Navigating mergers and acquisitions: integration advice for the TMT industry

9 December 2022

The UK & European Telecoms, Media & Technology (TMT) sector is about to undergo another wave of Mergers and Acquisitions (M&A) - driven partly by the need to scale with synergy captures (to take on the FAANGs), partly by the economic trading environment and also partly stimulated by a 'trigger' transaction, like the recent Virgin Media and O2 merger and the potential Vodafone and Three deal.

These M&A deals will be harder than ever to execute successfully due to the impending global financial downturn, post Covid headwinds (e.g. remote working), and the sheer amount of change already happening in the industry - 5G and FTTP in Telecoms and the ongoing shift to digital in every Telecoms, Media and Technology company.

With the recent news of Vodafone and Three potentially coming together, we see daily speculation in the press of further consolidation across the UK & European Telecoms sector. This is further supported by the EU Competition Chief and leaders of some of the largest global TMT companies. Additionally, the need to reduce costs, improve margins and deliver better shareholder returns will drive up levels of consolidation across the broader Telecoms, Media and Technology (TMT) sector as organisations look to shore up their balance sheets and use syne balance sheets and use synergy savings to drive improved financial performance.

The drivers for these M&A deals have had a lot of coverage in the press, but broadly fall into five main categories, which often are interconnected:

01. Scale

Growing in scale allows tech, media and telecommunication companies to access more customers, spread large investments across a broader customer base, to gain synergy capture savings and at the same time increase their buying power when negotiating content and partnership deals with the US giants.

02. Quad play or convergence

Many of the deals in the UK and European TMT sector will allow these joint entities to offer more products to their customer base. The long-awaited monetisation of quad play deals is seen as both a revenue generator, but also a defensive churn reduction mechanism.

03. Efficiency

The UK and European TMT sector is one of the most highly competitive markets in the world and M&A enables companies to drive down their cost base and offer lower prices to their customers while maintaining, or improving, margins.

04. Shareholder returns

Long term corporate shareholders and Group parent companies are looking to monetise their stakes in these businesses, to ward off predatory buyers and unlock hidden value and higher valuations.

05. Obtaining more capabilities, fast

Accessing new products and capabilities that can help companies accelerate their transformations and quickly take advantage of the disruption in the market. For example, Telecoms and Media companies becoming more like Technology companies, driving platform businesses, and accessing new customer segments.

The UK and European TMT sectors are among the most highly competitive markets in the world.

M&A Opportunities

In addition to the five main drivers, there are also a number of other benefits that mergers and acquisitions M&A can drive:

1. Being a catalyst for change

Due to the historical pace of change in the industry many Telecoms, Media and Technology (TMT) companies recognise that they might have an outdated operating model for today's business environment. It is, however, often very difficult to make the case for changing the Operating Model when the management team is focused on day-to-day trading in an aggressively commercial world.

This can be short termist and reduce shareholder value over the long term. M&A forces a business to re-think its operating model and gives it an opportunity to re-base its operation to be more relevant to the future trading environment and to move to new business models and bring on new capabilities, for example, digital, agile, platforms.

2. Delivery of synergy capture savings

M&A deals, if planned well, help organisations deliver short term and more strategic synergy benefits. Near-term benefits from legal entity rationalisation, head office synergies and procurement savings, through to more strategic savings in networks (consolidation/wholesale) and IT rationalisation. Also, improved Revenue Generating Units (RGUs) and Average Revenue per User (ARPU), resulting from new and more integrated products and services. If managed well, the efficiencies can make the combined organisation more competitive and the revenue benefits can drive improvements in market share and ARPU.

3. The challenge of the status quo

All organisations have a list of operations that have been set in stone for years, that are difficult to challenge - for example, the move away from engineer installs to self-install, breaking down product siloes and product P&Ls to move to a more customer-centric P&L, how far to drive the self-service and online agenda, how much high street presence to have (if at all).

M&A allows both businesses to directly compare their operations and, if managed well, can be used to challenge the status quo and to transform – usually to the benefit of the P&L.

4. A refresh of management and better engaged workforce

M&A gives both the opportunity to retain top talent by promoting them into larger roles in a larger business, as well as the ability to replace less able/relevant management via the integration process. If selected people in management positions leave as part of an integration, it gives opportunity for progression to more junior staff – something they might not have achieved during the status quo. Therefore, a well-managed integration can leave the business with a refreshed leadership team and a more engaged workforce.

A well-managed integration can leave the business with a refreshed leadership team and a more engaged work force.

Key risks to consider:

As these deals move from due diligence, through regulatory approval into integration planning and execution, there are a number of key points to be aware of specific to M&A

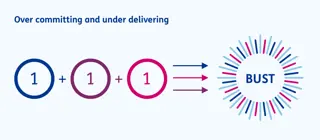

Because of the competitive nature of the TMT sector each company in a merger will have aggressive Business as Usual (BAU) plans already in place to release new products, attract new customers, and invest in strategic programmes. These plans will have been through the annual planning process and the long-range planning process and will be hard fought for. They are usually incredibly aggressive stretch plans and are just about achievable in their own right. Both organisations in an M&A will be committed to these plans, and then on top, the Board will have agreed an even more aggressive synergy case - the rationale behind the deal. Typically these synergy cases are done behind closed doors, with external support, to minimise the likelihood of a leak in the lead up to an M&A deal. They have to be aggressive to appease shareholders and analysts and often don't take into account the existing and aggressive BAU plans already in progress and Covid-related stretch.

