Baringa retail banking survey: legacy tech, lost loyalty

15 September 2025

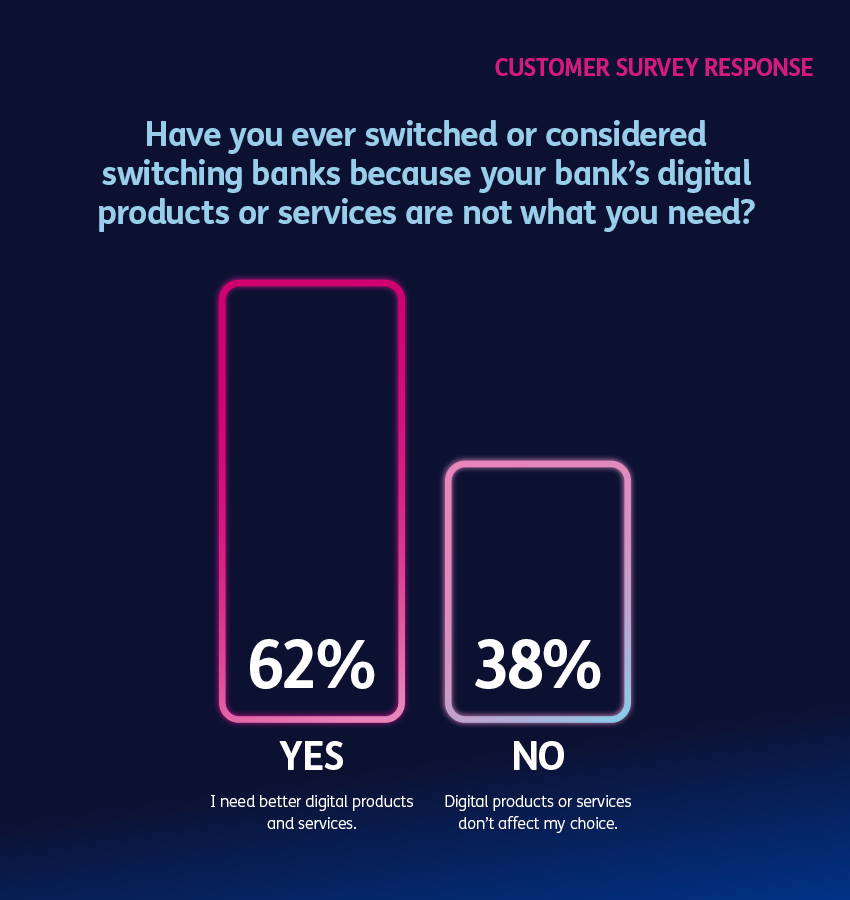

More than 1/3 customers switched banks in the last five years. So, are banks really delivering digital experiences that customers want and need? Our research suggests that they aren’t – and technology is a large part of what’s holding them back.

Traditional banks are failing to meet customer digital expectations, with technology constraints undermining transformation efforts. Baringa’s retail banking survey of 4,000 banking customers and 400 executives across the UK and US reveals a critical disconnect between customers’ needs and operational capabilities.

More than one-third of customers switched banks in the last five years – prioritizing better digital experiences rather than competitive rates – while 68% of banking executives admit their technology architecture actively hinders them from serving customers effectively.

Banks are investing heavily in digital transformation and personalization initiatives, yet legacy technology systems continue to sabotage these efforts. Our research shows that the gap between customer expectations and banks’ operational capabilities is widening. This creates significant competitive vulnerability as digital-native competitors reshape customer expectations and threaten traditional banks’ market position.

The stakes couldn’t be higher. Banks face a stark choice: transform their technological foundations or watch customer loyalty erode. Our research suggests three critical steps to help banks regain a winning position with customers and reclaim leadership in a rapidly-evolving market.

What leaders need to know

The stats speak volumes — and they’re speaking to you.

Unlock the report and read on for:

-

Five converging trends reshaping customer expectations, from accelerated digitalization and generational shifts to rising demand for ethical banking and 24/7 convenience, customers now expect seamless, personalized digital experiences as standard.

-

Why legacy tech is sabotaging loyalty, over two-thirds of banking executives admit their current technology architecture hinders customer service, with outdated systems consuming budgets and slowing innovation.

-

Three strategic steps to rebuild customer connection, Baringa outlines a transformation framework: clarify your business differential, forge a modern digital spine through build-buy-integrate, and embrace continuous change across culture and operations.

-

The commercial case for action, banks that invest in mobile-first, personalized experiences see higher retention, cross-sell success, and ROI, while those that delay risk customer attrition, regulatory scrutiny, and rising IT costs.

About the research

The findings of Baringa’s retail banking report are based on two separate surveys, with banking customers and executives from United States and United Kingdom.

The first survey took place from March to April 2025 with 4,000 customers, who answered 20 questions about their banking experiences and what they are looking for in a bank. We targeted a balanced representation of customers in terms of age, gender, and income.

The second survey, carried out from March to April 2025, involved 400 senior banking executives in banks with $500m+ revenue and AUM. The aim was to understand their primary focus areas, challenges and risks, particularly around customer engagement and technology.

Our Experts

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?