Europe’s gas consumers in the driving seat

How can gas/LNG buyers capture value and resilience in a fast-evolving LNG market?

5 min read 5 September 2025

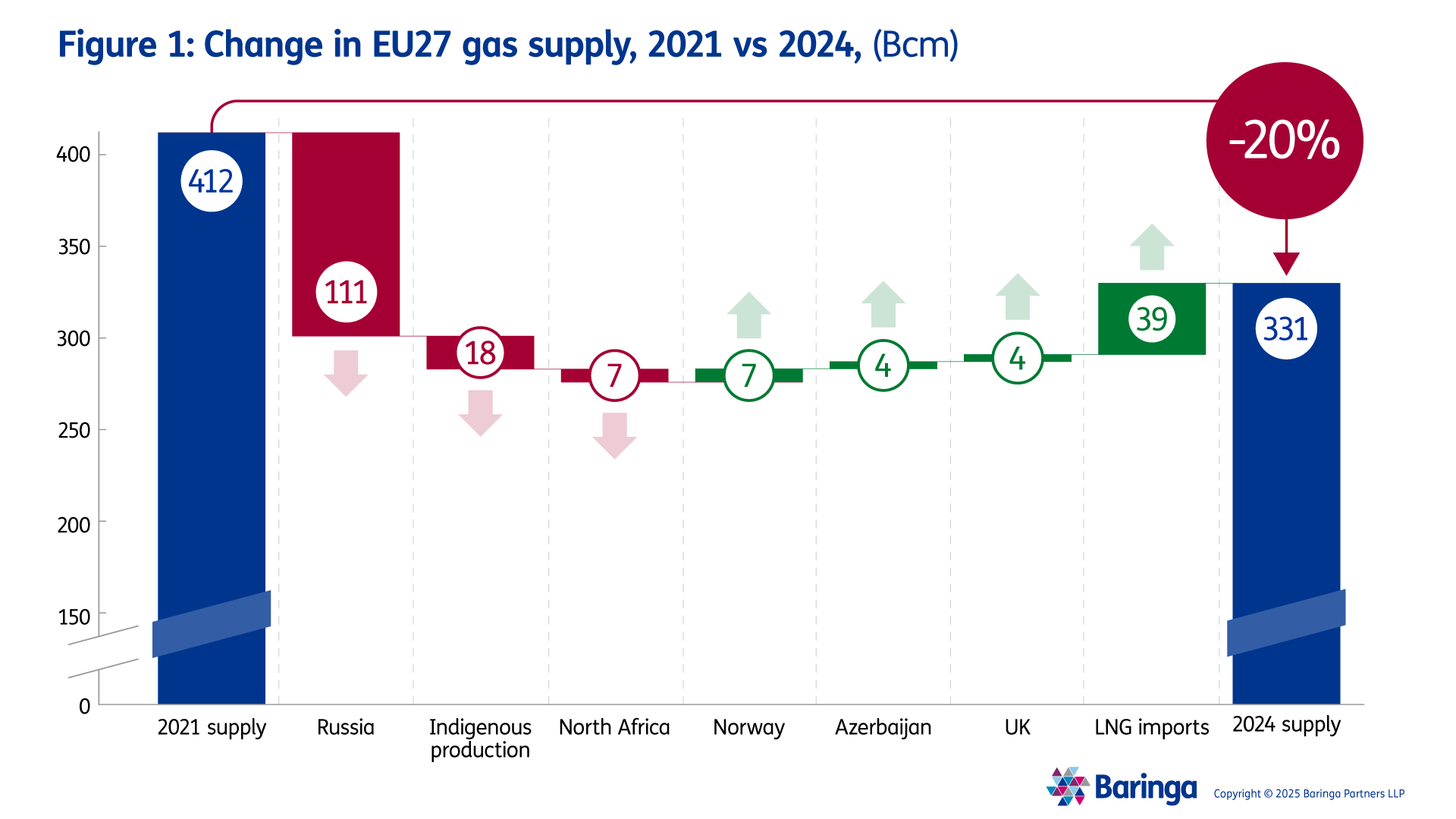

From dependency to diversification: How European gas consumers are rebuilding gas supply

Over the last three years, the Russia-Ukraine conflict has drastically restructured European gas market fundamentals. The region has all but stopped its import of Russian pipeline natural gas, coming down from 144 Bcm in 2021 to 33 Bcm in 2024. That figure is set to drop further this year as Russian gas imports passing through Ukraine cease, following the expiration of a 5-year transit agreement. Out of the four pipelines that once flowed Russian gas to Europe, only the Turkstream remains operational to service what marginal flows remain.

LNG has filled the gap, with imports into Europe rising 46% between 2021 and 2024. Europe’s location between the US and Qatar, coupled with extensive regasification capacity and deep hubs such as TTF, cements Europe’s role as the premium landing point for global gas.

For European gas consumers, this shift presents not only challenges but also real opportunities to secure supply more flexibly, competitively, and strategically than ever before. This piece explores the key themes, opportunities and challenges that these changes present to large European gas consumers.

A number of key themes are reshaping the European gas and LNG markets

The European gas and LNG market is undergoing structural changes, creating new opportunities for major consumers to secure supply that is both flexible and affordable. Rising US LNG exports and the rapid build-out of European regasification capacity are transforming how gas is procured and traded. At the same time, shifts in Asian demand and a slower pace of decarbonisation are opening further avenues across the gas and LNG value chain. To capture these opportunities, European consumers must be proactive in making informed choices on contracting, infrastructure access, and partnerships to maximise value for their companies, shareholders, and customers.

Key Gas and LNG Themes and opportunities for European Gas Consumers

| Theme | Opportunity for large European gas consumers |

| Upcoming US supply |

|

| Market trading and optionality |

|

| EU LNG import capacity growth |

|

| Declining Asian demand |

|

| Slowing pace of decarbonisation |

|

The opportunities are not without complexity. The ability to capture value lies in using optionality in regas access, trading and in contracting structures, while navigating supply, policy and transition risks. At Baringa, we help large gas consumers turn this complexity into a competitive advantage.

Key challenges to consider

| Theme | Challenges to consider | How We Can Help |

| Upcoming US supply |

|

|

| Market trading and maturity |

|

|

| EU LNG import capacity growth |

|

|

| Declining Asian demand |

|

|

| Slowing pace of decarbonisation |

|

|

To find out more about how to stay ahead in the European gas & LNG market, get in touch with Mashal Jaffery or Peter Thompson.

Our Experts

Related Insights

Navigating AI governance for energy companies: why a holistic enterprise model is key to compliance

As energy companies increasingly look to explore and adopt artificial intelligence (AI) as a major enabler of their strategy, discover Baringa’s recommendations for approaching the challenge and harnessing the power of AI, while ensuring compliance and mitigating risk.

Read more

How can a digital supply chain drive resilience in the age of the digital energy transition?

Four key areas where we believe digital technologies have the greatest potential to transform the performance, profitability and resilience of supply chains navigating the energy transition.

Read more

Digital transformation and decarbonisation in the energy sector

Energy leaders are using digital technologies and data to fast-track their journeys to decarbonisation.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?