How prepared are you as an insurer for net zero target setting?

3 November 2022

A target setting deadline is fast approaching for Net Zero Insurance Alliance (NZIA) signatories, with the imminent release of global industry guidance for non-life underwriting portfolios. In this article we outline what insurers will need to do to prepare ahead of setting net zero underwriting targets.

The big question insurance CROs are asking us is not “should we…”, but “how do we…” align our strategy, risk management and portfolios with net zero. The answer to this will be shaped by net zero target setting guidance from Partnership for Carbon Accounting Financials (PCAF) and Science Based Targets Initiative (SBTi) before January 2023, starting with motor and commercial lines.

However this creates a new problem for many insurers – a fast turnaround. NZIA signatories will have until July 2023 to set targets, assess, and prepare their business for change. Stakeholders will expect non-signatories to be fast followers.

Why are insurers committing to net zero underwriting?

Committing to net zero plays an important role in combating the climate crisis and protecting the planet. But beyond this, there are powerful commercial drivers for committing to net zero. These include:

|

Capital To maintain favourable demand and conditions with investors and global capital markets. |

Growth and competition To identify nascent industries, risk transfer solutions, and technology which unlocks competitive advantage. |

Strategy To ensure strategy and portfolios are resilient to climate-related economic change. |

Risk To manage changes in underlying risk, claims costs and to mitigate greenwashing and regulatory intervention through credible action. |

|

Purpose To ensure corporate Purpose (protecting people, businesses and communities) is not undermined by lack of action on climate change. |

|||

So what questions should CROs be asking their leaders?

CROs, CFOs, Chief Underwriters and Executives should be asking themselves eight key questions to prepare their businesses for net zero alignment and implementation.

