In the run up to COP27, what next for the oil and gas industry?

16 August 2022

In this series of blogs, we share our insights on how climate change and the response to it will affect the oil and gas industry. And we’ll discuss how companies can analyse their risks, cut their operational emissions, and create low-carbon businesses so they can thrive through the energy transition.

In the previous blog, we talked about how oil and gas companies can lower their emissions. Now we look ahead to new business opportunities in renewable energy.

Exploring New Business Opportunities and Markets

Today, the world has an urgent need for energy that is reliable, affordable and low carbon. As countries work to scale up the supply of low-carbon fuel, oil and gas companies are uniquely positioned to succeed as providers of renewable energy. The question they ask is what technologies and in which markets should they invest to deliver attractive returns for their shareholders?

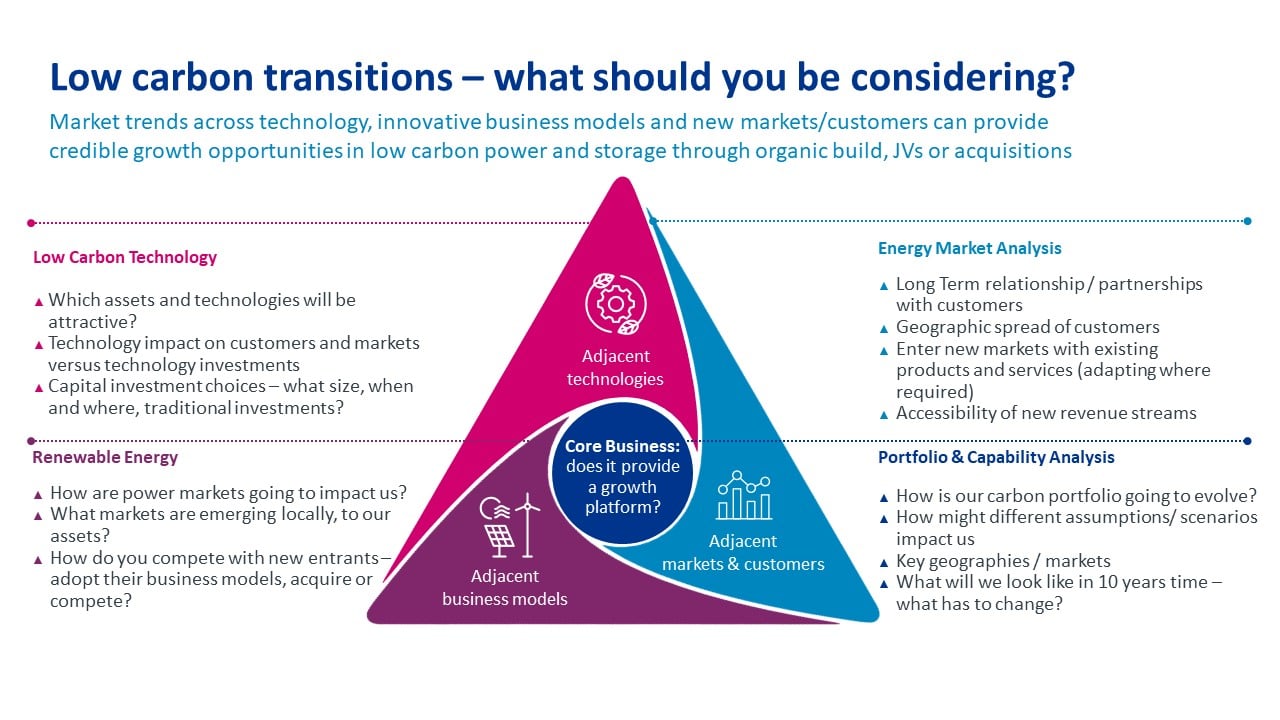

The Baringa low-carbon transition opportunity assessment framework uses our decades of research, market trends across technology, innovative business models, new markets, and customers to find growth opportunities in low-carbon power and storage – through organic build, joint ventures, or acquisitions.

Figure. 1: Click to expand

Energy producers can make similar returns from renewables

With mass deployment and improvement, the prices of wind turbines and solar fell by 40% and 90% respectively in the last decade. There are similar trends with energy storage and green hydrogen. As renewable capacity increases, the supply chain becomes more efficient, lowering costs.

