Are your risk management tools “fit for purpose” in today’s world?

22 March 2023

Given the continuing level of uncertainty in the global financial markets, we have been talking to our clients to understand their focus and their expectations going forwards.

At the heart of their current challenge is how to manage any misalignment across asset and liability gaps. In particular, duration and interest rates gaps which could impact capital and ultimately liquidity. As a result, treasury and credit teams across the industry have been under pressure to provide reassurance.

How robust is your current risk management framework?

It is inevitable that multiple perspectives will be shared on where banks should be prioritizing their efforts. We believe that, in some institutions, the complexity of managing the inter-connectivity of balance-sheet risks mean that the current tools are no longer be fit for purpose. In this short article we suggest some priority areas for optimization.

First, understand what good looks like

-

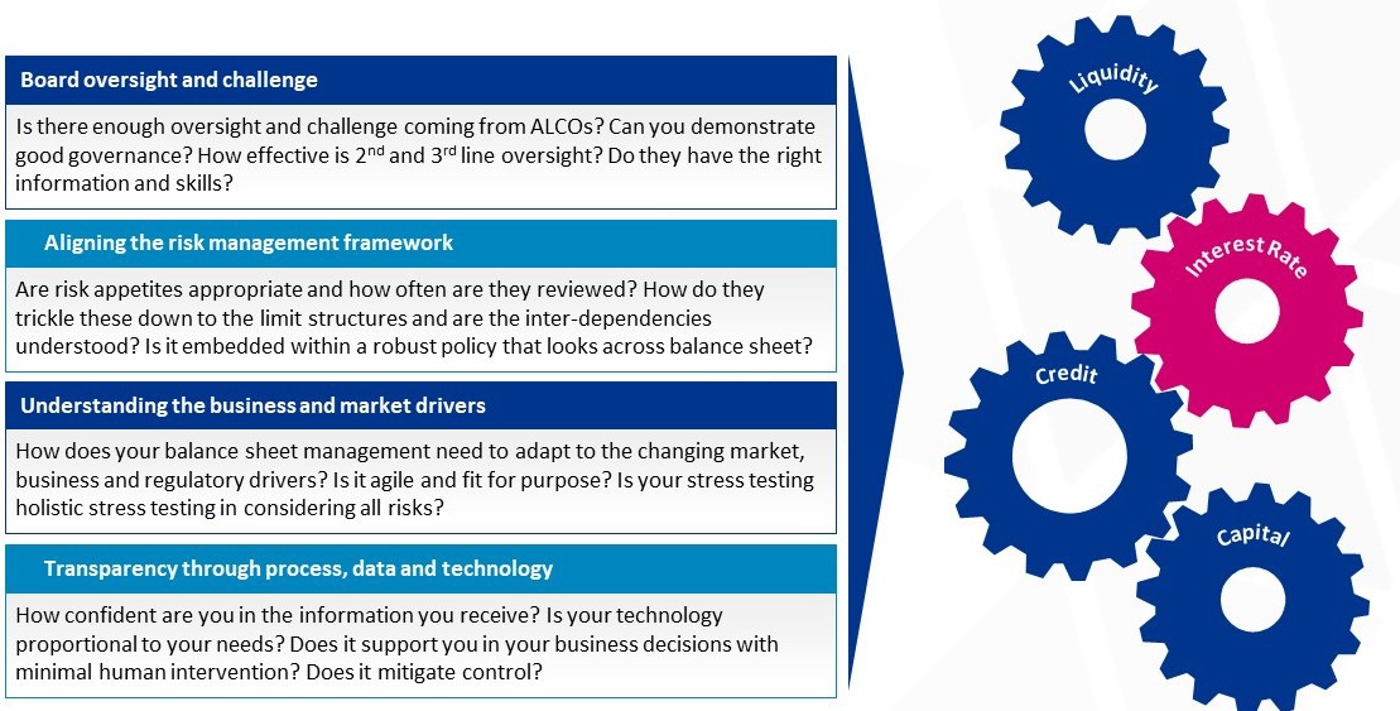

Focus on Governance

Good risk management begins with robust board oversight and effective control through clear visibility into strategy – and the risk framework supporting that strategy. Fundamental to all this is the preparedness of boards to continuously challenge strategy and approach. Board oversight needs to be supported by skilled second and third line in providing this robust challenge.

