The evolution of distributed ledger technology (DLT) in financial services

13 July 2022

In our latest report, we identify some of the applications of DLT and their ties into Web 3, including the three key processes where we believe DLT is having the greatest impact, with examples of disruptors providing innovative solutions.

We look at how distributed ledger technology (DLT) is already impacting the finance sector, presenting countless opportunities to build a more resilient, efficient and reliable infrastructure.

Download our report to learn:

- What DLT is and the difference between public and private

- How financial services organisations can benefit from the advancement of Web 3 technologies

- The three key processes where DLT is having the greatest impact and how they’re currently being utilised

- Plus, two additional use cases yet to be explored by financial services

You can also find more examples of where disruptors are providing innovative solutions to existing processes.

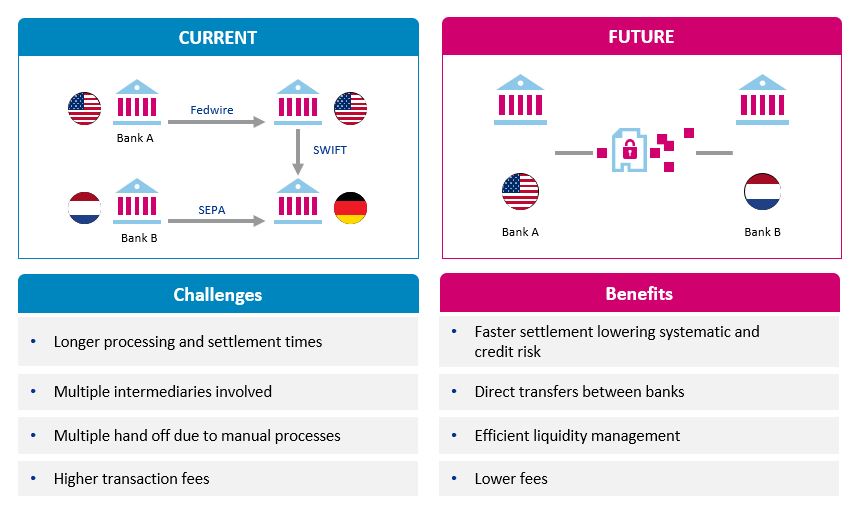

Example: Improving cross-border settlement

Download your copy

Enter your details below to receive a copy of: The evolution of distributed ledger technology (DLT) in financial services

Your personal data will only be processed in accordance with Baringa’s Privacy Policy.

Our Experts

Related Insights

The role of regulators in accelerating Web 3 innovation

Financial institutions are seeing the potential that Web 3 technologies can offer but need the regulatory guard rails to have the confidence to commit.

Read more

Solving the KYC dilemma with Web 3

DLT has great potential to optimise Know Your Customer. We unpack the issues in KYC for retail and corporate banks and evaluate the application of DLT.

Read more

Blockchain opportunities for treasury – disruptive solutions or additional risks?

We take a look at how Web 3 is impacting investment banks, specifically bond issuance, intraday liquidity and in OTC derivatives.

Read more

Why NFTs are here to stay

What is a non-fungible token (NFT)? How will they impact the banking industry, and are they here to stay? In this article, we will dig into these questions.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?