Navigating financial vulnerability across the UK

5 min read 12 September 2024

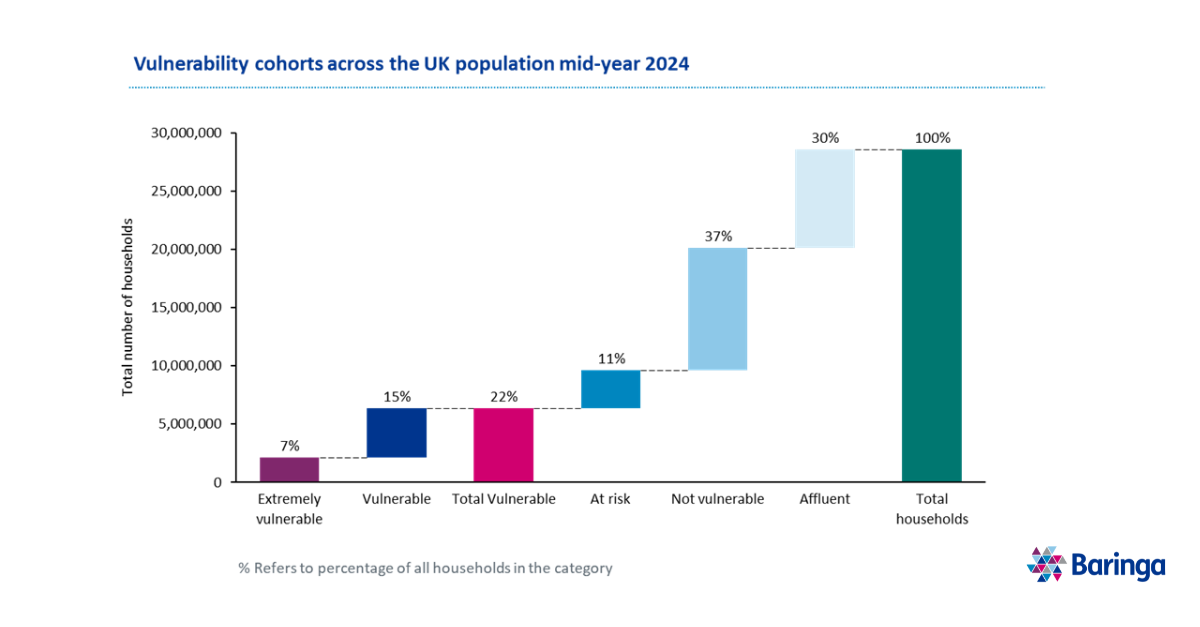

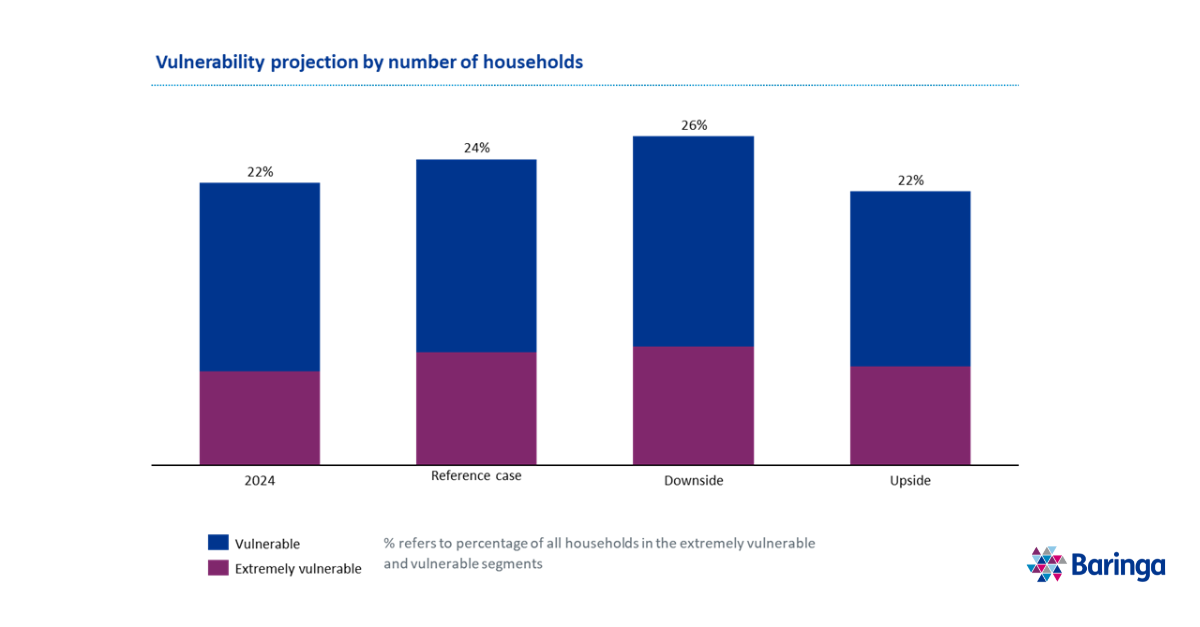

Navigating financial vulnerability across the UK has become increasingly critical as Baringa’s latest analysis highlights a growing systemic issue. This winter, an additional 2% of the population is projected to become financially vulnerable, adding to the 22% of households already struggling. Worryingly, 423,000 more households are expected to become “extremely financially vulnerable” by winter 2024-25, facing extremely low discretionary income and savings. The working-age population with children, particularly single-earner families in London, Western England, and Northern Ireland, are now bearing the brunt of this financial strain. As a result, higher risks of late payments and defaults are anticipated, especially in essential household costs like energy, with over £400 million in additional energy debt forecasted.

In this article we explore the underlying causes of financial vulnerability and examine the outlook for winter 2025.

