The impact of the Russia-Ukraine war on global gas markets, placing LNG in the spotlight for 2022

21 March 2022

The Russia-Ukraine war is first and foremost a humanitarian crisis and while nations are looking to take measures to ensure a quick and peaceful resolution, there are strong warnings of an enduring conflict. The impact is being seen in markets globally, and with regard to commodities, is fuelling an already volatile market.

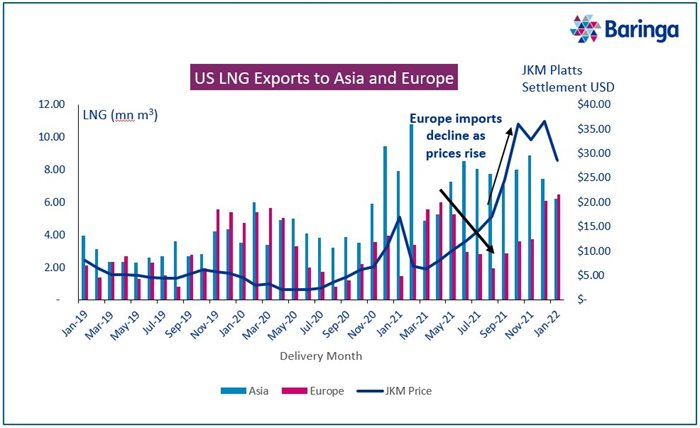

Over the course of autumn and winter 2021 and into 2022, the LNG price had risen to new highs. Initially strong Asian demand and Europe’s shortfall in typical Russian supply prompted a drive to secure gas for the winter. Whilst initially, Asian buyers outbid European prices, paying up to $50/MMBtu, milder weather in Asia had seen cargos switching to Europe for the first time in over a decade.

Flows to Europe are increasing due to a combination of a softening Asia demand, lower European gas reserves than is typical for this time of year and the possibility of sanctions on Russian pipeline gas restricting supply. This market activity is showing how Europe sees the extremes of LNG market dynamics.

As the Russia-Ukraine war has escalated, Russia has been sanctioned by the West - although not yet in terms of energy supply. That said, there is now a conscious and public effort to reduce dependence on Russian gas supply. This places greater emphasis on the role of LNG as a possible salvation. In the short term, the sanctions are causing payment challenges, but gas is continuing to flow, in the medium term, there may be less gas flowing from Russia and a continued larger role for LNG, with longer term structural changes in gas supply for Europe. LNG’s capacity to respond in the short-term is limited by available supply capacity and the ever-present competing demand in Asia and elsewhere. This has been exacerbated by the bans imposed on Russian flagged, controlled or operated vessels seeking to discharge LNG into the UK and other European nations, as well as the ‘voluntary’ refusal to take Russian LNG due to public pressure.

Further, increased LNG supplies have been identified as a means of lessening Europe’s reliance on Russian gas – in the longer term from new supply projects and, perhaps more hopefully, with significant volumes increasing into Europe in 2022 and the next few years

Playing a role as a ‘balancer’ for LNG volumes benefits Europe when supply is ample, as excess LNG cargoes flow to Europe and support lower prices (see 2020). But as the past autumn and winter has demonstrated, the flip side of this role (in concert with other supply challenges) results in high prices and has created uncertainty in Europe’s ability to rely on LNG to meet its gas demands. Based on the current market dynamics and how they’re expected to evolve in the next 1-2 years in terms of LNG supply and demand, we assess the impact this will have on the various LNG market players:

The Current Market State: Trends from 2019-2021

1. The demand for LNG has risen

A cold 20/21 winter in Asia saw LNG demand increase across major Asian countries including Japan, South Korea, Taiwan and China – seeing the largest rise by more than 30%. Central and South America had the 3rd largest rise in LNG demand, largely driven by Brazil’s shortage of hydroelectricity and Argentina’s lower gas production leading it to seek LNG as an alternative energy source.

2. LNG supply has been disrupted

Operational issues in plants across the globe including Norway, Trinidad, Nigeria as well as other countries across Central and South America, Africa and Australasia has meant that LNG capacity has been lagging nameplate capacity. New capacity has become available in the US Gulf Coast and other regions including Egypt, Malaysia and Russia and so overall capacity has increased but not in line with the overall demand increase, causing a squeeze on LNG supply.

