2026 tech industry outlook: the five trends that shaped 2025 and what comes next

5 min read 26 January 2026

Five major trends converged in 2025 to transform the technology sector, reshaping business models and competitive dynamics. The rapid rise of AI workloads spurred a surge in data center investments, in turn increasing energy costs and sustainability pressures, inflationary factors that directly impact profit margins. Similarly, as tech companies faced rising expenses and more complex ecosystems, they turned to workforce restructuring and operational discipline as key strategies to build resilience.

The influence of these trends is evident across the industry. Hyperscalers such as Microsoft and Google doubled down on AI infrastructure, pouring billions into data centers to support generative AI services. Meanwhile, SaaS providers like HubSpot and Atlassian faced margin pressures, leading to a renewed emphasis on pricing discipline and commercial rigor. Companies like Meta and Amazon made headlines for large-scale layoffs, driven by a mix of pandemic-era over-hiring and the pivot toward AI-driven capabilities. Even hardware companies such as Intel and NVIDIA, while benefiting from AI demand, are navigating operational complexities and energy limitations as they expand production.

Figure 1. Diagram demonstrating five key trends that shaped the technology market in 2025

Understanding how organizations are responding can help you prepare for what lies ahead. In this outlook, we share our perspectives on the trends that defined 2025 and their implications for technology executives in 2026.

1. AI workloads are surging, but expect more discipline going forward

In 2025, we saw most companies move beyond defining AI use cases and developing proofs of concept. However, it was only a handful of leaders that were scaling up production-ready solutions for internal productivity or enhancing customer engagement1. Most organizations are caught in the "pilot trap", unable to move forward because of the realization of significant investment needed to productionize and scale and AI solution to the enterprise. It is because of this that 40% of agentic AI projects are predicted to be canceled by 20272 .

Baringa’s response: Extracting value from AI requires moving beyond experimentation to AI-driven decision-making integrated into daily operations, empowering frontline teams with real-time, personalized insights. That’s the approach we took with a major U.S. telecommunications firm, designing a solution to reduce customer churn that would provide its frontline teams with personalized, dynamic retention offers powered by AI workflows, showing the potential to improve both efficiency and customer experience. This was made possible by an agentic pipeline that integrates automated agents, empirical churn-driver models, competitor insights, and a real-time LLM-powered agent.

Our outlook for 2026: We expect the approach to AI will shift from one of “exuberant scale” to a focus on unit economics discipline and governance by design. Organizations will reduce model sprawl, standardize MLOps across business lines, and emphasize agentic systems that produce measurable results (e.g., churn reduction, revenue increase, cost-to-serve improvements) over simply experimenting with “AI everywhere”. Tech companies should expect to maintain tighter model portfolios, and develop robust business cases for building towards production with a few foundational models and more fit-for-purpose small models.

2. Explosive data center growth will demand more sophisticated power planning and forecasting

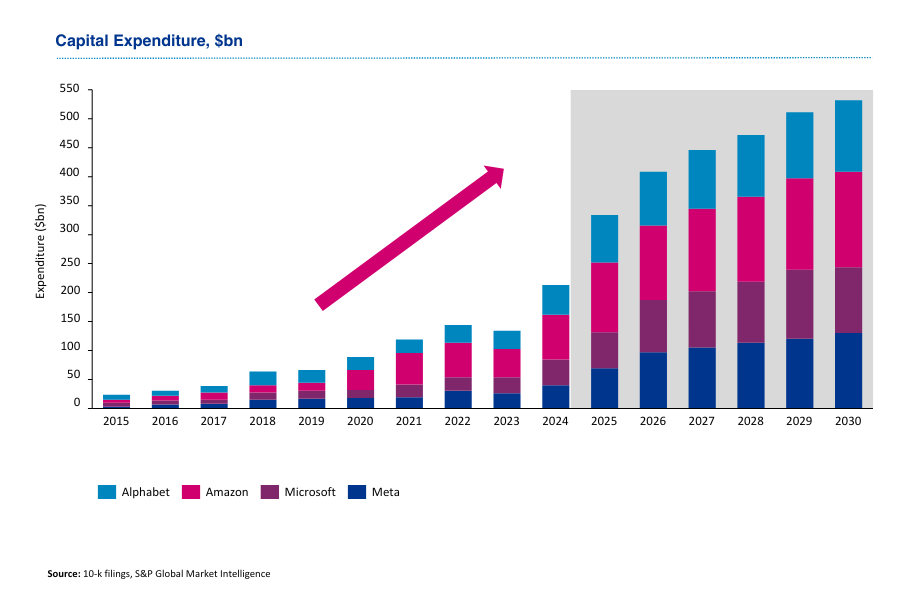

The surge in AI workloads fueled unprecedented investment in data center infrastructure. Baringa recently highlighted capital expenditure of $325B in 2025, and that’s only accounting for Alphabet, Amazon, Microsoft, and Meta. Mega-facilities repeatedly made headlines for overwhelming the towns that host them. This rapid growth is increasing pressure on energy demand, sustainability, and power-grid reliability.

