Delivering energy infrastructure at scale and pace

12 min read 26 June 2025

As the energy transition accelerates, there is a global imperative to deliver large-scale upgrades to energy infrastructure – including renewable generation capacity; the electricity grid and new connections; as well as the wider energy system infrastructure including LNG / gas assets, at an unprecedented scale and investment level. If we don’t act now, we are at risk of missing net zero targets, delaying electrification, and driving energy costs even higher for consumers.

Meeting global climate targets requires more than $4.5 trillion in annual clean energy investment by the early 2030s, according to the International Energy Agency (IEA). This reflects the scale of transformation needed across energy systems worldwide, including significant upgrades to electricity grids.

In the UK, the three electricity Transmission Operators (TOs) have collectively proposed over £90 billion in grid investment through the 2030s. This funding aims to unlock new connections, modernise critical infrastructure, and ensure the network is resilient enough to support the shift to electrification.

Closing the Capital Projects’ productivity gap with digital and AI

Yet a major obstacle stands in the way. Output and efficiency in major capital projects have been declining for years – jeopardising the timely development of critical energy infrastructure. This article outlines four dimensions of change that we see as essential to transforming capital delivery performance, zooms in on the role of digital and Artificial Intelligence (AI) and showcases how Baringa and our partners are helping clients apply these innovations to boost efficiency and enhance delivery outcomes.

The productivity problem

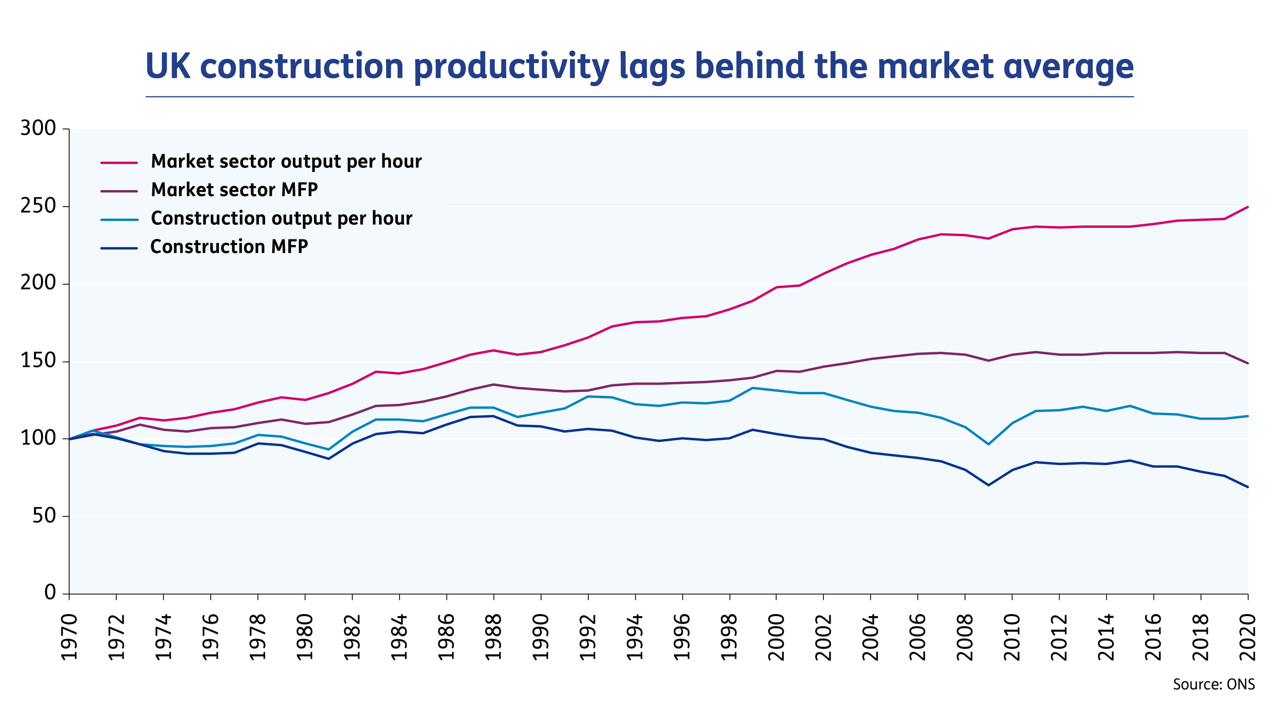

While most sectors of the economy have seen steady productivity growth over the past five decades, the UK construction sector, on which the energy transition critically depends, has largely stagnated. Since 1997, it has even recorded negative growth in output per hour and multifactor productivity (MFP), diverging sharply from broader market trends.

