REMA and investing in the GB power market under uncertainty

7 min read 16 June 2025

The energy transition, with its emphasis on electrification, creates both investment opportunities but also risks due to uncertainty around evolving power system requirements, grid expansion, technology innovation, shifting demand patterns and digitalisation.

The system changes are the reason why, three years ago, the Government launched the Review of Electricity Market Arrangements (REMA) programme to consider fundamental changes to Great Britain’s (GB) electricity market design – including whether GB should move to a zonal wholesale electricity market. This question has been the focus of intense debate across the industry, with strong opinions on both sides of the argument, and concern that uncertainty around the final decision is affecting investment.

Government’s decision on REMA is imminent. It will provide clarity on the near-term direction of travel. However, the decision is unlikely to be the end of the matter. Market design will continue to evolve over the longer term, with price signals relating to the location and timing of generation and demand likely to continue to be strengthened.

Investors focusing on fundamental, long-term value, and building resilient portfolios that align with system needs, are more likely to succeed under uncertain future scenarios and outcomes. The GB electricity system – demand, capacity - is expected to grow over time, creating significant opportunities to deploy capital.

Baringa can help. By leveraging Baringa’s deep power sector expertise, market-leading analytics and advanced modelling capabilities, we can help you develop robust investment strategies that anticipate trends, capitalise on opportunities of emerging market dynamics, and mitigate risks.

Uncertainty is inherent in the energy transition

The Government’s Clean Power Action Plan 2030 is rapidly transforming the GB energy system, accelerating and scaling-up investment in clean power, with policies aiming to decarbonise the rest of the economy by 2050. This ambition comes with significant opportunities to deploy capital and scale up businesses.

However, there is significant uncertainty that you, as an investor, need to consider:

1. Changing system requirements and new system risks: The transition to a power system increasingly dependent on weather-driven resources, such as wind and solar, is redefining system dynamics and changing system needs, introducing new risks and operational challenges that are not yet fully understood.

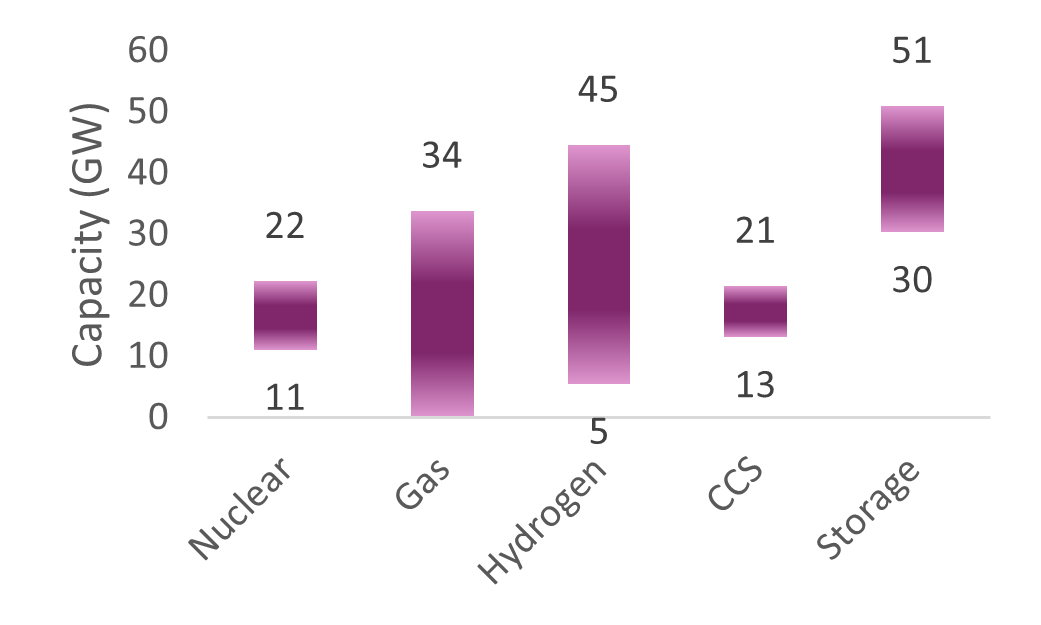

2. Multiple new technologies are vying for dominance: To maintain reliability, we must develop alternatives to unabated natural gas — resources that can complement wind and solar while ensuring adequacy, resilience and operability. Candidate technologies include long-duration energy storage, power-CCUS, hydrogen turbines and nuclear. But it is unclear which technologies will prove viable at scale, how seamlessly will they integrate into the grid, and what the eventual power mix will be (see Figure 1).

