taxonomy is key to understanding – understand the dimensions your business needs to exploit content, and use them in your taxonomy

- Build trusted data – build the fundamentals of good processes, roles and standards which will ensure your data is trusted and effective in supporting product and sales teams

- Performance data is a crucial part of the picture – consumer usage data e.g. viewing data, social interactions and reactions help understand the value of rights and IP strategy changes

- Build for scalability and real-time insights - with information on content consumption pouring in from multiple digital platforms, data volumes are soaring - adopt scalable systems that can continuously ingest large data volumes and deliver real-time insight

Managing – a well-oiled rights machine

It is important to get the right processes, technologies and teams in place to effectively manage and grow the value of your IP portfolio.

Our key recommendations:

- Organise for active management – rights operations focused on actively growing the value of rights. Organisational setup is key, with clearly defined roles and responsibilities. Teams and processes to bring in new rights, renew the most valuable and dispose of those which are not profitable

- Evolve complex and bespoke legacy technology - gradually modernise and transform the rights architecture by reviewing, refining and if required replacing the technology components. Buy or build decisions must be based on business needs with an eye on integration and data complexity

- Standardise with an eye on the future – building a machine for worldwide distribution drives a trend towards multi-country licences and standardisation. But any standardisation must be designed with flexibility in mind - flexing and rights dimensions change over time

Integrated Agile product development

Building a valuable base of IP and understanding what is available is a crucial first step – second comes the ability to test new products and business models and to rapidly make decisions based on that insight. This is essential in taking new products to market, creating new revenue streams and embracing new commercial models.

In order to meet the needs of the modern consumer, attract new consumers and reduce churn, companies must launch, test and iterate product experiences and content propositions.

Consider launching a new direct-to-consumer business model, for example multiple SVOD services including Netflix and Disney+ are expanding into advertising-funded video on demand to attract younger and more cost sensitive audiences. Your rights operation should tell you which content rights are available to exploit within each channel, but when coupled with a product development capability focused on testing and learning, propositions can be transformed in line with consumer needs. Real-time data on content usage and commercial performance in each business model can drive a content and windowing strategy to maximise value from both business models.

Our key recommendations:

- Insights from data - providing quick, detailed insights into content consumption and engagement into sales and product teams, using these to evolve and optimise products and content propositions

- Explore your options for new strategies, propositions and models that you think will serve consumers’ evolving needs – consider how you can innovate, pilot, test (and fail) and embrace the new, e.g. commercial models, windowing strategies

- Build an Agile organisation and break the siloes – adopt agile organisational practises and quickly adapt to new needs to drive outcomes relevant to consumers rather than organisational siloes

Conclusion

The IP Rights operation is key to remaining relevant to today’s digital consumers. Investing in IP rights and building an integrated product development capability is fundamental to creating great consumer products.

- North-America-OTT-TV-and-Video-Forecasts-2022-TOC.pdf (digitaltvresearch.com)

- Digital news subscriptions ranking: 100k Club topped by NYT and WSJ (pressgazette.co.uk)

- Streaming Services to Lose 150M Subscribers in 2022 Due to Churn – The Hollywood Reporter

Get in touch with our experts

Related Insights

Talkin' bout a rights and royalties revolution

We explore how emerging blockchain and non-fungible token (NFT) applications are shaking up contracts and rights and royalties' models.

Read more

Rights and royalties: creators at the core

We explore how leading rights and royalties approaches will enable new generations of creators to thrive and monetise ever more high-quality content.

Read more

Mapping fan experiences to an organisation's rights and royalties capabilities

Rights and Royalties is the strategic foundation of a content organisation and a key enabler of engaging fan experiences.

Read more

Remodelling Rights and Royalties in Media

How can media companies transform their IP rights and royalties capabilities into a powerful competitive differentiator? Our media team share their insights.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?