The UK is not an outlier here. A similar picture has been playing out in construction and infrastructure sectors in several other countries. What’s behind this? We see three intersecting issues that must be addressed enduringly to solve the industry’s performance problem.

The UK is not an outlier here. A similar picture has been playing out in construction and infrastructure sectors in several other countries. What’s behind this? We see three intersecting issues that must be addressed enduringly to solve the industry’s performance problem.

1. Cost and schedule overruns remain a systemic challenge

Infrastructure projects, especially major ones, consistently cost more or take longer than their initial estimates. According to the Institution of Civil Engineers, nine out of ten projects with a value of over $1bn go over budget.

Much of the issue stems from a mismatch between initial estimates and eventual outcomes. Estimates for major projects are inherently challenging due to their long planning and delivery horizons, large scale, and high degree of complexity. Change is urgently needed, however. If projects continue to overshoot their expected budgets and delivery timeframes, key goals for the energy transition are at real risk of being missed.

2. Supply chain and talent constraints challenge delivery

Across energy infrastructure – especially among network and transmission developers – demand for skilled labour and critical materials far exceeds supply. A DESNZ-commissioned study by Baringa highlighted severe pressures on manufacturing capacity for critical grid infrastructure. Lead times for high-voltage transformers have in some cases doubled, reaching 15 months for 33kV, two years for 132kV, and up to four years for 400kV units. Similar constraints affect other strategic components, including switchgear, cables, and reactors. Manufacturers are now fully booked years in advance, with some requiring commitments up to five years ahead of delivery. This underscores the urgent need to identify and procure Long Lead Items (LLIs) early to avoid bottlenecks that could stall the UK’s decarbonisation timeline.

Labour availability presents a parallel constraint. The study identifies persistent and growing skills shortages across the renewables supply chain, particularly for design and commissioning engineers, project managers, and installation technicians. These gaps are worsened by international competition and an ageing workforce. A 2023 European Commission report shows construction labour shortages are nearly three times higher than a decade ago. Similarly, Baringa’s clients report ongoing difficulty recruiting technical specialists across mechanical, electrical, and power system engineering – adding further risk to project delivery across the sector.

3. Construction lags in digitalisation

Compared to other sectors, construction remains one of the least digitised industries in the world. A 2024 survey by the Royal Institution of Chartered Surveyors (RICS) reveals that, following a spike in digital adoption during the pandemic, the UK’s built environment sector has made “no significant progress or growth” in digitalisation over the past two years.

With relatively few construction firms modernising their workflows, site operations, or supply chains, a digital divide is emerging. This gap is especially pronounced in energy infrastructure, where low-tech delivery partners are struggling to meet the expectations of asset owners that are rapidly advancing their own digital capabilities. Without greater uptake of digital tools, the sector risks continued inefficiencies, cost overruns, and reduced transparency.

Transforming and innovating how capital programmes are delivered

To meet the energy transition demands, energy companies must radically improve the performance and predictability of capital delivery. This requires a fundamental shift – not just in tools, but in operating models, delivery structures, and ways of working.

