Beyond the build: what data centre operators must master to operate at scale

7 min read 19 February 2026

A key question facing the industry is how do you capture the value of expansion without over inflating the cost base and sacrificing operational excellence?

Situation: the growth imperative

The data centre industry is undergoing an exceptional period of expansion, driven by surging global demand for digital services, accelerated cloud adoption, and the rapid rise of AI workloads that require vast processing capacity. This momentum is reflected not only in utilisation growth, but also in the accelerating pace at which new facilities are being built worldwide. The global data centre footprint is expected to increase significantly over the coming years, with hundreds of new sites planned or already under construction to meet demand.

Major technology companies alone are projected to invest more than $500 billion annually in capital expenditure by 2030, underscoring both the scale of digital infrastructure required and the longterm commitment to expanding the global data centre ecosystem (1).

Speed to market at scale

With this unprecedented growth often comes significant complexity. Many operators, having scaled through incremental builds or acquisition-led strategies, now face the challenge of harmonising fragmented processes and legacy systems to create the “blueprint” for the business that supports scale.

With the pressures of speed to market, increasingly in new geographies, operational inefficiencies can emerge, driving up costs, requiring new compliance obligations, and making it harder to deliver on efficient, consistent, high-quality services.

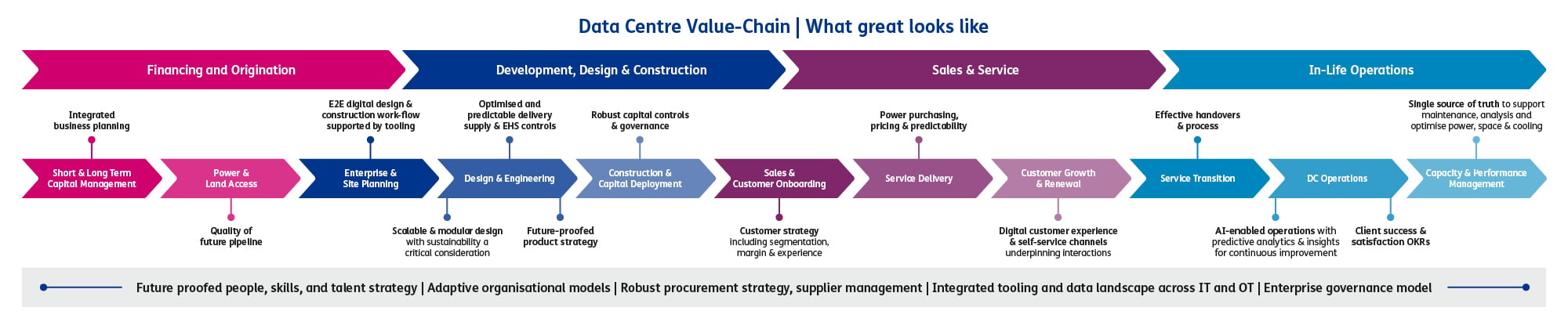

We have outlined the significant opportunities for Data Centres using Baringa’s value-chain framework to drive value end-to-end and then take a deeper look at the operational imperatives for success.

Figure 1: What does Great look like across the Data Centre Value-Chain

(click to enlarge)

Six operational imperatives that determine success or failure at scale

1. Energy access, cost and carbon

Power availability is the primary constraint on data centre growth. Operators face mounting pressure from limited grid capacity, rising energy costs, and volatile renewable supply. Power procurement is no longer a utility arrangement; it’s a strategic capability requiring earlystage engagement with utilities, investment in onsite generation and load management. Meanwhile, tenant and investor expectations for credible, measurable decarbonisation continue to intensify, with customers demanding renewable energy matching. Sites that fail to secure reliable, cost-effective power will struggle to attract hyperscale customers or meet ESG commitments.

2. Supply chain and construction

Achieving predictable, scalable build‑out is constrained by supply chain fragility and construction complexity. Critical equipment can carry long lead times, especially in a concentrated vendor market. In addition, the market is experiencing critical skills shortages in specialist trades, including high voltage electricians, mechanical engineering, plumbing etc can create bottlenecks in construction. Construction delays impact revenue projections, customer commitments and undermine investment basis. In a competitive market the inability to deliver on time is a real threat to growth.

