Web 3 is transforming the financial services industry globally

30 May 2022

Web 3 represents the evolution of the internet, leading a wave of disruptive innovation across the globe. The impact this will have on financial services, and indeed all industries, will be huge, fundamentally changing how we organise, interact and govern ourselves. This includes how we create and exchange value through delivering and consuming goods and services, as well as how we carry out financial transactions.

The history of the web

The fundamental shift brought about by Web 3 can be understood by considering a simple and chronological history of economic interactions:

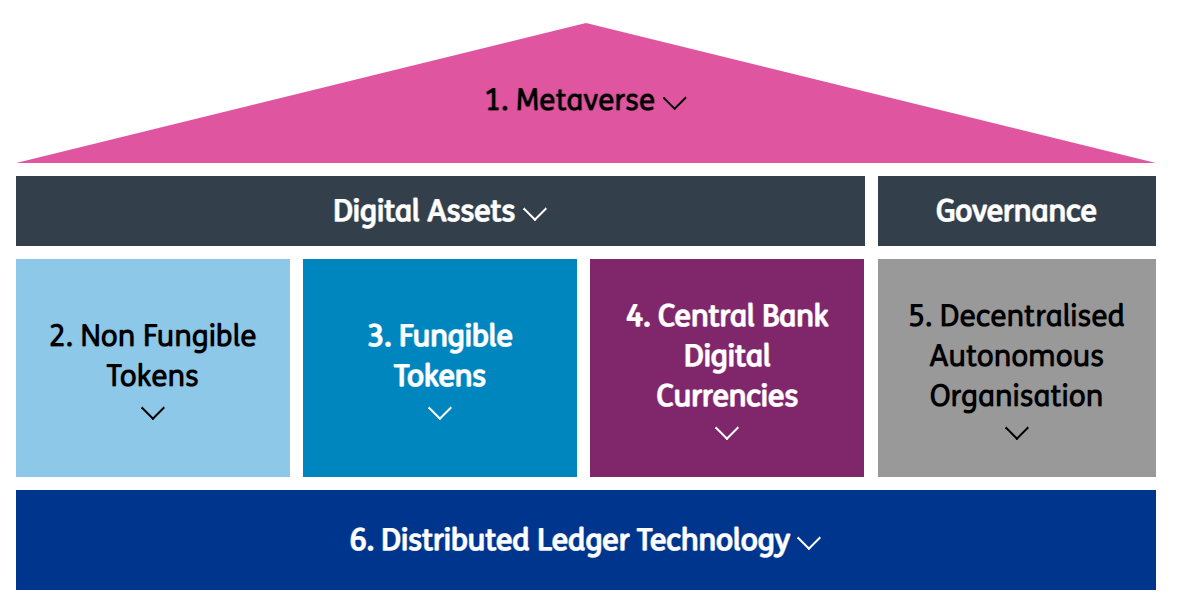

Web 3 is a new ecosystem for social and business interaction

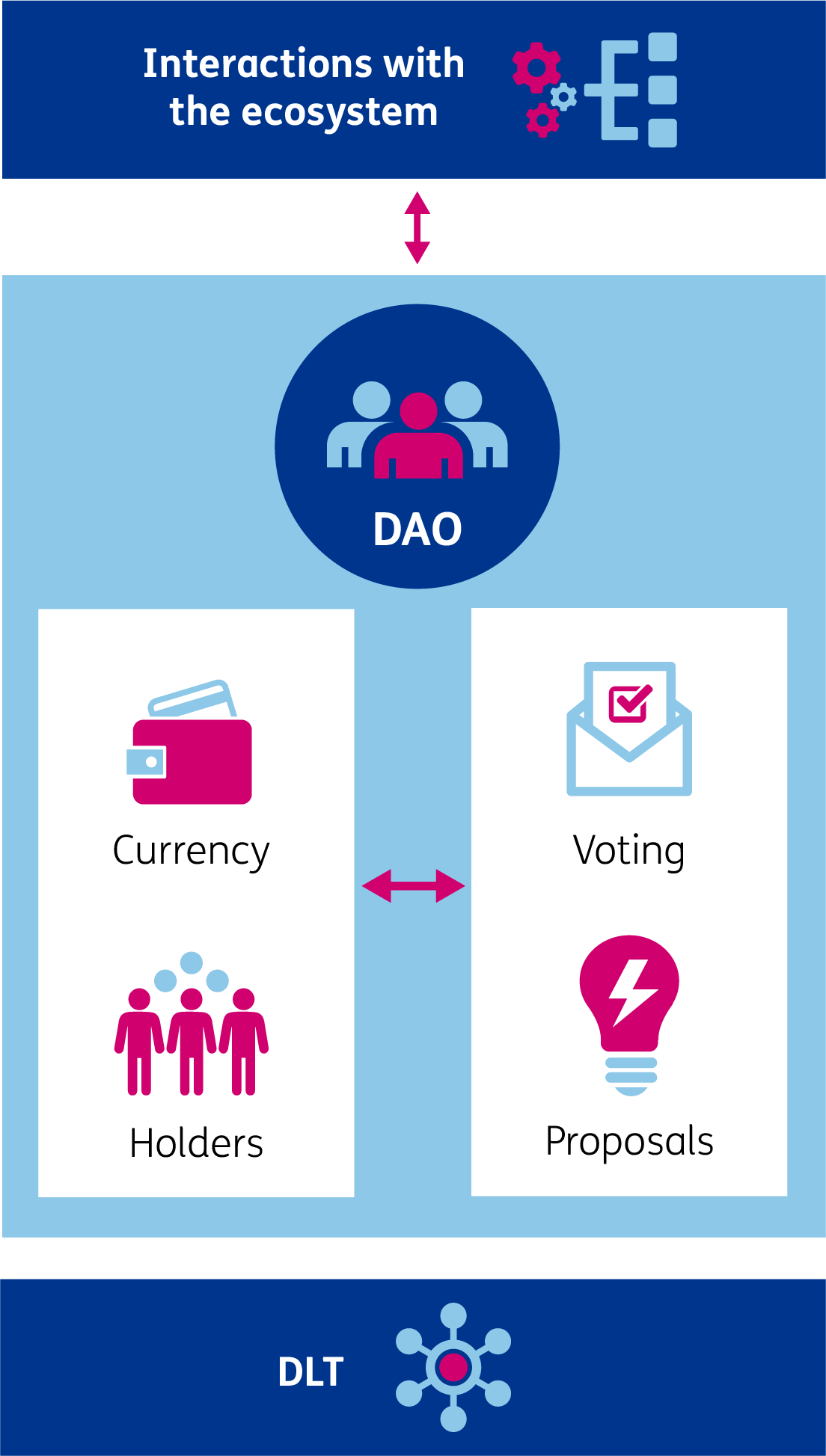

Cyptocurrencies, Decentralised Autonomous Organisation (DAOs), Non-Fungible Tokens (NFTs) and the metaverse - no longer buzzwords but rather the latest technologies impacting the world of finance. But what are they actually? They are effectively elements of the Web 3 house. Like with a traditional house, there are many components, that individually aren’t particularly interesting, for example bricks, mortar, windows, roof tiles, timber, cabling and piping. But assembled in the right way, you create a home for someone to live in, providing them safety and shelter.

Web 3 works on a similar principle, with a number of unique components that collectively make up this vast and exciting ecosystem.

We have identified six key components of Web 3 that will have the greatest impact on financial services