Figure 1: There are wide capacity ranges for ‘firm’ generation technologies in 2050 across FES scenarios (Source: NESO, FES 2024)

3. The level and flexibility of demand are a big unknown: The demand-side of the energy equation has the potential to change rapidly but the extent to which retail innovation will emerge and unlock consumer flexibility under different conditions is still a big unknown (Figure 2). Additionally, AI applications are driving surging demand for clean power and grid connections - the pace, scale and geographic spread of this future demand growth is uncertain.

Figure 2: Projections for DSR are ambitious and wide-ranging (Source: NESO, FES 2024)

4. What can the digitalisation era deliver for the system: The power sector is undergoing a digital transformation, where AI, IoT, and data analytics are poised to reshape efficiency, costs, and reliability - but it’s unclear to what extent, and how rapidly will it happen, and how this will impact investment.

5. The pace of transmission network reinforcement and expansion: Upgrading and expanding grid infrastructure is essential to accommodate renewables, but the process is fraught with challenges. Network congestion is already a pressing issue, and while efforts are underway to accelerate grid expansion, the rate of deployment of grid capacity may still struggle to keep pace with the speed that generation needs to connect to the system. Innovation and response to locational investment signals on both the supply and demand sides could influence the timing and scale of network build.

But some things about the transition are certain…

Location and flexibility of generation and demand will be critical

The dynamics of tomorrow’s energy system will be fundamentally different from the system of the past. Wind and solar provide c.35% of all generation today, but this is projected to rise to 70-80% or more by 2035.

In a system dominated by weather-dependent renewables, where and when power is generated and consumed becomes critical – inefficient location and inflexible operation of assets will lead to much greater costs in terms of network build requirements, reserve capacity, and system support services. This in turn will lead to higher electricity bills, higher risk of operability challenges, reduced industrial competitiveness, and ultimately a loss of support for the energy transition.

