Heat decarbonisation

Discover our experts' insights into heat decarbonisation.

Our Insights

Decarbonisation: heat pumps in the home

With the number of heat pumps needing to increase dramatically, we explore why the economics don’t add up today and the urgent action needed to address this.

Read more

Green homes and net zero - the industry's response

The Baringa Green Homes white paper will combine contributions from the UK energy ecosystem to explore how green homes can be delivered

Read more

Decarbonising heat

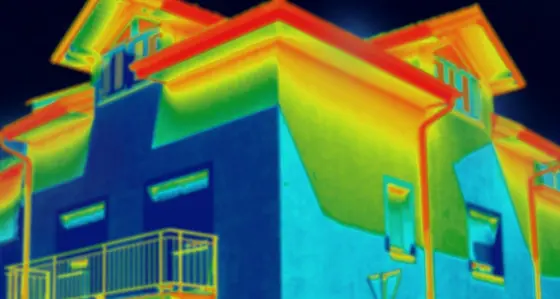

In the UK, gas is the predominant model of heating and as a result buildings are a major source of greenhouse gas emissions.

Read moreOur Impact

Heat & Buildings Strategy – lacking vision or a call to action for industry?

The announcements made on the Heat and Buildings strategy are a step forward; the transition to net zero requires unprecedented change over a rapid timeframe.

Read more

Five steps to attracting capital for heat networks

Expanding heat network provision to meet net zero goals needs £6 billion of private sector capital but the sector isn’t reaching its potential with investors.

Read more

Decarbonising how we heat our homes: yesterday's budget kicked off the journey

Heat had a high profile in the budget, testament to how the sector, and the challenges of decarbonising how we heat our homes have risen rapidly up the agenda

Read moreOur Experts

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?