Three ways in which increased volatility and flexibility are reshaping Spain’s energy market

10 min read 3 June 2025

In early May, Baringa hosted a fascinating roundtable in Madrid discussing the groundbreaking changes and paradigm shifts afoot in the Spanish energy market. We heard multiple perspectives, with participants including asset owners and developers, trading companies, lenders and software vendors. This article summarises the three key takeaways from the discussion, and our perspective on what the future holds.

1. Amid curtailment, negative prices and the recent blackout, volatility is challenging asset owners to transform the way they operate. But it’s also unlocking lucrative opportunities for those best able to adapt and respond

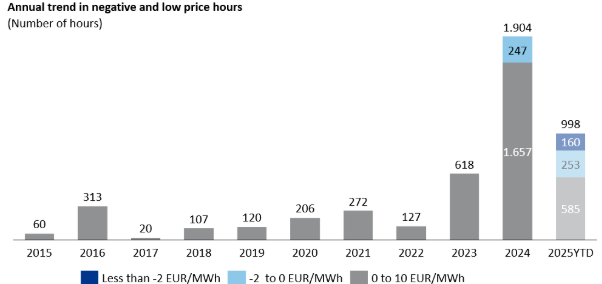

Roundtable participants agreed that Spain’s energy market has become increasingly volatile. For example, there has been a rise in curtailment (when power generation must be reduced to balance supply and demand across the grid), as well as hours with zero or negative pricing. In fact, 2024 saw 247 hours of negative prices, mostly during daytime hours in Spring. In 2025, this figure has already increased to 413 hours, reflecting a significant upward trend. Drivers for this include the rapidly increasing penetration of renewable energy generation, a lower-than-expected growth in electricity demand and two wet-weather years that have significantly boosted hydroelectric output.

Esios data and Baringa’s analysis

For generation asset owners, curtailment and low/negative prices can significantly dent revenues. In the face of these rising risks, we have seen the most active asset operators diversifying their bidding strategies, for example, increasing their participation in ancillary services instead of the day-ahead market. As the value of these services is currently negatively correlated with day-ahead prices, this switch provides a meaningful hedge for players that are more actively managing their assets according to fluctuating market dynamics.

In our experience in more mature European battery energy storage system (BESS) markets, battery operators have the potential to gain significant benefits from volatility, since they can respond very quickly to capture market arbitrages and participate in a wide range of lucrative system-service markets. Batteries provide significantly greater optionality in portfolio management compared to renewables. Operators actively manage the state of charge (SoC), stacking revenues from multiple, diversified streams. This necessitates careful and skillful optimisation and management.

Regardless of which bucket they fall into, all asset owners recognise that they must change the way they operate to respond to this new market turbulence. This could include embracing new technologies such as BESS to hedge risk, enhancing asset oversight, and proactively managing assets to increase margin. The sentiment in the room was that people have begun preparing for heightened volatility. But with so many options on the table, it’s easy to underestimate the magnitude of change required.

The recent blackout sent another shockwave through the market. Participants agreed that it could cause a profound shift in regulation and grid flexibility. In our live poll, 100% of respondents said there was a high (70%) or medium (30%) probability that the blackout will drive further energy policy actions to accelerate deployment of flexible assets. These changes could present further opportunities and challenges for market participants, including:

- Creation of new specific inertia and frequency markets to support system stability. These have been highly profitable for batteries in other countries, such as new frequency response markets that were created in the wake of UK’s partial outage in 2019

- Greater restrictions on access to reserve markets, such as stricter rules on telemetry and control systems, requiring additional investment from market participants.

- Further interconnections to help grid operators better manage flexibility and benefit from shared reserves. The blackout may breathe new life and urgency into negotiations between Spain and France, potentially accelerating interconnection upgrades.

- Accelerated development of specific remuneration frameworks for standalone and co-located BESS could prompt a review of existing grid connection queues and priority dispatch rules, potentially fast-tracking strategic storage projects.