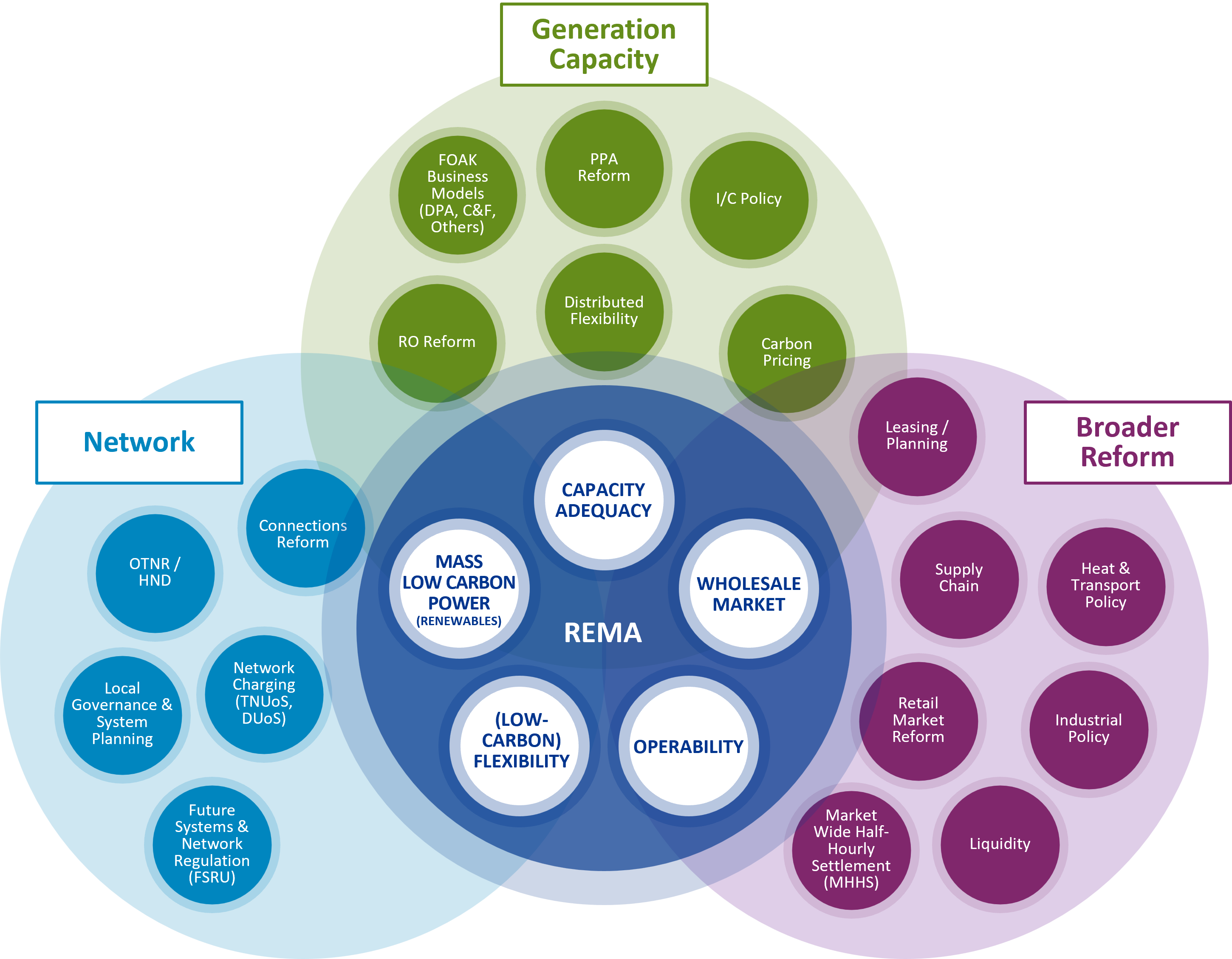

Under REMA and related reforms, locational signals will be strengthened

Under either a zonal or reformed national market, Department for Energy Security and Net Zero (DESNZ) has been clear that locational signals will be strengthened.

In a zonal market, this would be directly reflected in wholesale price – Baringa analysis suggests that average wholesale prices could vary by up to 40% between the highest (typically in the south of England) and lowest (typically Scotland) priced zones. Locational Transmission Network Use of System (TNUoS) charges or benefits will likely reduce in most zones, offsetting some of the changes in wholesale prices. However, the impacts of these signals in the market will be partially mitigated by the protections DESNZ has indicated it would provide to certain generators and consumers – for example, existing Contracts for Difference (CfD) holders will be protected from zonal wholesale prices and volume risk – so only a proportion of assets will be directly exposed to zonal wholesale prices.

Under a reformed national market, DESNZ has indicated that locational signals in TNUoS are likely to be increased and made more predictable, and there may also be additional locational signals sent through local constraint markets, reforms to the Balancing Mechanism, and other policy changes.

Under either wholesale market design, other mechanisms may also have a key role in influencing locational investment decisions, including connection reforms, the Strategic Spatial Energy Plan, and potentially changes to investment policies such as the CfD, other low carbon support schemes, the capacity market and long duration storage cap and floor.

Figure 3: REMA is one part of a broader set of market and policy changes

...but in the long-term further changes are likely to be required to manage costs and maintain a reliable system

Whatever reforms are adopted through REMA this summer, there will likely be more change coming.

Under a reformed national market, there will remain an inherent disconnect between wholesale prices in the market and the underlying physics of the system – power will be traded when it is known that it cannot physically be delivered to consumers, meaning that flexible demand, batteries and interconnectors may respond to incorrect price signals or have to be redispatched by the System Operator in the Balancing Mechanism. This results in inevitable inefficiencies that cannot be fully addressed through other mechanisms, and will likely be unsustainable in the long run.

Whilst a zonal market represents the underlying dynamics of the system more accurately than a national market, it will be an approximation relative to the actual system constraints (which are more granular on both a locational and temporal basis), and signals will be dampened by grandfathering and shielding measures.

Both models will also be limited by the nature of today’s legacy systems and data sources. As networks, assets, control systems, and trading desks are modernised with the latest digital and AI technology, new possibilities for market design will become available – for example using automated, real-time trading and dispatch of assets, fully internalising system constraints into the traded price.

We therefore anticipate that future market and policy reform that further strengthens incentives for efficient location and dispatch of assets is inevitable.

The key question is, when will further reforms be required? This will depend on the extent to which REMA reforms address the medium-term challenges. There is a risk that another review could be needed in the future if underlying system inefficiencies continue, or short-term ‘emergency’ interventions may be needed to protect consumers from high costs or risks. Thus, whilst there are concerns about the impact of radical changes as a result of REMA, an overly cautious approach could also harm investor confidence by postponing change and prolonging uncertainty.

Enduring success lies in developing robust investment strategies based on fundamental value

In a rapidly evolving energy landscape, with the prospect of continued reforms to market design over coming years, investors need to take a long-term, strategic mindset. This means focussing on the long-term, fundamental value of assets to the system, rather than focusing only on value under current market design. There are huge opportunities to invest in the sector as power demand and capacity is expected to more than double.

Making informed decisions in this complex environment requires applying rigorous frameworks to evaluate opportunities and risks. For example, a systematic review of risk exposure—whether for individual assets or an entire portfolio—combined with additional analytical layers such as spatial assessment, can provide deeper insights. This approach enables data-driven precision, enabling more strategic capital deployment and optimising long-term returns.

