Variable recurring payments: The next step for open banking

5 min read 30 June 2023

In this article we cover:

- What variable payments are

- How customers can use variable recurring payments

- How variable recurring payments compare to other payment methods

- What benefits variable recurring payments can have for consumers, merchants, banks and payment service providers

Moving funds between your accounts, or investing into a monthly fund? Variable recurring payments have the potential to revolutionise how you save and pay for goods and services. Based on rules and thresholds set by the customer, funds can seamlessly move between accounts, or working in tandem be used to initiate payments of varying amounts for goods and services. These represent an opportunity not only for customers and merchants for flexible payments and convenience, but also for financial institutions to utilise APIs in generating greater revenue and customer loyalty.

Variable recurring payments (VRPs) are one of the latest innovations in open banking. They allow customers to initiate recurring payments securely and quickly by connecting third party payment providers (TPPs) to the customer’s bank account and authorising them to execute payments. What makes these payments unique is that value or date of the payment can vary based on pre-agreed parameters – a level of flexibility not currently offered by incumbent solutions like direct debit. As a simple example, you could set up a VRP ‘mandate’ to transfer funds from your current account to your savings account every time your balance reaches a specified amount.

In March 2023, the Joint Regulatory Oversight Committee (JROC) – who oversee open banking in the UK – published a report which suggests the implementation of non-sweeping VRPs will be subject to an increased, pro-competition regulatory drive. We believe that in response to clearer regulatory guardrails, there will be increased industry collaboration to develop a ‘premium’ API to support VRP across the industry. As this is the case, payment service providers (PSPs) will be more likely to invest in their VRP propositions. If the regulatory drivers are not there, we believe hesitance to commit to spend here will continue given the other priorities and limited budgets PSPs must balance.

Read more insights on Future-Proofing Payments

The types of VRP and how customers can use them

There are two types of VRPs:

- Sweeping (me-to-me): Used to automatically ‘sweep’ funds between accounts held under the same name at different banks

- Non-Sweeping (commercial): Used to make payments to merchants or accounts under a different name

Although sweeping VRPs were mandated by the Competition and Markets Authority for the UK’s largest banks (the CMA9) in 2021, implementation has been slow. Non-sweeping VRPs are not yet mandated, but there is increasing discussion within the payments industry around the opportunities they present.

So, what are market players doing?

In addition to their March report, the JROC set up a working group in June dedicated to VRP with the aim of developing a blueprint for the phased roll-out of Non-Sweeping VRP by the end of September. Out of the banks, HSBC were the first to roll out the mandated Sweeping VRP in 2022 to all open banking participants of its HSBC personal and business brands with oversight from the Open Banking Implementation Entity (OBIE).

Meanwhile, NatWest are the only bank to have implemented non-sweeping VRP so far. They did so in 2022 and are leading the charge in the UK by offering it to businesses and consumers through partnerships with companies including TrueLayer, GoCardless, and Crezco. Meanwhile, other banks are at varying stages in the process of implementing the mandated sweeping VRP.

For the implementation of VRP to be effective, providers will need to identify the most promising use cases for their customers. These have the potential to transform the way that consumers and businesses pay for goods and services. Some of our favourite VRP use cases which drive positive customer experiences are included below:

|

VRP Type |

Use Case |

Overview |

|

Sweeping |

Savings |

Sweep ‘spare’ funds from a current account to a savings account to optimise how much interest you earn, or be more prudent about saving for future holidays |

|

Loan repayment |

Sweep ‘spare’ funds from a current account to pay off a credit card automatically, using a rule to ensure your balance is paid off as soon as you have the funds available |

|

|

Non-sweeping |

Utility bills |

A customer with irregular income could set up a VRP to deduct a payment only when they have been paid rather than a fixed monthly amount |

|

Subscriptions |

Monthly payments for things like a streaming subscription or gym membership could be automatically paused if a customer’s account falls below a specified threshold |

|

|

Investments |

Automated transfers from your current account to an investment account set up in your child’s name |

|

|

Charity payments |

Customers can set up donations which execute only when their balance is high enough, reducing the number of customers cancelling recurring donations |

These examples are just the beginning; the possible use cases for VRP are expansive, allowing value to be added to end consumers wherever increased control and flexibility over recurring payments is desirable. For example, VRP in the future could present the opportunity for insurance providers to offer variable insurance premiums based on insured monthly driving habits, or for merchants to use dynamic pricing in subscriptions based on variations in demand.

