The growing popularity of ESG funds, underpinned by strong recent performance is to be welcomed. But allocating capital to low-carbon emitters alone will not be enough to avoid damage to the environment.

To be part of the climate solution, investors and banks also need to support and encourage firms and sectors in their transition to lower emissions.

However, investing in “climate sinners” using current simplified climate metrics can expose investment institutions to reputational risk as a result of their climate disclosures. How then can investors judge whether these investments make sense and avoid the potential negative connotations? The answers lie in Temperature Alignment or ‘Implied Temperature Alignment’ as referred to by TFCD and firms demonstrating credibility in their climate strategy.

The importance of forward-looking metrics

The purpose of climate metrics, in an investment context, is to generate standards of reporting and transparency that will allow financial institutions and individuals to make informed investment decisions that will support the transition to a low carbon economy. The shortcoming with the basic suite of metrics is that they are ‘moment-in-time’, providing a snapshot of an evolving problem.

The solution is more complex than abandoning emission-heavy industries. We need to support innovation and be able to differentiate between good and bad behaviour in any given sector. People will still want to travel and will still need cement and aluminium. By lending to these institutions to enable them to invest in transition, banks find themselves facing “financed emissions”. Without further information, investors will punish these banks accordingly as ‘bad actors’. The world needs a more sophisticated approach to analysing the pathways to climate goals over time.

By definition, any such pathway will only be as good as the data provided, as well as the credibility and ambition of the individual company’s climate plan. Equally imperative is the ability to communicate any company’s climate pathway in a way that is simple to understand and convey. This is possible using Temperature Alignment.