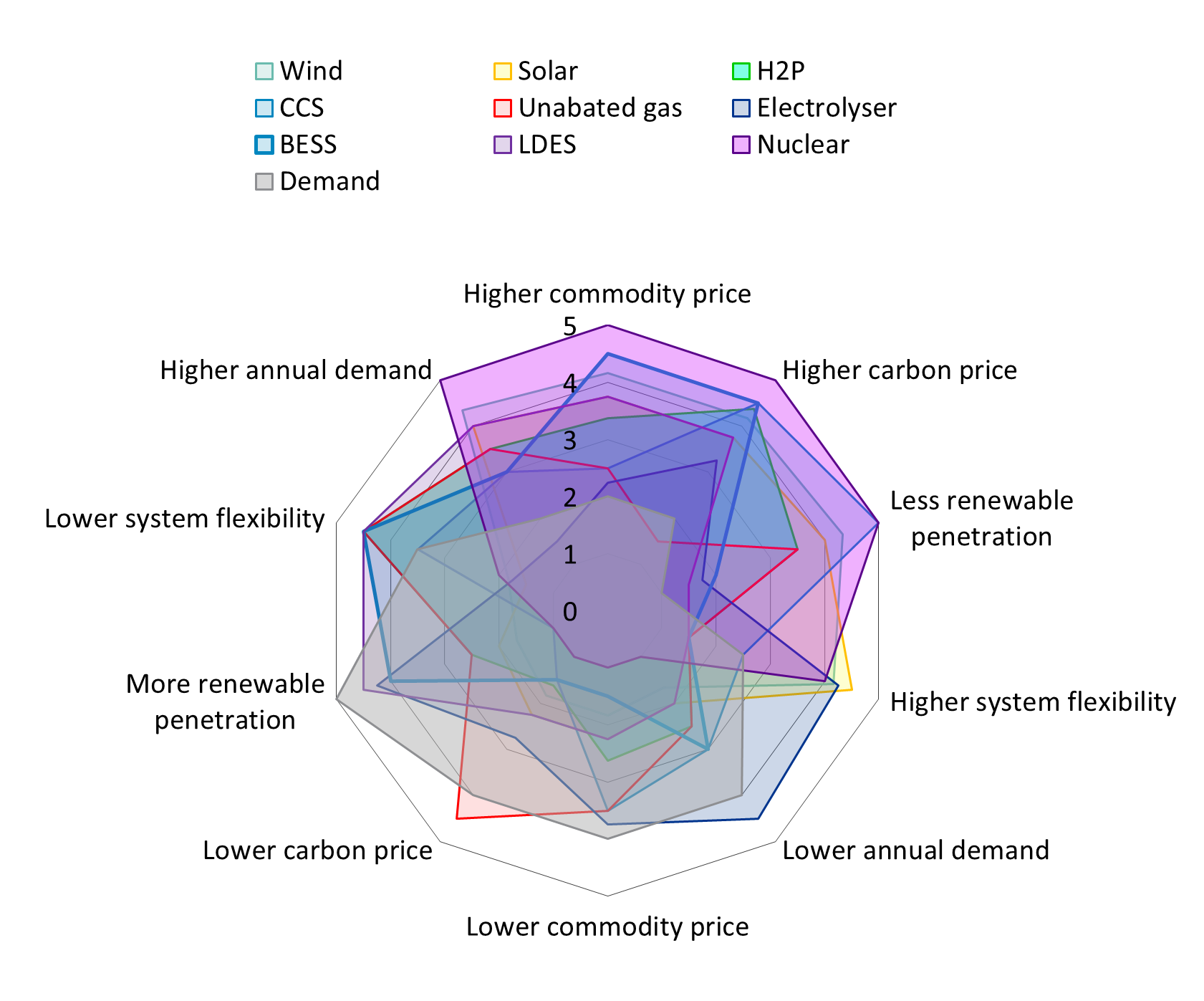

Whilst individual technologies can be highly exposed to specific risk factors, it is possible to construct a portfolio of assets with synergies that are resilient to different outturn scenarios (Figure 4).

Figure 4: Illustrative revenue exposure of different technologies to different market risks, which can be used to construct a portfolio of assets that captures opportunities and is resilient to a range of risks

Baringa is best placed to help you capitalise on opportunities to invest in the sector and mitigate risks in the face of change. Combining our market-leading analytics, advanced modelling, intellectual property and deep power sector expertise, we work closely with our clients to guide successful decisions under uncertainty and develop robust investment strategies.

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?