How can digital supply chains drive resilience for the digital energy transition?

10 min read 1 May 2024

The energy transition is underway, with governments the world over setting ambitious targets for decarbonisation and renewable energy. This is driving up demand for a variety of assets – wind and solar systems, batteries for storing energy and powering electric vehicles, electrolysers to produce green hydrogen and heat pumps to decarbonise heating.

Delivering the new-generation technologies required for the energy transition demands robust supply chains. They’re central to sourcing critical materials, manufacturing key components and co-ordinating the labour and resources required for asset construction, installation and maintenance.

With supply chains already stretched, the energy transition is set to lift the pressure to unprecedented levels.

Supply chains experienced major disruption during the pandemic, with sudden restrictions on movement resulting in months-long production halts in many countries. Recent geopolitical events, such as Russia’s war in Ukraine, have further disrupted the supply of key raw materials, impacting trade flows and price volatility.

The strain on supply chains is only likely to increase as more economies make the shift to green energy and technologies. Consider the UK’s renewable energy supply chain, which was the focus of a recent research study conducted by Baringa for the UK Government. With demand for renewables like wind and solar photovoltaic (PV) surging, it’s only exacerbating the fight for access to finite resources.

Overview of capacity constraints for key renewables components and installation services

|

|

|

|

|

|

High |

|

|

|

|

|

Medium-high |

|

|

|

|

|

Medium |

|

|

|

|

|

Medium-low |

|

|

||

|

Low |

Source: Baringa UK renewables deployment supply chain readiness study 2024

This is directly linked to the current limited pool of suppliers globally, which is creating fierce competition for materials and personnel, both nationally and internationally. These shortfalls have limited the ability of supply chains to deliver at the scale, quality and pace needed to meet renewables deployment targets.

Compounding the problem is the reality that many suppliers have little incentive or commercial outlook to scale up. Take suppliers of offshore wind components as an example. Most lack the certainty of a pipeline of orders or specifics of required components. It’s left them unwilling to invest speculatively in new manufacturing capacity.

We see similar patterns repeating across many other parts of the energy value chain, from the procurement of raw materials and availability of labour through to pricing and distribution. If these issues aren’t addressed meaningfully and quickly, bottlenecks, shortages and price increases are inevitable.

At the same time, the energy transition will create new and growing value pools for companies that are prepared to seize the opportunity. Shifts in demand would unlock new markets for low-emissions products and services, as well as new kinds of infrastructure assets and components.

Capturing the opportunity will require organisations to anticipate key trends and potential risks early on, and pivot quickly to develop new capabilities. Companies will require different strategies, tools and techniques to succeed in this new world. Investing in the right digital and data technologies will be a crucial part of the equation.

Digital can strengthen supply chains’ ability to react and catapult them forward

It will take substantial work and smart investment to build out and scale up supply chains for the energy transition. The integration of digital data, artificial intelligence (AI) and analytics paves the way for a transformative digital supply chain experience.

