The value of carbon: How internal carbon pricing can drive business decisions that unlock and protect enterprise value

6 min read 6 May 2025

Putting a price on carbon can help companies cut emissions faster and with less risk. Research from the Carbon Disclosure Project (CDP) confirms that organisations with internal carbon pricing (ICP) drive decarbonisation at a faster rate than those without it. Less than 25% of global emissions are currently covered by compliance mechanisms, leaving the remainder of the economy not incentivised to drive decarbonisation. ICP can be an effective way to close that gap and ensure businesses are making the right decisions.

In this article, we explore the benefits that ICP offers, current barriers to action, and how Baringa can help corporates find their optimal carbon price.

What is carbon pricing?

The Taskforce on Climate-related Financial Disclosures (TCFD) defines ICP as an “internally developed estimated cost of carbon emissions”. It can be used by organisations to factor the cost of carbon into decision-making, better identify the opportunities and risks associated with decarbonisation, and drive investments in low-carbon technologies.

Two common approaches for applying ICPA shadow carbon price is a hypothetical cost of using carbon across operations, investments, and supply chains. It can be included as an explicit cost in financial models for projects requiring CAPEX deployment or in bid prices as part of supply chain tenders, for example. An internal carbon fee is used voluntarily by companies to levy business units for their carbon emissions. This revenue can then be used to fund decarbonisation projects and innovation. For instance, Klarna raised $2.3m in 2023 for climate projects managed by a third-party fund. |

What benefits does ICP offer?

By allowing companies to set a price on their carbon usage, a well-designed ICP scheme brings benefits on two key fronts.

1. ICP drives value by unlocking more sources of finance, optimising sales and pricing strategies, and enhancing product development.

- Carbon pricing adds credibility to transition plans and sends a clear signal to investors and external stakeholders, such as financial institutions, that you are committed to decarbonisation. This can unlock financing from banks at more competitive rates.

- It can be used to inform sales and pricing strategy, especially when exporting to markets with carbon taxes on imported goods. The introduction of the EU's Carbon Border Adjustment Mechanism (CBAM), for example, means non-EU producers will need to weigh the impact on their export strategy, as well as how they price products sold in the EU.

- It supports better decisions around product development and R&D investment. With a carbon price baseline, companies can prioritise lower-carbon/less-resource-intensive products and operations. They can also allocate more capital to innovation that drives carbon reduction/avoidance for both the business and its customers. In turn, this could unlock new revenue streams through sustainable products and services that command a green premium.

2. ICP minimises risk by supporting better-informed business models, investments, operations, and procurement.

- Setting a shadow cost of carbon helps test and assess the economics of investment in different carbon price scenarios. These can be used in internal investment appraisals to de-risk business models, infrastructure, and assets against future climate change legislation. Take the EU Emissions Trading System 2 (EU ETS 2) as an example, which is expected to launch in 2027 and expand coverage of the existing ETS to the heat and transport sectors. It will substantially impact operating costs of a wider range of businesses. If companies neglect to account for the change in their financial planning, they will face unplanned costs and missed opportunities for operational or investment options to reduce them.

- It can improve understanding of the risk of asset stranding. Failing to include a shadow price when making capital planning decisions (including in long-lived infrastructure or high-value assets) could lead to unexpected costs in the future or even investments that become stranded as climate policy evolves.

- Carbon pricing can be used in procurement decisions to quantify the impact of different supplier’s carbon footprints, drive Scope 3 emissions reductions, and de-risk the supply chain.

Barriers to adopting ICP

Despite the clear benefits, and even as urgency grows around getting to net zero, CDP data reveals that just 14% of companies are using ICP. This low adoption rate reflects several fundamental challenges linked to carbon accounting and wider decarbonisation efforts.

A central aspect that companies often struggle with is how to set the level of internal carbon pricing. Set too low, an ICP becomes merely symbolic, failing to influence operational behaviour or investment choices. Set too high, it risks putting the company at a competitive disadvantage.