This Web 3 ecosystem enables both people and machines to interact trustlessly to create, deliver and consume services and exchange value. This environment is governed by openly published and known consensus and validation mechanisms delivered through decentralised networks supported by Blockchain and DLT technologies. Whilst currently at a formative stage, experts predict that Web 3 will be predominant within five to ten years. With far reaching impact on the way we operate in all areas of society, the ‘powered by the people’ characteristic of Web 3 makes it more than just a technology, but also a social movement which affects how we interact with one another, encouraging inclusivity, data ownership, economic participation, and of course, regulation.

This will impact how companies engage with their clients, the services they provide and what value their clients have for those services. Many sectors will see significant disruption, not only to their business models but right down to their purpose. Regulatory frameworks haven’t been designed to cope with a decentralised and open economy so will need to adapt fast.

The change can easily be glossed over because it is nuanced. You may believe that everything you can do in Web 3, you could already do with Web 2 systems. This is partly true; however, Web 3 opens up the possibility that society can fundamentally change what it values. This change in value drives change in behaviours. What was an economy based on a collection of walled gardens, is becoming an open ecosystem of actors who are all able to participate equally in the economy. Centralised and closed systems will become obsolete. This is not because the technology supporting the service is different, but rather the service being delivered is different.

Understanding these trends and how they impact your company and your ability to react and respond to Web 3 is critical to stay ahead and take advantage of the changes. We look specifically at what this means for banks, FinTechs, regulators and corporates.

