Why are B2B SaaS companies throwing profit and value away?

4 min read 21 November 2025

Is there anything more criminal in Private Equity than to listlessly throw value away? So how is one of the most invested-in sectors for PE so keen on seeing value erode - especially when some of the simplest ways to protect and enhance value are comparatively easy?

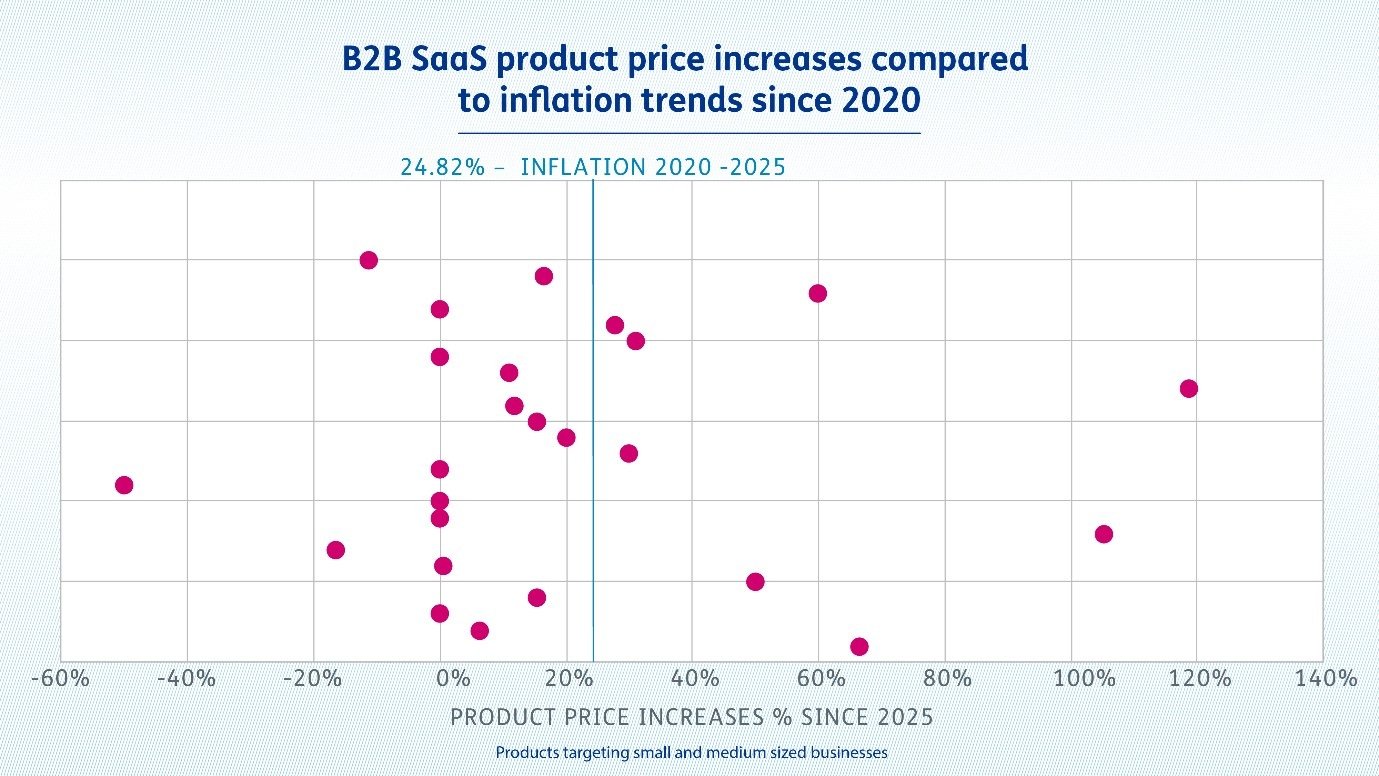

Since 2021, broadly over the last investment cycle, inflation has outpaced pricing adjustments for most B2B SaaS businesses, especially in SME packages, eroding margins and clouding profitability. We know this from our survey of 100+ private equity-backed SaaS companies revealing a glaring truth: those focusing on and investing in pricing capabilities are achieving stronger growth and margin protection.