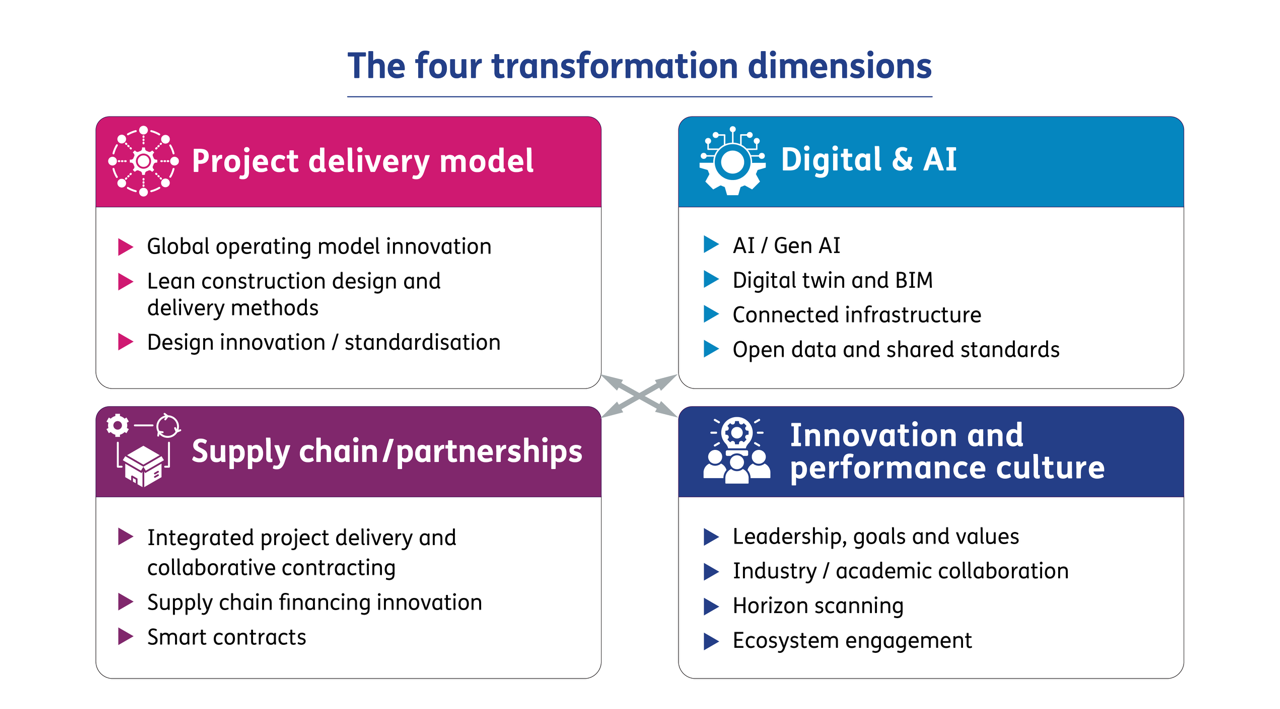

To drive sustained change, transformation must span four key dimensions: evolving the project delivery model, deepening supply chain partnerships, embedding digital and AI technologies, and fostering a culture of innovation and performance. At Baringa, we see clients making progress by adopting more adaptive delivery models, forming more strategic relationships with the supply chain, and applying digital and AI in ways that drive real execution value – all underpinned by leadership, learning, and collaboration that sustain long-term performance.

Want to learn more about how Baringa can help you address the different dimensions of operating model innovation? Get in touch with us today.

Improving capital delivery performance requires action across multiple fronts. Delivery models must become more agile and outcome-focused, underpinned by clearer accountability, better interface management, and a stronger focus on delivery planning from the earliest stages. Supply chain relationships need to mature into genuine partnerships built on early involvement, shared risk, and aligned incentives. Organisations also need to invest in capabilities — not just tools and systems, but the skills, behaviours, and governance required to execute differently.

Complementing these shifts, evolving digital and AI technologies act as powerful accelerators, unlocking value at each link in the project value chain – from de-risking early investments to enabling more reliable design development and delivery