Some renewable technologies will eventually become cheaper than fossil fuel. The global median levelised cost of solar is expected to reach the operating costs of fully depreciated coal and gas-fired electricity (around $30/MWh) in 2028. In many regions, it’ll be cheaper to install a new solar farm than to operate an existing gas power plant as evidenced by the recent UK Government auction which UK secured nearly 11GW of renewables at prices 4x lower than current cost of gas.

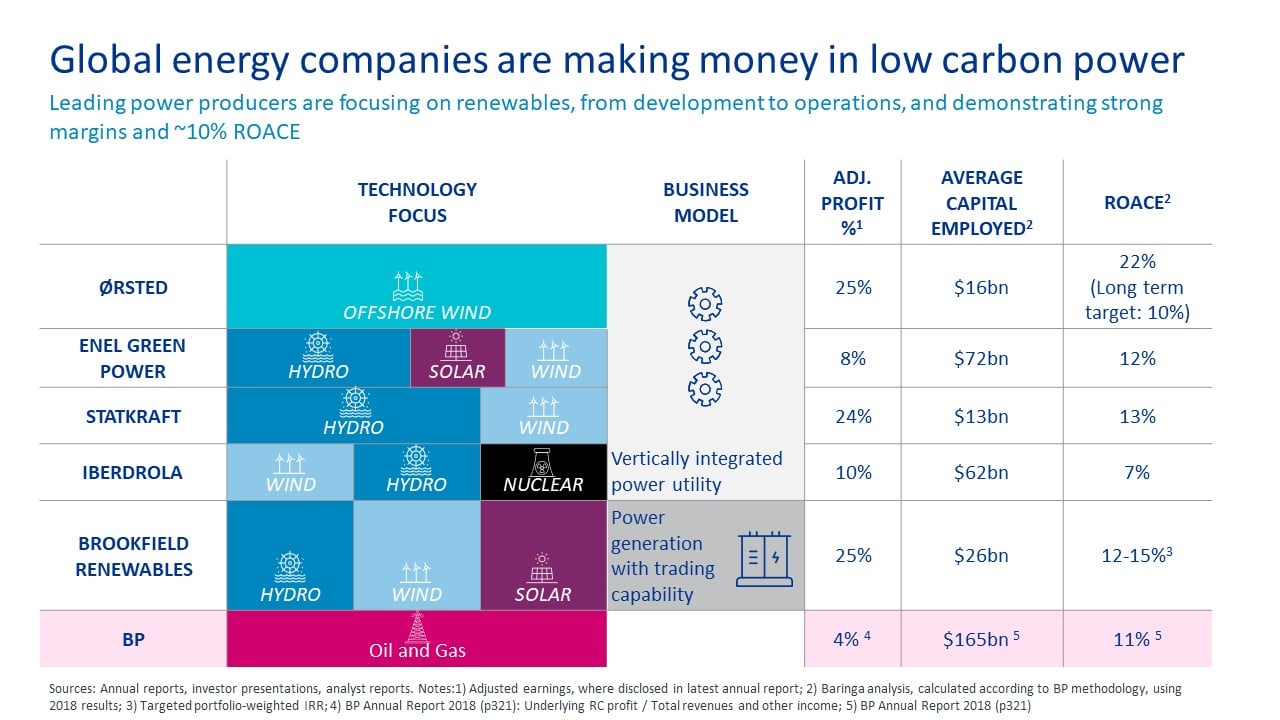

Oil and gas companies can profitably enter this market. Our analysis shows that power companies focusing on renewable energy achieve comparable financial performance to oil and gas investments, at ~10% ROACE.

Figure. 2: Click to expand

Our analysis shows that power generation as it’s the most lucrative part of the low-carbon power value chain. We estimate the generation market size of low-carbon power generation to be c.$240bn on a net profit basis in the US and Europe alone, compared with the wholesale trading market at c.$35bn and the retail supply market c.$19bn.