- Increased participation of combined-cycle gas turbines (CCGTs) in the restrictions markets to support system stability - the blackout may reinforce their role as a preferred technology for maintaining grid reliability.

In this context, adaptability and agility are no longer optional, they become core capabilities. Whether developed in-house or acquired through strategic partnerships, these capabilities will determine an organisation’s ability to respond to dynamic market conditions, capitalise on new opportunities, stack revenues across markets and maintain a leading edge in an increasingly complex energy landscape.

2. Power generation is no longer a volume game. Market participants need to actively manage their assets to increase the margin they capture – either through greater scrutiny of market agents, or by strengthening in-house trading capabilities

Previously, maximising production was the best way to maximise revenues. But increased volatility has made matters more complex. The stakes are much higher, with greater opportunities for revenue stacking in solar and wind power as curtailment and negative prices force asset owners to participate in secondary and tertiary reserves.

In this new era of exposure, the role of the asset owner has changed. They must now manage their assets much more proactively to predict and respond to market conditions. There are two main options for doing this.

Asset owners who outsource their trading activities are becoming much more discerning in selecting market agents. The priority is shifting from low-cost market access to the ability to capture and protect value. Strong performance on asset monetisation and resilient, trust-based relationships are now prioritised over lower fees.

- Transparency of strategy and decisions taken will become much more important. Increasingly, asset owners are requesting more frequent engagement with their market agents to understand strategy and decisions taken. It’s becoming more common for service contracts to mandate monthly, or even weekly, performance review meetings.

- Roundtable participants told us that they seek market agents that take a proactive approach, including support with regulatory changes and agility to respond rapidly to changing market conditions. They know that prioritising long-term, trust-based partnerships over short-term fee savings will yield the best commercial outcomes overall.

Some larger asset owners will look to begin directly engaging with the market themselves.

- Owners of larger asset portfolios may explore the option of building out market access capabilities, such as creating their own trading desks. However, this decision must not be taken lightly.

- To rival high-performing market agents, companies need to develop a clear strategy and strong in-house capabilities. They will require expert support to navigate complex decisions as they assemble the complex ‘jigsaw puzzle’ of capabilities needed to trade successfully, deciding which ones to insource and outsource. Each company’s journey will be unique, depending on its risk appetite and operational and commercial strategy.

3. BESS unlocks opportunities for flexibility, new revenue streams and portfolio risk diversification. But it also adds complexity, and it’s not yet clear whether the government will introduce support for these technologies.

We heard mixed views regarding the potential of BESS in Spain. Some participants believe the business case for these technologies doesn’t currently stack up, due to the lack of regulatory support and Spain’s abundance of other grid-support technologies, such as CCGTs and pumped storage hydropower.

However, the tide may soon change. The reduction in battery CAPEX over recent years has meant that these assets are now becoming more attractive for some developers, particularly those who already operate flexible assets in other markets. Furthermore, the upcoming capacity market can provide a long-term bankable revenue stream which will support financial viability of such projects. Moreover, as the blackout may trigger a wider review of how to operate the Spanish network more flexibly, further grid services available to batteries may soon arise, as they have in other countries, representing additional revenues streams for the asset class. As well as opening up new revenue streams, BESS technologies also offer diversification of risk in an asset portfolio and can form part of a wider toolset to manage risk.

Several attendees recognise the power of BESS and are already exploring opportunities. They understand that first-mover advantage will be high, as seen in more advanced battery markets such as Great Britain, where some developers were able to achieve exceptionally short payback periods on their BESS investments.

One of the key obstacles is building the advanced capabilities required to manage batteries, balancing state of charge and capitalising on margin opportunities. Although sophisticated software can help, the reality is that teams need to be highly skilled and hands-on. These kinds of capabilities cannot be built overnight. Companies are preparing now so that they can act fast if/when more significant market and regulatory drivers arise.

Our perspective: Companies will pursue closer market proximity, but there’s no one-size-fits-all path to get there

Listening to event attendees, we know that asset owners are keen to get closer to the market – whether by becoming a more active customer who places greater demands on their market agents, by insourcing their trading or a number of options in between.