The pricing challenge also varies significantly by sector. For instance, while a technology services company can typically handle a higher internal carbon price with minimal impact, heavy industry players face much greater exposure to carbon costs. This is a function of emissions being a larger proportion of the final cost of a product combined with high price elasticity for products in heavy industries.

Setting the right carbon price

There is no one price level-setting method being used by companies looking to implement ICP. Every organisation will have its own starting point, operating context, and decarbonisation priorities – resulting in highly variable carbon prices.

Carbon prices vary significantly across the board

- SwissRe introduced an internal carbon fee of $123/t in 2023, rising to $200/t in 2030, and uses the funds to purchase carbon removal certificates

- Novartis currently applies a shadow carbon price of $100/t

- Singtel, Singapore’s largest telco, is introducing a carbon fee of $37/t

- Microsoft has a carbon fee of $15/t for scope 1 and 2 emissions and $100/t for business travel

- The European Investment Bank has a shadow cost of carbon rising to €250/t in 2030 and €800/t in 2050

- Landsvirkjun is using an ICP of $144/t to assess bids for the construction of Iceland’s first 120MW wind farm.

Every company needs to consider its unique circumstances in order to determine if it is ready for ICP, what its business stands to gain, and what the potential risks could be. To make those determinations, start by asking the following questions:

- Do our operations cover geographies or sectors with varying policy risk or customer expectations, which might drive the need for differentiated ICPs? Should our carbon price remain fixed or evolve over time?

- What’s the expected direction of regulation? How can we hedge against future policy-driven carbon pricing?

- In what ways could ICP affect our competitiveness, given the sector that we operate in and the nature of our business and competitive advantage?

- What’s the minimum level of carbon pricing needed to drive meaningful action within the business?

