As Germany accelerates its journey towards net zero, what are the risks and opportunities for market participants?

30 November 2021

The Social Democrats, the Green Party and Free Democrats have set out a coalition treaty which will guide the work of the government in the coming legislature and potentially beyond. A key part of this is its new energy policy, which will have far-reaching implications for the electricity sector. What can we expect from the new government and what are the key barriers to implementation of the policy? How could the new policy impact wholesale prices and how should asset investors respond to this new situation?

What has the coalition decided in the terms of energy policy?

The three-party coalition has set an ambitious energy policy promising to put Germany back on track to a net zero trajectory by 2045. The agreement foresees a massive and accelerated renewable energy deployment, faster coal phase-out, expansion of grid and storages as well as expansion of hydrogen-ready gas power plants for guaranteeing security of supply.

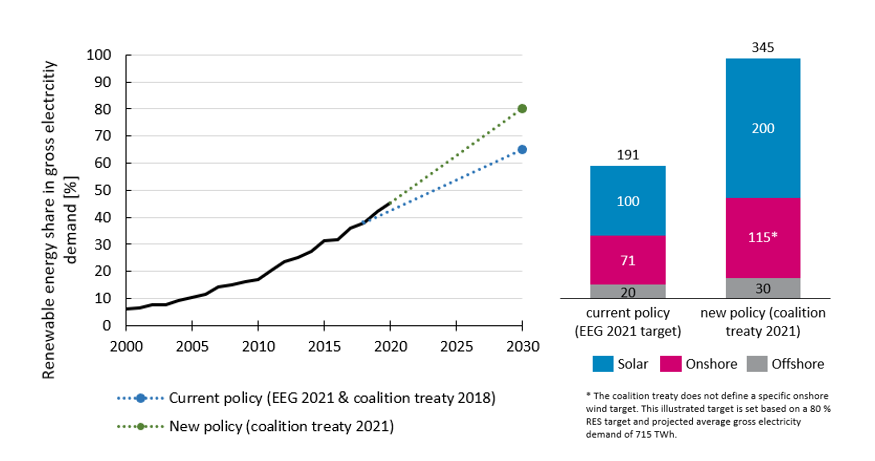

- Recent policy goal of 65% renewable energy share in gross electricity demand is elevated toward 80% in 2030 assuming power demand rising to between 680-750 TWh in 2030

- This translates into doubling the 2030 solar target towards 200GW and increasing the offshore wind goal by 50% to 30 GW – the treaty lacks a concrete onshore wind target but sets a dedicated two percent land area target designated for this

- Ongoing nuclear phase-out 2022 and earlier coal phase-out “ideally” taking place by 2030 will increase Germany’s reliance on gas

- Natural gas is explicitly mentioned as “indispensable for a transition period”- new build gas power plants will be required to be hydrogen ready

- The treaty also sets a target of a 50% share of climate neutral heat generation by 2030. This would imply more than doubling the current share.

This massive renewable energy expansion shall be facilitated by accelerated planning and approval procedures and obligatory solar installation for new commercial buildings.

Figure 1: renewable share as a percentage of gross electricity demand (left); expected solar and wind installed capacity in 2030 based on current and new policy targets

What are the key market impacts and key risks?

Drawing on our experience helping energy market participants navigate the German market and our net zero modelling capability, we can draw a number of ‘directional’ conclusions from the announcements that have been made to date. Of course, further clarification with regards to particular aspects of the policy is needed for more comprehensive analysis, but this provides an indication of what we can expect.