-

Understanding the interconnectivity between risks

Balance-sheet risks do not exist or act in isolation from one another. So, it’s essential to ensure the risk management framework is fully aligned and that interdependencies across the balance sheet – from liquidity, interest rate, currency to credit and capital risks are understood.

To support an integrated approach to risk management, firms should ensure that these risks are not viewed in a standalone manner. Instead, their interconnectivity needs to be considered so individual factors and their interdependencies are continuously examined and evaluated. Evaluating them across multiple scenarios in stressed and normal conditions will enable a more robust definition of the balance sheets binding constraints.

-

Stress testing and scenario planning are not “one and done”

A more rigorous ALM (asset and liability management) approach should incorporate a real understanding of the risks created by business, market and regulatory drivers. A key example: segmenting deposits to understand underlying client behaviours and how these could drive potential mismatch across liquidity, duration, interest rate risks, alongside any associated capital impacts.

Crucially, stress testing and scenario planning are not “one and done”, but part of an ongoing process that should include consideration of social media and other external factors in planning the scenarios. This requires continuous evaluation and challenge of the multiple scenarios that a bank may face, especially when there are material changes in business strategy or market events.

-

Data, data, data…

Timely data is key to understanding balance sheet constraints and sources of potential risk. This means that confidence in its accuracy, completeness and timeliness is a fundamental requirement. This includes challenging assumptions and dependencies used to drive Treasury and Risk models.

With the right infrastructure in place to provide real transparency, firms can identify, measure, monitor, manage and report on risks, as well as provide their boards with the right information to support decisions.

Five things you should do next

As thinking moves from the tactical to the strategic, we expect to see a heightened emphasis on the importance of risk management fundamentals, stress testing and scenario planning in all financial institutions – with boards demanding greater transparency into their firms’ risk management processes. For banks, we suggest the following priority focus areas:

- Ensure you have the right skillsets and information needed to support effective challenge and oversight of balance sheet risks and mitigation strategies by the board and senior management.

- Assess the effectiveness of your stress testing: review the assumptions, dependencies, and testing approach to ensure they are still fit for purpose and consider all interdependencies across the balance sheet.

- Be confident that you have the right tools to do the job; understand the advantages of tactical tools like Alteryx or Power BI (business intelligence) versus longer-term vendor solutions.

- Gauge your level of comfort with data timeliness, completeness and accuracy, as well as the confidence you have in it to support strategic and day-to-day decision-making.

- Review your recovery and resolution planning to ensure it is fit for purpose in today's real-time business and market reality; for instance, in the age of social media, are management information and governance agile enough to act decisively to manage potential balance sheet challenges as a result of media and market events.

We understand that many banks will be grappling with the current market conditions. For support, you can contact our Financial Risk and Controls team: Cindra Maharaj or Simon Gray.

Related Insights

Navigating sustainable retrofit in real estate

Achieving successful sustainable retrofitting in real estate can seem like a complex challenge. Discover how your organisation can unlock the strategic value of retrofitting with our new report, commissioned by Barclays and in collaboration with JLL, Travis Perkins and TrustMark.

Read more

Typify™ - more accurately detecting Financial Crime

Typify, Baringa's investigation and analytics product, creates a fit for purpose solution that is easy to use and implement.

Read more

An introduction to Typify™

Typify™accurately pinpoints the atypical by combining an understanding of typical customer and peer group behaviour with insight from financial crime experts. This enables financial institutions to manage financial crime effectively and efficiently, reducing the need for large and expensive teams of investigators.

Read more

Typify™ - financial crime typologies identified

Transaction monitoring is key to detecting suspicious financial activity. However, this is not 100% accurate. Baringa’s Typify offers a tailored solution.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?