Can green hydrogen produced in the UK be competitive in the emerging global market?

6 July 2023

Hydrogen offers a compelling route to market for offshore wind in the UK that would otherwise be grid constrained, subject to high grid charges, or is so far from shore that it is more cost effective to bring energy ashore in the form of hydrogen rather than electricity.

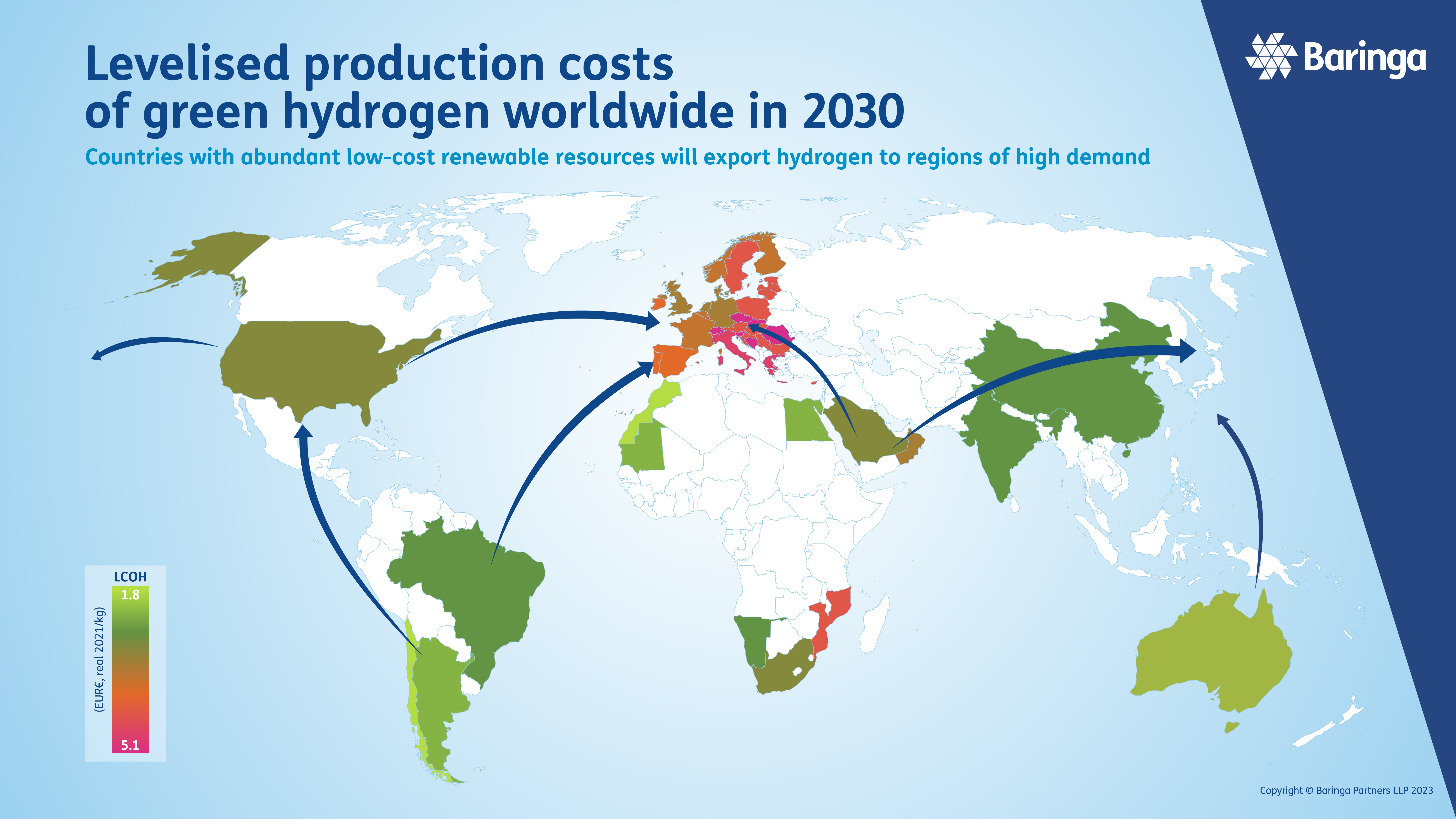

While early-stage hydrogen production projects are predominantly co-located with anchor demand, a global market for the trade of hydrogen and related commodities (eg ammonia and methanol) will emerge in the medium term, similar to the Liquefied Natural Gas (LNG) market today.

Both the UK and Scottish Governments have recognised the strategic importance of hydrogen from offshore wind as an export opportunity for the UK.

However, can green hydrogen produced in the UK compete with green hydrogen produced domestically in Europe? Or with hydrogen exported from low-cost production regions such as the USA?

