ISO 20022: a new language, for better payments

25 June 2021

The financial services market is more dynamic than ever, with organisations offering compelling customer propositions anchored on ‘invisible payments’, and a raft of new strategic partnerships accelerating innovation. It’s an exciting time!

At the centre of these opportunities and some of the challenges lies data – how it is interpreted into meaningful customer insight, or used to simplify customer experiences and ensure seamless interactions. This is where the ISO 20022 message standard comes in, and it is much more than just a ‘payments’ opportunity.

Customers don’t want a ‘payments experience’, they don’t even want to talk about payments. They want instantaneous, seamless, convenient and reliable movements of money.

This is not an easy thing to do, particularly in the highly regulated and security-critical context of financial services.

It’s clear, though, that those who place customer experience and transaction journeys at the heart of their payment design are those more likely to understand the opportunities ISO enables.

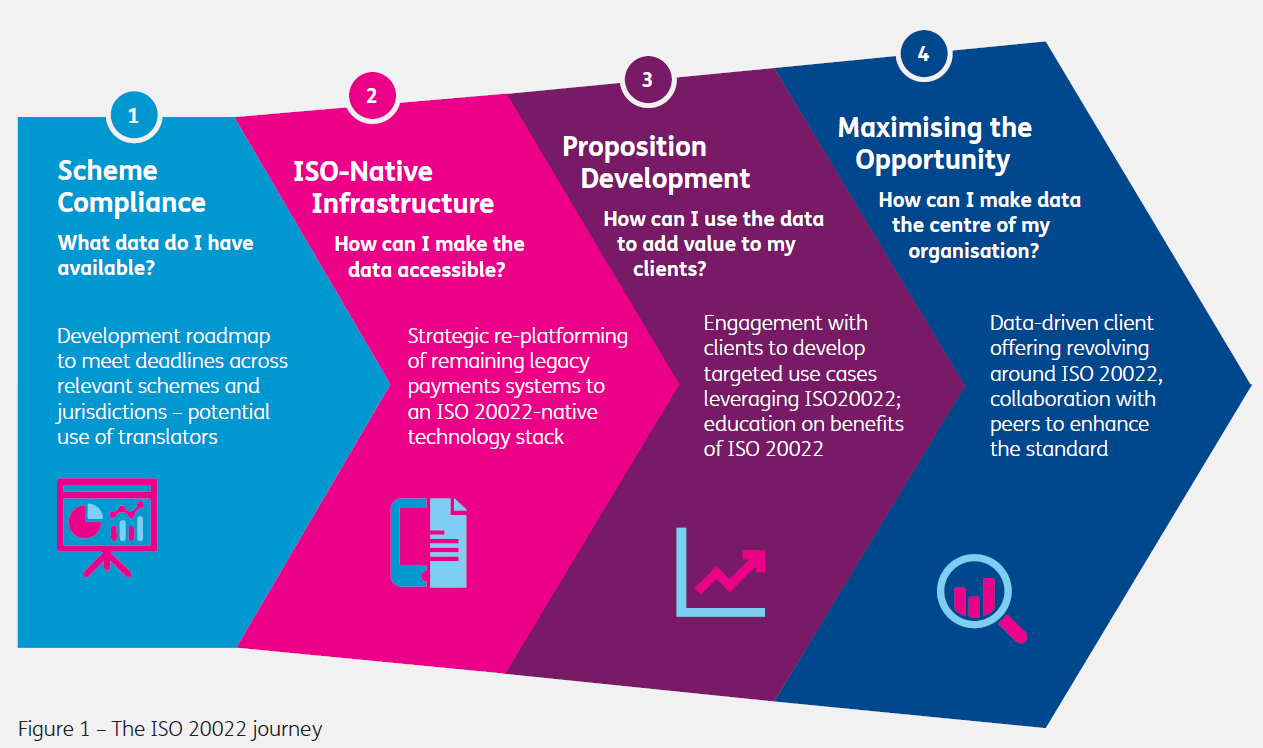

Becoming a market leader is a function of how quickly your organisation can begin on this journey.

Are you going to make the move?

In truth, you don’t really have a choice. If you are a business or a bank, the move to ISO 20022 is inevitable – but we would recommend you embrace it as an exciting opportunity and not as an affliction.

So what are the salient points to take forward?

If you would like to find out more about how we can help with your move to ISO 20022, please contact us.

Our Experts

Related Insights

Can payments really play a role in creating a differentiated and distinctive customer experience?

Industry experts share how payments have been a key driver in creating a differentiated and engaging customer experience in their businesses

Read more

Combining technology with a human touch

Financial institutions must combine digital and human interaction to meet customer expectations and differentiate their businesses.

Read more

Reimagine Financial Services Leadership Dialogues

We explore the topics of reinvigorating payments, refreshing customer journeys, rethinking the “Ecosystem” and how Financial Services are adapting to digital

Read more

Leadership Dialogues: Perspectives from a VC firm

In this video, we discuss how VC firms can support companies to solve real problems for financial services institutions.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?