Figure 2. Historical and estimated capital expenditure of big technology companies (2015-2030)

Sources used to generate the chart: Baringa Partners’ report: "Data Centres: Boom or Bust?", September 2025 based on the information from 10-k filings from S&P Global Market Intelligence

Baringa’s response: We are tackling these developments on multiple fronts. Our proprietary platform, Energy Source, allows tech providers to manage their entire electricity portfolio and make smarter short- and long-term energy decisions. Additionally, as rapid customer growth creates uncertainty about energy ramp-up needs for the data center providers, our teams have been helping clients establish contracting mechanisms with incentives for accurate power forecasts, as well as helping to deploy AI-enabled forecasting models that predict ramp-up requirements, which can ease strain on distribution networks.

Our outlook for 2026: We anticipate AI infrastructure capital investments will continue to grow, potentially reaching $500 billion annually by 2030. This makes it essential to prioritize power-aware orchestration going forward. Hyperscalers and colocation providers need to shift from a “more megawatts” strategy to grid partnerships, energy hedging, and smarter workload placement. Future strategies should include AI-ready zones co-developed with utilities, demand-response contracts, on-site renewables and storage, and heat-reuse economies. The winners will be those with the strongest power planning and forecasting, turning AI demand curves into grid-ready ramp profiles.

3. Margin pressures will necessitate more strategic pricing approaches

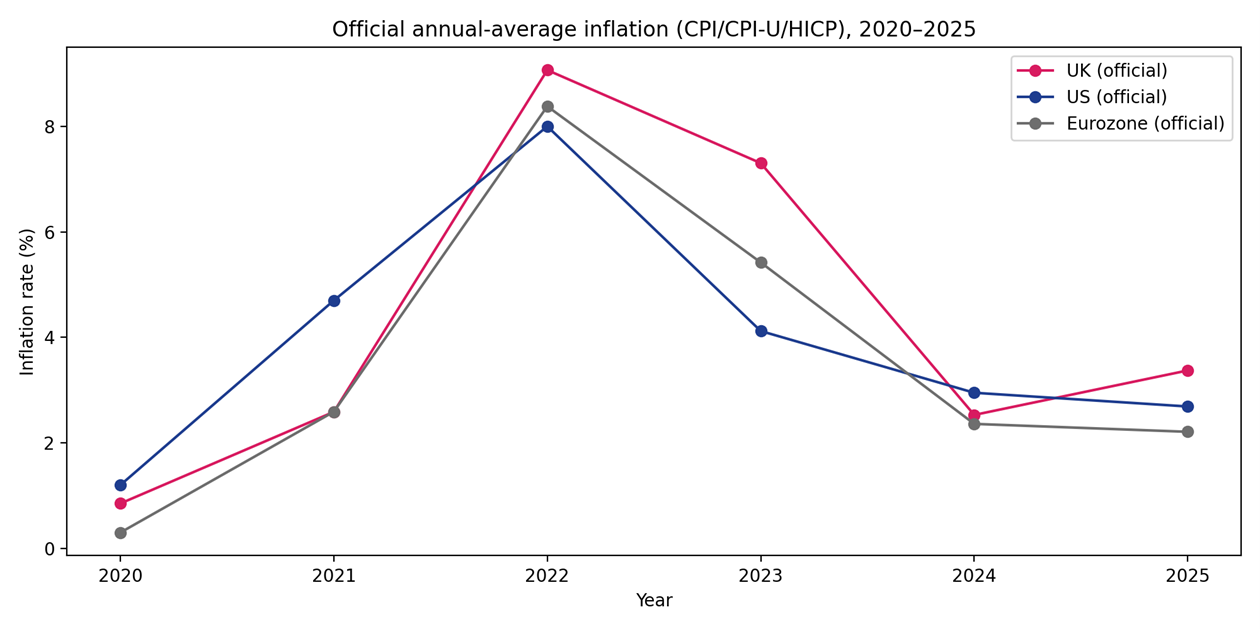

Inflation was top-of-mind for many in 2025, and while it has come down from the 2022 peak across key geographies 2 (see Figure 3), it remains a focus, especially with tariffs dominating much of the media narrative.

Figure 3. Annual average inflation in the UK, US and the Eurozone (2020-2025)

Sources used to generate the chart: ONS Consumer price inflation, UK: December 2025 (official bulletin), BLS Consumer Price Index – December 2025 (news release), Eurostat Inflation in the euro area and Eurostat HICP annual dataset

For businesses, increases in energy prices and wages created margin compression scenarios. Despite this, many firms were hesitant to raise prices because of competitive concerns.

