Q2: Five key insights from the Baringa Consumer Spending Outlook 2025

5 min read 24 June 2025

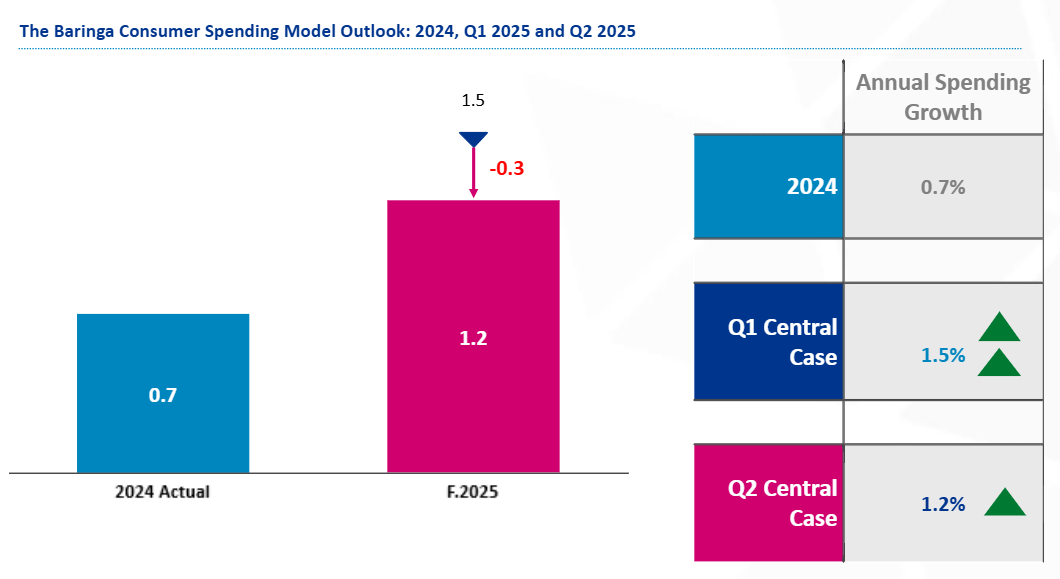

In our latest Q2 2025 outlook, we've revised down annual UK consumer spending growth to 1.2%, from 1.5% in Q1, amid stronger inflation and a slower rate-cutting cycle. Still, this marks an improvement from 0.7% in 2024.

In our latest report we identify key emerging trends:

