Firms considered “kind” are more likely to be successful

5 September 2023

Our research indicates that kindness isn’t simply a matter of ethics – it’s a no-nonsense business issue too. If your firm is considered kind, it is likely to have stronger growth than a firm considered unkind.

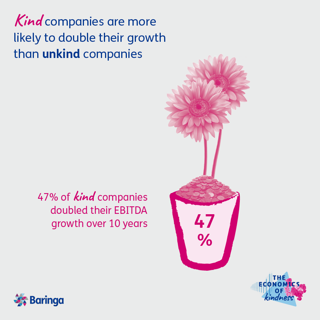

For these calculations we are using companies’ earnings before interest, taxes, depreciation and amortization (EBITDA). 47% of companies considered kind doubled their EBITDA in the decade to 2022. Just 35% of unkind companies did.

"This strong, clear correlation demonstrates that being kind isn’t a well-meaning but woolly aim – there are clear business reasons to ensure your firm is kind, and is perceived to be kind."

Anya Davis, Baringa

In almost all circumstances, kind companies outperform unkind ones.

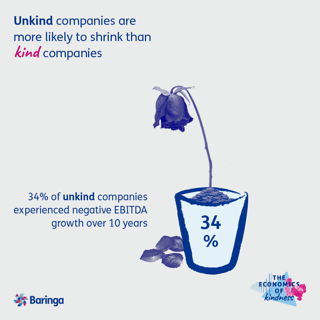

34% of companies considered unkind experienced negative EBITDA growth over the decade to 2022. Just 28% of kind companies did.

No matter which way you cut the data, kind firms are more likely to enjoy higher performance.

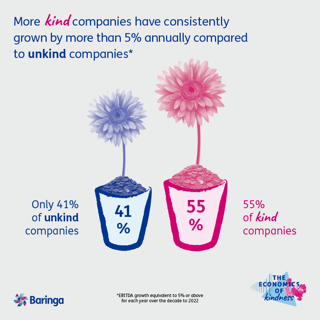

We consider 5% annual EBITDA growth to be a minimum benchmark for almost any firm. Companies considered kind are significantly more likely to achieve this.

"Kindness is not the sole criterion for business success, and some unkind firms can thrive. But if your company is considered kind it is more likely to enjoy stronger growth.

"This suggests a lesson for business leaders: when setting strategies, ensure you weigh up kindness and the perception of kindness, alongside ‘harder’ business metrics such as cost, price and margin.

"Alternatively, kindness can be used as a lens to challenge business decisions. Once you have provisionally decided on a course of action, take a step back and ask whether that course of action is also kind. If it is not, amend or reconsider."

- Anya Davis, partner, expert in energy and resources

Methodology

In Spring 2023 Baringa commissioned survey firm Censuswide, who surveyed 6,028 people in 7 countries. As part of this survey, all respondents were asked to name a company they considered “kind” and a company they considered “unkind”.

Baringa then gathered EBITDA data for the period 2013-2022 for all these companies where it was able to find such verifiable, public, published information.

Our findings show a strong correlation between kindness and relative strength of EBITDA growth but the precise causation is a matter for debate.

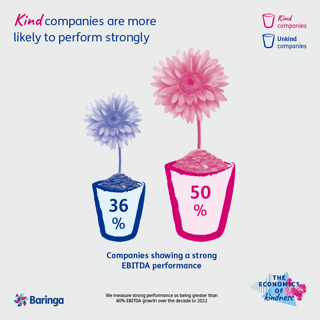

EBITDA performance figures

|

EBITDA performance |

Companies perceived to be kind |

Companies perceived to be unkind |

|

Extremely well performing |

50% |

36% |

|

Well performing |

6% |

4% |

|

Moderately well performing |

3% |

6% |

|

Fairly well performing |

4% |

10% |

|

Poorly-performing |

7% |

7% |

|

underperforming |

29% |

36% |

Performance criteria referenced in the above table were based on the following categories, which Baringa created for the purposes of simplicity:

- Greater than 80% EBITDA growth over the decade, the company is extremely well performing

- Between 60% and 80%, the company is well performing

- Between 40% and 60%, the company is moderately well performing

- Between 20% and 40%, the company is fairly well performing

- Between 1% and 20%, the company is poorly performing - Below 1%, the company is underperforming

Related Insights

Trending content in this series

Introducing the Economics of Kindness

At Baringa we’re convinced that, no matter the macroeconomic backdrop, kindness in business really does pay. That’s why we’re taking this opportunity to explore the economics of kindness across four pillars: people, business, leadership and investors.

Read more

People – planet – profit, in that order

The notion of a ‘triple’ bottom line – people first, then planet, then profit – is reshaping how organisations around the world do business. They’re bringing corporate kindness to the fore as we enter a new type of economy, and the businesses that organise themselves in this way will be the ones that succeed.

Read more

Redefining kindness in the workplace

Corporate kindness is all about the impact an organisation has on the world, engaging in responsible practices that benefit their customers, employees, and the communities they operate in.

Read more

Bringing kindness back to the top of the leadership agenda

Should kindness be back at the top of the leadership agenda? Managing Partner Adrian Bettridge discusses how when we lead with kindness, we generate lasting success for ourselves, our clients and our businesses.

Read more

It’s not easy to be a kind leader

Can leaders be kind all of the time? What gets in the way? Ian Peters reflects on the challenges and trade-offs of trying to be kind to all stakeholders.

Read more

Our Economics of Kindness journey: the story so far

What have we learned about kindness in business and in our public organisations? Does it pay? And if so, how?

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?