When you combine the two BAU plans and a synergy plan, as well as a Day One preparation project, a potential brand re-launch, and some staff attrition, you end up with a real challenge - there is a risk of creating a set of undeliverable plans which will have significant financial consequences if they under deliver.

Forewarned is forearmed

- Take the time to plan properly

- Look at the triple constraint of financial outcome, scarce resource and ability of the business to absorb the change.

- Prioritise ruthlessly, be ambitious but realistic and make sure the Integration Leadership Team raise all potential conflicts early, to drive decisions.

Losing your focus when your competitors are targeting your customers

Your competitors will be watching intently as the deal progresses. They will have carefully developed plans to deploy in order to capture as much market share as possible, during a period when your business attention is focused elsewhere i.e. on the integration, or delivering remedies imposed by the regulators.

Don't underestimate the amount of disruption M&A has on three primary levels:

Leadership

Will be focused on landing the deal, competing amongst themselves for a reduced number of roles, or starting to check out mentally.

Management and staff

May have been kept in the dark, and will be focusing on what the deal means to them - will they be financially better off as a result of the deal? Will they have a job? Who will be their new line manager? And of course, many will be interviewing with competitors.

Customers

Business and consumer customers will also be wondering what the deal means to them, will there be better products, will customer service fall off, will competitors be bringing great, new, low-priced propositions to market. Customer expectations will be high from Day One (one bill, access to better deals) and will need to be well managed.

Competitors will naturally be more aggressive in the market, trying to make a decisive move to gain customers. Management will need to be even more aware and focused on short-term trading to address this challenge. All of this will put pressure on the achievement of BAU plans and the ability of Management to focus on synergy savings and Day One readiness.

Division of labour

- Clear, visible leadership from the CEO and the Exec for both Integration and BAU trading priorities.

- It is imperative that a cadre of senior management is 100 per cent focused on trading, on the market and on competitor activity.

- It is equally important that another cadre of management is focused on integration and delivery of a successful Day One, as well as setting up the synergy programme for success (a strong, proven integration team).

- These teams must work together but you will need to make sure your management team is set up for success - don't expect them to focus on all areas, otherwise something will drop - and that something could have a larger than normal financial impact.

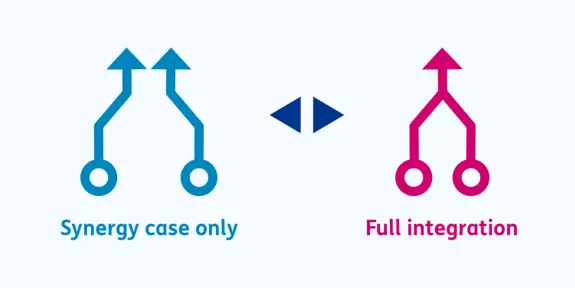

As the deal concludes, and the business starts to plan for ‘integration’, an inordinate amount of time and money can be wasted by businesses debating what ‘integration’ means – even when a set of integration principals have been agreed.

On the one hand there will be a relatively clear synergy case that the Board has signed up to and has committed to shareholders and the City.

On the other hand, Management may consider that integration means fully integrating the back end of the business and addressing many of the burdens on their day-to-day lives – including significant operational and systems related improvements.

In reality, integration will probably sit somewhere between the two and the synergy plans will make high-level assumptions around underlying process and systems consolidation.

In addition, many people will be looking at integration as one of the ‘only games in town’ for the next two to three years and, therefore, can see this as the only way to get their pet project on the agenda through scope creep and ‘interpreting’ the integration in a favourable way to their business area.

All this can result in a loss of focus and wasted delivery effort and cost. Scope creep is a real threat and if unmanaged can make an already difficult e difficult execution plan even more undeliverable and value destroying. This is arguably harder to plan, manage and control in the new hybrid world.

Establishing transition states is a good way of focusing people on scope, whilst helping ensure financial and operational risk (data/security/financial integrity) is limited as the merger progresses.

Clarity of integration

Clarifying the purpose and scope of integration and actively managing scope creep is essential to successfully delivering the benefits from M&A.

Being clear on the purpose of business integration

- Set a clear and detailed description for the purpose and scope of integration.

- Communicate it consistently and regularly throughout the business.

- Closely monitor the programme to minimise scope creep - otherwise an already difficult delivery becomes increasingly hard to achieve

- Be clear on what is to be delivered as part of 'integration', what will be delivered 'post integration' and how this will be delivered e.g. continuous improvement or a dedicated Operational Efficiency programme.

Clarifying the purpose and scope of integration and actively managing scope creep is essential to successfully delivering the benefits from M&A.

Being flexible on synergies and not declaring success too early

Because of confidentiality sensitivities surrounding deals, synergy cases are usually written behind closed doors, by a small group of strategy consultants, banks and company leadership.

