The rise of the retail trader

5 August 2021

Reimagining capital markets

The surge in retail trading is heralded by advocates as the triumph of the ‘little guy’ over financial giants - and by its detractors as a dot.com bubble waiting to burst. But love it or loathe it, retail trading is now so prevalent that it can’t be ignored.

In January 2021, the growing power of digitally-enabled small investors hit the headlines, following the spectacular rise and fall of shares in the US video game retailer GameStop.

The retail traders’ actions defied professional experts. Commentators speaking out against the subsequent restrictions on platform trading include Tesla CEO Elon Musk and one-time Wolf of Wall Street, Jordan Belfort, who went so far as to herald this a “radical change” in the market. “Information travels instantly now…so the little guy finally has the ability to play the same game [as the big guys], at least somewhat,” he said.

Case for caution

Others including regulators see risks ahead, especially if people with little or no money to spare experience severe losses. Moreover, while some believe that retail trading opens the way towards a fairer and more democratised market, others worry that the ‘big guys’ will always have more experience, analysis and financial clout at their disposal. Even the so-called ‘Reddit rebellion’ that was thought to have fuelled the rise in GameStop’s share price may not have been quite as impactful as it first appeared. Research carried out by JP Morgan suggests that the market movements owed more to institutional money than small investors.

Further controversy centres on the ultra-low or even zero commissions used to attract investors. These provide welcome price competition in the equity trading market. The internet has also made it easier to compare fees and shop around. However, there are concerns that, once in, investors could be encouraged to buy riskier securities such as contracts for difference (CFDs). In response, sale of CFDs have been severely restricted by the FCA.

Embracing a new reality

Welcome or not, this phenomenon is here to stay. According to analysis carried out by Bloomberg for the Financial Times, retail trading now accounts for almost as much US equity trading volume as mutual funds and hedge funds combined. It’s therefore an important channel for sourcing and directing capital.

Rather than combating, curtailing or even prohibiting retail trading, a more sensible course would therefore be to accept it as one of the realities of a market being transformed by digitisation, manage the risks and embrace the opportunities. This is certainly the view of many banks and brokers, who are launching new investment portals to take advantrage of the trend.

Setting up your own retail trading platform not only provides access to a new pool of investors, but would also enable you to directly influence this increasingly important area of the share dealing market. It can also be aligned with robo-advice, digital profiling and other tech-enabled capabilities to create low cost, customised financial guidance and solutions.

(Click to enlarge)

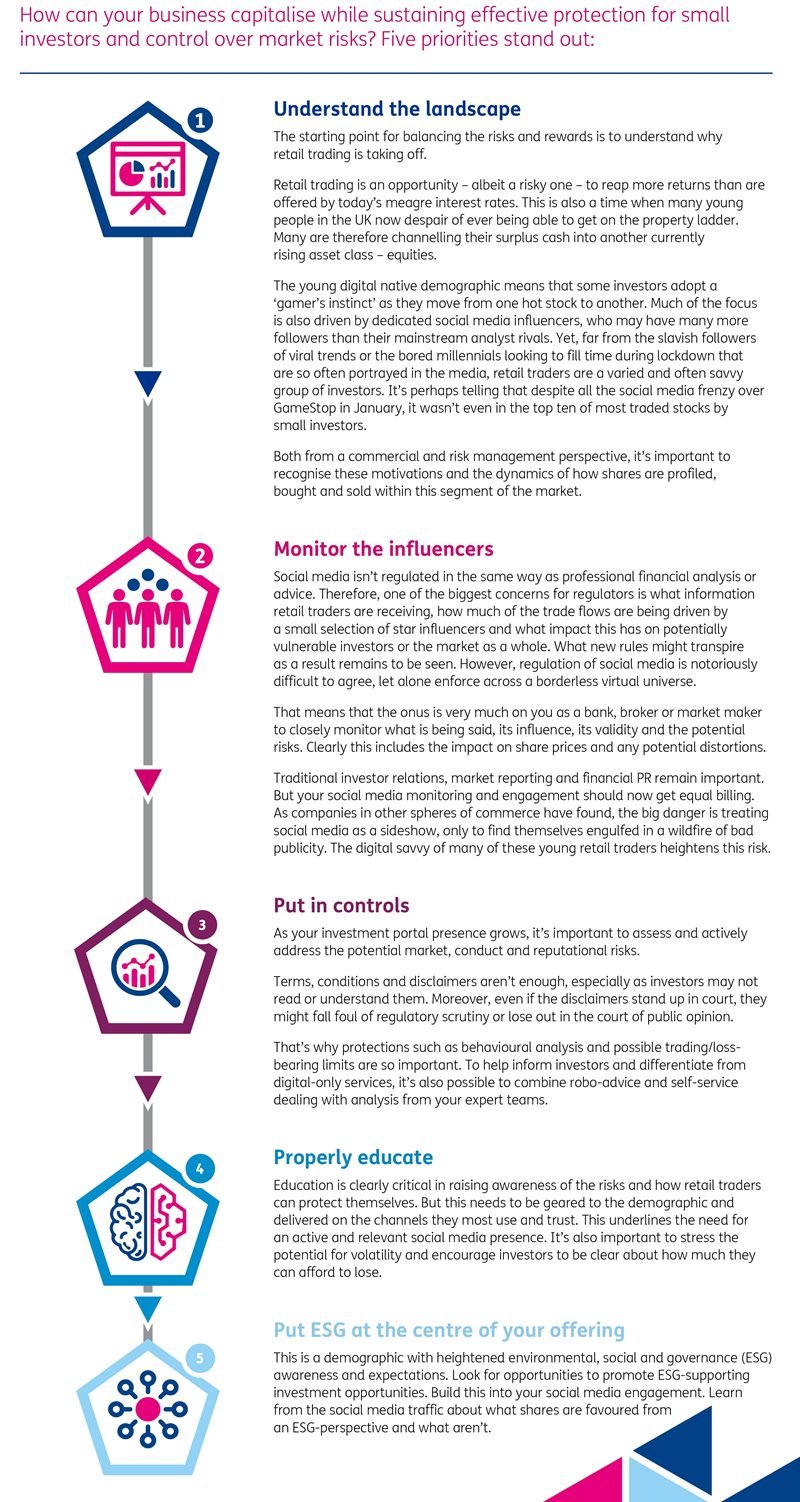

Managing threats and opportunities

Like all disruptive trends, retail trading can’t be wished away. Winners will embrace the increased pool of investors, while boosting risk awareness and control. We will continue to see them building retail trading into their wider push to attract digital natives and integrate ESG into investment strategies.

An example of this is the Robinhood IPO, which will allocate as much as 35 percent (an unusually large amount) of the 55m shares it plans to sell to investors buying directly through its app, but is also facing increased volatility and regulatory scrutiny.

Related Insights

Can payments really play a role in creating a differentiated and distinctive customer experience?

Industry experts share how payments have been a key driver in creating a differentiated and engaging customer experience in their businesses

Read more

Combining technology with a human touch

Financial institutions must combine digital and human interaction to meet customer expectations and differentiate their businesses.

Read more

Reimagine Financial Services Leadership Dialogues

We explore the topics of reinvigorating payments, refreshing customer journeys, rethinking the “Ecosystem” and how Financial Services are adapting to digital

Read more

Leadership Dialogues: Perspectives from a VC firm

In this video, we discuss how VC firms can support companies to solve real problems for financial services institutions.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?