Preparing for local and international regulatory reporting requirements

25 October 2023

Understanding your Scope 3 emissions across all 15 categories

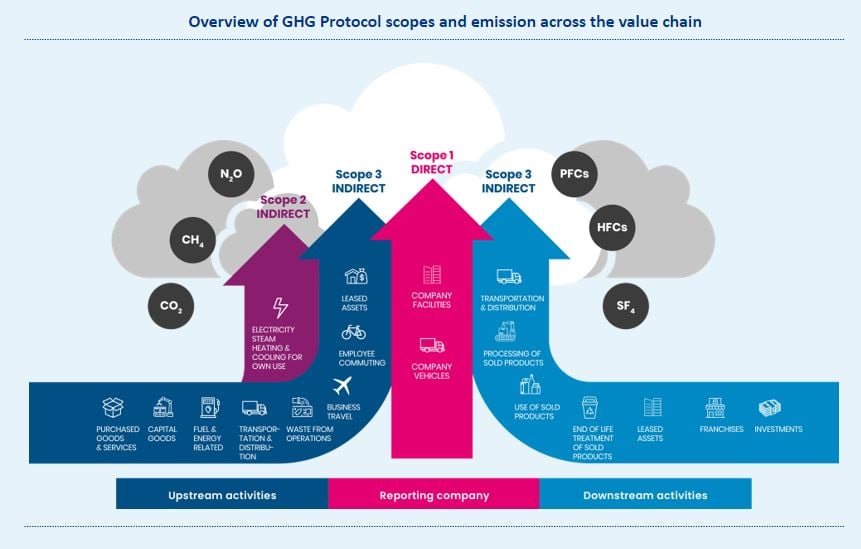

With heightened regulatory, investor, and consumer pressures, companies are facing questions on the measurement, methodologies and management of scope 3 greenhouse gas (GHG) emissions, in accordance with the Greenhouse Gas Protocol. As defined in the Greenhouse Gas Protocol, Scope 3 emissions encompass all indirect emissions (not included in Scope 1 or Scope 2) that occur in the value chain of a company, including both upstream and downstream emissions.

For financial service organizations, Scope 3 accounts for 99.98% of total emissions.

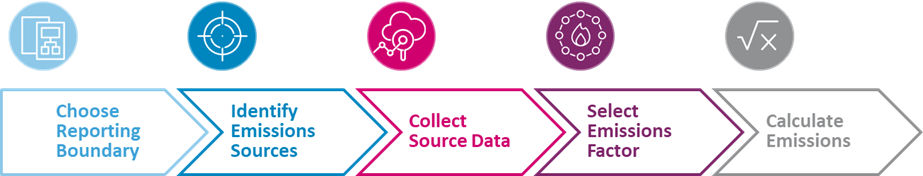

Thinking about your entire carbon footprint, Baringa’s has developed a 5-step emissions journey outlined and discussed in more detail below.

Baringa’s Scope 3 Playbook describes a practical approach to get started on your emissions management across all 15 scope 3 categories.

Our customizable Scope 3 playbook can be used for different types of advisory support we offer, ranging from:

1. Definitions and impact assessment

2. Data sources and stakeholders

3. Calculation methodologies

4. Implementation approaches

For all 15 scope 3 categories, Baringa’s Scope 3 Playbook addresses:

![]()

Definition and impact

Definition and impact

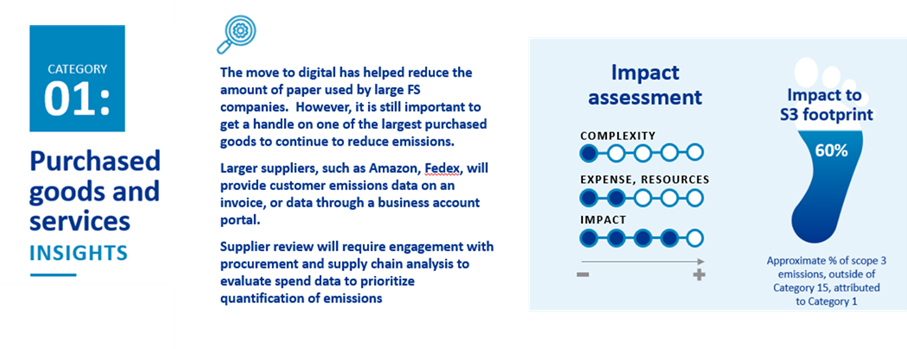

In addition to providing GHG protocol aligned definitions, our Scope 3 playbook provides tailored insights to inform your approach, agnostic of company sector or geographical profile.

Example of Category 1 Definition & Insights

Data sources & stakeholders

Data sources & stakeholders

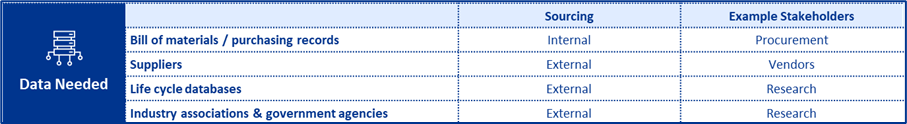

Getting a handle on emissions data is a critical and challenging task for any company. In our Scope 3 playbook, we explore available data sources and emissions factors, as well as key stakeholders to participate in the data collection process. This will enable an enterprise-wide approach to embed emissions management into existing business and reporting routines.