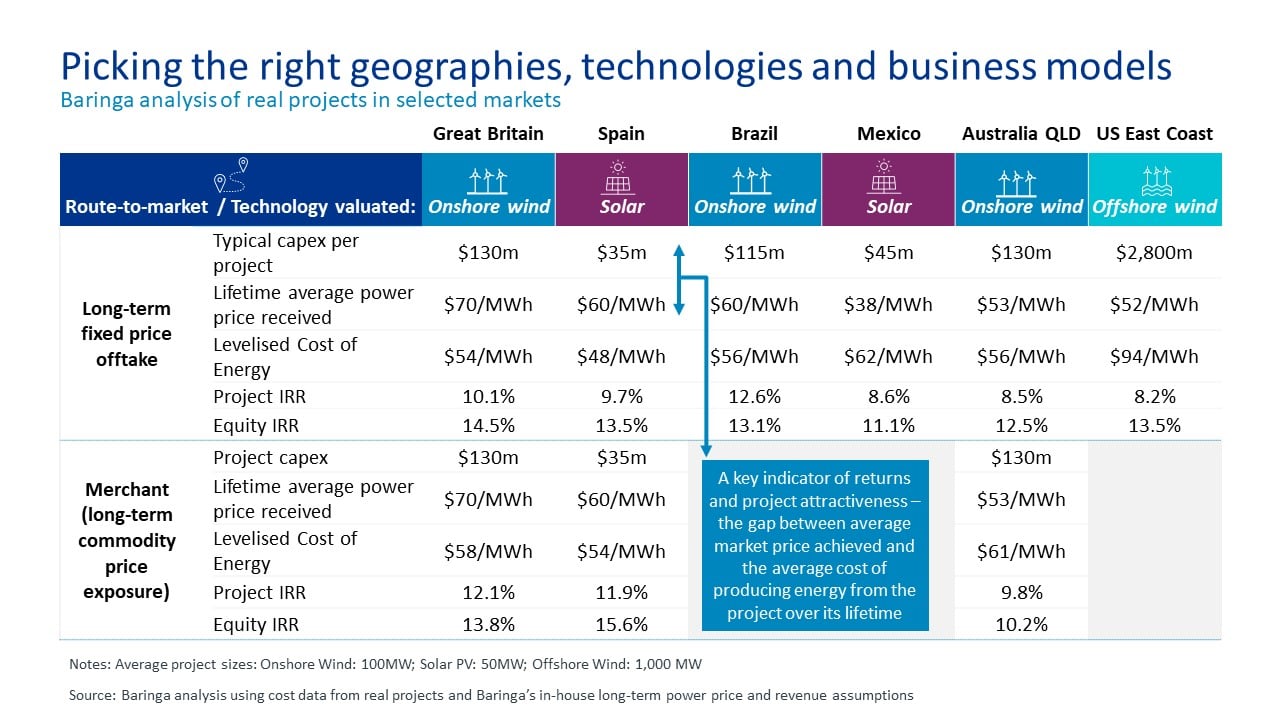

Choosing the right geographies, technologies, and business models is key

By focusing on select geographies, multiple technologies, and diversified contracting and price risk management strategies, oil and gas companies can earn equity returns on projects between 10% and 15%.

To achieve that level of return, companies should:

• take development risk

• create value from capital arbitrage

• act as aggregators and RTM providers

• provide O&M wraps for infrastructure money.

Our proprietary energy market fundamentals models help organisations make investment decisions in over 50 countries. Baringa has advised on the allocation of over £200bn of capital into renewables, with 70% of the largest infrastructure investors to deliver over 150GW of renewable energy investments – enough to power 180 million homes.

