Adapting to the renewables era: How energy trading organisations can capture maximum value

5 min read 28 January 2026

As renewables reshape energy markets, trading organisations must transform to navigate an increasingly complex and fast‑shifting landscape. This article highlights the key steps to success in energy trading’s future, offering a clear path for organisations ready to adapt and lead.

Renewables are rapidly transforming the energy production landscape. According to the IEA, renewables will become the largest global energy source by 2030, used for almost 45% of electricity generation. It is a shift with profound implications for energy companies, utilities, and trading houses operating at the heart of energy markets.

The rise of renewables is redefining trading fundamentals that have governed markets for decades, introducing sharper volatility and new risk profiles as the new norm. At the same time, technological innovation is revolutionising how energy players operate, from algorithmic trading platforms to leveraging flexibility to maintain system stability and system balance.

The dual transformation requires organisations to embrace new approaches. Operating models and systems must evolve to support real-time reporting and faster reaction speeds. In turn, this demands greater cross-functional integration. Traditional siloed trading setups must give way to multi-commodity, algorithm-enabled decision engines, supported by modern data architectures and platforms capable of short-term optimisation and rapid dispatch.

Equally critical is defining clearer roles across front, middle, and back office. These are increasingly required to support operations in the real-time nature of power markets and to enable business to swiftly move into new products and locations. All of this must be done while maintaining a consolidated view of company-wide risk and exposure.

Understanding what needs to change is only half the battle. The real challenge for energy players lies in knowing how to adapt. In this article, we explore the most significant developments reshaping energy markets, their impact on trading operations, and the practical steps organisations can take to evolve their operating model in response.

Energy markets are transforming, with the most fundamental changes being driven by growth in renewables

As renewables claim greater share of the energy mix, predictable dispatchable capacity is being replaced by volatile, less predictable renewable capacity. This uncertainty is both a risk and an asset. The volatility of the renewable asset mix is reflected in market price levels, with greater opportunity to capture upside when value is high. At the same time, increased uncertainty opens trading to higher risk, especially if organisations are not careful about managing their exposure.

Unlike fossil fuels that typically offer a more stable and consistent input into the grid, renewable energy is much less predictable. This can often lead to imbalances between production and demand, disrupting supply that must be handled by the market participants or the respective transmission system operators (TSOs). To address this imbalance, TSOs can activate balance power in the balancing market, which follows intraday trading. With an increased need for balancing services balancing markets increase in size and become more attractive for traders as more renewable energy can mean larger imbalances and therefore higher imbalance prices.

Competition is also intensifying as barriers to entry in energy markets continue to fall. Established players are being challenged by new entrants in areas that were once more closed playing fields. This democratisation has its limits, however, as participating in volatile markets demands substantial capital to withstand sharp price movements. Only those with deep reserves can sustain their positions over the long term.

As energy markets evolve, so too are regulations. Europe has already seen the introduction of directives and market designs, like flow-based market coupling (FBMC) and EMIR Refit, changing the playfield and and creating administrative burdens for businesses. The power market has also shifted from hourly to 15-minute settlement. Greater granularity has led to sharper and more frequent price swings, greater complexity, shorter decision windows and increased trading frequency. This is pushing market participants to invest in improved forecasting, real-time analytics, and automation to maintain their edge in a faster-moving market.

Meanwhile, technology advancements in areas like generative AI (GenAI) and algorithmic trading are rapidly reshaping the face of trading. Decisions once made based on extensive desk analysis and forecasts are now being driven by ever-more sophisticated algorithms. Trained on detailed data and capable of processing vast amounts of information instantaneously, these machine models bring newfound speed and sophistication to trading.

What Nordic markets reveal about energy trading’s future

Looking to frontrunners in renewables development such as the Nordics offers a glimpse of the likely impact on energy companies, utilities, and trading houses worldwide as the energy transition accelerates. In Nordic markets, we’re already seeing clear changes, including:

- Shifting talent strategies, with energy companies and trading houses looking to recruit new roles such as data scientists, AI and platform engineers, and cloud and security specialists

- Higher focus on short-term markets where renewables variability materialises most acutely and where greater value can be captured. This is also driving increased investment in forecasting tools and real-time capabilities, critical for capturing advantage from volatility

- Some traditional and renewable energy producers are looking to move trading and balancing in-house to optimise monetisation. Previously, marketing the power was typically outsourced or sold on long-term power purchase agreements (PPAs).

