Have we reached peak net-zero?

Why focused commercial collaboration is the route to net zero supply chains.

8 min read 28 November 2024

COP29 and increased regulation

With COP29 (the 29th Conference of the Parties to the United Nations Framework Convention on Climate Change) just having finished, the expectations, ambitions and commitments have indeed been tempered by a backdrop of high geopolitical tensions and economic recovery considerations.

In parallel to this backdrop, we are seeing sustainability regulations across Europe, the United States and globally shift from voluntary to mandatory, as organisations now need to integrate ESG requirements into their strategy and operations to improve data collection, reporting and drive performance.

With the deadlines coming up fast, this places a greater burden on organisations and sustainability functions to invest time and resources into full value chain reporting (based on double materiality principles), >180 minimum disclosure obligations up to a maximum of >1000 for qualifying organisations. Additionally, all this activity requires (limited) assurance from external audit teams, which is time consuming for the teams involved.

What are the key obstacles for most organisations?

- The availability of resources, data and skills of organisations to deal with the demand, including change management and limited additional funds to compensate

- Focusing on the here and now (compliance) versus the future (innovation and commercial value) - where organisations once were leaders in this space, resources are now being directed to regulatory compliance activity when global temperatures rise year on year.

All the regulatory and compliance activity is simply table stakes – what drives enterprise value is not necessarily this.

Scope 3 emissions within supply chains represent the biggest challenge and opportunity for genuine decarbonisation progress.

Redefining a top-level strategy and ambition for clients across their end-to-end sustainability journey has highlighted that the biggest area we can support our corporate clients in this space is to deliver enterprise value through collaboration with a focus on driving down carbon emissions in supply chains.

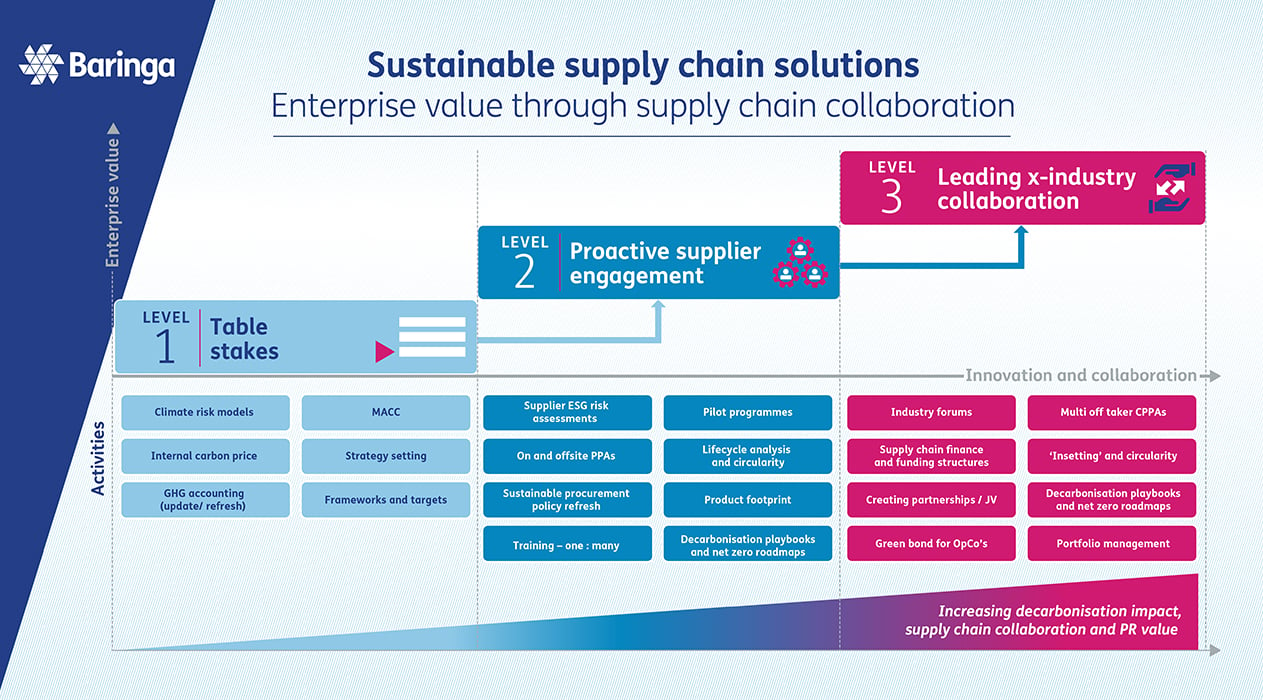

Focusing in on supply chain solutions for decarbonisation means moving from table stakes (Level 1) to proactive supplier engagement (Level 2) and leading in x-industry collaboration (Level 3) as illustrated below.