3. Talent acquisition, development and retention

Scaling also comes with an inherent people challenge. The industry faces shortages in technical skillsets, resulting in a 'race for talent', particularly for specialist roles. Organisations are increasingly relying on unsustainable hiring practices, offering premium compensation to attract top talent. However, this approach is limited as candidates increasingly prioritise company values, a sense of purpose, and flexible working. Operators must ensure expansion is accompanied with a well-formed people strategy and talent pipeline to attract and build capabilities locally. Going beyond compensation, promoting purpose and providing clear knowledge and skills building is vital for growth.

4. Regulatory complexity and social license to operate

Expansion into new markets requires navigation through fragmented regulatory environments and diverse stakeholder landscapes. Planning approvals face tight rules on energy consumption, water usage, visual and infrastructure impact on the local environment. Concerns are also amplified by social media, traditional media and organised lobby groups. In Europe, there are comprehensive sustainability frameworks - CSRD, Energy Efficiency Directive and mandates on PUE for new facilities. In the US there are evolving regulations at a state level. Operators need to proactively manage their presence and impact through genuine community engagement, visible sustainability commitments and measurable positive value creation in the region.

5. Operating model flexibility

As operators scale in the number of sites and across multiple geographies, operating model effectiveness becomes a more acute challenge. What is held centrally vs kept at a local level (energy strategy, procurement, vendor management)? What are the optimal spans of control? How many sites can be managed by a regional Operations Director? How do you retain and share knowledge and maintain consistent capability across geographies? Scaling also increases demand on business insights across operations, finance, customer, sales and marketing. Serving those stakeholder groups effectively requires structured data governance and an operating model to deliver on the business needs. Success at scale, in part, relies on designing operating models that can flex across markets while delivering consistency and avoiding siloes.

6. Technology stack and integration

As operators scale legacy IT/OT technology limitations are exposed. Point solutions proliferate - management systems, planning tools, customer portals, ticketing platforms etc, which create integration complexity and data fragmentation which hamper the advancement of operational excellence. Customers expect sophisticated monitoring and automation, particularly as AI workloads demand increased visibility and dynamic resource allocation. The key is to modernise IT/OT to enable scaling across a growing portfolio while maintaining operational continuity.

What do data centre operators need to do to scale?

