Reporting scope 2 emissions: the GHGP's new consultation

What does the Greenhouse Gas Protocol's (GHGP) consultation mean for your business?

28 November 2025

Context

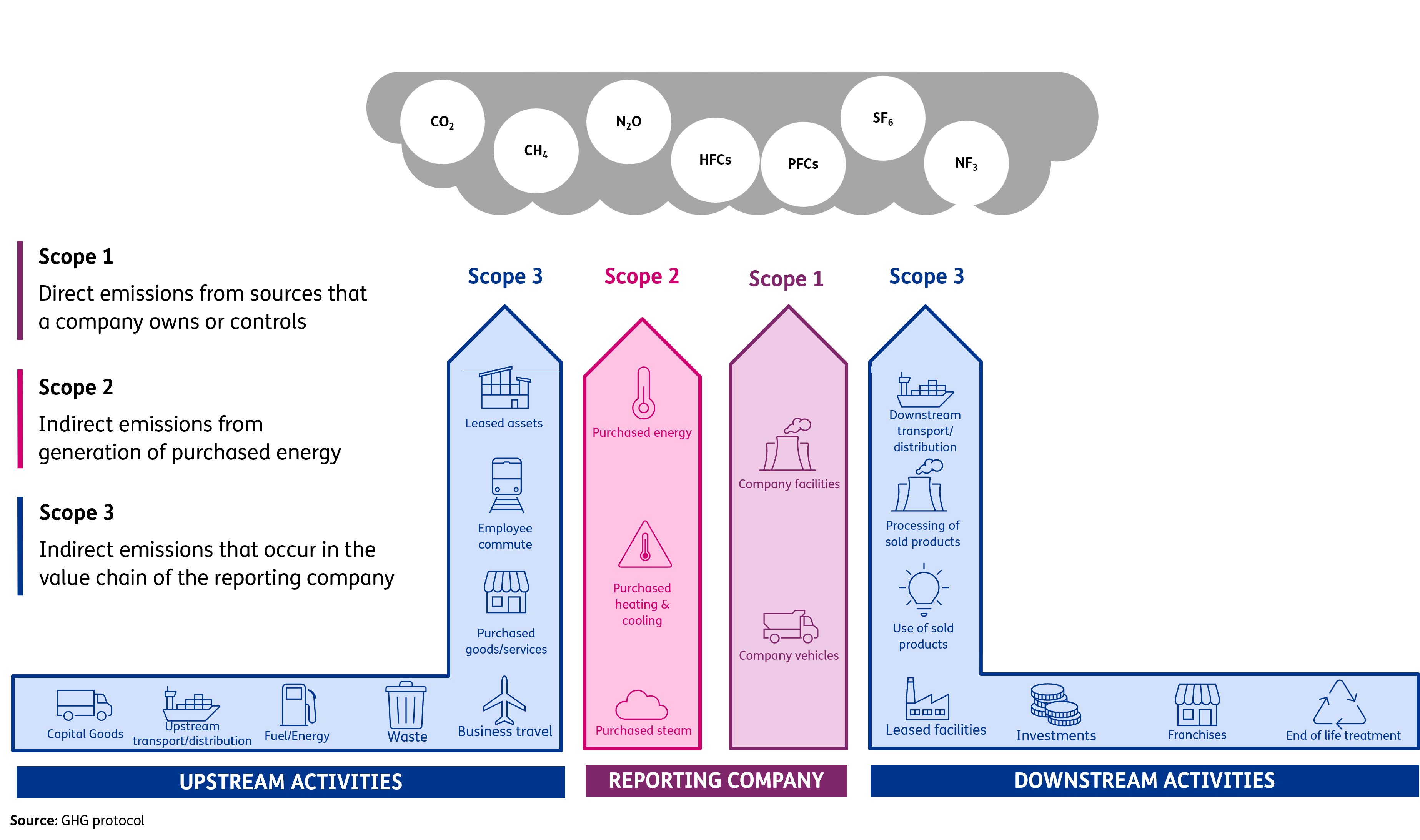

The current global standard for how companies report their emissions - set by the Greenhouse Gas Protocol, an independent standards authority - has long been criticised for enabling uncredible claims to Scope 2 emission reduction. The criticisms centre on three main topics:

The standards currently require corporates to report both their location-based emissions, those based on the average annual emissions intensity of the grid where they operate, and market-based emissions, calculated via purchased power volumes.