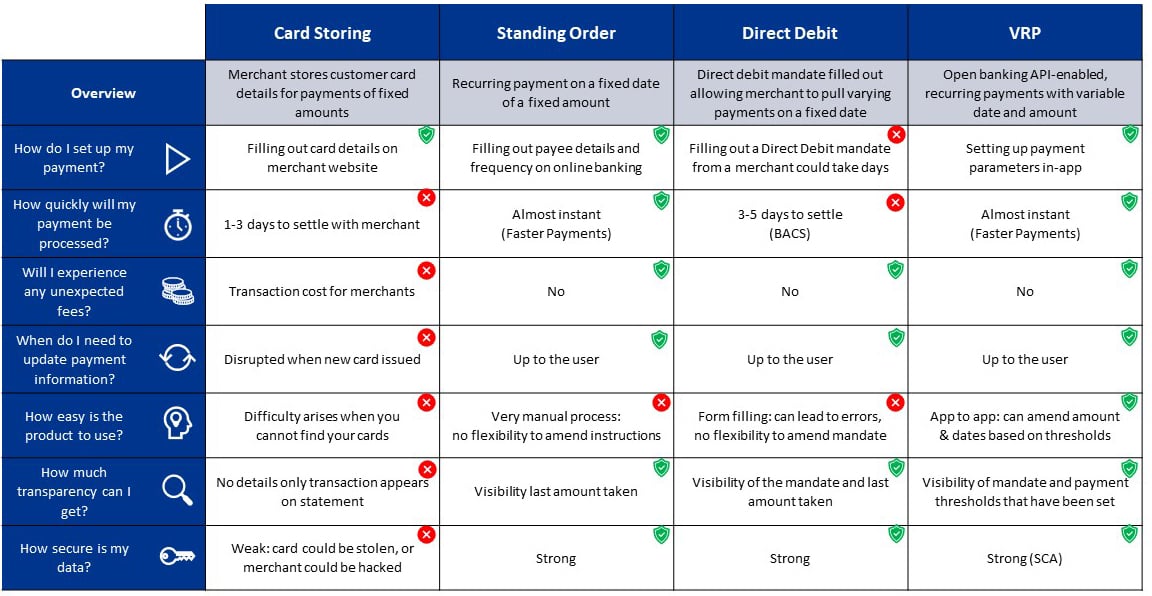

How VRP compares to other payment methods

Compared to its primary alternatives, VRP offers distinct advantages across the board

The benefits outlined in the table above are relevant to both consumers using VRP and merchants offering VRP to their customers.

Key benefits to consumers:

· Increased flexibility and transparency: consumers are able to set up a VRP mandate which can be quickly and conveniently viewed, updated or cancelled via the channel that works best for the consumer (in-app, branch, online banking, or other)

· Less manual data entry: a VRP mandate can be set up and amended with less manual forms than alternative recurring payment options, meaning less error associated with manual data entry

· Greater convenience: VRP mandates are set up using bank account details rather than card details, so these won’t have to be updated every time a consumer gets a new card or loses one

Key benefits to merchants:

· Cost-effectiveness: VRP is an account-to-account solution so doesn’t have the high costs or fees generally associated with card payments

· Improved security: VRP doesn’t require the storage of card information and utilises Strong Customer Authentication (SCA), meaning a reduction in fraud and associated costs

· Cashflow management: VRP runs on the Faster Payment Scheme so settlement is considerably quicker than the alternatives, therefore allowing customers to understand their financial position in real-time as oppose to 3-5 days

For individuals or businesses using a recurring payment solution, and for merchants offering it to their customers, the benefits that a VRP solution offers over the alternative payment method are clear. They span the areas most commonly raised as important to this group: flexibility, transparency, cost and operational efficiency.