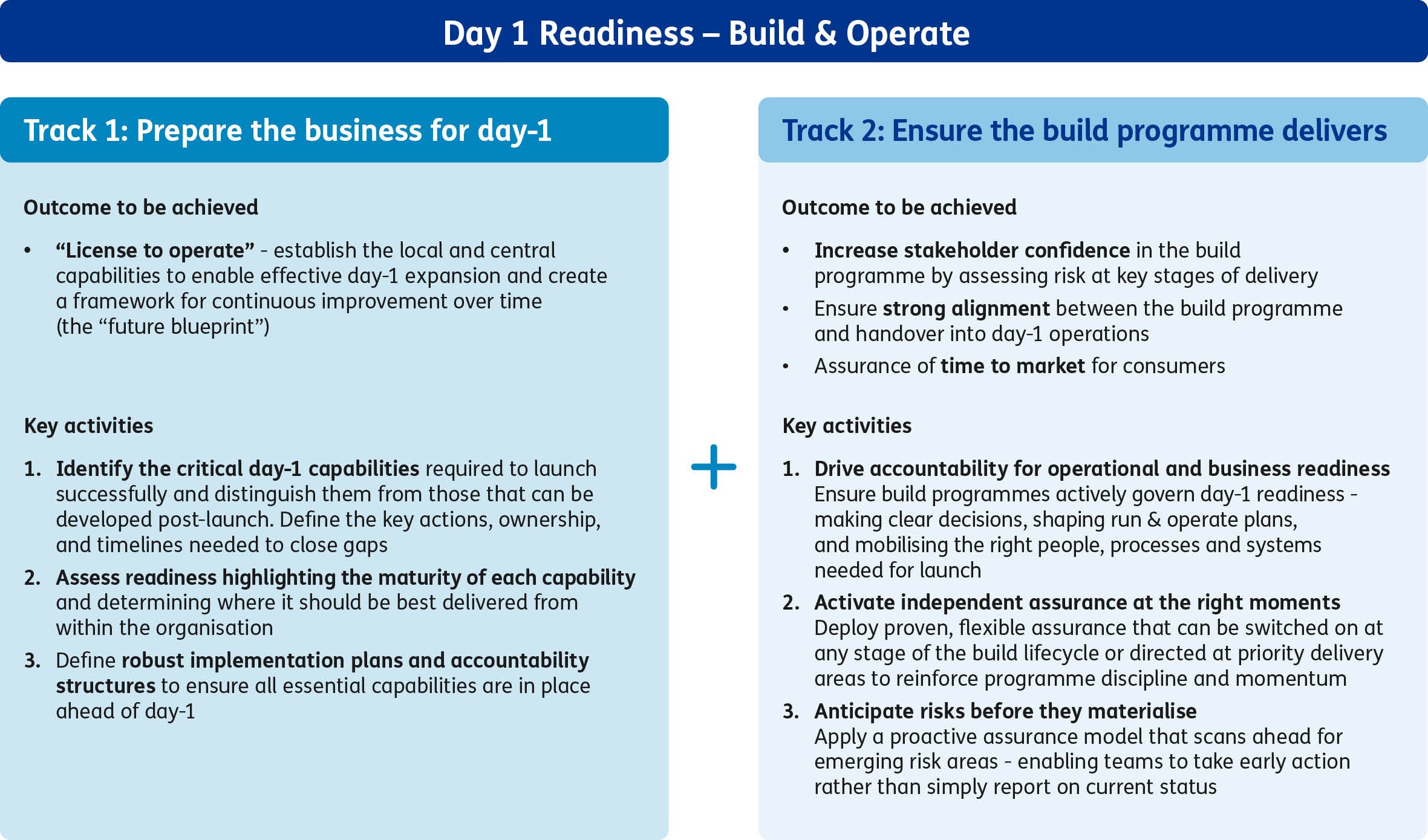

Addressing the six imperatives requires operators to manage the construction programmes and Day1 operational readiness as two sides of the same coin.

They must advance simultaneously, not as purely consecutive activities, which is the traditional ‘modus operandi’ across many industries. How many times have we heard ‘construction/build complete’ followed by ‘operationally ready’ as an afterthought.

Don’t think of these as finish-to-start activities - operational readiness needs effort months before go-live. Embed Day 1 capabilities in parallel with physical infrastructure development. This means recruiting and training site teams months before go-live, configuring systems and testing integrations during commissioning, developing and validating runbooks against real equipment, and ensuring handover documentation is complete, accurate, and accessible. Operators who master this dualtrack approach unlock significant value: faster time-to-revenue, reduced operational risk, enhanced customer satisfaction, and the ability to scale with confidence into new markets.

Avoid the trap of opening ‘hot’ with immature operational processes and procedures.

Figure 2: Dual track considerations for Build and Operate

(click to enlarge)

What operational challenges are you encountering as you scale data centre operations in new markets?

How Baringa can help

The required scale and pace of global Data Centre development pose multiple challenges across the value chain.

We partner with our clients to build and sustain the digital backbone that drives growth and innovation in a connected world, navigating challenges from energy access and cost, to attracting, retaining and delighting customers, to driving operational performance, profitability and resilience, to future proofing your workforce and the planet.

Our Data Centre Consulting Services

Source list

1. Baringa Partners LLP. Data Centres: Boom or Bust? September 2025, 10-k filings, S&P Global Market Intelligence

Our Experts

Related Insights

Winning the race for talent: building a sustainable future for the data centre workforce

Winning the data centre talent race is critical as unprecedented industry growth drives fierce competition and escalating salaries, making it increasingly challenging to attract and retain skilled professionals. Operators must urgently reimagine talent management and employee experience, going beyond traditional compensation strategies to power sustainable industry growth.

Read more

2026 tech industry outlook

Tech leaders face rising AI demand, energy constraints and margin pressures. Discover the five forces that shaped 2025 – and what will define successful technology firms in 2026.

Read more

Price profitably or perish: B2C telcos investing in advanced pricing capabilities see 2–7x ROI in 12 months. Those that aren’t are falling behind

In the commoditised and tightly regulated UK consumer telecoms market, operators face ongoing margin pressure. Price sensitivity is high, and raising prices on core products is increasingly difficult.

Read more

Transforming service delivery to unlock ROI for a global telecommunications provider

A global telecommunications provider was struggling with fragmented service operations and limited visibility across its customer lifecycle. Legacy systems and siloed processes were slowing response times, inflating costs, and constraining the business’s ability to scale.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?