Recognising the call for change, the GHGP started a revision process in 2022 to update the standards, creating a more robust framework that aims to drive greater decarbonisation. The latest Consultation released in October 2025 outlines some major proposed changes to reporting methods and will likely bring in a new age of corporate renewable procurement.

The consultation outlines three main changes to emissions reporting

These changes demonstrate a move to drive a closer link between the power consumption of organisations and the renewables they procure, as well as recognising system-wide benefits of investments that decarbonise grids around the world:

Location based

Increase locational granularity

|

Aim |

|

Strengthening the relationship between the local grid emissions and company demand. |

|

Application |

Feasibility |

|

Introduce a requirement for location-based emissions to use the most precise location-based emissions factor accessible and available:

New definition introduced for ‘accessible’ or ‘available’ emissions factors:

|

The spatial emissions factors will depend on companies having access to the most precise locational emission factor data, which may not be accessible or consistent across geographies.

|

|

Impact |

Outstanding Questions |

|

This should drive greater consideration by organisations of the location and time of their demand. When combined with SBTi’s new requirements to set both location and market based emissions targets, this should encourage more consideration for choosing locations with higher renewables penetration (e.g. California, Spain) and shifting demand where possible to times of higher renewable generation. This will primarily affect developed markets and grids where more granular emissions data is available. |

With growing interconnection across neighboring markets, it is unclear how the hierarchy will apply for imported power, although it will likely just be covered as part of the grid emissions factor. It is also unclear how this will affect battery assets, namely how battery export to the grid will be treated, i.e. will this contribute to decarbonising a Scope 2 position and eligible for certificates, or is this to be captured by the consequential method. |

Hourly reporting

|

Aim |

|

Strengthening the relationship between the time of grid generation and company demand. |

|

Application |

Feasibility |

|

Introduce a requirement for location-based emissions to use the most precise temportal location-based emissions factor accessible and available:

New definition introduced for ‘accessible’ or ‘available’ emissions factors:

|

Load profiles can be used to approximate hourly consumption from annual or monthly data, enabling use of more granular emission factors even when detailed metering isn't available.

|

|

Impact |

Outstanding Questions |

|

This should drive greater consideration by organisations of the location and time of their demand. When combined with SBTi’s new requirements to set both location and market based emissions targets, this should encourage more consideration for choosing locations with higher renewables penetration (e.g. California, Spain) and shifting demand where possible to times of higher renewable generation. This will primarily affect developed markets and grids where more granular emissions data is available since markets without hourly data will remain on monthly or annual emissions factors. |

With growing interconnection across neighboring markets, it is unclear how the hierarchy will apply for imported power, although it will likely just be covered as part of the grid emissions factor. It is also unclear how this will affect battery assets, namely how battery export to the grid will be treated, i.e. will this contribute to decarbonising a Scope 2 position and eligible for certificates, or is this to be captured by the consequential method. |

Market-based

Moving to hourly reporting

|

Aim

|

|

Aligning contractual instruments (i.e. Energy Attribute Certificates) with electricity consumption on an hourly basis to more accurately reflect the emissions intensity of the grid mix consumed by companies

|

|

Application

|

Feasibility

|

|

All contractual instruments used in the market-based method must be matched on an hourly basis, except in certain exemption cases.

Exemption thresholds: smaller organisations (threshold to be determined via consultation) may be exempt from hourly matching requirements

Default exemption conditions being tested:

|

Load profiles: Organisations without hourly data can use pre-determined ‘load profiles’ to approximate hourly consumption from monthly/annual figures

|

|

Impact

|

Outstanding Questions

|

|

Potential major impact on EAC markets, prices and company willingness to pay (if moving to an hourly certificate standard):

Using load profiles may limit the incentive for companies to invest in DSR / batteries unless they have hourly data

|

Unclear how GHGP will calculate hourly matching; CFE approach, or potentially an hourly matched EAC standard.