Seizing the digital and AI opportunity in major capital projects

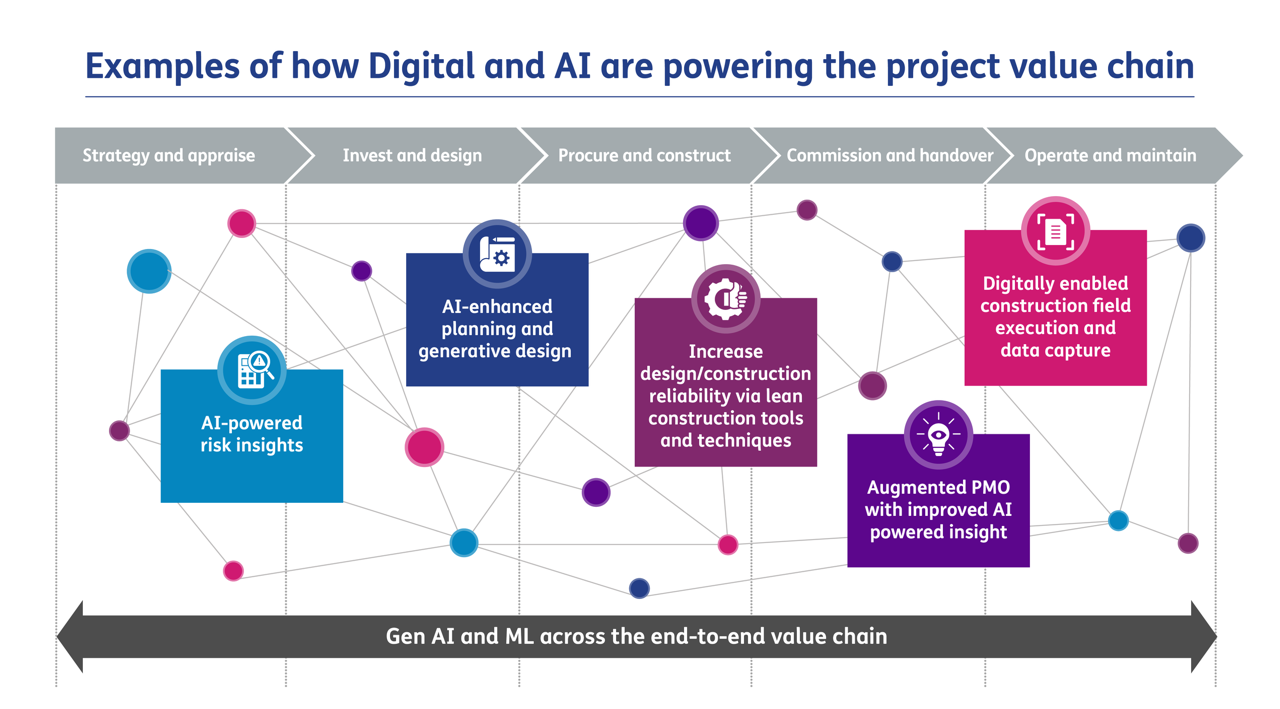

Digital and AI innovation represents a step-change opportunity to improve capital project outcomes. These technologies are already enabling smarter investment decisions, faster engineering and procurement cycles, and better control of delivery risks.

Drawing on Baringa’s extensive experience working with clients and partners in energy, infrastructure, and adjacent sectors, we have outlined five representative, high impact use cases where digital and AI tools are already generating value across the project lifecycle. While not an exhaustive framework, these examples highlight the range of opportunities that can improve capital project delivery through practical application of AI, automation, and advanced analytics.

1. AI- powered risk insights

Effectively identifying and managing risk exposure is fundamental to delivering capital projects on time and on budget. AI tools are helping organisations gain a clearer view of risk across portfolios – from commercial exposures to supply disruptions. One area where this is especially critical is commodity pricing. AI models can analyse historical trends, market signals, and external drivers to forecast price movements, quantify exposure, and simulate what-if scenarios. By understanding exposure across different time horizons, project teams can shape more accurate budget estimates, secure stronger supply agreements, and prioritise investments that are less vulnerable to market volatility. These insights are increasingly essential for reducing delays, unplanned cost escalation, and contracting risk in today’s uncertain environment.

|

To help a multinational energy company gain a better view of price movements, Baringa built a commodity pricing and risk management app. Providing a three-to-five-year prediction of commodity prices, it helps the firm’s procurement division to understand and manage exposure to commodity price fluctuations and contract risks. It unifies previously fragmented commodity-related spend and risk reporting and supports improved forecasting and risk management, potentially saving hundreds of millions. |

2. AI-enhanced planning and generative design

AI and automation technologies are being incorporated into new design tools that streamline design optioneering, clash detection and decision making, using historic and new project data.

National Highways, together with a partner, developed their rapid engineering model (REM) which integrates computational design, automation, and modularisation to streamline design. With it, teams can rapidly test thousands of design options and enable a design for manufacture and assembly (DfMA) delivery approach. It’s helping maximise standardisation, reduce rework, and cut design time by up to 50% for greater speed, efficiency, and cost savings.

In parallel, tools like Target Value Delivery (TVD) are being enhanced by AI-enabled optioneering and cost forecasting. By setting cost targets early and continuously informing design decisions with predictive insights, TVD improves budget certainty and helps teams avoid costly late-stage redesigns.

3. Digital twins and Building Information Modelling (BIM)

Adopting Building Information Modelling (BIM) as part of a broader digital transformation strategy offers significant advantages for major capital project delivery. BIM enables a unified, data-driven approach to planning, designing, and managing complex infrastructure projects, while facilitating real-time collaboration across multidisciplinary teams and the supply chain, this streamlines workflows, improves coordination and accelerates project timelines.

BIM also enables Advanced Work Packaging (AWP), a powerful methodology for aligning engineering, procurement and construction activities which improves field productivity and reduces rework. Expanding the BIM models to 4D and 5D BIM through the integration of time and cost data further enhances schedule accuracy, estimating and cost control, but requires high-quality structured data that is interoperable between systems.