How changing markets might impact trading activity and operating models

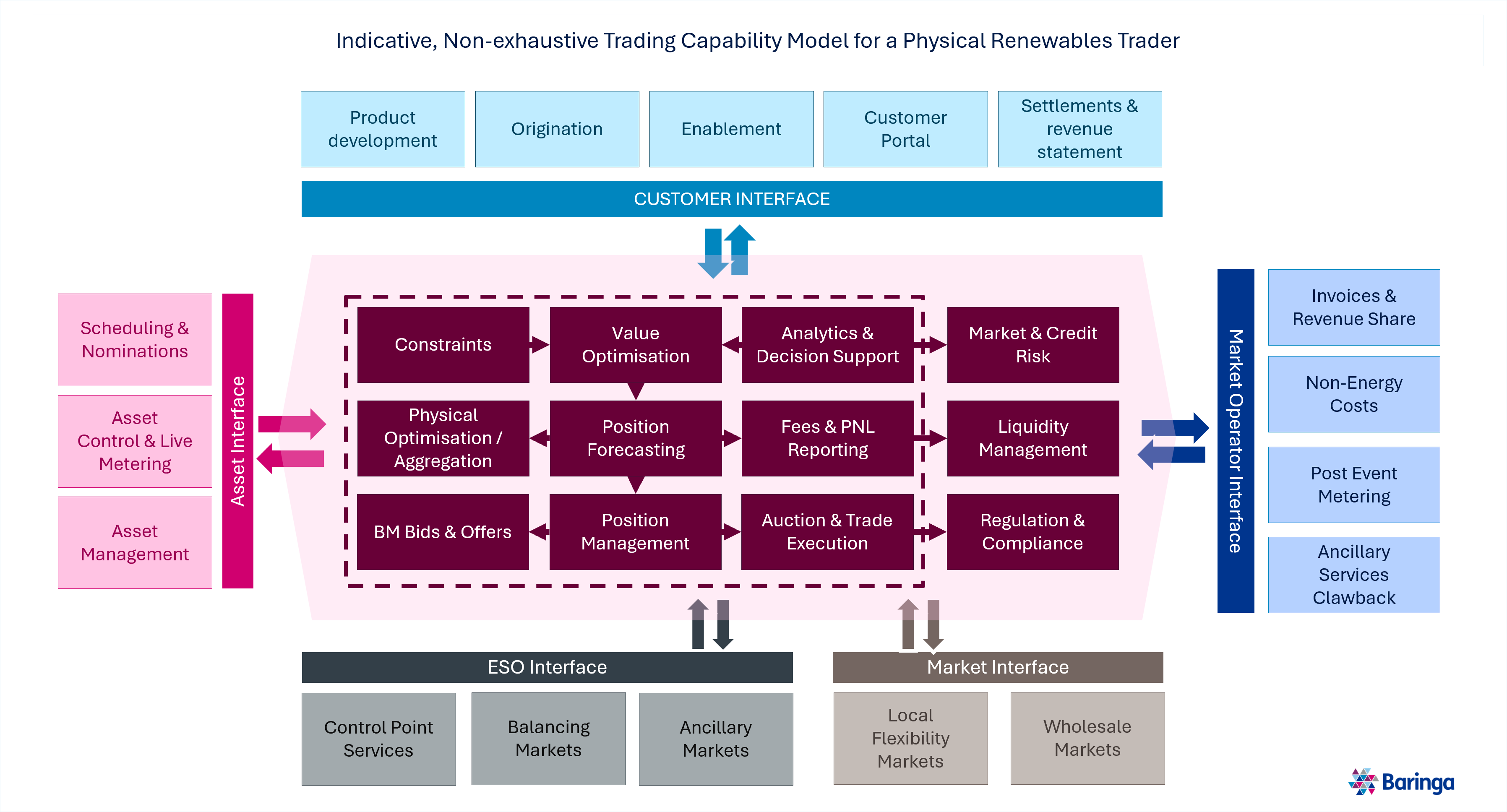

As market participants increase focus to near-continuous trading, intraday automation has become essential to continued competitive advantage. This is not solely limited to trading activity either. Automation is increasingly needed for the kaleidoscope of capabilities that support trade processing, including risk reporting, scenario analysis, trade verification, and margining. To illustrate how these activities interact in practice, our indicative, non‑exhaustive trading capability model for a physical renewables trader (see image) provides a helpful view of the end‑to‑end processes and supporting functions required in modernised trading environments.

The move toward high-frequency trading also amplifies cashflow and margin requirements. Contending with volatile market movements and greater transaction volumes, trading houses require robust treasury management and capital allocation frameworks to maintain liquidity buffers.

As the pace of regulation amendments picks up, with the arrival of additions such as EMIR Refit and upcoming REMIT II rules, organisations must contend with more complex reporting obligations. Technology is foundational to enabling the auditable processes and workflows that are now prerequisites for market participation. Additionally, more firms are investing in decoupled architecture to report on and manage the complexity of contracts and trading products. This all comes at a cost, with the technology and data solutions needed to comply with greater legal and reporting scrutiny pushing up overheads.

Beyond ensuring regulatory compliance, technology has become essential to determining competitive advantage. Advanced forecasting models interpret inputs from weather forecasts, consumption profiles, grid capacity, and more to assist analytics and decision-making. Likewise, algorithmic execution systems allow for orders to be placed in milliseconds to capture fast-moving opportunities.

As renewables transform operations on trading floors, they are also changing workforce dynamics within them. Data scientists, data engineers, AI specialists, and others will step on stage to support traditional players such as traders, analysts, controllers, and operators. While the latter employees will continue to maintain their central positions, they will perform their jobs in different ways and will need to develop new skills to keep pace in an evolving workplace. The capability model (above) also highlights how these roles integrate across processes, reinforcing the shift toward more multidisciplinary, tech‑enabled trading functions.