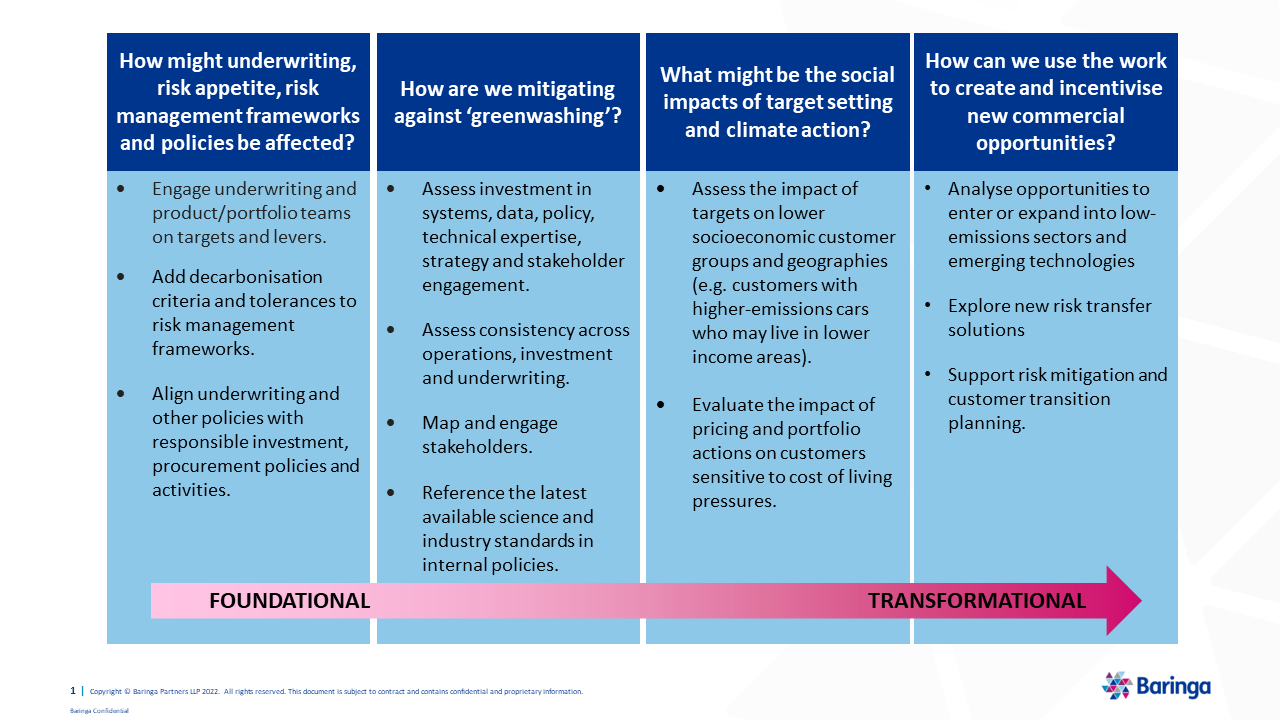

These questions build from foundational Strategy and Capability considerations, through to transformational changes that can build competitive advantage. In the accompanying diagrams, we also include critical focus areas under each question to help insurers build momentum. You can download the full set of questions and diagrams as a PDF at the bottom of this page.

Strategy - 4 questions to ask

1. How might underwriting, risk appetite and risk management frameworks be affected? Which policies will need to be reviewed or updated?

Net zero underwriting targets are a way to align business strategy with future changes in the real economy, which may require changes to existing risk architecture.

2. How are we mitigating against ‘greenwashing’?

Net zero underwriting targets and implementation readiness can take several months as it needs to be underpinned by a consistent approach to net zero across the organisation.

When done well, these components help re/insurers mitigate greenwashing - and demonstrate credibility to Boards, regulators and investors.

3. What might be the social impacts of target setting and climate action?

Often baselining and target setting is performed as a mathematical exercise, with the social or human impacts of action not fully considered. Unintended impacts of Net Zero targets may be contrary to a company’s socially-minded purpose.

For example, while PCAF guidance includes methodologies to measure insurance-associated emissions in motor portfolios, it does not include guidance on how to factor socioeconomic trends within that portfolio – a key consideration for communities where average emissions intensity of cars may be higher due to economic factors such as available income to upgrade to newer cars.

4. How can we use our work on net zero to create new commercial opportunities? How are we incentivising success?

Banks have shown in recent years that net zero is not an insurmountable or ill-defined task – however it does require a shift in mindset from ‘compliance’ to ‘competitive advantage’.

Strategy - Key focus areas to explore to when addressing these questions

Click to expand the graphic or you can download a PDF of the full set of questions and diagrams at the bottom of this page.

