The financial services sector must get 'fit for the future' now or risk becoming extinct

23 January 2020

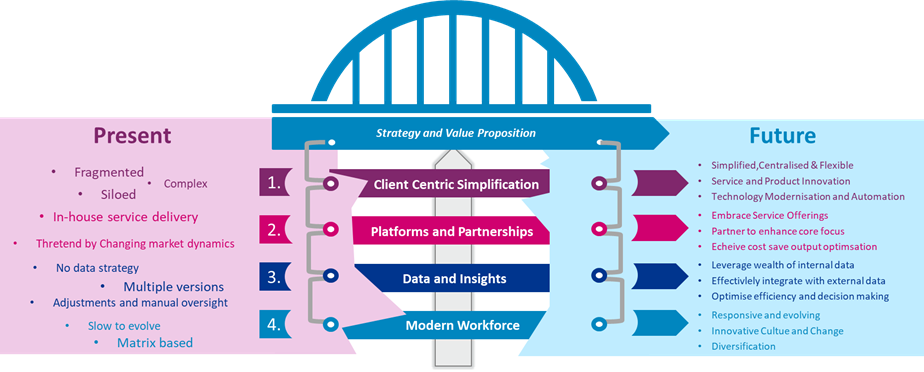

Financial Services institutions continue to face challenging macro socio-economic conditions, cost and profitability challenges and regulatory pressure. Organisations also need to make choices given the risks and opportunities from cross-sector disruption, whether through exponential technologies, potential new entrants or industry changes. To survive and prosper, firms must consider how they will respond, transform how they think and operate – in other words, they must get fit for the future.

Breaking this down into the 2 key words:

Fit - firms should consider suitability, sustainability and success. These are about assessing how to remain relevant and meet the desired outcomes from growth revenue and market share in chosen ‘core’ products and services.

Future - look at the 5 year horizon to commit to a strategic view and understand the steps to take to move towards that objective.

So where do organisations start? Organisations need to re-think their strategy along the value chain, focusing on their strengths, and be ready to transform and partner, in order to deliver the value proposition.

By taking an aggressive view and identifying non-differentiating activities, organisations can begin to deliver these more efficiently, by focusing on 4 main levers:

1. Client Centric Simplification

By putting customer and business outcomes first, organisations need to move from fragmented and complex to simplified and flexible operating models with product innovation embedded in the organisation. Organisations need to focus on profitable business activity, elevating the client experience, increasing automation and intelligent decision making.

2. Data and Insight

As execution is increasingly digitized, organisations must be able to capture and store data arising from market activity in a usable manner, integrate it with external data, apply evolving data science techniques to generate actionable insights and deliver increase in margins.

3. Platforms and Partnerships

Firms must embrace the changing market dynamics where outside providers offer services. This requires firms, in some cases, to move away from in-house service delivery to one that draws on the capability of ecosystem partners to create cost efficiencies and risk mutualisation. Moving towards more open and API based architecture to help deliver efficiencies.

4. Modern Workforce

Digital disruption will create the need for new roles and skills. Firms must identify ways to acquire and develop talent which are responsive to the fast-evolving needs of a digital business, operating in a culture of innovation, diversity and enhanced analytics, both in terms of “run” and “change” the bank activities.

Over the coming weeks and months, Baringa will publish a series of blogs across these 4 themes and across the FS sub-sectors, including global markets, banking and insurance. For further information, or to get more insight along these themes, please contact lucine.tatulian@baringa.com

Related Insights

Navigating sustainable retrofit in real estate

Achieving successful sustainable retrofitting in real estate can seem like a complex challenge. Discover how your organisation can unlock the strategic value of retrofitting with our new report, commissioned by Barclays and in collaboration with JLL, Travis Perkins and TrustMark.

Read more

Typify™ - more accurately detecting Financial Crime

Typify, Baringa's investigation and analytics product, creates a fit for purpose solution that is easy to use and implement.

Read more

An introduction to Typify™

Typify™accurately pinpoints the atypical by combining an understanding of typical customer and peer group behaviour with insight from financial crime experts. This enables financial institutions to manage financial crime effectively and efficiently, reducing the need for large and expensive teams of investigators.

Read more

Typify™ - financial crime typologies identified

Transaction monitoring is key to detecting suspicious financial activity. However, this is not 100% accurate. Baringa’s Typify offers a tailored solution.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?