Temperature Alignment

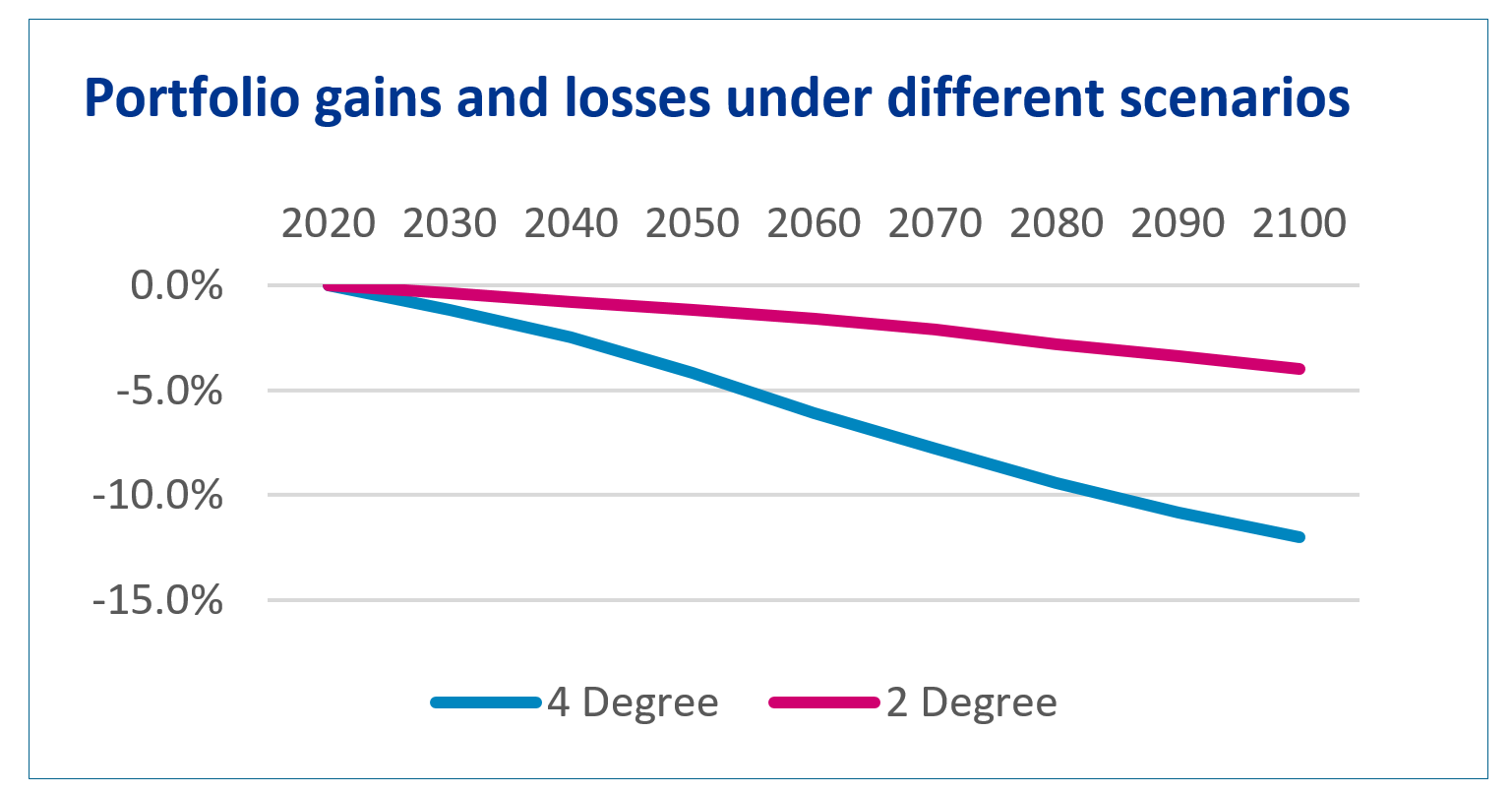

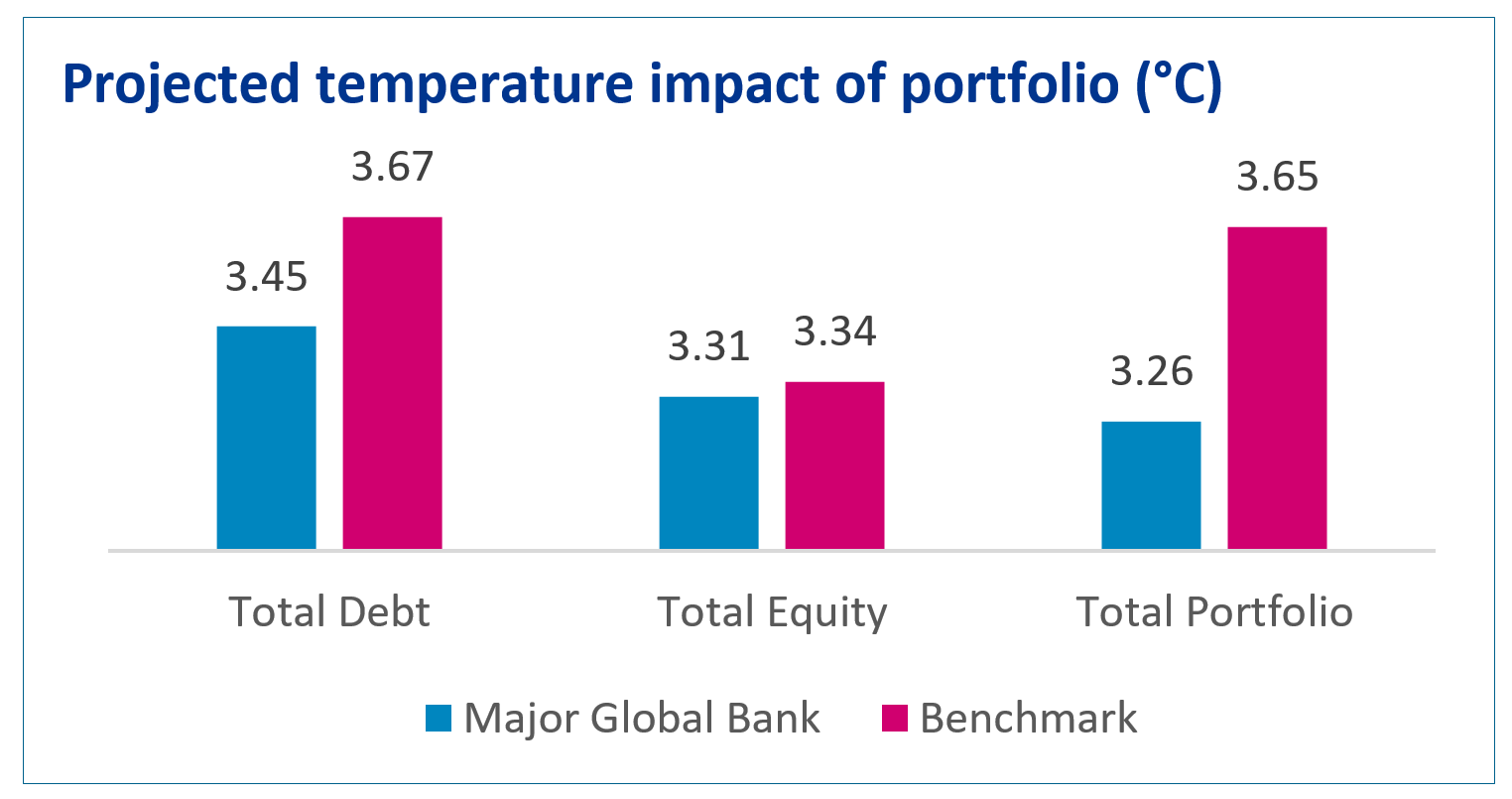

TA is a forward-looking metric that attempts to convey the future trajectory of Green House Gas (GHG) emissions of a given entity or portfolio in terms of its estimated global temperature rise. Each sub industry and region is modelled in order to target the source of emissions. In effect it is designed to convey a simple story: whether the planned pathway is aligned with the goals of the Paris climate accord e.g. below 2 degrees or a more damaging climate pathway such as 4 degrees.

Clearly there are challenges with such a forward-looking approach, requiring effective modelling and qualitative assessment of the strategic climate plans of a given firm. For instance, you may have a plan to reduce carbon emissions, but is it credible?

The strength of this measure is to encourage the investment required in the sectors that are critical to avert disaster, while rewarding efficacious behaviour.

Part of the reason we at Baringa have chosen Temperature Alignment as a core part of our climate scenario model is that it is easy to understand and relate to – everyone understands temperature, and ‘Paris-alignment’ is becoming a relatively common term.

Challenges to Temperature Alignment

Clearly such an approach requires significant amounts of data and that is a challenge. The best way to be able to improve the quality of data is to set a standard. Making climate disclosures mandatory via TCFD reporting will drive financial institutions to insist that the counterparties they lend to also disclose – this will encourage more granular and accurate reporting and make forward-looking metrics more meaningful.

Governments have started to mandate climate-related financial disclosure; this will only increase the availability of GHG data facilitating temperature alignment. Getting this right will help tackle the physical and transition risk of climate change.