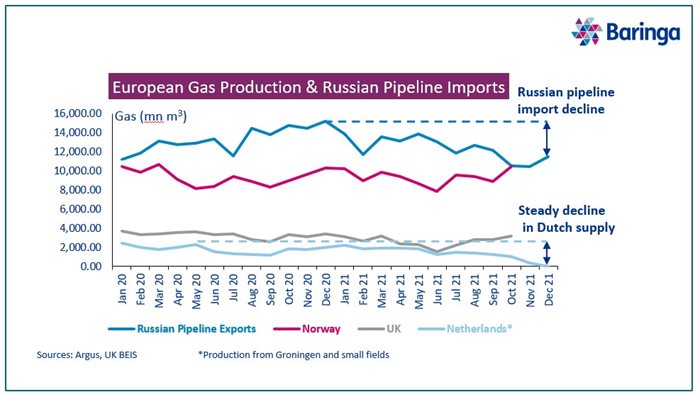

3. European gas production has been shrinking

Plant maintenance in the UK and Denmark and the continuing decline of Netherlands pipeline gas has meant reduced pipeline gas supply from NW Europe.

4. Pipeline imports reliant on Russia

A decline in Russian pipeline gas by around 25% has outweighed the increase from Northern Africa and Central Asia leading to a net decrease in pipeline imports. Russia’s market share (~35-40%) means Europe remains vulnerable to the implications of any supply challenges there.

Depending on how the Russia-Ukraine war develops, the possibility of either Russia limiting gas supply to Europe, or Europe sanctioning Russian gas supplies cannot be ruled out. This would have a profound effect on European markets (as well as global energy markets more generally). Whilst lower supply through spring and summer may be manageable in terms of meeting immediate demand, the failure to restock underground storage would likely lead to a repeat – or even escalation – of last year’s gas supply crunch.

What is the outlook for 2022?

In the immediate term, the markets are volatile in attempts to secure gas supplies but this is expected to ease as we enter spring and summer. In the short term, there will be a drive for energy security for the coming winter in anticipation that sanctions will be biting and continue. Looking further out, market players will look to structurally realign gas flows with the objective of removing all reliance on Russian gas supplies for the future.

As an LNG trader:

- Volatile gas prices are presenting opportunities to extract value from LNG contract flexibility – the profitability of US cargoes in Europe has never been higher

- The mild Winter in Asia has seen LNG diverted from Asia to Europe to meet demand and chase prices

- With strong indications of Europe looking to LNG as an alternative to Russian gas, the increased demand for LNG is likely to mean prices remain high, opportunity abounds for sellers and more Asia-to-Europe trades

- Asian LNG buyers could start to act on a non-economic basis, directing cargos towards Europe to counter Russian aggression. Unless these volumes are significant, it is likely to make little difference to the overall market dynamic

- Traditionally fuelling LNG vessels by using the LNG on board has been the cheaper alternative to fuel oil. However, with gas trading at a premium to oil, vessels are being fuelled by fuel oil, reducing the amount of boil off gas incurred in voyages.

As a European Energy supplier:

- Although Russian contracts continue to flow, European gas suppliers are actively seeking as much alternative supply as possible, driven by security of supply concerns and political desire to reduce reliance on Russian gas (as well as lower prices)

- Gas storage levels in December were the lowest they have been since 2016 as the October gas price traded higher than March, incentivising traders and suppliers to sell at the time rather than maintaining the long position until late Winter

- In order to meet energy demand, energy suppliers are likely to look to non-gas alternatives such as Nuclear and coal. However, with Russia also being the world’s third largest exporter of coal and businesses being deterred from investments in coal mining in recent years, there is also scarcity in this supply. With March 2022 coal prices trading above $300/mt, coal may not offer much of an economic benefit for consumers over natural gas.

As a European Energy Retailer:

- As we’ve seen already, a number of small UK energy suppliers have succumbed to the high gas price. Energy retailers may change and maintain more secure hedging strategies going forward, deciding to hedge the larger proportions of their long-term portfolio in advance

- In the eventuality that restricted gas supply sees increased coal fired power generation (not only in Europe but globally) this will likely have an impact on retailers’ carbon offset policies and green commitments to customers

- Sustained or increased gas and power prices could put pressure on governments to intervene to further protect their customers.