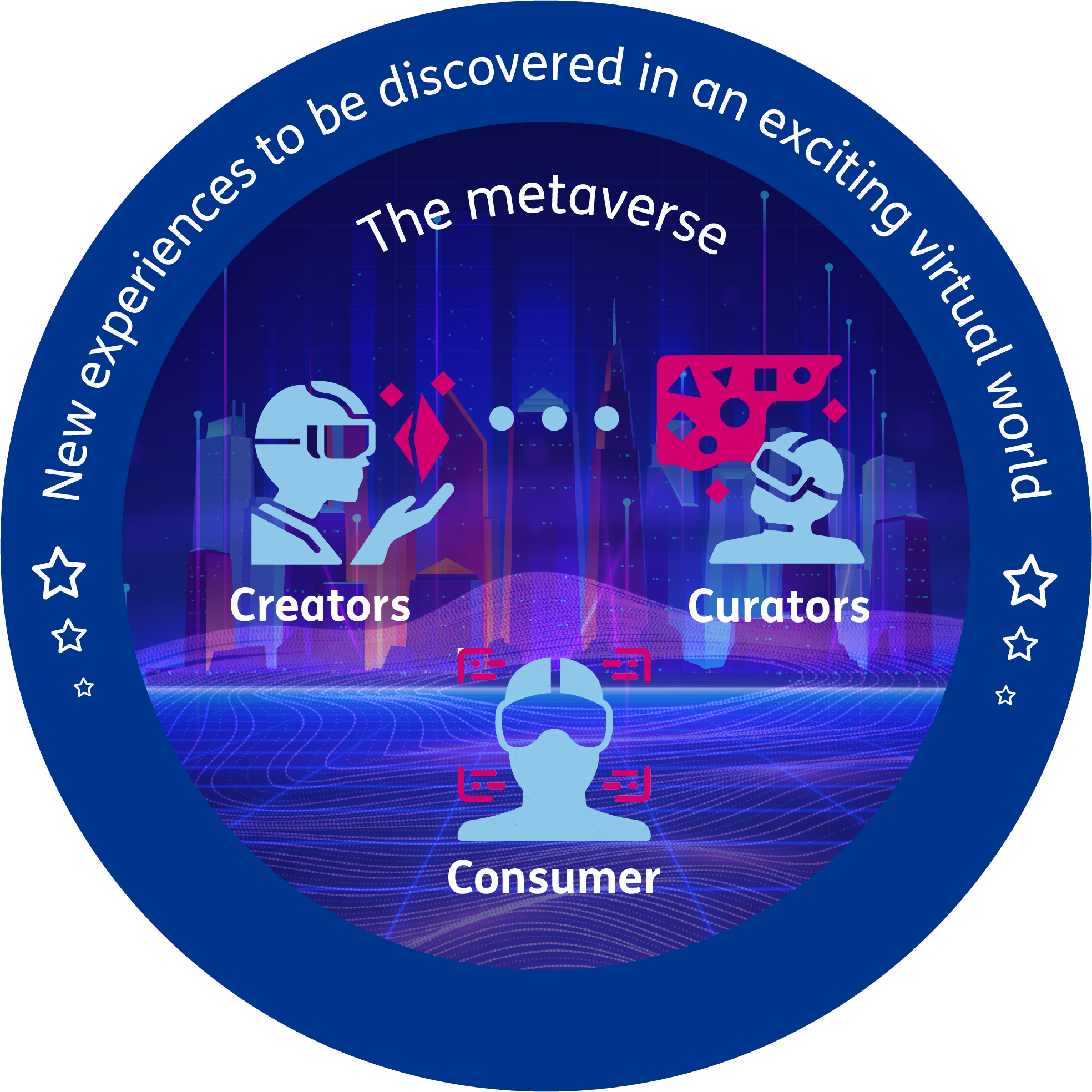

Metaverse components

The impact from Web 3 on the global financial services ecosystem is far reaching and all market players need to react to the change.

To maximise the value in your organisation, you need to have a balanced and comprehensive understanding of the implications of the movement, including both the threats but also the exciting opportunities ahead.

Here are three key questions we suggest you start with to approach the shift to Web 3 head-on:

- How is Web 3 going to impact your business?

- What can you do to take advantage of the opportunity?

- What will happen if you don’t adapt to Web 3?

To help you to unpick these challenges, please get in touch with one of our experts.

Our Experts

Related Insights

The role of regulators in accelerating Web 3 innovation

Financial institutions are seeing the potential that Web 3 technologies can offer but need the regulatory guard rails to have the confidence to commit.

Read more

Solving the KYC dilemma with Web 3

DLT has great potential to optimise Know Your Customer. We unpack the issues in KYC for retail and corporate banks and evaluate the application of DLT.

Read more

Blockchain opportunities for treasury – disruptive solutions or additional risks?

We take a look at how Web 3 is impacting investment banks, specifically bond issuance, intraday liquidity and in OTC derivatives.

Read more

Why NFTs are here to stay

What is a non-fungible token (NFT)? How will they impact the banking industry, and are they here to stay? In this article, we will dig into these questions.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?