Steps to success in energy trading’s future

With energy markets poised for further waves of change, there are practical steps that trading organisations can take today to ensure they remain on top:

- Speed is key. Competitive advantage hinges on the ability to interpret information rapidly and convert it into action. Automation and analytics are already enabling split-second insights and decisions. Algorithmic execution will become table stakes, as will real-time reporting and monitoring. Trading firms need to be ready for ever-higher levels of automation and speed.

- Technology matters more than ever, and people who can master it. Tomorrow’s trading desks will be powered by AI, machine learning algorithms, and vast data streams. Organisations should be reinforcing their technology foundations and developing talent with the skills needed to work with new technologies, so they can take advantage of advances and not get left behind.

- Old information advantages are vanishing. The rise of data transparency, driven by digitalisation and regulatory pressures, is rapidly stripping traders of their information edge. Simply holding large portfolios of physical assets no longer conveys the same advantage as it once did. Companies must augment existing tactics, diversifying their trading strategies, pushing for greater cross-functional collaboration, and investing in technologies that keep them ahead of the game.

As renewables reshape energy markets, trading must transform to navigate new dynamics. To find out how Baringa can help your business capture maximum value in a changing landscape, please contact our team.

Our Experts

Related Insights

How to solve the data paradox in commodity trading

Implement successful change programmes for your commodity trading businesses

Read more

Commodity market trends: expect diversification, disruption, and strategic shifts in 2026

Commodity markets in 2026: diversification, disruption, and digital transformation. Discover the trends shaping strategies for energy and trading businesses.

Read more

The four-pillar framework that ensures benefit certainty to trading transformation

Our benefits and value framework enables trading organizations to quantify the tangible benefits of transformation upfront.

Read more

How do commodity trading organisations become AI future-ready?

Commodity traders are incentivised to adopt AI, but face challenges with legacy integration.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?