Why customer loyalty determines the success of bank M&A

8 min read 10 December 2025

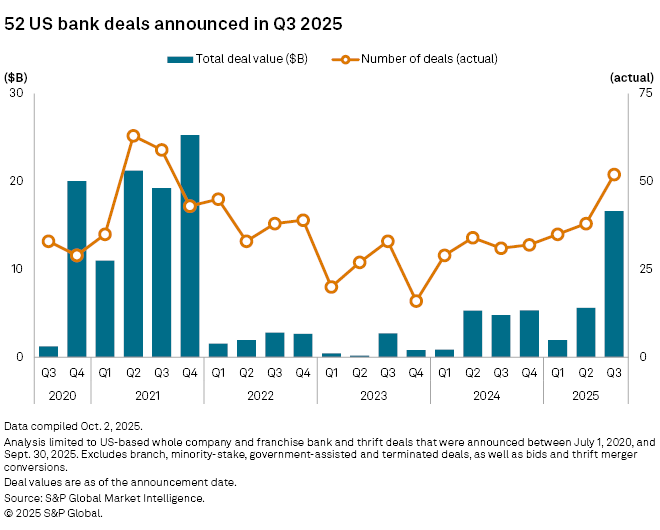

Bank M&A is back and accelerating, reaching its highest level in four years (S&P Global, see figure 1). Lower rates, improving deal valuations, and a more predictable regulatory path are creating the conditions for continued consolidation into 2026, as banks balance the limits of organic growth with the need for scale. Regional and community banks are using acquisitions to expand beyond their home markets as efficiency pressures and funding costs rise.

Recent announcements across the Midwest, Texas, and the Carolinas reflect how aggressively banks are pursuing scale. A similar trend is taking shape among credit unions, which are pursuing targeted acquisitions to expand membership and modernize their digital capabilities.

The logic feels familiar:

- A bigger footprint supports a bigger balance sheet

- A bigger balance sheet attracts more customers

- More customers create scale, efficiency, and revenue

But once the announcement settles and integration begins, the customer experience often gets overlooked. That’s where loyalty – and the value of the deal - can start to unravel.

Figure 1. S&P Global Market Intelligence data through Sept. 30

The Risk Hiding in Plain Sight

Baringa’s latest research shows just how fragile loyalty has become. More than one-third of U.S. customers switched banks in the last five years, driven by better digital experiences, stronger security, and more modern products.1 In other words, the very areas most stressed during an integration.

Customers are also three times more likely to switch banks during an acquisition.2 Some leave immediately; others stay but begin to question whether the new bank still fits them. One study found that 17% of customers left after a merger, and a third of those who stayed expected to switch within a year.3 A growing share of this churn is driven by digital expectations. 62% of customers say they have switched, or would switch, because the bank’s digital experience falls short, a risk that intensifies during conversion periods.4

What pushes people away isn’t pricing or product changes; it’s the disruption to their routines. Confusion, inconsistent communication and unexpected changes make customers feel like they’re losing control over the habits that anchor their financial lives. Competitors understand this. They watch conversion weekends closely and make it easy for frustrated customers to move their money.

Why Customer Experience Gets Overlooked

During an acquisition, integration teams juggle a long list of priorities: core conversion, digital migration, data mapping, regulatory work, branding changes, and staffing decisions. All of it matters, but it pulls focus inward.

Customer experience usually comes later. And when it does, it’s often reduced to emails, FAQs, and letters. Helpful, but nowhere near enough to guide customers through a messy, real-world transition.

There’s also an unspoken assumption: if the systems connect and the branding updates on time, customers will adapt. But a conversion can look perfect in a project tracker and still frustrate someone trying to log in, pay a bill, or get help.

Older technology doesn’t help. More than two-thirds of U.S. banking executives say their current architecture limits their ability to support customers with many still relying on systems built decades ago. Those cracks show up quickly during cutovers.5

Where the Experience Breaks

Customers don’t experience a merger through cutover plans or system diagrams. They feel it in their routines:

- Paying a bill

- Checking a balance

- Calling for help

- Walking into a familiar branch.

That’s where the gap opens.

A login failure becomes a crisis. A delayed payment becomes a missed deadline. Conflicting instructions create frustration. A declined card becomes embarrassment.

For the bank, these are incidents. For the customer, they’re moments that break trust.

A smooth transition builds confidence, a rough start sends customers drifting - shifting balances, reducing activity, or quietly moving their money elsewhere.

The Human Layer

One of the biggest blind spots in integrations is how much the customer experience depends on frontline employees – tellers, customer service reps, and branch staff. These are the people customers turn to first and they are often the last to get clear information.

When staff can’t answer basic questions about account access, fees, cards, or logins, customers sense that immediately. Confidence drops on both sides of the counter.

Frontline teams aren’t just a support function. They are the part of the bank customers trust most. When they’re informed and equipped, customers feel reassured through the change. When they aren’t, even small issues start to feel like warning signs.