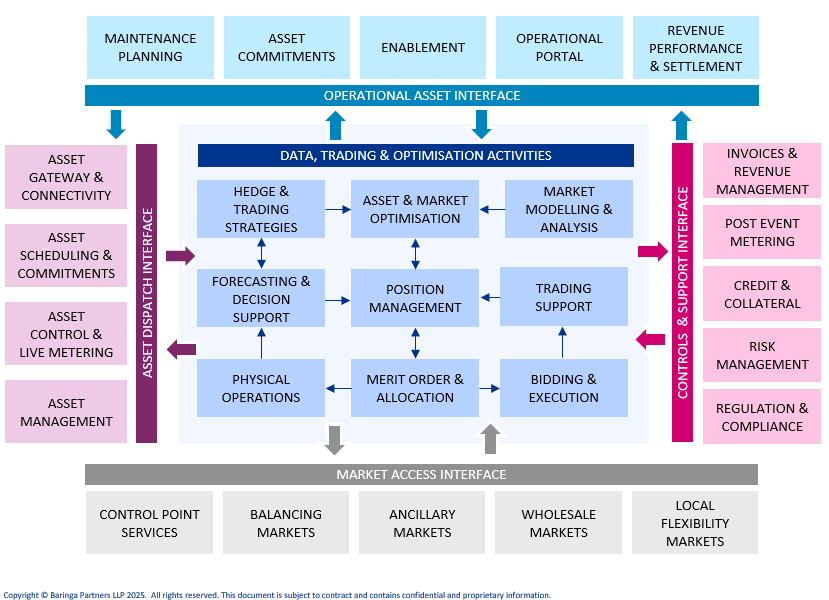

Bringing route to market inhouse may prove lucrative in the long run, but it’s also highly complex. It requires critical capabilities around asset controls, a data-led approach to value optimisation of the asset, and automation of trade execution to minimise timing risk.

Reaching mature capabilities will take time and careful investment. Organisations must clearly define their target business model to identify the capabilities that offer true market differentiation and should therefore be retained in-house, as opposed to those that can be outsourced.

Baringa´s PowerFlex Trading Capability Framework

However, the reality is that there’s no one-size-fits-all route to market proximity. Instead, each company’s goals, risk appetite and target business model will shape its investment in capabilities. The journey will inevitably involve careful decision making regarding the economies of scale needed to make internal trading desks viable, managing impacts to the cost of capital, and skilful investment in technology and capability development. But making these investments in the target operating model for their organisations could enable asset owners to thrive for years to come.

For companies at earlier stages of their journey that choose to outsource trading activities, we provide support in identifying the most suitable partners and in defining the internal capabilities required to effectively supervise and evaluate outsourced performance. For organisations that are further along the maturity curve, we assist in designing the target operating model necessary to internalise trading activities and offer strategic guidance and delivery support throughout both the planning and implementation phases.

To discuss further how this transition and capability development looks in practice or to learn more about how Baringa supports clients in the energy market, please get in touch with Nichola Plower, Gerardo Fernández, Karim Alnakkash and/or Alexis Stavropoulos.

Our Experts

Related Insights

Unlocking private capital: scaling investment in the CCS sector

Unlock the next wave of CCS investment. Discover how the financial services sector can scale viable models, reduce risk and mobilise private capital for commercial CCS deployment.

Read more

Transforming the trade lifecycle for efficiency, resilience and growth

Trading organisations face rising pressure to deliver speed, accuracy and cost‑efficiency while managing growing product diversity, data and technology complexity.

Read more

Did you miss out on Italy's MACSE Auction? Here is why you shouldn’t give up

Developers face a key choice: refine their bid and compete in the next MACSE auction, or pivot to a targeted merchant strategy where subsidies won’t reach.

Read more

Podcast - S3-E2 - Decarbonising complex industries

Navigating the challenges of decarbonisation while maintaining energy security.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?