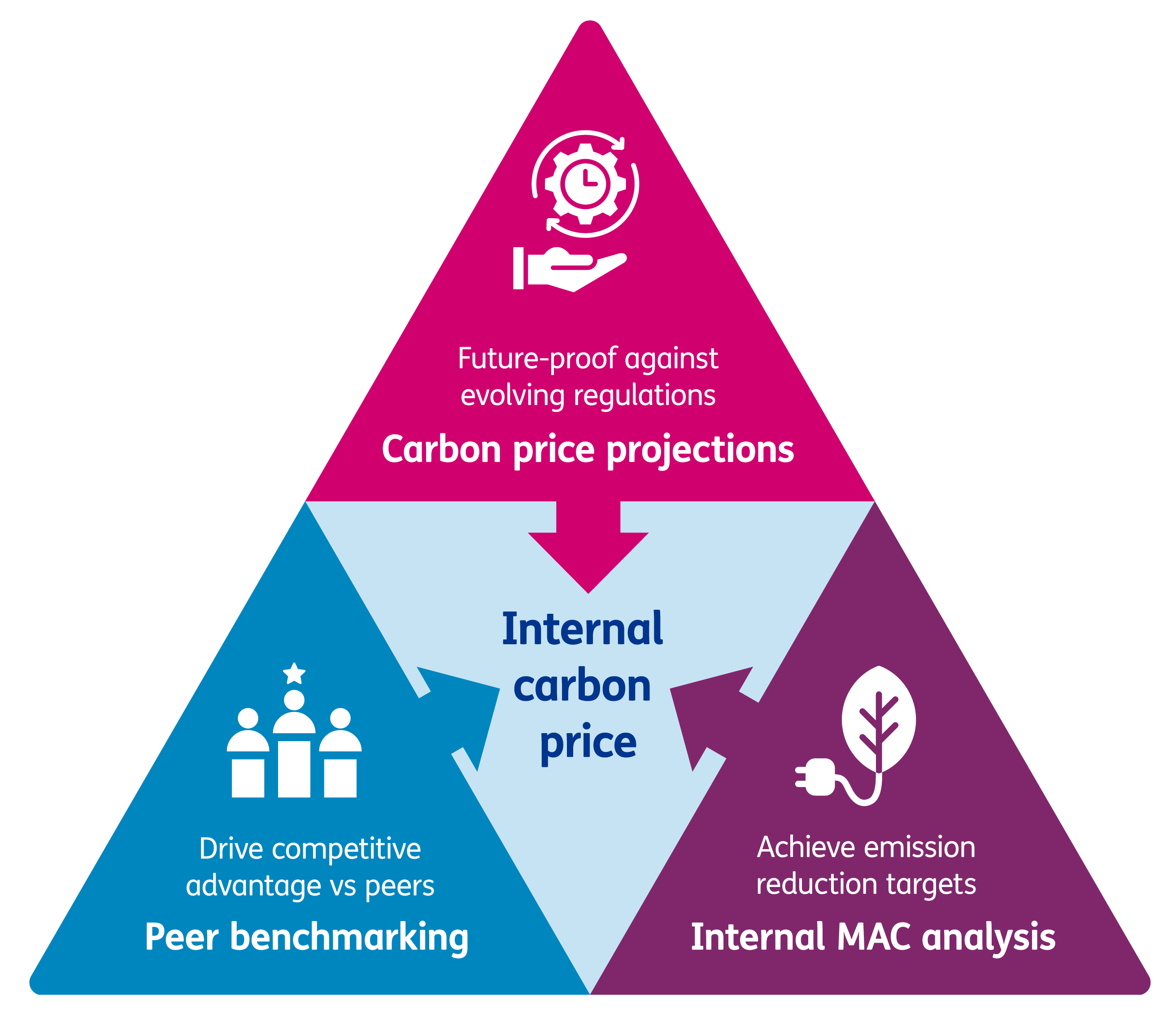

If a company is ready to embark on a carbon pricing programme, it has multiple entry points to choose from, with each route helping provide answers to the questions above.

Three common routes to setting carbon prices

|

1. Carbon price projections Assess current and future carbon-pricing policies and regulations. Sources include IEA scenarios, IPCC guidance, and the Baringa-developed Global Transition Model. This approach can be used to answer questions 1 and 2 above. |

2. Peer benchmarking |

3. Internal analysis of marginal abatement cost (MAC) curves |

How Baringa can help

Whatever route a business takes, setting the right price and implementing an ICP can be a complex task. At Baringa, we’ve developed unique tools and methodologies to make carbon pricing easier and more effective for our clients.

A cornerstone of our approach is the Baringa-developed Global Transition Model – a uniquely valuable dataset for carbon price projections. Unlike generic methods, our model accounts for regional variations and sector-specific dynamics, allowing organsations to implement precisely calibrated carbon prices across different business units and locations.

On top of this, we add market-leading energy pricing data and our in-house decarbonisation lever library to calculate company-specific marginal abatement cost (MAC) curves. Our market intelligence and modelling insights allow clients to set carbon prices that align with their decarbonisation ambitions and effectively drive emissions reductions.

Would you like to learn more about incorporating carbon pricing into your decarbonisation strategy? Or do you need support designing and implementing a long-term ICP strategy? Get in touch with Baringa today – we are here to help turn your carbon pricing ambitions into action.

Our Experts

Related Insights

Reporting scope 2 emissions: the GHGP's new consultation

The current global standard for how companies report their emissions - set by the Greenhouse Gas Protocol - has long been criticised for enabling uncredible claims to Scope 2 emission reduction. read on to see what this means for you

Read more

The inertia challenge in renewable energy

The shift to renewables is reshaping grids, replacing traditional plants with wind, solar, and batteries. This transition challenges grid stability with lost inertia.

Read more

Progress amid uncertainty: How complex industries are driving decarbonisation

From telecoms and retail to the built environment and critical infrastructure, our vibrant discussion focused on how companies are driving forward their renewables strategies.

Read more

Fuelling maritime decarbonisation: The role of regasification terminals in unlocking bio-LNG

The maritime sector is under increasing regulatory pressure to reduce its environmental impact, with frameworks pushing for reductions in greenhouse gas emissions through renewable fuels, while biofuels and certification systems play a crucial role in achieving these goals.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?