Protecting the Experience

The banks that get integrations right treat newly acquired customers with the same seriousness they apply to balance-sheet modelling or technology cutovers.

A few principles consistently make the difference.

- Bring into planning early and make sure it has an owner. In many integrations, no single team represents the customer. CX sits between marketing, operations, digital, and frontline leadership, which means it often shows up late or not at all. Successful banks give customer experience a defined seat at the integration table and ensure frontline perspectives are represented from the start.

- Plan for exceptions, not just the ideal path. Most customer pain comes from edge cases that were not mapped

- Keep communication clear, simple and consistent

Frontline teams also need real support. They’re the ones customers turn to first, and their confidence sets the tone for the entire transition. When the frontline is prepared, customers feel reassured. When they’re not, even small issues start to feel like bigger problems.

The first weeks after conversion matter most. Real-time monitoring, quick issue resolution, and clear escalation paths prevent minor issues from becoming moments customers remember for the wrong reason.

None of this is complex. It just requires intention.

When It Goes Well

Not every integration drives customers away. Many strengthen the relationship. Customers aren’t afraid of change, they’re afraid of change that feels unmanaged. When the transition is planned well, a merger can deliver real benefits: better digital tools, stronger support, more locations, and new capabilities. The message customers take away is simple: my banking got better. That only happens when the experience feels intentional and cared for.

The data reinforces this. Mobile is now the primary channel for 45% of customers, and 44% say improving the mobile experience is their top request. Even small upgrades after a merger can have an outsized impact on confidence and loyalty.6

The Bottom Line

Banks pursue M&A to grow.

Ironically, many shrink before they grow because they overlook the customer experience during the transition. Most business cases assume customers will stay. That is never guaranteed.

A balance sheet is ultimately a collection of individual customer choices.

- “Do I stay?”

- “Do I trust this new bank?”

- “Do I move my money?”

Integration is not only operational, its emotional.

Banks that recognize this and design the transition accordingly are the ones that keep customers and unlock the growth the deal promised.

What Banks Need to Do to Protect Loyalty

Everything in a merger comes down to how the change feels for customers and for the people who serve them. The steps that protect loyalty are not complicated, they just require intention.

- Bring customer experience into the room early.

If CX only shows up after the technical decisions are made, it’s already too late. The customer perspective needs a voice when cutover timing, digital migrations, and Day-1 experiences are being shaped. - Design for the real moments customers will live.

Not the perfect journey. The real one. Logging in. Using a card. Calling for help. Visiting a branch. These small moments carry most of the emotion and most of the risk. If they go smoothly, everything else feels manageable. - Prepare the frontline before the questions start.

Customers look to the people they trust: tellers, call-center reps, branch staff. When those employees have clear, simple answers, confidence rises instantly. When they don’t, uncertainty spreads just as quickly. - Communicate clearly and repeat the essentials.

Customers don’t need long letters or technical explanations. They need short, direct guidance: what is changing, what is not, and what they need to do. Repetition builds reassurance. - Watch the experience closely in the first weeks.

The early days after conversion matter more than most teams expect. Real-time monitoring and fast issue resolution turn potential crises into minor bumps. Slow reactions turn small problems into moments customers remember. - Make customer impact part of governance, not an add-on.

Every major decision during integration has a customer consequence. Bringing that lens into steering meetings and risk reviews keeps the focus where it belongs.

If you are preparing for an acquisition or in the midst of one, Baringa can help you put these steps into practice in a way that keeps customers confident through the transition.

References

- Baringa retail banking survey: legacy tech, lost loyalty | Baringa

- How to Keep Customers After a Merger or Acquisition – FI Works – Sales and marketing you can bank on

- Revitalizing Bank Merger Enforcement To Restore Competition and Fairness in Banking - American Economic Liberties Project

- Baringa retail banking survey: legacy tech, lost loyalty | Baringa

- Baringa retail banking survey: legacy tech, lost loyalty | Baringa

- Baringa retail banking survey: legacy tech, lost loyalty | Baringa

Related Insights

Unlocking private capital: scaling investment in the CCS sector

Unlock the next wave of CCS investment. Discover how the financial services sector can scale viable models, reduce risk and mobilise private capital for commercial CCS deployment.

Read more

10 tech trends reshaping financial services in 2026

We explore ten interconnected themes that will define success in 2026 and beyond—covering how firms can modernise architecture, embed AI responsibly, strengthen resilience, and optimise technology investment.

Read more

Baringa retail banking survey: legacy tech, lost loyalty

Legacy tech is eroding customer loyalty. Discover why over a third of customers switched banks, and what leaders must do to close the digital experience gap.

Read more

Navigating sustainable retrofit in real estate

Achieving successful sustainable retrofitting in real estate can seem like a complex challenge. Discover how your organisation can unlock the strategic value of retrofitting with our new report, commissioned by Barclays and in collaboration with JLL, Travis Perkins and TrustMark.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?