For many of our clients, BIM implementation is a cornerstone of their digital transformation journey. Success depends on having a clear delivery roadmap, robust governance and standards, effective integration with the wider technology ecosystem, and sustained emphasis on upskilling and change management.

Digital twins go a step further, creating a complete digital representation of assets that is continuously updated with new data – providing powerful insights across the asset lifecycle. They enable more effective commercial and operational decision-making, support predictive maintenance, and unlock efficiencies in resource planning.

As the energy system evolves and supply chain pressures mount, digital twins offer a way to integrate engineering, operational, and climate data into timely, resilient decision-making. Baringa clients are already using digital twins to optimise both physical operations and supply chain management across the energy spectrum – from transmission and distribution to upstream assets spanning gas, LNG, and green hydrogen. We work closely with these organisations to define the commercial and operational value cases for digital twin deployment.

4. Augmented project management with AI-powered insight

AI-powered tools are transforming project and portfolio management by strengthening schedule reliability, cost forecasting, risk management, and decision-making abilities. These tools analyse large volumes of historical and real-time project data to flag emerging risks, forecast cost and schedule variances, resource bottlenecks and uncover patterns that more traditional project controls methods may miss.

We see that an increasing number of energy and wider infrastructure clients are embracing AI-driven platforms to enhance their project controls capabilities and are realising positive outcomes. These include tools that predict likely delays, identify high-risk activities, simulate new mitigation strategies and generate new project schedules from scratch. Others offer AI-powered health checks and forensic schedule analysis that surface hidden activity dependencies and reveal deeper insights into the root causes of project delays.

By integrating these capabilities as part of a modern project controls setup – and using them in combination rather than in isolation – organisations can unlock significant productivity gains and improve overall project delivery performance.

5. Digitally enabled construction field execution and data capture

Digital tools are transforming how field teams execute and monitor construction activities. By capturing and integrating real-time site data – from worker progress to asset installation and commissioning – project teams can better manage workflows, resolve issues earlier, and optimise delivery.

One recent example we’ve seen is an AI-powered progress-tracking platform for semiconductor fabrication plants (fabs). It uses AI to track construction progress, while predictive analytics anticipates and flags potential delays, and automatically detects deviations in designs. It’s saving hundreds of thousands in rework costs and avoiding weeks of delays by identifying issues early.

Digital implementations of Lean planning methods like the Last Planner System (LPS) are also gaining traction. These platforms enable collaborative planning, help teams identify and mitigate design and construction workflow risks in real-time, eliminate process waste, and drastically improve communication and coordination across the supply chain. This, in turn, results in increased schedule reliability. Notably, studies have shown that LPS enhances coordination, schedule adherence, and cost control in infrastructure projects.

Are you asking the right questions to close the productivity gap?

As digital and AI innovation reshapes the landscape, developers, clients, and contractors must challenge themselves with questions that cut to the heart of the transformation.

Start with strategy

Is your digital & AI strategy clear, focused, and aligned with your long-term delivery ambition? Then consider your…

| People |

|

| Processes |

|

| Data |

|

| Technology |

|

It’s time to embrace digital and AI as part of the transformation agenda

With global demand for infrastructure showing no signs of slowing down, organisations can no longer afford to cling to old technologies or delivery models. To close the productivity gap and meet the pace of the energy transition, it is essential to embrace all the tools in our disposal to enable greater speed, certainty and informed decision-making.

Interested in how Baringa can help you harness digital and AI to optimise capital delivery and improve project performance? Get in touch with Silas O'Dea and Konstantinos Kasmirlis to explore the possibilities.

Our Experts

Related Insights

From Pilots to Portfolios: Scaling the Rollout of Utility Microgrids

Across the U.S., utilities are under pressure to deliver reliable, affordable energy in the face of rising risks and shifting policies. Download our research to see how scaling microgrids can help meet that challenge.

Read more

Unlocking the North Sea’s future potential with digital and AI

The North Sea is entering a new chapter powered by AI and digital innovation, offering a path to low‑carbon leadership while boosting efficiency, investment and resilience.

Read more

Safeguarding critical energy infrastructure against converging cyber and physical threats

UK energy utilities strengthen their resilience against emerging cyber-physical threats by developing a holistic security methodology that bridges digital and physical domains.

Read more

Vom Commodity-Anbieter zum intelligenten Dienstleister: Wie Energieversorger mit KI den Kundenservice transformieren

Die Rolle von Künstlicher Intelligenz im Wandel der Energiebranche

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?