Customer screening: watch list optimisation

27 October 2021

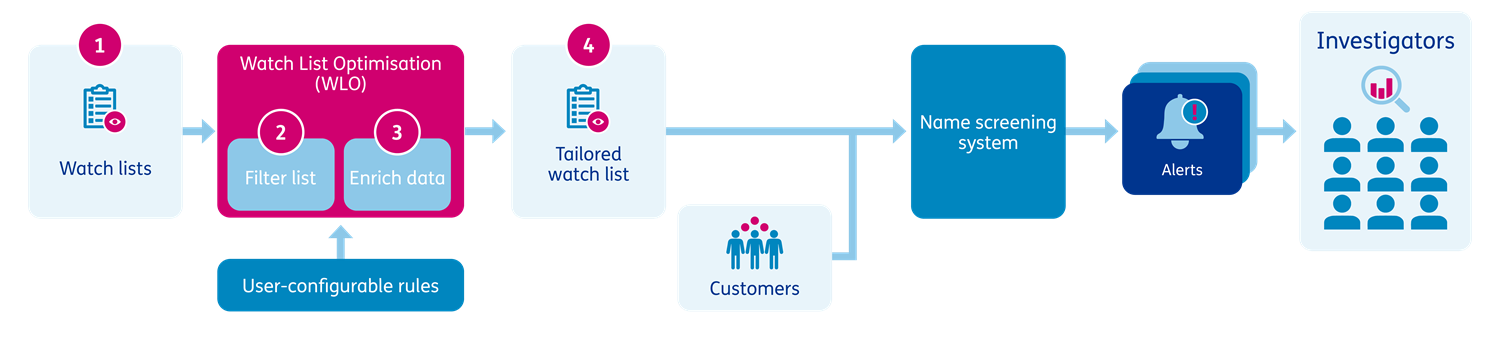

Recognising the lack of a tool in the market to manage watch list content, Baringa have developed a solution to help organisations tailor watch lists to match their jurisdictional footprint and risk appetite. Our watch list optimisation solution provides a configurable, user-friendly method of managing watch list content, removing records of no value whilst improving the data quality and completeness of those kept for screening.

Baringa’s watch list optimisation solution provides a lightweight method for rapidly reducing name screening alerts and improving operational outcomes. The solution can be rapidly and seamlessly integrated into existing screening processes, working to replace the watch list / watch lists that are ingested into a name screening system. The solution is driven by a user-configurable ruleset, is fully auditable and processes both full files and ‘deltas’ that are provided by third-party watch list providers.

(Click image to expand)

Functionality

WLO enhances third party watch lists and tailors them to an organisation's risk appetite. It does this by:

- Directly consuming third party watch lists in order that they can be ‘pre-processed’

- Filtering the lists, excluding entries which are not relevant to the organisation based upon a set of dynamic, user-configurable rules

- Enriching the lists by addressing data quality issues and tailoring the data to the name screening matching logic

- Exporting a tailored list, bespoke to the organization, for consumption by the customer or payment screening system so that only customer or payments of interest lead to alerts being generated

Risk management benefits

- Significant reduction in alerts and associated operational cost – ~40% reduction in name screening alerts in some organisations

- Enables greater focus on alerts which present a real financial crime risk to the organisation

- Fewer false negatives – enhancement of data quality enables matches to be identified which would otherwise would not have been

- Better investigator decisions – enhancement of data quality enables investigators to make more informed decisions as to whether a match is valid

- Reduced reputational risk as a result of poor financial crime risk management decisions being made on the basis of spurious list entries

Implementation benefits

- Rapidly deployable: No changes are required to the configuration of the files supplied by the list provider or the name screening system – WLO works by transforming the third party list into a tailored list in the format required by the name screening system

- Fully auditable: All entries included or excluded from the third party list, and the reasons for their inclusion/exclusion are tracked by WLO each time it is consumed by the name screening system

- Fully configurable: All business rules are fully configurable by business users (with appropriate permissions) within a graphical user interface

- Greater agility to respond to changes in risk appetite and/or policy

If you would like to know more about our Watch List Optimisation solution and how it could benefit your organisation, please contact Cat Morris.

Related Insights

Typify™ - more accurately detecting Financial Crime

Typify, Baringa's investigation and analytics product, creates a fit for purpose solution that is easy to use and implement.

Read more

An introduction to Typify™

Typify™accurately pinpoints the atypical by combining an understanding of typical customer and peer group behaviour with insight from financial crime experts. This enables financial institutions to manage financial crime effectively and efficiently, reducing the need for large and expensive teams of investigators.

Read more

Typify™ - financial crime typologies identified

Transaction monitoring is key to detecting suspicious financial activity. However, this is not 100% accurate. Baringa’s Typify offers a tailored solution.

Read more

Top 10 financial crime risks 2022

Baringa is committed to reducing financial crime and the negative consequences it has on society.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?