What investors need to understand about Japan’s shift to renewable energy

6 min read 13 August 2025

As the third largest liberalised electricity market in the world, Japan is an attractive destination for investment aimed at both long-term sustainability and profitability. With renewables set to displace the country’s heavy reliance on imported coal and LNG, Japan’s energy transition is a strategic pivot to greater resilience and long-term energy security.

The Japanese Government envisions ¥150 trillion (US$996bn) of investment over the next decade in both public and private funding. The country's strategic direction, reinforced by regulatory support and policy incentives, offers a clear roadmap for renewable energy investors. But the market also has unique constraints and challenges.

Our Japan: Wholesale Electricity Market Report offers investors an independent perspective on the demand and supply-side changes across Japan’s energy market, drawing on information from public sources as well as Baringa’s in-house views. It answers key questions, including:

What’s driving the investment opportunity?

Japan’s renewable energy market is entering a pivotal period of growth, driven by strong regulatory targets and a projected surge in electricity demand.

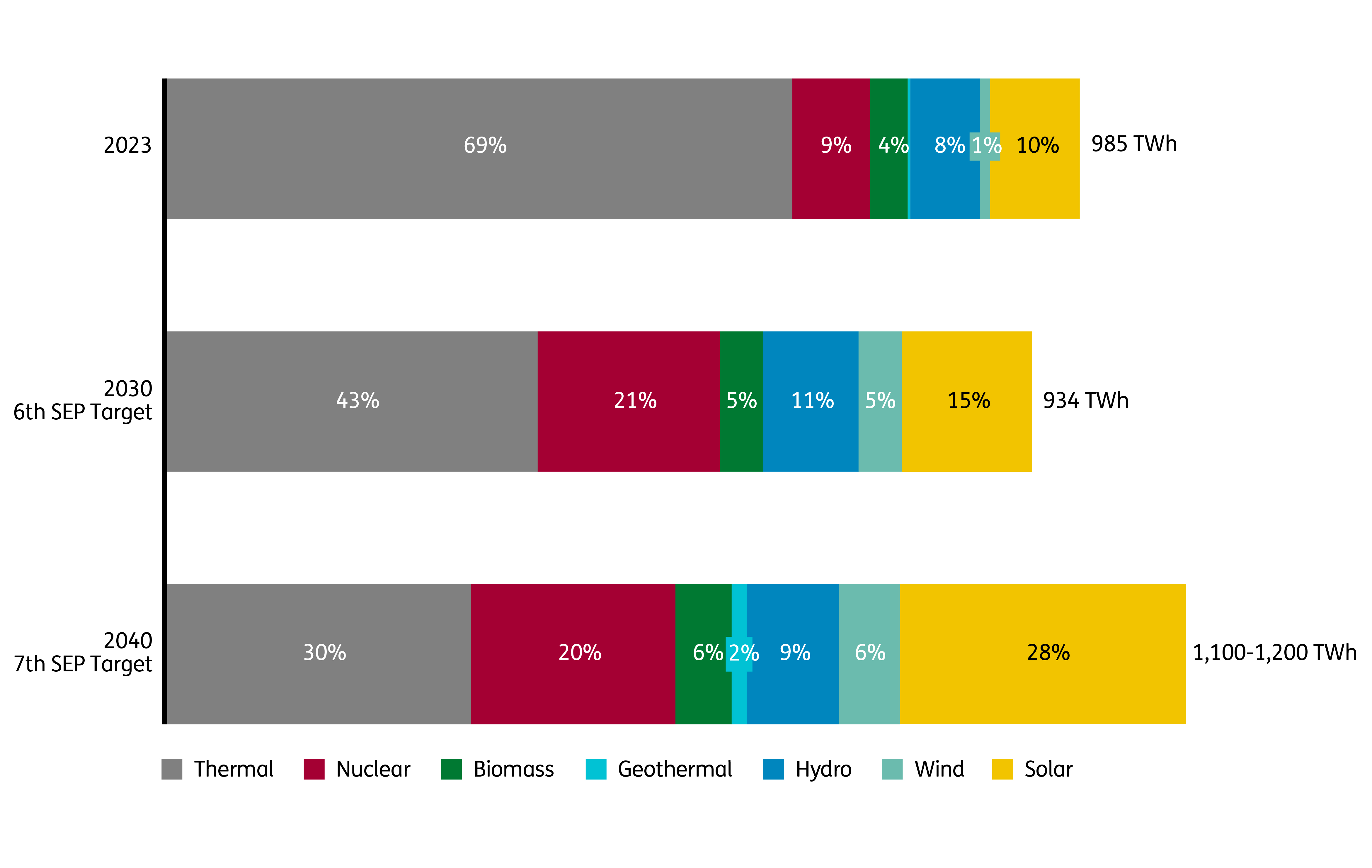

The government’s 7th Strategic Energy Plan lays out ambitious goals: by 2040, renewables are expected to provide up to 50% of the electricity mix, with a 73% reduction in greenhouse gas emissions (relative to 2013) and renewables building from just 15% today to 50%.

