Bridging the energy investment gap to net zero

13 October 2021

The World Energy Outlook 2021, published by the International Energy Agency this morning in preparation for COP26, makes sobering reading.

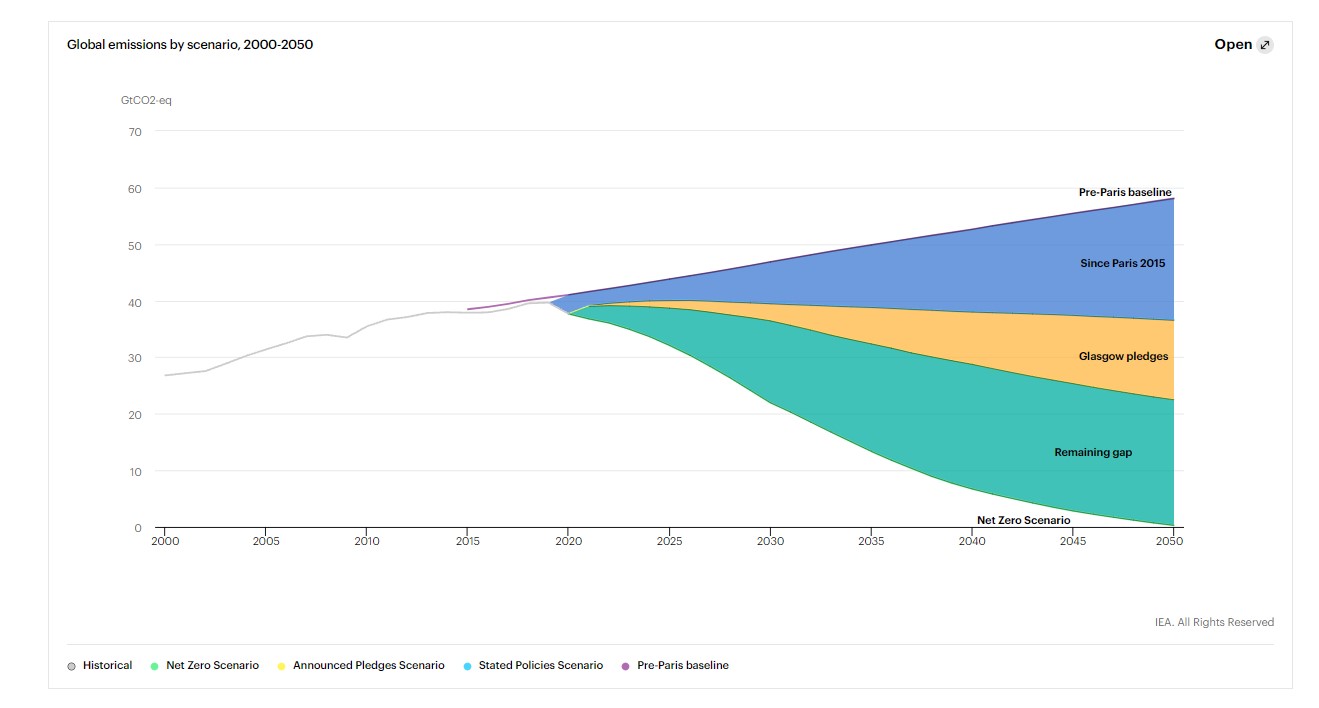

It outlines 3 scenarios - the first describes what needs to be true to limit the rise in global temperature to 1.5 degrees, widely accepted as the absolute edge case of what the world canmanage. The second outlines what will happen if international governments deliver against commitments made to date.

The third, and most sobering, shows what happens if governments deliver what they have in flight so far. The consequences of that latter scenario are horrific – rising sea levels and a huge amplification of the floods, droughts and fires we’ve seen plague the world over recent times.

Source: IEA World Energy Outlook 2021

A sharp wake-up call

With COP26 imminent, one of the conference goals is to lay the foundations for faster progress in the decade to come. The IEA report provides a clear breakdown, by source, of what international governments need to do to close the gap to the first scenario, by energy source, by year.

In summary – invest heavily in renewables, cut our stubborn dependence on fossil fuels more bravely than ever before and carefully manage the inevitable volatility that will be a feature of the transition and worsened by cutting investment in transition fuels before really ramping up renewable generation capacity.

Invest now for all our futures

To deliver this, the report clearly states that annual investment into clean energy projects and infrastructure, per year, needs to rise to $4trn per year by 2030. This is a 70% increase vs. today.

$4trn. Let that sink in. 150% of UK GDP. Huge.

OK it’s at a global level, but it’s also Every. Single. Year.

What does that mean for us in the UK, a country that’s currently struggling with the intermittency that’s characteristic of renewable sources of energy generation. A country whose energy retail sector is grappling with the consequences of this intermittency and is therefore testing the boundaries of how quickly it can consolidate, where that sector is materially loss making for yet another year.

For me, the IEA report is another stark reminder that a fundamental reset is required. If we are to increase our investment by 70%, the many private investors who are ready and willing to for the right opportunities to arise must be allowed line of sight to a return without it being regulated away.

They must be given space to innovate, to partner with customers, for longer periods without fear of the market forcing a switch. They must also be incentivised in supporting customers along the journey of learning about and having a different relationship with their energy consumption to reduce overall demand.

As sobering a read as the IEA report may be, I read it as tough love. Double down and invest in a sector that we love and wholeheartedly believe in, for the sake of our kids and theirs.

To understand the impact in more detail or to find out more about our work in the energy retail sector, contact us.

Our Experts

Related Insights

Asia’s power markets: Poised for investment

Asia's electricity demand is projected to increase significantly in the coming decade, driven by increasing market and economic growth.

Read more

The future of European CfDs

Contracts for Difference have been successful at increasing competition, accelerating capability buildout and stabilising prices in many European states.

Read more

Asian LNG markets: evolution and growth in response to the war in Ukraine

The rapid reduction in Russian gas exports to Europe has resulted in an unprecedented reshuffling of LNG trade dynamics.

Read more

Commercial fleet electrification – adoption is accelerating, but barriers remain

With 50% of new car registrations in the UK being registered by businesses, it’s vital for companies to start electrifying their fleets.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?