Here are rapid approaches to add value to your business by turning pricing into a growth engine:

1. Is inflation eating your margins? Be assertive in your pricing.

An astounding 68% of B2B SaaS firms haven’t adjusted SME product prices since 2020, even as inflation soared. Fear of customer churn is holding leaders back from taking decisive action on pricing, despite evidence that low costs are rarely the clincher in SaaS purchasing decisions. Customers care more about product quality, service experience, and unique features.

(click to enlarge)

The remedy? Shift to a structured, value-based pricing approach. Leaders should ask:

- How do we stack up against competitors in price and product differentiation?

- Do our packages reflect customer needs and the value we deliver?

Armed with this understanding, SaaS businesses can blend value alignment with assertive pricing, minimising margin erosion while deepening customer trust.

2. How can you tame the "wild, wild west" of net pricing?

A lack of pricing governance results in chaotic discounting, with net price variation of 30-50% becoming common. Sales teams are often allowed excessive discounting freedom, prioritising volume and market share over profitability—short-term thinking that eats into EBITDA.

Successful firms are embracing smart discounting strategies:

- Define price boundaries using analytics and logic frameworks to ensure consistent, data-driven decisions.

- Align discounts with customer value, ensuring bundling or value-add packages replace blanket discounts.

- Enforce strict deal governance, empowering sales teams with data-backed tools rather than unchecked discretion.

This approach drives quick wins: we found SaaS firms adopting disciplined, strategic pricing often see EBITDA uplift of 3-8 percentage points within a year—without harming market share.

3. Should I invest in holistic pricing capability - or continue to use band-aids?

Pricing isn’t just a number; it’s a scalable lever for growth, profitability, and competitive advantage. Top-performing SaaS firms integrate pricing into their growth strategy, incentivise profitability over volume, and empower leadership with tools like AI-driven insights.

Critically, our experience shows that businesses with mature pricing capabilities achieve up to 6 percentage points higher gross profit compared to laggards.

In summary

Profit-focused SaaS businesses should prioritise:

- Market positioning: understand customer value perceptions and competitive dynamics.

- Pricing discipline: implement firm logic and governance frameworks.

- Holistic capability: align tools, strategy, and execution for maximum impact.

By mastering these elements, SaaS companies can protect margins, drive growth, and create lasting competitive edge.

Get in touch with us to obtain outputs from our research, or if you want to know exactly what we have done to help PE-backed businesses achieve better value: Baringa's framework evaluates 26 pricing capabilities, tailoring tactical and strategic solutions to deliver profitable, sustainable growth.

Our Experts

Related Insights

Price profitably or perish: B2C telcos investing in advanced pricing capabilities see 2–7x ROI in 12 months. Those that aren’t are falling behind

In the commoditised and tightly regulated UK consumer telecoms market, operators face ongoing margin pressure. Price sensitivity is high, and raising prices on core products is increasingly difficult.

Read more

How to improve profitability without hacking at costs

Discover two powerful strategies for improving profitability without undermining growth.

Read more

Unlocking the power of intelligent pricing technologies and commercial capabilities

Baringa researched pricing and profitability with over 60 firms in energy services to assess their experiences, adaptations, and future needs.

Read more

Are we facing a slowdown in corporate profitability?

Discover eight key strategies to supercharge value creation and mitigate the ongoing squeeze on corporate profitability.

Read moreRelated Client Stories

Transforming B2B sales with a data-driven GTM strategy

We partnered with a prominent computer manufacturer to engineer a go-to-market (GTM) strategy rooted in analytics, unlocking a potential 25% surge in revenue.

Read more

Helping a global media giant get smarter with sales

How do you standardise lead-to-cash processes and the technology underpinning them?

Read more

Freeing up £500m+ in cost savings for investment in new growth and future value at a global FMCG business

How can you improve margin, boost operational resilience and accelerate innovation across a global business?

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?