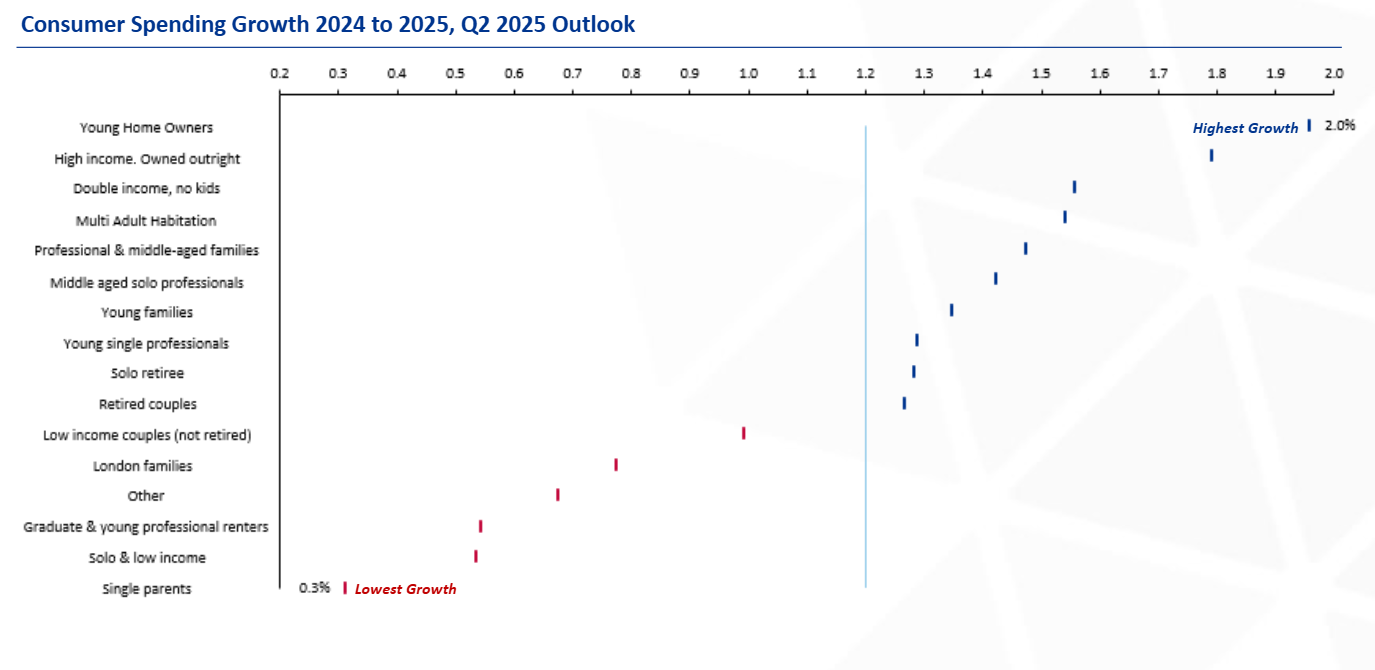

- Young homeowners lead the way, with projected spending up 2% year-on-year

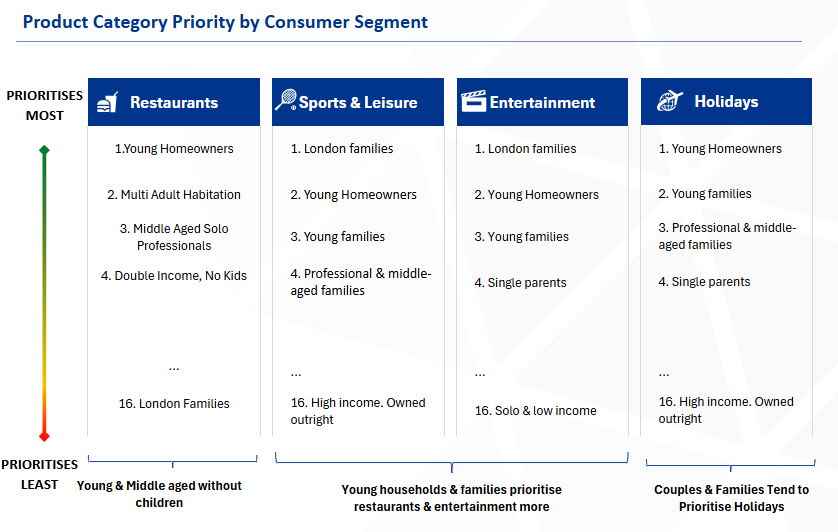

- Restaurant spending is marking a comeback, afer years of subdued economic activity during the cost of living crisis

- Recreation and holiday spending remains resilient

- Clothing is bifurcating - value brands like Primark are outperforming mid-tier rivals, while luxury remains steady

- Supermarket spend is slowing, likely ending the home indulgence trend

These shifts reinforce the need for granular, segment-level consumer insights in a volatile macro landscape as spending cnditions in the spening review are expected to signal a deteriorating fiscal picture for the government with further tax rises or spending cuts on the horizon.

Report in brief

In our Q1 2025 report, we forecasted that UK consumer spending would grow by c1.5%. Recent economic revisions of growth and fears around trade relations have led to a slower growth expectation at c1.2% in our latest Q2 outlook. This remains stronger than the 2024 actual spend growth of 0.7%.

Our revised assumptions come predominantly from stronger inflationary pressures which are set to generate a slower rate cutting cycle from the Bank of England. As a result, households are expected to have less benefit from falling mortgage costs than our Q1 forecast over 2025.

Our latest outlook shows that, while we expect economy wide spending growth to be at 1.2%, there is significant variation across consumer groups as households experience economic recovery asymmetrically across region, income level, age, and family composition. For example, young homeowners are likely to experience the highest growth in spending from 2024 at 2%, compard to an economy wide increase of 1.2%.

Recreation on the rise

|

Out of the home recreation spend has proved more resilient than anticipated. In Q1 consumer behaviour indicated that out-of-home recreation was highly susceptible to economic downturn and yet, despite revised projections, in Sports & Leisure and Entertainment, we see families prioritising spend. Couples and families will continue to disproportionately spend on holidays. |

Navigating constant change to reach real value

Retailers and CPGs must keep their fingers on the pulse of consumer trends and pivot fast when conditions change. Achieving this level of insight and agility demands reliable data and flexible processes. Baringa can help you build both. Blending unique resources like our Consumer Spending Model with deep consumer products and retail expertise, we allow you to understand how consumers are thinking, feeling, and acting.

Working alongside your teams, we help your business harness the latest consumer and market insights to shape sharper strategies and operating models - driving value and growth for your business in an ever-changing world.

If you're interested in exploring more insights from Baringa's Consumer Spending Model, or if you'd like to discuss how we can help refine your strategy and operations, get in touch with us today.

Related Insights

AI - its role in revolutionizing the food and beverage industry

Join Baringa's Evan Kelly and trailblazing entrepreneur, best selling author, digital transformation guru, and AI thought leader Charlene Li as they explore how AI is revolutionizing the food and beverage industry.

Read more

The AI advantage: Reshaping retail supply chains for a new era

The supply chain landscape has shifted. What began as pandemic-driven disruption has evolved into an era of persistent volatility, marked by wave after wave of geopolitical tensions, trade disputes, and economic realignments.

Read more

From instinct to intelligence: why the future of food and beverage demand planning is AI-driven

Discover how AI enables smarter, real-time demand planning in F&B, boosting accuracy, agility and profitability in a fast-changing market.

Read more

Shaping food and beverage innovation with AI

AI is reshaping food and beverage. Move fast, transform boldly, and turn innovation into growth before your competitors do.

Read moreRelated Client Stories

Scaling a retail brand from local to national with smarter digital marketing

A fast-growing retail business was struggling to convert marketing spend into meaningful growth. With two high-priority markets critical to their expansion, they needed an experienced partner who could help build a model that could scale.

Read more

Freeing up £500m+ in cost savings for investment in new growth and future value at a global FMCG business

How can you improve margin, boost operational resilience and accelerate innovation across a global business?

Read more

Transforming digital capabilities for one of the UK’s best-loved food and coffee chains

Read about how we put our client’s users first to design market-leading digital products.

Read more

Helping an American personal care company become a truly digital business

How can you prepare for the future of e-commerce?

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?