Figure. 3: Click to expand

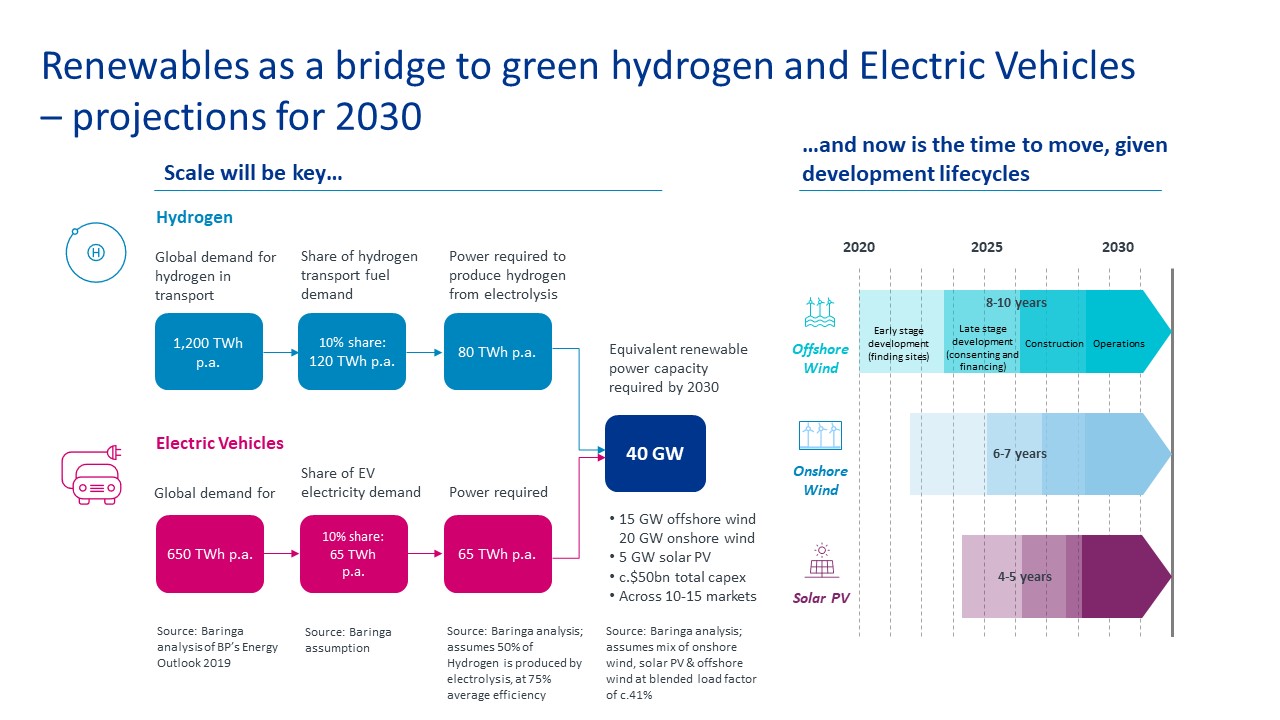

Establishing a renewables business can not only be profitable in the near term, but it can also help oil and gas companies become major players in the rapidly emerging market for green hydrogen fuel and electric vehicles. But, given the time and scale required to take projects to operation, companies must start now.

Figure. 4: Click to expand

Clean hydrogen will play a critical role in decarbonising

We expect clean hydrogen (blue and green/pink) to replace grey hydrogen in existing markets (fertiliser feedstocks, oil refining, petrochemical production). It’ll also be used for decarbonisation of steel, shipping, and aviation.

In many of these markets, clean hydrogen can attract a green premium in the short term. Hydrogen may also have a role in long-term energy storage. We expect the global market for hydrogen to grow by 15M to 88MT/year by 2030, led by China, Europe, and Japan.

Blue hydrogen is currently more profitable than green, but as renewable energy and electrolysers become cheaper, beyond 2030, green hydrogen will become more economic in many places.

Baringa has market insights on the cost evolution of low-carbon hydrogen supplies and the role of hydrogen in meeting net-zero targets. Our power and low-carbon modelling suite, covering 120 countries, is used extensively by strategy functions, policy makers, and investors.

Electric vehicles will dominate short-distance transport

As battery densities increase and costs drop, we expect 25% of UK’s fleet of 32M cars to be electric by 2030, supported by c.450k public charge points. We project similar adoption rates in Western Europe and China, with the US and Southern Europe following.

Automotive manufacturers have already announced they will replace the production of fossil-fuelled vehicles with electrified ranges. This will accelerate the transition to EVs and radically change the needs of consumers and fleet and HGV operators.

We believe that oil and gas companies are uniquely placed to provide an integrated service to retail, HGV, and fleet customers covering a range of alternative fuel requirements in the short, medium, and longer term.

Baringa is advising companies on developing their EV business models and propositions across energy and other value chains. We bring our unique customer insights, global market analysis, and commercial modelling to support investment cases.

We hope you’ve found this series on the future of oil and gas interesting. If you’d like to talk about how Baringa can help your company navigate its transition journey, please get in touch.

Related Insights

Dissecting the REMA decision

Three years in the making, the Review of Electricity Market Arrangements (REMA) decision has now been published: the UK Government has decided to retain the national wholesale price.

Read more

Navigating Germany’s inertia market evolution

Germany’s inertia market launches in 2026, opening opportunities for assets like BESS. Success depends on clearing prices, with early movers set to benefit.

Read more

The value of carbon: How internal carbon pricing can drive business decisions that unlock and protect enterprise value

What are the benefits that ICP offers, the current barriers to action, and how can Baringa help corporates find their optimal carbon price?

Read more

Podcast - S2 E8 – How ‘Energy-as-a-Service’ models unlock commercial decarbonisation

Tim Meanock, CEO and co-founder of Tallarna, joins Ellen Fraser and Daniel Bolton to discuss Energy-as-a-Service (EaaS) as an innovative solution for commercial decarbonisation.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?