Consumer Duty guidance: essentials for implementation

16 November 2022

The Consumer Duty sets a clearer and higher standard of care that financial institutions must give to consumers, as defined by the Financial Conduct Authority (FCA). This will require firms to put customers at the heart of their businesses, and deliver good outcomes for consumers.

The Duty is made up of an overarching principle and rules that firms will have to follow and evidence. It will mean that consumers should receive communications they can understand, products and services that meet their needs and offer fair value, and they get the customer support they need, when they need it.

Firms should review the appropriateness of their culture, strategy and processes, as well as the robustness of their controls relating to these areas:

- Products and services

- Price and value

- Consumer understanding

- Consumer support

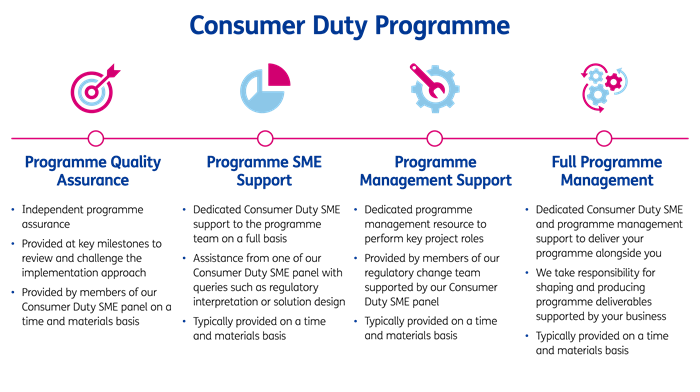

There is a significant amount of preparation and implementation to complete along the key milestones set out by the FCA. Baringa teams can support you in taking a phased approach to meet these requirements and the regulators deadlines.

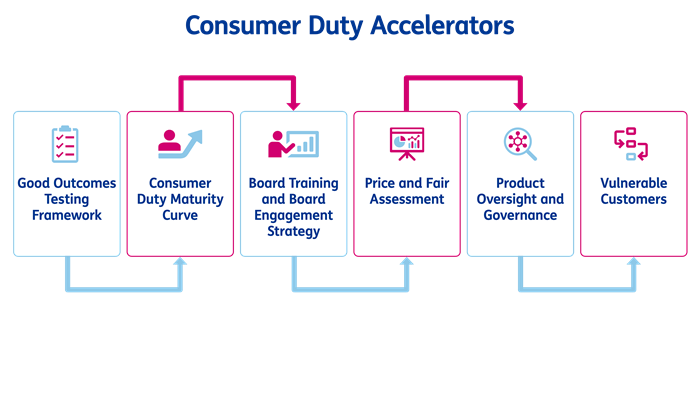

Good Outcomes Testing Framework

- Good outcomes taxonomy framework to define ‘good’ as a step change from ‘fair’

- Outcomes testing framework to ensure your good outcomes are driving a risk based approach to Consumer Duty compliance monitoring and testing

- Pilot programme to run high risk products and services through your outcomes testing framework

Consumer Duty Maturity Curve

- Identify your current and target state of maturity relating to delivery of good consumer outcomes

- Map your progress against peer firms in your industry and track developments in your maturity over the 1, 3 and 5year + outlook

Board Training and Board Engagement Strategy

- Deliver understanding of Consumer Duty background, context and requirements

- Board expectations of programme teams and key areas to challenge teams on

- Industry benchmarking to understand current and target state against peers

Price and Fair Assessment

- Template framework document to embed price and fair value assessments into your product lifecycle

- Fair value methodology to ensure price and value considerations are balanced

- Detailed technical standards and guidance to enable your business to transfer technical skills to deliver price and fair value assessments into your BAU teams

Product Oversight and Governance

- Product oversight and governance framework document to ensure your POG approach is comprehensive and well documented

- Product assessment templates with detailed guidance to transfer technical skills to deliver regular reviews into your BAU teams

Vulnerable Customers

- Vulnerable customer maturity framework to assess how embedded supporting vulnerable customers is in your strategy

- Vulnerable customer journey mapping to identify key moments of truth to deliver good consumer outcomes

- Reporting dashboard to track development of vulnerable customer treatment over time and monitor improvement

If you'd like to know more about the Consumer Duty and how to develop a cohesive good outcomes framework, please connect with us.

Our Experts

Related Insights

Consumer Duty: What’s next? Five focus areas for the months ahead

The FCA’s Consumer Duty rules went live on 31 July 2023. We look at five key points firms should consider in the next 12 months.

Read more

Why the Consumer Duty will empower firms to combat greenwashing

What are the regulator’s intended outcomes from SDR and how are they linked to the Consumer Duty?

Read more

Turning compliance into competitive advantage: how to move up the Consumer Duty maturity curve

Discover how to transform the Consumer Duty into a market differentiator. Explore maturity stages, benefits, and steps for maximizing your business potential today.

Read more

The first big test: get set for the board submissions in October

How can you make sure you and your Board are ready ahead of the consumer duty board submissions? Find out with Baringa's comprehensive guide.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?