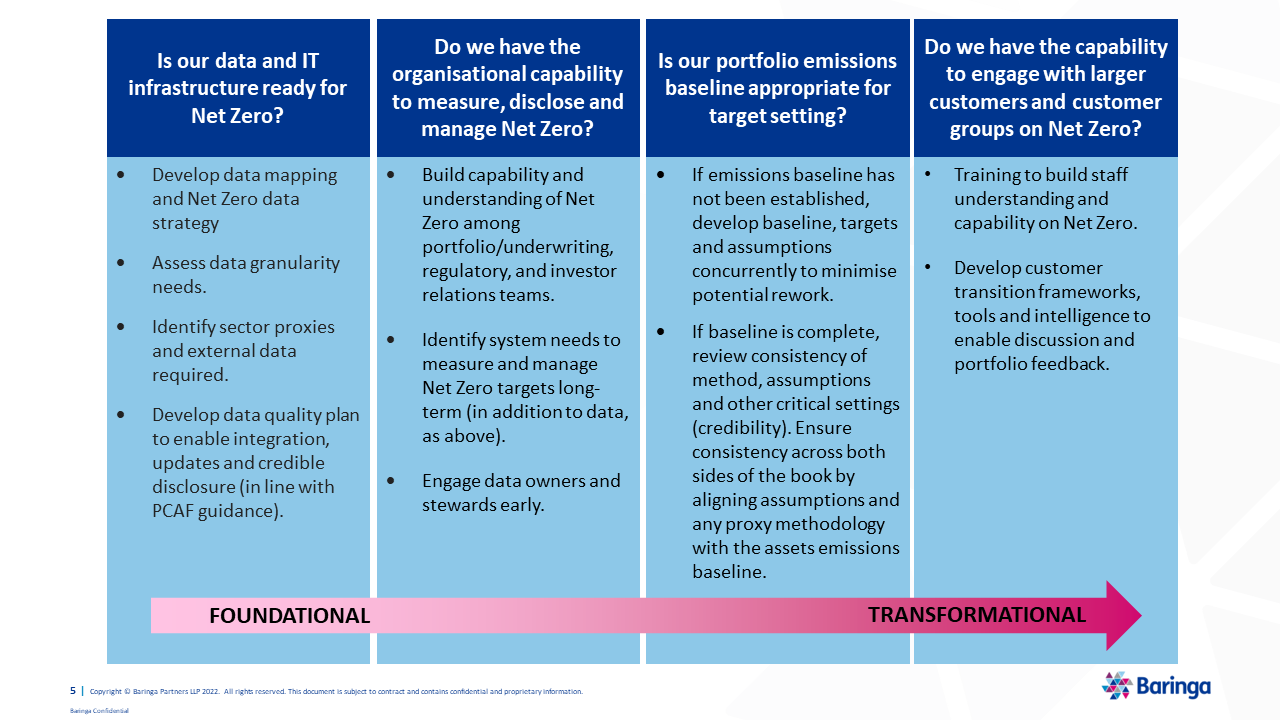

Capability - 4 questions to ask

1. Is our data and IT infrastructure ready for net zero?

Credible baselining and target setting requires well-structured data and may also require changes to the way customer and non-customer data is collected, categorised and stored. For example, in commercial lines, early guidance indicates aggregated sectoral exposure data may inhibit accurate targets.

2. Do we have the organisational capability to measure, disclose and manage net zero?

GHG measurement for Scope 1 and 2 has typically been the responsibility of a sustainability or operations/real estate team. Scope 3 financed/insurance-associated emissions requires broader capability.

3. Is our portfolio emissions baseline appropriate for target setting?

The purpose of baselining is to calculate (and disclose) financed or insurance-associated emissions. This can be done independent of target setting, however, can result in inefficiencies and circular recalculation due to misalignment of assumptions.

Intensity-based targets (e.g. Tonnes of C02-e per $million GWP) require not just an absolute emissions baseline, but also relevant financial/activity/production data and baselines; and a science-based emissions, technology and economic pathway that aligns with the assumptions used in the baselines.

4. Do we have the capability to engage with larger customers and customer groups on net zero?

As we have found working with banks and asset managers in the implementation of NZBA / NZAMi, part of implementing net zero targets is working with a firm’s largest or most emissions intensive customers to understand their alignment with net zero ambitions.

Capability - Key focus areas to explore to when addressing these questions

Click to expand the graphic or you can download a PDF of the full set of questions and diagrams at the bottom of this page.

There's no time for insurers to delay when it comes to net zero. Baringa has extensive experience globally helping financial institutions across the industry to implement net zero programs including banks, insurers and wealth managers. To discuss how you can progress net zero target setting, implementation, and competitive advantage for your business, contact Stephen Bell or Joanna Lloyd-Davies.

Related Insights

Future-proofing climate disclosures: Leveraging climate reporting for nature

Forward-thinking companies are integrating climate and nature into their strategies to drive innovation and resilience.

Read more

Transition planning in turbulent times: How financial institutions can adapt and lead

The shift to a low-carbon economy is challenging for financial institutions; we explore how they can adapt and lead in today's tough landscape.

Read more

Simplification Omnibus: what you need to know and where to go from here

We share what the Simplification Omnibus means for CSRD, CS3D and the EU Taxonomy and how you should respond.

Read more

2025 Outlook: What lies ahead for climate and sustainability in financial services?

Here's what's front of our minds for 2025 based on our dialogue with, and work for, climate and sustainability leaders across financial institutions.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?