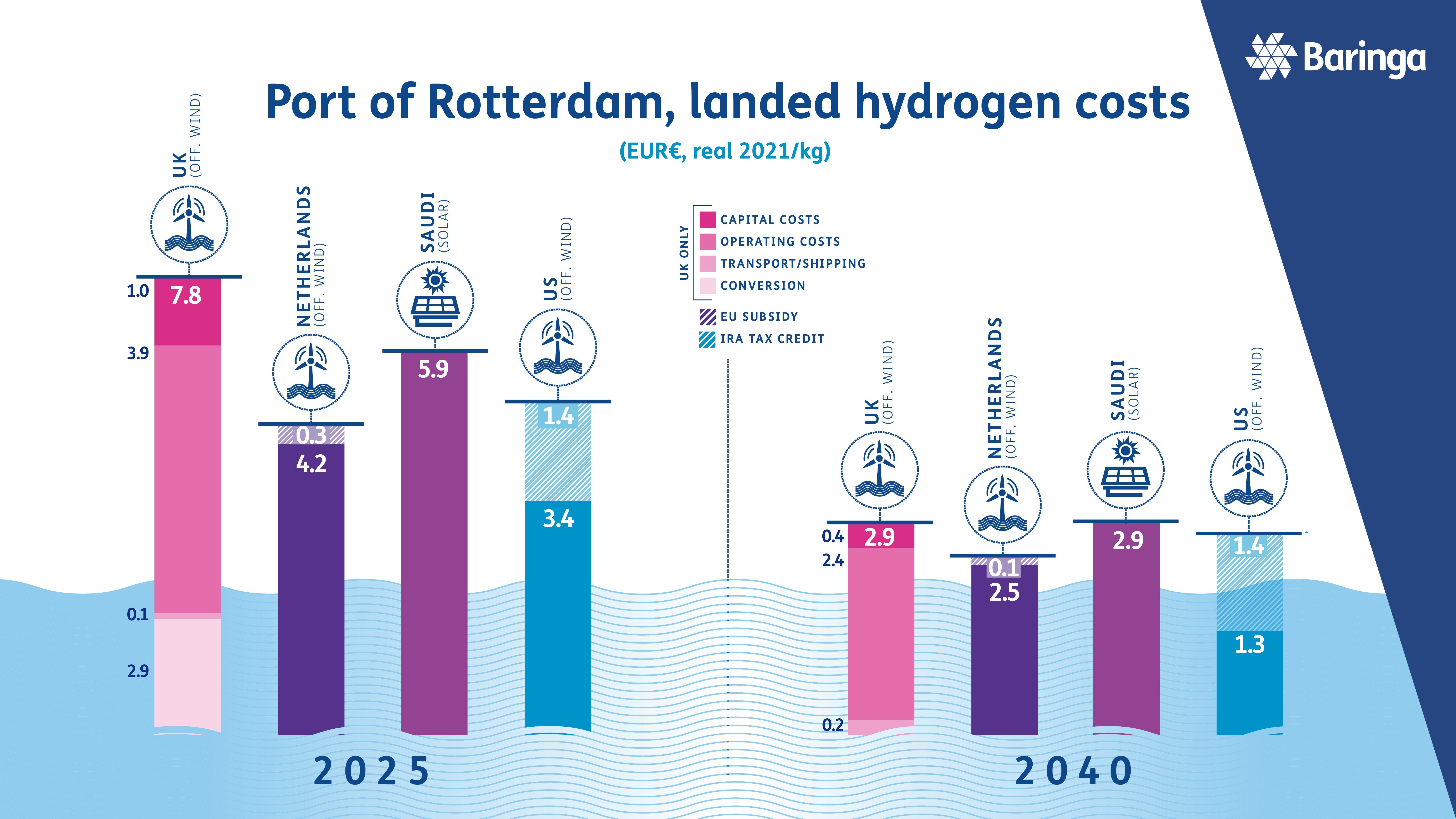

This graph shows a comparison of the competitiveness of hydrogen from offshore wind in the UK, in comparison to green hydrogen produced domestically in the Netherlands, and green hydrogen exported from Saudi Arabia and the USA. Aside from in the Netherlands, the costs include conversion to ammonia, transport to Europe, and reconversion back to hydrogen.