As an LNG Freight Trader/Charterer:

- LNG freight charter rates are seeing extreme swings from very high to (recently) negative prices. This is being driven by the location of vessels vs. where they need to be. This volatility presents an opportunity to either make large wins or conversely, large losses.

Market Impacting Factors to Monitor in the next 12 months

Depending on the political outcome of the Russia-Ukraine war with regards to Russian pipeline flow to Europe, European gas supplies could be in short supply heading into the Winter, putting increased pressure on global LNG prices to meet any shortfall.

- The rate at which gas storage levels replenish and decline throughout the year should be closely monitored

- Increases in Russian gas towards China could lessen China’s LNG demand, freeing up supply to Europe

- Conversely, problems in Kazakhstan could see some modest reduction in gas flows to China from there

- Changes to policies in Europe to increase supply such as Norwegian, Dutch, UK and Danish volumes or alternatively an acceleration of policies away from natural gas in an attempt to meet carbon net zero commitments.

Looking further beyond 2022

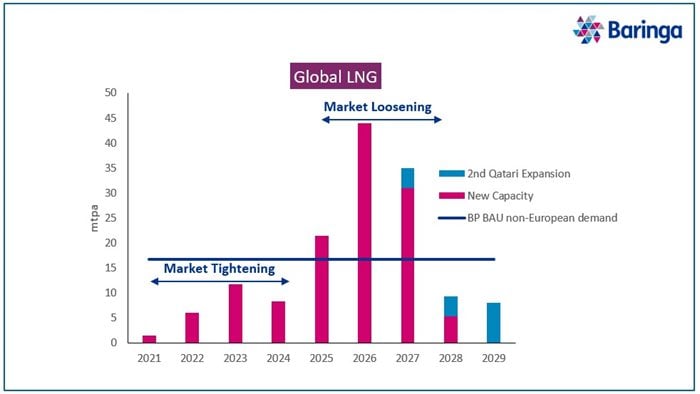

The Russian political situation is complex and part of shifting global geopolitical forces – whether Europe can rely on the availability of Russian gas as before is unclear. In the next 3-4 years, given the new LNG supply due to enter the market, the global LNG market is expected to tighten further while incremental demand growth is expected to outstrip new supply. LNG is unlikely to provide a ready solution in the event of continued or further Russian gas (or other) supply constraints.

Based on this projection, we could see the following outcomes:

- The triggering of new LNG FIDs, but in the context of the energy transition, funding new LNG projects are uncertain i.e. will they be needed for 20 years or become stranded assets? And they will enter the market in 2026/7 at the earliest

- The market doesn’t act, creating a structural shortage of gas and this may last for some time if market demand doesn’t decline fast enough to natural balance with available supply

- Further stimulation of de-carbonisation. However, an unintended consequence might result in a surge in coal demand in places like India for industrial consumption which cannot be run off renewables.

Future supply projections are expected to increase from 2025 onwards, including the Qatari expansion. It is a hypothesis that this will loosen the market with gas supply and demand stabilising but until then the risk of high prices remains. By this time – there may be more clarity of the energy transition trajectory that the world is on and thus the longevity of such investments as more countries become more definitive on their targets

For more details on current and future LNG market activities or to talk to one of our team, please contact Peter Thompson, Andy James or Jayesh Parmar.

Related Insights

Asia’s power markets: Poised for investment

Asia's electricity demand is projected to increase significantly in the coming decade, driven by increasing market and economic growth.

Read more

The future of European CfDs

Contracts for Difference have been successful at increasing competition, accelerating capability buildout and stabilising prices in many European states.

Read more

Asian LNG markets: evolution and growth in response to the war in Ukraine

The rapid reduction in Russian gas exports to Europe has resulted in an unprecedented reshuffling of LNG trade dynamics.

Read more

Commercial fleet electrification – adoption is accelerating, but barriers remain

With 50% of new car registrations in the UK being registered by businesses, it’s vital for companies to start electrifying their fleets.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?