Unlike earlier projections of declining electricity use, the government now forecasts rising demand of up to 1,200 TWh, powered by the green and digital transformation of industry and society. This shift opens up significant investment opportunities across solar, offshore wind, battery energy storage systems (BESS), hydrogen infrastructure and the growing non-fossil value traded market.

Source: Baringa

To meet these goals, the government is advancing a range of enabling reforms, including the Green Transformation Act and Basic Hydrogen Strategy. Substantial investment in transmission is also underway, including new HVDC submarine lines to connect remote renewable generation with urban demand centres. In offshore wind, Japan has set a target of 30-45 GW by 2040 and recently expanded designated promotion zones into its exclusive economic zone.

How can solar investors manage revenue uncertainty from the Feed-in Premium (FiP) scheme?

Because FiP payments are linked to the wholesale power market price, solar generators need to understand wholesale price dynamics and take steps to mitigate the resulting uncertain revenue streams. One option is to enter into Power Purchase Agreements (PPAs) with corporate buyers keen to use green energy to meet their ESG commitments. Another involves combining solar developments with BESS to capture merchant upside through time-shifted generation – a strategy that requires careful consideration of the timing and operational complexities.

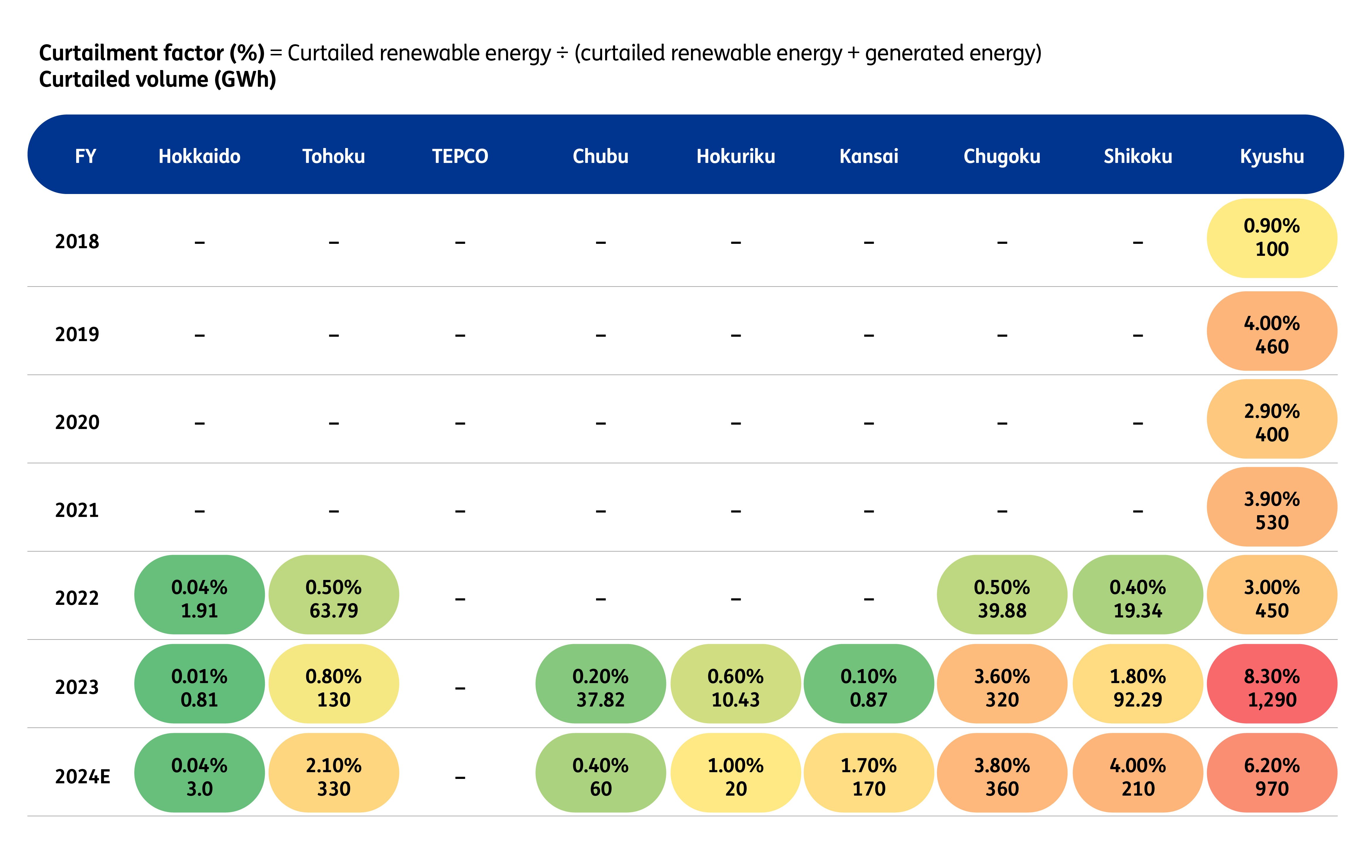

What can be done to mitigate price and curtailment risks?

As renewable energy grows across Japan, so do the risks of curtailment and price volatility. Economic curtailment – where supply exceeds demand – is now common in nearly all regions, while transmission grid congestion has begun causing technical curtailment, even in the TEPCO region. At the same time, solar power is driving deeper “duck curve” effects, with JEPX prices regularly falling to JPY 0.01/kWh during midday peaks. These risks threaten project revenues and offtakers’ ability to meet clean energy targets. To reduce exposure, developers need to prioritise sites with strong grid access and low congestion.

Economic curtailment table:

Source: METI

Where else can renewable investors find stable cash flows?