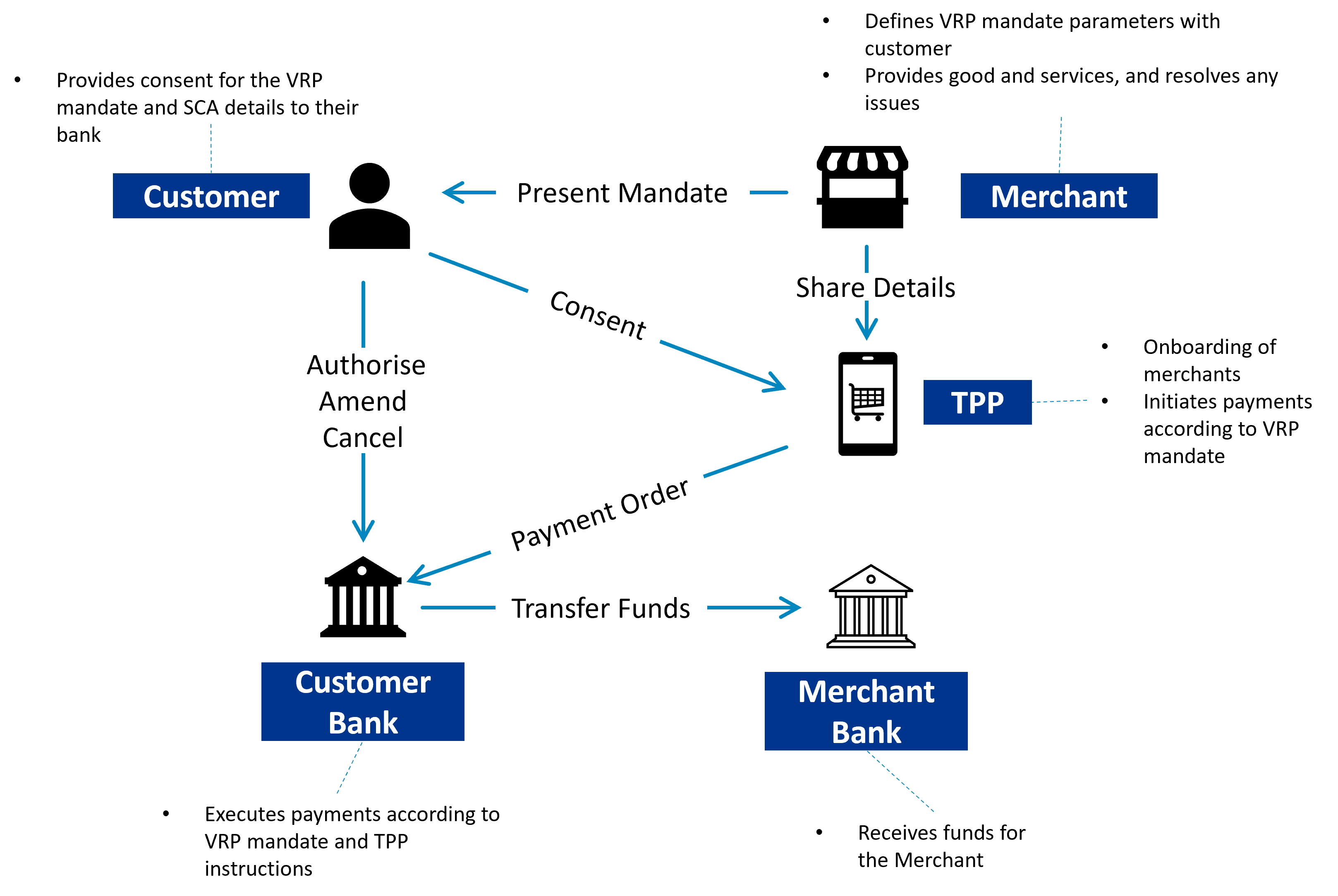

A potential commercial structure for VRPs – how will it work in practice?

In order for the use of VRPs, especially non-sweeping, to become more prevalent, banks and PSPs need to be clear on the commercial structure of their offering. The first step in this is identifying who the parties are in the ecosystem and what their responsibilities are:

The benefits that a VRP solution would provide to banks and PSPs who offer it are clear:

- Revenue generation: this can come from numerous sources, including: charging TPPs a fee for access to ‘premium’ APIs or transactions, cross-selling other products and leveraging VRP data for more targeted marketing

- Cost savings: the anticipated reduction in fraud and more seamless, secure payments processing should mean cost savings for PSPs

- Enhanced outcomes for customers which will drive loyalty: as outlined, VRP is helping to respond to consumer needs by offering an improved user experience, more flexibility, security, and control. In turn, this will improve loyalty to PSPs who can offer compelling VRP products

The attitude and actions of the banks and PSPs offering the solution, will be key in determining the future of VRP. We believe VRP goes beyond an open banking compliance requirement and can add real value as a highly competitive and differentiated payments opportunity within the ecosystem. Tapping into the appealing use cases for end consumers can open up new revenue streams for providers if they can overcome obstacles like defining an effective pricing approach and managing the risk and liability framework for consumer protection.

Baringa are working with our clients every day on some of their most exciting payments engagements. Please get in touch if you would like to discuss.

Our Experts

Related Insights

Striking the balance: Regulation and innovation in payments

As we look ahead to the Payments Vision Delivery Committee's Q2 2025 announcement, we ask: can we ever truly balance regulation and innovation in payments?

Read more

Reflections on the UK's National Payments Vision

We share our view on the UK's National Payments Vision and uncover what it means for the wider payments landscape.

Read more

Meet the payments leader of the future

Traditional banks are starting to realise the huge revenue-generating potential of their payments functions and are transforming their operating models, embracing new technologies, and ushering in fresh ways of working. But there's a piece of the puzzle remaining: people.

Read more

Why banks need to evolve their legacy payments operating models

Evolving your payments operating model could hold the secret to greater customer-centricity and value creation. Discover our three steps to building a strategy centered on innovation and growth.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?