The synergy benefits are typically directionally correct (in terms of the scale of opportunity) but often need to be re-worked by operational management once they are communicated more broadly into the business.

It is a balancing act to capture and deliver these synergies. It is important not to walk away from the macro synergies – these, after all, are the rationale for the deal. Having said that, it is the operational management who have the best view of how to deliver these synergies in the best way, for lasting effect – and many will not have been involved in the synergy case definition.

Take, for example, quad play. Many telecommunication merger synergy cases have quad play at the heart of them. Quad play can sound attractive but can also be value destroying if managed poorly. Front line sales, marketing and customer management leadership will have the best view on how to execute this.

Being firm on the quantum of the synergy savings is key, but being flexible on how they are delivered is crucial to delivering ongoing, sustainable value.

Likewise the timing of synergy savings is important – expectations have been set with shareholders and Boards. It is important to drive these synergies at pace, to drive the operational and financial improvements.

However, we also see many examples where success has been declared, companies have told the market that integration has been completed, yet on the ground the integration feels anything but complete – different technology stacks exist with high levels of technical debt, speed to market for new products is slow, and businesses struggle with agility resulting in a poor customer and employee experience.

Setting key timelines at the start of integrations is commonplace (Day one, brand launch etc.), however it is just as important towards the latter stages of integrations.

Synergy execution

- Set a clear target for synergies and stand behind them

- Give operational management flexibility on how best to achieve these

- Don't declare integration success too early leaving the business with years of inefficiencies which impact profitability and customer experience

Set stretching synergy goals, but empower operational management on how best to deliver.

People don’t like to be kept in the dark

M&A is an incredibly stressful time for staff and management alike and people are already under unprecedented levels of stress amid the impending financial downturn.

People like to be communicated to and kept aware and it can be difficult to do this during M&A deals – as the deal is coming to fruition it is rightly kept secret. While it gains regulatory approval you want to avoid the business getting distracted by the deal when there is still a chance it may not come to fruition. When the deal is approved, there is often a period of uncertainty during consultation and people re-interviewing for their jobs. All the while, everyone is working hard to prepare for Day One, deliver the plan and present to the City or shareholders on synergy savings.

Throughout this cycle, people are often under-communicated to and, as we mention above, people will be thinking about different things when a deal is announced – from calculating their potential pay out, to worrying about career prospects.

People in the TMT sector are often already working flat out and may be carrying vacancies in their team, so they may not be set up to cope with the additional level of new workload coming from integration. If communication is poor and people don’t understand the integration plans, the business priorities, their own future roles, their new ways of working, the degree of extra workload ahead of them (and associated timelines and resource commitments and when there will be a return to BAU), then the M&A will quickly feel arduous and this will create an enormous people risk.

If people in key roles exit the business, or the level of stress related sickness increases, then the business will be weakened and their ability to deliver the synergy case and compete in an aggressively competitive market will dwindle.

Given that it is people that make a successful company, and that M&A offers companies the ability to refresh their leadership teams, this is an area which needs constant and regular focus throughout the deal cycle. It is all too easy to focus on delivering a successful Day One, preparing for brand/product launches and synergy savings, and looking at bottom line performance without focusing on the people and communication aspect until it is too late.

People and good communications are critically important

- People are your number one asset as a business and you must prioritise them.

- You want your people to be engaged by the proposition of becoming a different company, brought into new ways of working and you want to recognise that you will be asking a lot of them over the next two to three years during an extremely busy and intensive period.

- Therefore, the people agenda must be front and centre of any integration planning.

Recommendations

The rationale for M&A is usually compelling. The intent is typically sensible and well considered. Execution of an integration and competing business priorities is difficult to get right at the best of times and we are in unprecedented times now. The rewards from getting it right can be extraordinary and game-changing.

While there are many potential pitfalls, there is also significant opportunity to address these and to deliver a fantastic integration which is great for the company and often career defining for those involved.

The summary of our top recommendations for navigating mergers and acquisitions are:

Leadership

Clear, visible leadership from the CEO and their Leadership Team. Supported by an experienced Integration Director and team.

Integration

Articulate clear integration principles, description and scope - articulate what integration is and isn't, when integration will be completed and what happens after the integration programme is closed down.

Synergy

Maintain a clear focus on achieving the synergy case, but have flexibility on how the synergies will be delivered - empowered operational management, who can agree the best way of delivering the synergies, will help ensure the changes are sustainable.

Division of Labour

Ensure there is division of labour at the right points during an integration between the integration team and BAU Management.

Change

Use M&A as a catalyst for change – address those sacred cows and implement the appropriate operating model and technology changes for now and for the next wave of growth.

People

Instil an unwavering focus on people – put people at the centre and communicate effectively with them at all times.

Focus

Avoid declaring success too early as this can be damaging. Maintaining a focus on operational improvement after integration teams have been disbanded will drive further benefits as well as reduce scope creep during integration.

Execution of an integration and competing business priorities is difficult to get right. The rewards from getting it right can be extraordinary and game-changing.

Get in touch with our experts

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?