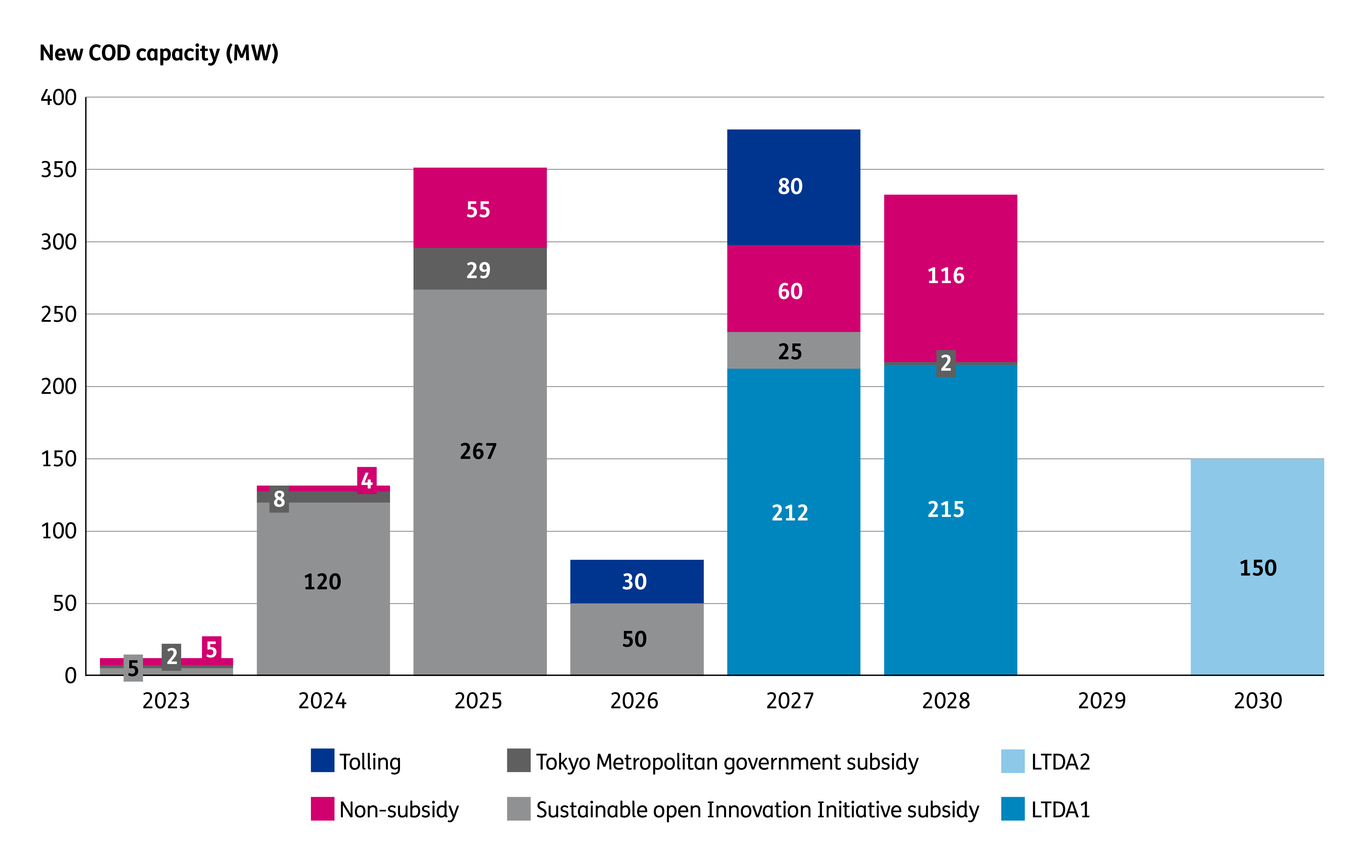

Japan’s Long-Term Decarbonisation Auction (LTDA) offers renewable investors a rare source of stable, predictable returns. Launched in 2023, the LTDA provides successful bidders with fixed 20-year capacity payments, helping to de-risk capital investments in clean energy projects. Awarded through technology-specific auctions, the LTDA has so far supported renewables, energy storage, hydrogen-ready thermal plants and nuclear upgrades. With CCS projects now eligible and offshore wind expected to join, the scheme is becoming a key pillar of Japan’s transition. The next auction round begins in the third quarter of 2025.

How should offshore wind projects prepare for auctions?

Offshore wind investors need to understand the complexities of the auction evaluation criteria. Recent developments, like “zero premium” bidding behaviour have led to many consortia using bid advisors. Winning requires deep market knowledge and an understanding of auction rules and auction theory so consortia can build a strategy and navigate the bidding process with confidence.

How can BESS developers minimise risk?

Source: Baringa BESS Deal Tracker

Multiple revenue streams are available to BESS assets in Japan, which are able to participate in the wholesale, capacity and balancing markets. BESS developers can make use of LTDA auctions – although only for longer-duration batteries – to secure 20-year capacity payments while optimising the remaining floating revenue portions across other power markets.

The fully merchant option continues to grow in importance alongside mounting interest in FiP co-located storage projects. These projects will need robust wholesale power, balancing and capacity market price projections to develop BESS trading algorithms that can maximise BESS revenues. It’s also critical to understand the dynamics of how choice of region, storage duration and degradation affect the trading strategy and revenue stack.

What about hydrogen and ammonia projects?

Japan is set to become the world’s largest importer of hydrogen and ammonia. The LTDA offers hydrogen and ammonia co-fired plants 20-year payments on CAPEX, allowing for existing units to tap into the scheme to achieve repowering. From the next round of LTDA, variable fuel costs may also be included in the bid price for hydrogen projects – the only technology for which this is possible.

