Why the Consumer Duty will empower firms to combat greenwashing

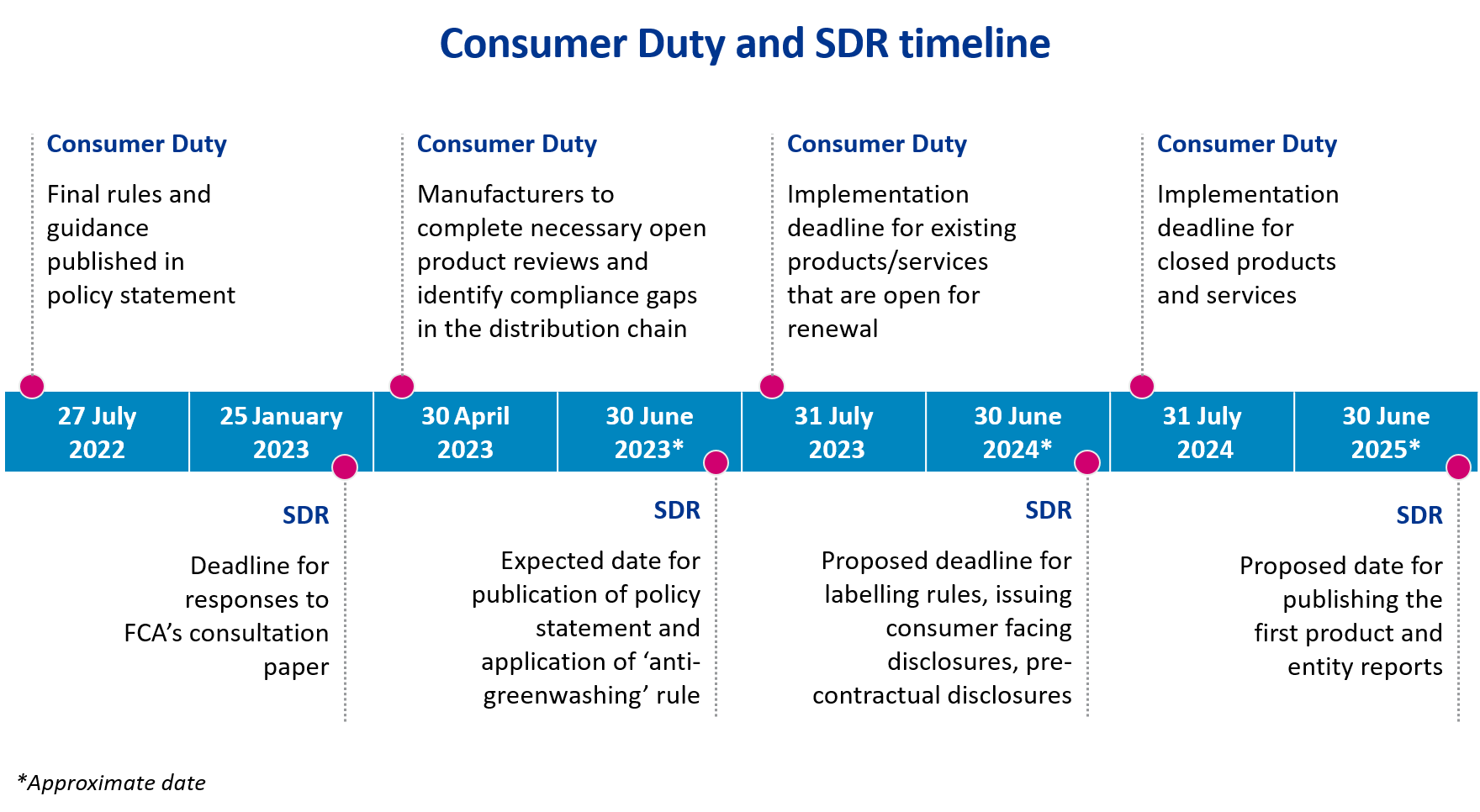

The Consumer Duty deadline for open or existing products is less than six months away. The work that firms have put into improving and evidencing good outcomes to meet Consumer Duty requirements will inform actions on the FCA’s Sustainability Disclosure Requirements.

4 min read 13 March 2023

Connecting ‘good outcomes’ to SDR

The FCA is intent on preventing consumer harm and is increasingly adopting an interventionist approach to ensure that its expectations are being met. The Consumer Duty with its new principle of “good outcomes for retail customers” is central to this approach, and it is evident that the Duty will provide the foundation for any subsequent consumer focused regulation.

The Sustainability Disclosure Requirements and Investment Labels (SDR) is one such regime that aims to reduce misleading or unsubstantiated sustainability related claims in the market and rebuild consumer trust.