Summing up

In place of existing metrics that can only give a snapshot of where we are, we must adopt forward-looking metrics, stemming from credible data and robust modelling, to help all sectors along the desired path. Temperature Alignment metrics that are based on robust modelling will help financial institutions make better asset allocation and investment decisions that take full account of climate change.

Baringa

At Baringa, climate is in our DNA and we have built temperature alignment methods and climate value-at-risk into the heart of our climate scenario model. Forward looking modelling supports our clients in addressing their climate-related financial risks, allowing efficacious investment as well as attracting capital. We believe that to effect change you need to be part of the solution where the change needs to happen, not just by investing in a zero emissions portfolio but by driving a portfolio to zero emissions.

Related Insights

How superfund CROs navigate the AI double-edged sword

CROs must manage AI risks while seizing its opportunities.

Read more

Four steps to comply with the updated BCBS239 regulations

Banks have spent millions on BCBS239 compliance, but they aren’t yet in the clear. In case you missed it, the ECB recently published new guidance that updates the decade-old regulation. Here are the four actions that we recommend firms take to meet the latest BCBS239 rules.

Read more

How can financial services firms leverage CSRD and TPT synergies to future-proof business strategies?

Six actions financial institutions should consider when navigating CSRD and TPT.

Read more

AI risk management: are financial services ready for AI regulation?

Find out how AI is transforming financial services and the crucial need for proactive risk management and compliance in the evolving regulatory environment.

Read more