By enterprise value we mean reducing supplier costs, increasing resilience and accelerating Scope 3 emission reduction.

How we have supported our clients

We see the biggest contributor to enterprise value through greater focus on a small number of targeted Level 2 and Level 3 initiatives across many industry segments. Some examples of this include:

|

25% reduction in Scope 3 emissions by 2028 through targeted supply chain engagement |

Over the last 12 months Baringa worked with a global manufacturer to design and deliver a sustainable procurement programme engaging wth ~150 suppliers. |

|

Embedding sustainability into strategic sourcing and supplier management policies |

Baringa designed and implemented a sustainability sourcing programme at a major global bank, covering peer benchmarking and implemented across seven key spend categories. |

|

Supply chain finance solutions that reduce suppler costs by 2-3% for earlier payment and lend at 5-70 bps lower rates for ESG compliant services |

Baringa are working with multiple clients exploring options to act as a market channel for supply chain finance products. |

|

Cross industry supply chain financing to generate returns, increase resilience and reduce Scope 3 emissions |

Engaging with supply chains in a different way, is the supply chain finance facility that H&M has set up together with 3 other fashion brands. |

|

Increasing lending activity in asset finance solutions to decarbonise supply chains |

We have supported an increasing number of financial services / major banking clients to build out the business cases for differentiated supply chain decarbonisation propositions. |

|

Insetting platforms for waste/circularity that have the potential to generate new revenue streams |

We see major potential for “insetting” to drive greater value from e-waste and circularity. By “insetting” from your own supply chains and the ability to verify and certify avoided emissions and generate revenue streams via trading certificates. |

|

Multi Party / Multi Geography PPAs that support the industry supply chain and long tail suppliers |

Working in collaboration with suppliers to deliver faster, cheaper and more equitable energy transition, as seen with Lightsource bp’s innovative collective virtual power purchase agreement (CVPPA) with The Fashion Pact, the largest CEO-led initiative for sustainability in the fashion and textile industry. Baringa’s latest piece of work for Amazon highlights the opportunities for corporates from cross-border renewable procurement within the context of the GHG protocol. |

Focusing on the right sustainability initiatives leads to commercial opportunities, as opposed to sustainability being seen as a cost item

In our next article, we discuss if value is being left on the table with circularity and if ‘insetting’ revolution could be the answer. To find out more or if you have interest in building cross-industry coalitions to deliver these sustainability supply chain solutions, get in touch with Jon Roberts, Jan-Willem Bode or Maureen O’Shea.

Key Terms

- Scope 3: These are the indirect emissions – not owned – created anywhere in the upstream supply or downstream value chain

- Inset: Insetting involves reducing or removing greenhouse gas emissions within a company's own value chain

- Offset: Offsetting involves investing in external projects that reduce or remove emissions

- Carbon credits: Carbon credits are created by projects that have either avoided or removed greenhouse gas emissions

- Circularity: Circularity or the circular economy is a model of production and consumption designed to extend the life of products and reducing waste

- eWaste: eWaste, or electronic waste, refers to discarded electrical or electronic devices

Our Experts

Related Insights

Introduction: Human in the Machine AI research

Our global survey reveals evolving consumer attitudes towards AI in content creation, highlighting the balance between human authenticity and technological advancement.

Read more

Truth: people value what they know most - other people

Consumers prefer human-created content for its authenticity and personal touch, highlighting the risks for companies ignoring these values in the age of AI.

Read more

Quality: a price to be paid, or risk a race to the bottom

AI's role in content creation challenges traditional quality measures, with consumers valuing human touch but reluctant to pay more for it.

Read more

Trust: transparency earns trust, and right now there isn’t enough of either

Generative AI is transforming content creation and perception, from text and images to music and AI personas. How do we trust what we see, hear, and experience now?

Read moreRelated Client Stories

How Baringa supported Colt Technology with its CRM transformation

Join our TMT Partner Dan Nicholson, as he talks to our client Colt Technology

Read more

We talk to our client KCOM about modernising business operations

Join our TMT Director Sarah Roberts, as she talks to our client Tim Shaw, CEO at KCOM

Read more

Building a trusted data platform to enable scaling and cost savings

How do you accelerate delivery of a £multi-billion network expansion programme using advanced analytics and targeted insight?

Read more

Developing a Target State Operating Model for a technology and language services provider

Developing a comprehensive high-level target state operating model, defining the process architecture, and modelling the necessary capabilities for success.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?