In a recent Baringa survey of over 100 private equity-backed SaaS companies across the United States, the United Kingdom, and continental Europe, 68% had not adjusted their pricing strategies for small- and medium-sized enterprises since 2020, despite ongoing inflation.

Baringa’s response: Those that practiced pricing discipline outperformed their peers in growth and margin resilience. We helped a $4 billion data analytics provider identify $20 million in immediate new value by transforming its Deals Desk from a reactively managed discounting function into a transparent, structured commercial capability focused on coaching sellers, reducing leakage, and protecting margins.

Our outlook for 2026: Companies that have resisted pricing changes will finally adopt structured pricing programs. We anticipate that more tech firms will move to value-based pricing for AI-enhanced features, risk-based contracts, and better deal governance, including more seller coaching with guardrails, leakage control, and clean book-to-bill practices.

4. Headline-grabbing layoffs will give way to strategic workforce planning

Companies that couldn't pass rising costs to customers turned to cost restructuring, primarily through layoffs. Although some cuts were related to AI efficiency gains, it's still too early to credit sustained productivity improvements to this. The main drivers were more likely pandemic-era over-hiring and a shift toward AI-related skills.

Baringa’s response: During times of uncertainty and evolving skill requirements, having the right people in the right roles is crucial. To address this, Baringa assisted an $8B electronics manufacturer in strengthening continuity in critical roles while speeding up the development and deployment of scarce capabilities through improved internal mobility and succession planning. This not only prepared the company for the future but also built leadership resilience and decreased its dependence on external hiring.

Our outlook for 2026: We anticipate fewer headline layoffs and more retooling through internal mobility markets, skills adjacency mapping, and structured succession planning for AI-focused roles, such as transforming prompt engineering into workflow design, and data science into productized analytics. Tech companies will invest in competency frameworks and career lattices aligned with AI-enabled operating models and will increasingly adopt bionic models where human judgment works alongside agentic systems. They will design roles centered on collaboration with AI; supervising, orchestrating, and enhancing agents rather than competing with them. This shift will fundamentally change how work is assigned and how value is created.

5. "Boring excellence” is in, as operational rigor intensifies

Although not as headline-worthy as layoffs, there has been a renewed focus on operational discipline. In fact, we believe this is the most widespread and potentially most significant trend emerging in 2025. Rising costs, competitive pressures, and increasingly complex product architectures (including bundling, consumption-based pricing, and value- or risk-based models) have put more strain on downstream lead-to-cash processes. This has prompted firms to examine their operations more closely.

Baringa’s response: We are collaborating with clients to evaluate and redesign operations for better efficiency and effectiveness. For example, we helped one software company increase revenue by 3% in a year and cut operational costs by $11 million by redesigning its go-to-market operating model to clarify roles, streamline processes, and align multiple functions to support a growth-focused, customer-driven commercial engine.

Our outlook for 2026: Companies that get ahead will be those that industrialize their lead-to-cash and serve-to-renew processes. This includes clean product catalogs, consistent bundling logic, consumption meters wired to billing, and policy-driven discounting. This is the “boring excellence” that transforms AI gains into margins and enhances customer experience.

Amid uncertainty, readiness is key

Predicting how the macro landscape will change in 2026 is challenging, but one key principle remains: Tech companies with strong operational fundamentals, clear processes, disciplined pricing, scalable architectures, and sustainable infrastructure strategies will be best positioned to seize new opportunities and handle emerging risks. The winners will not see AI as a mere add-on but as an essential part of their core operations, integrated into decision-making, frontline workflows, and governance frameworks. Instead of depending on isolated pilots, they will intentionally expand AI use, combining human accountability with autonomous systems to enable faster decisions, improved economics, and long-term competitive advantage.

In 2026, the advantage won’t belong to the companies that experimented fastest. It will belong to those that industrialized intelligence, mastered the fundamentals, and turned AI ambition into operational reality.

1 Wharton / UPenn 2025 AI Adoption Report

2 Gartner June 25, 2025 press release

Our Experts

Related Insights

Twelve Shifts of Digital

What are the Twelve shifts of digital, and how can they underpin your digital strategy or transformation journey?

Read more

Digital by default

Organisations that relied on traditional business models became exposed during the Covid crisis. Shifting to digital has become necessary to survive.

Read more

The future of work

Covid-19 has accelerated the future of work, and many businesses have had to embrace a new way of working more quickly than they may have anticipated.

Read more

Digital twins - energy transition drives a new purpose

Digital Twins have a role to play in optimising our current Oil & Gas assets.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?