Also no guidance yet on which technologies will be considered ‘renewable’ or zero-emission and eligible for EACs (i.e. nuclear and Energy from Waste)

|

Standard Supply Services

|

Aim |

|

Aims to prevent double counting and provide global rules for how to account for electricity from publicly funded, mandated or shared resources – i.e. potentially those from Contract for Difference (CfD) support schemes, Renewable Portfolio Standards (RPS), Clean Energy Standards (CES), stae-level nuclear-support policies (United States), or Feed-in Tariff (FIT) mechanisms |

|

Application |

Feasibility |

|

Each reporting entity may account for its fair, proportional share of electricity from SSS resources That portion shall not be transferred or used to substantiate claims by another reporting entity Companies can claim only their pro-rata share of SSS resources; any unclaimed SSS contractual instruments are ineligible for use by other reporting entities |

Applies to:

|

|

Impact |

Outstanding Questions |

|

Potential major impact for markets with high penetration of SSS resources, removing a large supply of EACs potentially causing prices to significantly rise (i.e. as transpired when the UK left the EU GoO market and removed GoOs from circulation in the UK). This may also remove an additional revenue stream for SSS generators. |

It is unclear what markets will fall under SSS, and the impact that may have on renewable procurement strategies and EAC prices. It is also unclear how this will be accounted for, i.e. an equivalent, SSS EAC, or managed through a central database of SSS as a share of total generation, or another mechanism. |

Mandating Residual Mix emission factors

|

Aim |

|

Aims to prevent double counting in the case where one company retires EACs and another uses grid-average factors instead of residual mix (the same clean generation is counted twice). |

|

Application |

Feasibility |

|

For consumption not matched with SSS or voluntary certificates, use a residual mix factor that explicitly excludes all claimed and SSS contractual instruments.

|

This will increase pressure on markets to report residual emissions (else their scope 2 emissions will significantly increase).

|

|

Impact |

|

This will impact companies using grid-average factors and increase market-based emissions. |

Legacy clause

|

Aim |

|

Recognise existing long-term contracts entered in good faith and prevent any unfair disadvantage to early adopters. |

|

Application |

Feasibility |

|

Design elements under consultation:

|

Potential alignment with other global standards asset life requirements:

|

|

Impact |

Outstanding Questions |

|

Highly dependent on the final clause A broad clause will ensure the majority of long-term contracts and investments made to date have merit under the new standards.

A restrictive clause will be challenging and companies may need to consider renegotiating contracts so they apply to new standards. |

It is unclear how the GHGP will apply grandfathering, and which investment (i.e. PPAs) will apply. |

Deliverability requirements

|

Aim |

|

Ensuring energy certificates match electricity that can actually reach the consuming facility. |

|

Application |

Feasibility |

|

All contractual instruments must be sourced from the same deliverable market boundary in which the reporting entity's electricity-consuming operations are located.

Market boundary: electricity from a generator could plausibly be part of the mix serving the reporting entity through an electrically connected grid.

|

Regional flexibility: In some countries, national borders will still approximate the deliverable boundary; in others with different grid operations, boundaries may differ from national borders.

Likely applies to the US, with multiple grid zones; i.e. day time RECs from Texas no longer valid for night-time consumption in California.

|

|

Impact |

Outstanding Questions |

|

Potential major impact on cross-border certificates (i.e. International Renewable Energy Certificates). There may also be large regional swings in EAC prices (as when the UK left the EU GoO market), more pronounced in markets with lower renewable penetration. |

More information is needed on application of market boundaries and which certificate programs this impact (e.g. I-RECS, US RECs, EU GOOS etc).

|

Consequential accounting

Consequential method

|

Aim |

|

Recognise the benefits of global / system-wide additional renewable deployment; i.e. investing in renewables where it has the most impact on lowering grid emissions. |

|

Application |

Feasibility |

|

Elements under consultation:

VPPAs (and other procurements not time-matched or deliverable to the load) will likely fall under consequential accounting.

|

Hourly marginal emissions rate data is required to calculate ‘avoided’ emissions, currently only provided by Watt Time, and no provider accredited.

Proposing that the best approach to calculate MERs is to report both operating (OMERs) and build (BMERs). Several existing methods for calculating both are under consideration:

|

|

Impact |

Outstanding Questions |

|

We expect this will be a voluntary metric and most applicable to those building generating assets to recognise the marginal additional decarbonisation delivered and incentivise renewables development in higher-emissions grids. |

Cited BMER methodologies do not recognise system-value contributions such as flexibility, renewable-integration support or grid services. For technologies like batteries and biofuels, which can enable fossil units to turn off and support system reliability in high-renewables systems, it is uncertain whether these effects should be reflected in long-term structural impact accounting.

|

Consequential consultation

The consequential-method is reviewed in more detail in a separate consultation, exploring options for an avoided-emissions method that estimates the system-wide effects of clean-energy procurement and investment, separate to corporate inventories. This method will sit outside Scope 1, 2 and 3 accounting, and we expect it will be most relevant for companies deploying renewable assets who want to report this impact.