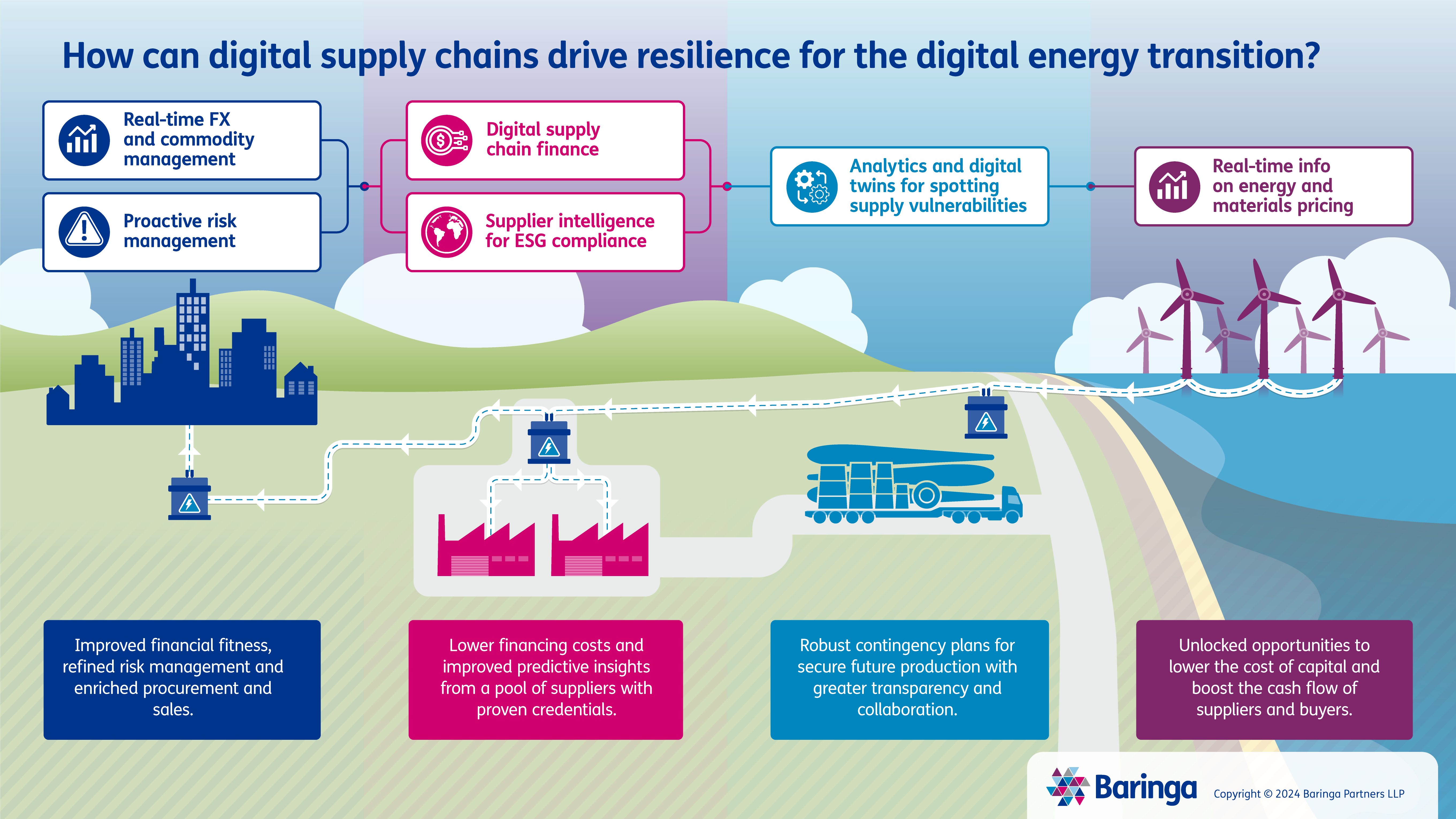

Here, we explore four key areas where we believe digital technologies have the greatest potential to transform the performance, profitability and resilience of supply chains navigating the energy transition.

1. Using the power of data to improve financial fitness

As with all digital strategies, the first step is getting data into good shape. Only then can it be easily shared and leveraged for analysis and decision-making. For a finance-specific solution, this starts with digital contracts, supplier records, purchase orders and invoices.

Once these documents have been digitised, a company can pull the data into emerging supply chain finance platforms. Here, it can be used for dynamic discounting and reverse factoring, which drive down financing costs for supply chains. At Baringa, for instance, we’ve helped clients deliver supply chain finance programs that lower overall supply chain costs by 2% on average.

Digitisation also opens up options for real-time FX and commodity management. Users can instantly place hedges on commodities or FX rates, or create tradable products with which to negotiate. For example, one of our clients saved $50 million in a year by using an FX analytics solution to support better commercial negotiations and hedging.

2. Refining and repositioning risk management

With data centralised and readily accessible, supply chain managers can put it to use for proactive risk management. Leveraging analytics platforms and digital twins, companies can conduct thorough risk assessments to uncover potential vulnerabilities and risky dependencies in the supply chain, and develop corresponding contingency plans based on backcasting and trendspotting.

The value of this approach is rising as the energy transition accelerates. For example, as governments announce new policy initiatives, they can have a knock-on effect on inflation, commodity prices and foreign exchange rates. Effective risk management ensures organisations are not caught on the back foot resulting in commercial losses, reputational damage or operational disruptions.

Transparency over an increasingly complex web of suppliers will also be vital to remaining compliant and avoiding potential penalties. By leveraging supplier intelligence solutions, organisations can track and evaluate suppliers based on sustainability criteria, ensuring compliance with emerging standards.