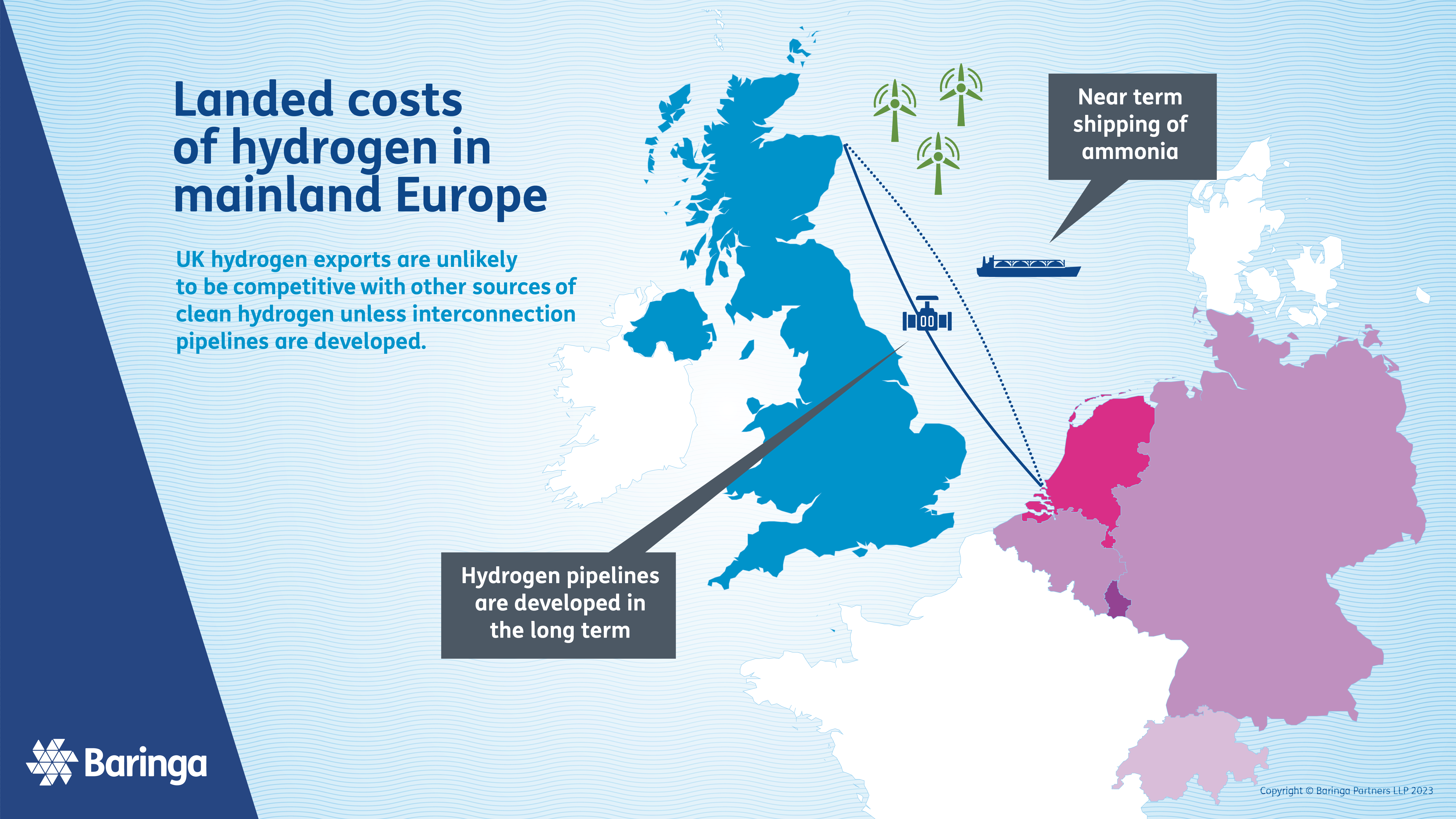

In the near term, hydrogen from offshore wind in the UK would struggle to compete on price with domestically produced hydrogen in the Netherlands due to the high transport costs. This reflects actual market developments, where early-stage projects are generally co-located with demand.

Once interconnecting pipelines are built, the landed price of hydrogen produced in the UK and exported to Europe becomes competitive, highlighting the vital role of enabling export pipeline infrastructure.

The US Inflation Reduction Act (IRA) provides a $3/kg tax credit for green hydrogen over 10 years, providing a major short-term distortion to the market. Regions such as Texas are positioned to become future low carbon hydrogen export powerhouses, with hybrid wind-solar projects able to achieve load factors of up to 70% to produce low-cost green hydrogen, which can be exported globally by leveraging existing infrastructure on the Gulf Coast.

Register your interest for our upcoming Low Carbon Futures Webinars and subscribe to our energy & resources newsletter to get access to Baringa’s latest hydrogen insights and our analysis of the role of hydrogen in Europe.

This insight leverages our global landed cost of P2X fuels database. To find out how our commercial analytics in hydrogen and P2X can help your projects, please get in touch with Shane Heffernan or Kieran Gilmore.

Related Insights

Five takeaways from the UK's first hydrogen allocation round

In December 2023, the Department for Energy Security and Net Zero (DESNZ) announced the results of its first hydrogen allocation round (HAR1), a significant step in promoting the development of the UK’s hydrogen economy.

Read more

Five things we’ve learned from speaking at hydrogen conferences around the world

Baringa’s hydrogen experts have been presenting our views on the developing hydrogen market at three conferences across the globe, and we’re keen to share some of our insights with you.

Read more

Texas - the hydrogen export powerhouse of the future

Texas is positioning itself as a global leader in hydrogen exports, which offers transformative opportunities to repurpose existing storage, transport and export infrastructure throughout the state, and in particular on the Gulf Coast.

Read more

How can Australian developers capitalise on the hydrogen export opportunity to East-Asian markets?

The role of hydrogen as an enabler of net zero targets in South Korea and Japan are making a market for hydrogen exports. But how can Australian developers tap into the opportunity?

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?