Specific topics considered are:

- Formula for quantifying the emissions impact from electricity projects

- The treatment of additionality

- Marginal Emissions Rate methodologies

- Build vs Operate margin weighting

What does this mean for energy markets?

Many corporates had previously met their emission reduction goals by purchasing EACs, unbundled from the delivery of power (i.e. annual purchases to fulfil annual consumption volume). However, hourly accounting brings an end to the unbundled certificate market we know today.

It is not clear how the GHGP plans to implement hourly accounting and there are few examples of this in practice, notably the UK’s Low Carbon Hydrogen Agreement, and the EU’s Green Hydrogen Standard. One possible method is to introduce an hourly certificate market, with certificates purchased and cancelled as they are today, but on an hourly granularity.

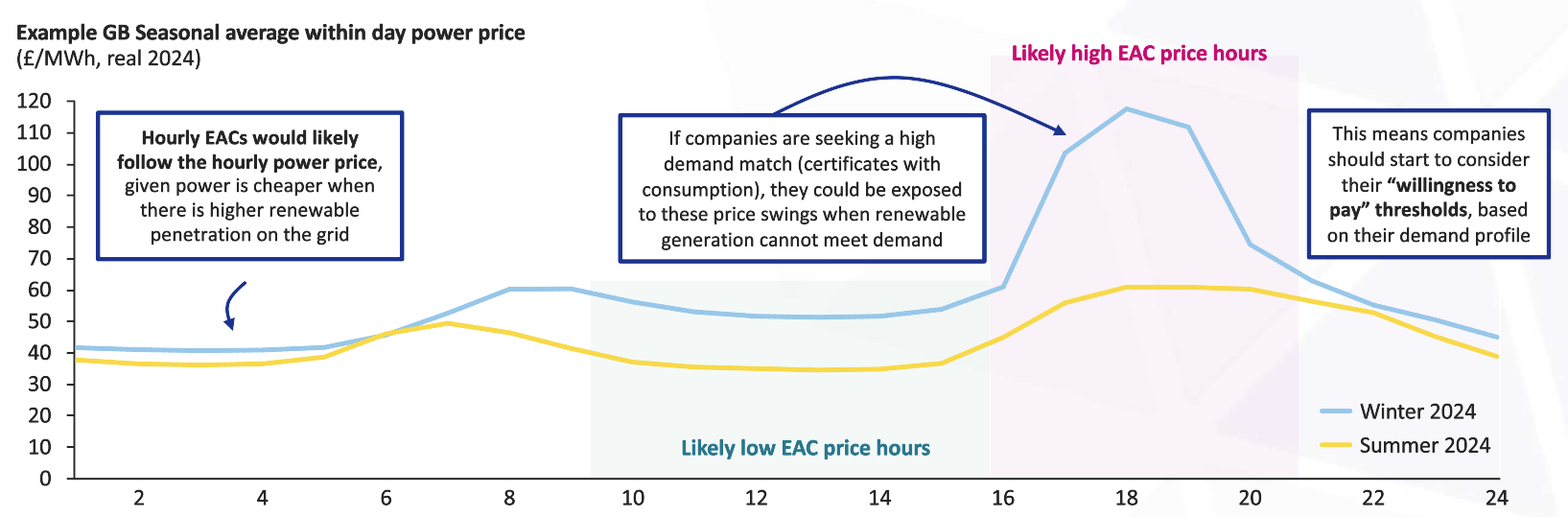

While it’s impossible to predict the price impact on certificates, which had typically enjoyed fairly low prices (below £1/MWh for GB REGOs and below €1/MWh EU GoOs), an hourly certificate market could largely follow the hourly power price. This would see certificates most expensive in periods of low renewable generation (both grid connected and behind the metre) due to supply scarcity and likely high demand if companies maintain their 100% renewable targets. Equally, certificate prices would be lower in high renewable, low power price hours, as illustrated by the chart below.

What does this mean for me?

Each week we will look at the impact for different market players. Coming next: Other low carbon technologies such as biogas, nuclear

Explore related topics

Energy Source | Manage your power position

The only investment-grade software for your energy strategy, execution and risk management.

Read more

Decarbonising Complex Industries

As the energy transition gains pace, we are ready to transform your decarbonisation goals into real-world impact, securing your competitive edge and commercial future.

Read more