3. Enriching the art of procuring and selling

With the energy transition expected to bring greater volatility for supply and pricing, especially in the short- to mid-term, predictive insights, forecasting and risk management will help buyers in procurement to make the right calls at the right time.

On the raw materials side, Baringa has partnered with a leading fintech to create commodity hedging solutions for our clients. This helps them better understand materials’ price movements and the potential impact on the wider supply chain, as well as make hedging decisions that insulate against pricing volatility.

By adding more sophisticated data and analytics capabilities, procurement can evolve beyond simple order fulfilment to more strategic coordination of supplier engagements. Teams can target long-term supply agreements or develop streaming agreements with advance lump-sum payments to secure future production.

Investing in digital capabilities also helps make an organisation easier to do business with – an immensely valuable characteristic when supply pools are limited, and competition is fierce. Digital data and tools help both buyers and sellers get the basics right, bringing greater efficiency and transparency to negotiations and transactions, helping position their companies as a partner of choice.

4. Extending to the ecosystem

Savvy supply chain players recognise the value of sharing data to enable greater collaboration, transparency and decision-making with their partners. This could take the form of leveraging digital via established shared supplier collaboration platforms, innovation incubators and even buying consortiums to support a more limited supply pool.

In supply chain finance specifically, we’re seeing a wave of new digital platforms that provide improved access to the tail end of supply chains. This unlocks exciting opportunities to lower the cost of capital and boost the cash flow of both suppliers and buyers – creating a virtuous cycle of lower-cost commodity products, more resilient suppliers and less cash-related risk for corporate buyers.

Taking things a step further, there’s also the possibility for companies to create a pool of suppliers with proven credentials for meeting net-zero and other environmental, social and governance (ESG) objectives. This kind of win-win strategy exists in a digital world where invoices can be grouped by ESG-compliant suppliers and packaged into an auditable process to secure lower lending rates.

Finally, we are seeing emerging use cases for GenAI helping buyers unlock new value from their supplier contracts. This includes the ability to automatically track and execute rebates and other commercial levers, which traditionally require manual intervention, generating savings that flow through to the wider value chain.

Making the shift to digital supply chains is a significant endeavour – but it’s a move that must be made if we are to steer and sustain a successful energy transition.

Supply chains for crucial energy transition and electrification technologies are only as strong as their weakest links. Committing to the process of plotting out and mitigating potential risks along each part of the supply chain offers a real opportunity for innovation and collaboration among all players.

Organisations that can build resilient, future-ready supply chains will be positioned to reap the biggest rewards as the energy transition continues to gather momentum.

Baringa is here to help you lead the change

At Baringa, we are energy consultants and supply chain experts, operating at the heart of digital transformation. We achieve real commercial value for our clients, whilst putting people at the centre of our approach. This means we can help you to deploy the right technology solutions, at the right time and, most importantly, help bring everyone you need along for the journey.

Want to plot the best digital route for your supply chain through the energy transition? We’re ready to help. Please reach out to our team for more information.

Our Experts

Rob Gilbert

Partner, expert in energy supply chain and procurement (on secondment to UK Government)

Contact Rob

Related Insights

Operational excellence in energy trading key to sustainable success

Find out the five key issues hindering operational excellence in energy trading and learn how to overcome them for sustainable success in a competitive market.

Read more

Powering the edge: Virtual power plants, the grid’s decentralized powerhouse

As the energy transition accelerates, the plants powering our future are taking on a new form. Download our research with Kevala on virtual power plants.

Read more

How can digital and data sharing help deliver the energy transition?

How can network operators get ready for new data sharing requirements? And how can data sharing help deliver the energy transition? In this article, our experts share example use cases and three things network operators can do now to get ready for the new data sharing requirements.

Read moreRelated Client Stories

Shaping New Zealand’s energy transition conversation

How do you create a distributed energy model that draws on best practice from around the world but is also fit-for-purpose for New Zealand?

Read more

Electricity network operator: securing critical national infrastructure with hybrid defences

Breaking new ground with a hybrid security approach.

Read more

Maximising impact from AI investment for a global energy leader

Discover how a series of experiential learning events resulted in employee confidence in AI skills hitting 85%.

Read more

Maintaining the stability of the New South Wales power system

How do you ensure the future stability of the NSW power system?

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?