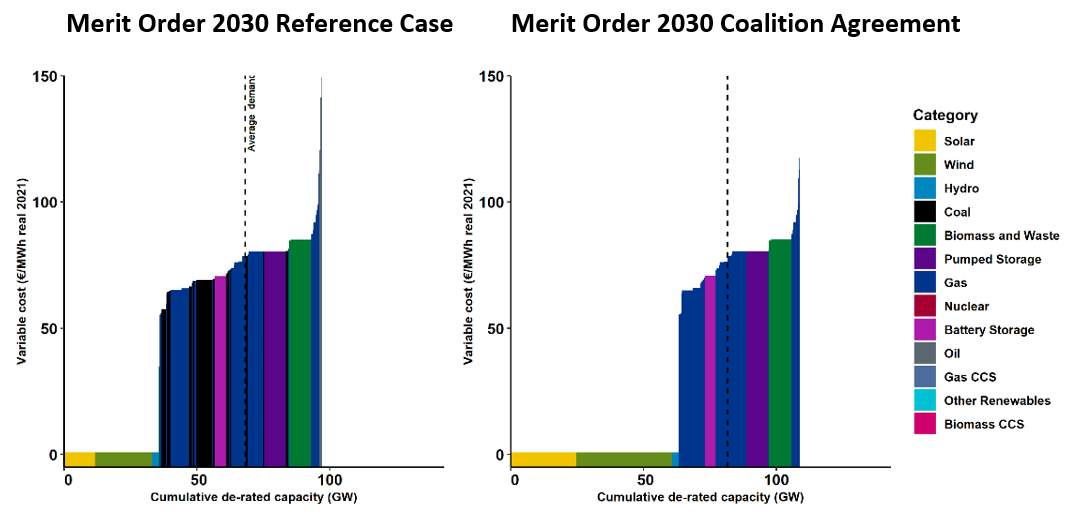

Overall, we expect the baseload price level to decrease in 2030 when compared to previous market projections. The German Merit Order will become flatter compared to our previous projections; renewable generation will set the price to a greater extent than it has in the past, making the baseload price less dependent on the commodity and carbon prices, and also leading to higher price volatility. Generally speaking, the replacement of coal with gas generation should support a lower baseload price, however, as we are witnessing today, exceptionally high gas prices can even lead to the reverse effect at times.

On the basis of the significant volume increases, we assume that the price cannibalization effects for renewable assets could be significantly higher than investors may have anticipated, effectively leading to lower income levels. This effect might be further amplified by similar policy measures taken in other interconnected markets (for instance, the recent Dutch plans to expand Offshore by 10 GW until 2031), however softened again by higher electricity demand growth, and use of some capacity for green hydrogen production. Also, a growing flexibility of the German energy system, both from a supply and demand perspective, will have some price stabilization effects, in particular in the low or zero price hours.

Figure 2: Merit order comparison between our Baringa Reference Case for 2030 (left) based on projections before the new policy and a potential scenario considering the new coalition agreement (right)

What opportunities does the new energy policy create?

On the basis of the implementation of the measures described above, there will be a number of opportunities for investors, developers, IPPs, utilities, large energy users and other market parties to participate in the German energy transition. For instance, the ambitious solar capacity target and to some degree onshore wind aims will require significant development activity, increasing the need to tap into relatively new areas such as ‘agri’ or ‘floating PV’. However, there are challenges to consider, including rising EPC and grid connection costs plus the need to secure the buy-in from local communities in the site development process. The new offshore target of 30 GW in offshore implies a doubling of the average annual auction volume over next decade – utilities, oil majors and financial investors have been traditionally seeing offshore as an attractive target, often also closing green supply contracts with large energy users on the back of these investments. The reduction of the subsidy mechanism and simplification of the energy taxes and levies should also lead to a more active participation by the downstream sector in the energy transition, visible in at least a much higher corporate PPA and prosumer activity.

Germany is facing unpresented change – how will you navigate your path ahead?

Undoubtably, the energy transition plans of the new government are ambitious and gratifying for the energy industry, but equally there are open questions and risks which need to be addressed. A key question is to what degree income from existing and new assets will be impacted by additional cannibalisation given the substantial increase of offshore and solar capacity in particular, and potentially decreasing baseload price levels. We also note it may prove difficult to accelerate the planning and permitting process at the level required to reach the announced targets; there is a risk of significant delays which might have negative business impacts (e.g. across the last three years, new additions in onshore wind were the lowest across the last 20 years leading to noticeable disruption amongst turbine manufactures, wind developers and the wider onshore supply chain).

However, if these targets are realized as per the coalition’s view, Germany will be facing an unprecedented decade of change of its energy system: the full exit from nuclear and coal, a widely decarbonized energy system based on an ambitious growth in solar (essentially more than doubling of capacity), offshore and also onshore capacity, and an increasingly merchant market structure will create various opportunities for existing players, but also support new market entry and novel service models. Market participants should explore the opportunities therein, including a thorough review of income level and risk based on different market and policy scenarios.

Baringa offers detailed analysis and modelling of wholesale market prices on a quarterly basis, including bespoke modelling of sensitives to cover for potential market uncertainties. Contact Simon Tywuschik, Manuel Eising and Florian Falcke for a more detailed discussion to explore the impact of the new energy policy on the German market.

Related Insights

Asia’s power markets: Poised for investment

Asia's electricity demand is projected to increase significantly in the coming decade, driven by increasing market and economic growth.

Read more

The future of European CfDs

Contracts for Difference have been successful at increasing competition, accelerating capability buildout and stabilising prices in many European states.

Read more

Asian LNG markets: evolution and growth in response to the war in Ukraine

The rapid reduction in Russian gas exports to Europe has resulted in an unprecedented reshuffling of LNG trade dynamics.

Read more

Commercial fleet electrification – adoption is accelerating, but barriers remain

With 50% of new car registrations in the UK being registered by businesses, it’s vital for companies to start electrifying their fleets.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?