What are the regulator’s intended outcomes from SDR and how are they linked to the Consumer Duty?

Sustainability Disclosure Requirements: next in line

The FCA published its consultation paper on Sustainability Disclosure Requirements and Investment Labels (CP22/20) in October 2022 which contained the following proposals:

- A general ‘anti-greenwashing’ rule applicable to all regulated firms to reiterate that all sustainability related claims must be clear, fair, and not misleading.

- Consumer facing disclosures to help customers understand sustainability related features of a product.

- Detailed disclosures that include pre contractual disclosures, ongoing sustainability related performance information, and sustainability entity reports.

- New investment labels (“Sustainable Focus”, “Sustainable Improvers”, and “Sustainable Impact”) to restrict the use of sustainability-related terms in product names and marketing.

- Requirements for distributors to ensure that product level information is made available to customers.

All FCA regulated firms will be impacted by the ‘anti-greenwashing’ rule. Additionally, investment labels and disclosures will apply to firms that manage investment products for retail investors, including wealth and asset managers (such as UK MiFiD firms). Although SDR is intended to be compatible with the EU’s Sustainable Finance Disclosure Regulation (SFDR), SDR is a labelling regime focused on aiding consumer understanding of the market, while SFDR focuses on disclosure requirements.

The long-term benefits of good Consumer Duty processes

The FCA’s three-year strategy is heavily oriented towards improving outcomes for consumers and markets. Reducing and preventing serious harm is at the forefront of this approach. To achieve this, the FCA is creating less prescriptive, outcomes based regimes to enable them to “focus on results” and both the Consumer Duty and the SDR, fall into this category.

It is evident that the SDR is based on the Consumer Understanding pillar under the Consumer Duty, which will lead to many overlaps in their respective implementation journeys. This means firms will need to engage relevant stakeholders, gather essential data, and evidence good outcomes to be compliant with each regulation. Most importantly, firms will need to provide consistent and clear information to customers that will help them identify products that meet their needs and objectives and ultimately allow them to compare the (sustainability) features of products more effectively. Thus, combining processes for good consumer outcomes with targeted actions to mitigate greenwashing risk will give in scope firms a running start to evidence SDR outcomes in 2024.

What to expect next

All regulated firms providing in scope products and services to retail customers have until 31 July, 2023 to evidence compliance with the Duty for open products. Meanwhile, the SDR policy statement will be published on 30 June, 2023 and the general, anti-greenwashing requirement will become effective for all firms, immediately. Labelling and consumer facing disclosures will become effective 12 months after the publication (June, 2024).

Five things firms should expect to do under Consumer Duty to support SDR outcomes:

- Determine foreseeable harms in relation to greenwashing risks as part of the pre-July product review, identify the products that meet the criteria for SDR investment labels and establish a plan to effectively mitigate those harms.

- Ensure that consumer facing product disclosures under the SDR are supportive of defined good outcomes under the Consumer Duty.

- Test customer communications for consumer understanding to enable customers to make the right financial decisions. Testing may not be required for some firms, but the Duty’s rules will guide firms to decide its appropriateness under SDR.

- Assess whether effective risk management frameworks and correct processes are in place to engage all relevant stakeholders.

- Identify and report Key Performance Indicators to monitor product performance against good outcomes under Consumer Duty and SDR’s sustainability objectives while navigating the challenges of evidencing these outcomes.

Put simply, it is the responsibility of the firms to evidence their readiness to comply with existing and upcoming outcomes-based regimes or risk being reviewed and/or fined by the FCA. Preparing to comply with the Consumer Duty will give firms greater clarity about the implementation journey to achieve the outcomes under the Sustainability Disclosure Requirements and future consumer facing regulation.

Get in touch

If you'd like to know more about how to conduct product reviews under Consumer Duty to mitigate greenwashing risks, please contact us.

Our Experts

Related Insights

Consumer Duty: What’s next? Five focus areas for the months ahead

The FCA’s Consumer Duty rules went live on 31 July 2023. We look at five key points firms should consider in the next 12 months.

Read more

Essentials for Consumer Duty implementation

Struggling with Consumer Duty requirements? Meet FCA standards for better consumer care with Baringa's expert guidance.

Read more

Turning compliance into competitive advantage: how to move up the Consumer Duty maturity curve

Discover how to transform the Consumer Duty into a market differentiator. Explore maturity stages, benefits, and steps for maximizing your business potential today.

Read more

The first big test: get set for the board submissions in October

How can you make sure you and your Board are ready ahead of the consumer duty board submissions? Find out with Baringa's comprehensive guide.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?