In tandem, the country is laying a solid foundation to introduce hydrogen-based fuels in the generation mix. Measures include a Contracts for Difference subsidy to bridge the cost gap between low-carbon hydrogen and its fossil counterparts and encourage the adoption of clean hydrogen.

How Baringa can help

Baringa works with investors, developers and offtakers across Japan’s energy sector – from offshore wind and BESS to corporate PPAs and the LTDA auction. We help clients make confident investment decisions by identifying the best technologies, locations and entry timing. Our proprietary grid and curtailment models (covering all nine of Japan’s regions) enable precise, location-specific insights and robust risk assessment.

With deep expertise in Japan’s market rules and auction design, we guide clients through PPA transactions, LTDA bids and market forecasting. For BESS developers, our Japan Battery Market Report offers a clear view of long-term opportunities and revenue potential.

Would you like to learn more about the opportunities for investment? Or do you need support market entry? Get in touch with our team.

Japan: Wholesale electricity market report

The Japanese Reference Case Report covers our half-yearly updated projections for wholesale power prices, and capture prices for solar and wind generation.

Read moreOur Experts

Related Insights

Organisational agility: a guide to taking the first steps

Our business agility and operational excellence expert Simon Tarbett offers some advice to clients when asked the question, Where To Start?

Read more

The need for agility to grow revenue and thrive in a turbulent market

We’re looking at how organisations need to be agile if they’re to grow revenue and thrive in a turbulent market.

Read more

How to set targets to drive business performance

Targets are essential for driving better business results. Let’s discuss what companies should – and shouldn’t – be doing.

Read more

How frozen organisations can become fluid

To develop organisational agility, focus on being like water.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?