Example of Category 1 common data sources

Calculation Methodologies

Calculation Methodologies

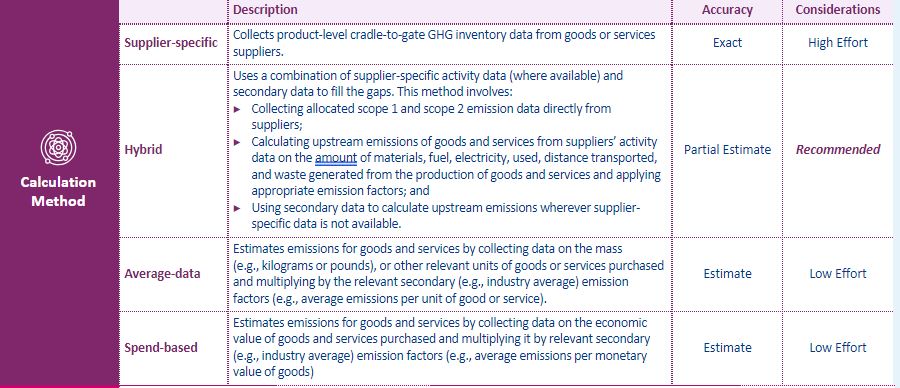

For each of the scope 3 categories we explore available calculation methodologies to inform your approach on what is aligned to your company’s profile and data availability.

Example of Category 1 analysis of calculation options

Implementation approaches

Implementation approaches

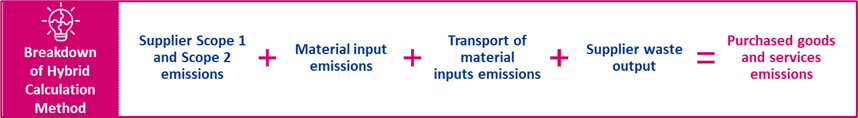

For each category in the scope 3 playbook, we have included example calculations to demonstrate how to translate the metrics and methodologies to understand and measure your emissions across each category.

Example of Category 1 calculation method

Baringa’s customizable Scope 3 Framework

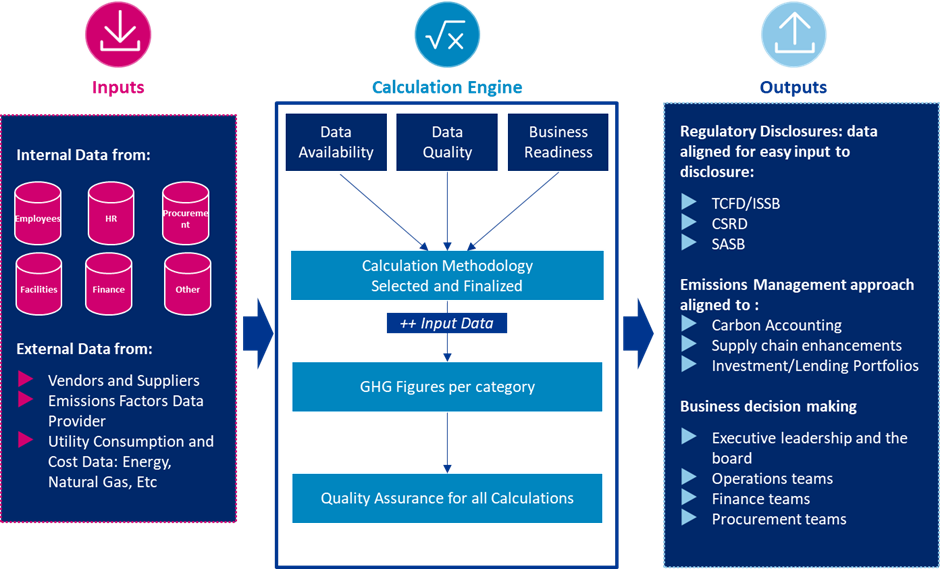

An emissions management framework is imperative for organizations. Our framework can be customized and built on your existing capabilities to align to regulatory compliance (eg., CA), and ultimately maximize the value for your organization.

Our framework is customizable based on your company’s sector and value chain to enable an adaptable and pragmatic approach to meet various use cases.

- Regulatory disclosures – Compliance with U.S. federal, national and local laws that is aligned with industry standard based on international regulatory requirements (e.g., ISSB, TCFD, CSRD)

- Emissions management – Strategic approach to carbon accounting, supply chain enhancements, or investment/lending portfolios

- Business decision making – Legal entity, business, and Board-level reporting to inform strategic planning efforts

To learn more about how Baringa can help on your scope 3 emissions journey, please reach out to Carolanne Boughton, Melissa Klimek, or Ryan Bohn.

Related Insights

Future-proofing climate disclosures: Leveraging climate reporting for nature

Forward-thinking companies are integrating climate and nature into their strategies to drive innovation and resilience.

Read more

Transition planning in turbulent times: How financial institutions can adapt and lead

The shift to a low-carbon economy is challenging for financial institutions; we explore how they can adapt and lead in today's tough landscape.

Read more

Simplification Omnibus: what you need to know and where to go from here

We share what the Simplification Omnibus means for CSRD, CS3D and the EU Taxonomy and how you should respond.

Read more

2025 Outlook: What lies ahead for climate and sustainability in financial services?

Here's what's front of our minds for 2025 based on our dialogue with, and work for, climate and sustainability leaders across financial institutions.

Read moreRelated Client Stories

Navigating the unknown for a super fund in climate-related transition planning

If the guidelines are still in development, how do you create a detailed transition plan now?

Read more

Helping a payments provider tackle two climate disclosures challenges at once

If you use scenario analysis for climate risk materiality assessment – can you satisfy both regulatory requirements?

Read more

Tailoring a robust ESG operating model for a superannuation fund

How do you design an ESG operating model that meets regulatory standards and the unique needs of the organisation?

Read more

Unlocking budget to uplift climate disclosure capabilities

If you had to disclose next month, where would the gaps be, and what would it take to close them?

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?