Navigating financial vulnerability across the UK

Following the economic volatility of the past few years, the UK has been experiencing both persisting and worsening financial vulnerability. Whilst high inflation has eroded real wage growth, high interest rates have driven up living costs, resulting in a squeeze on discretionary incomes across the UK. This low discretionary income, allied to low savings, characterises the segments of the UK households which are financially vulnerable in Baringa’s financial vulnerability model.

The UK’s high level of financial vulnerability is a systemic issue as 6.4 million, equivalent to 22% of all households, now experience financial vulnerability. Two million are considered extremely vulnerable, defined as households at or below subsistence living levels, with minimal savings and income.

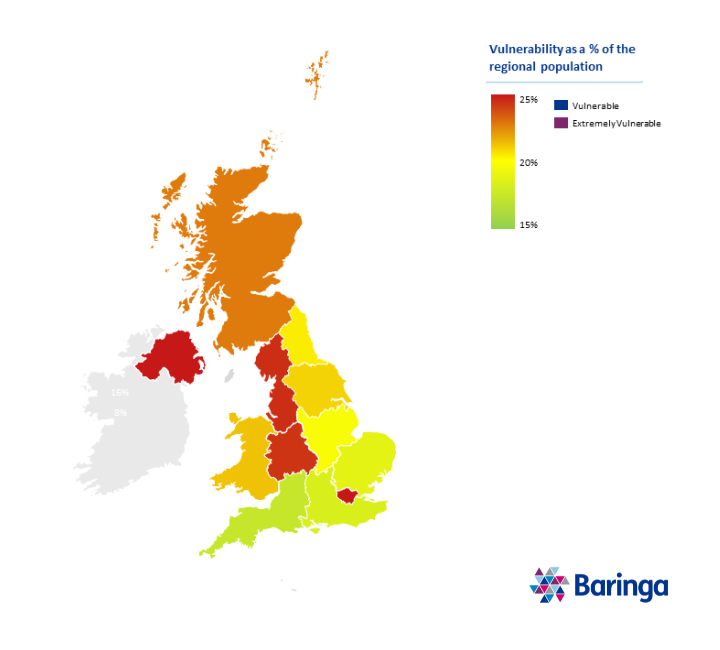

This is largely concentrated in London, Western England and Northen Ireland, which are all experiencing above average levels of financial vulnerability, as can be seen in the map below.

What are the core causes of vulnerability?

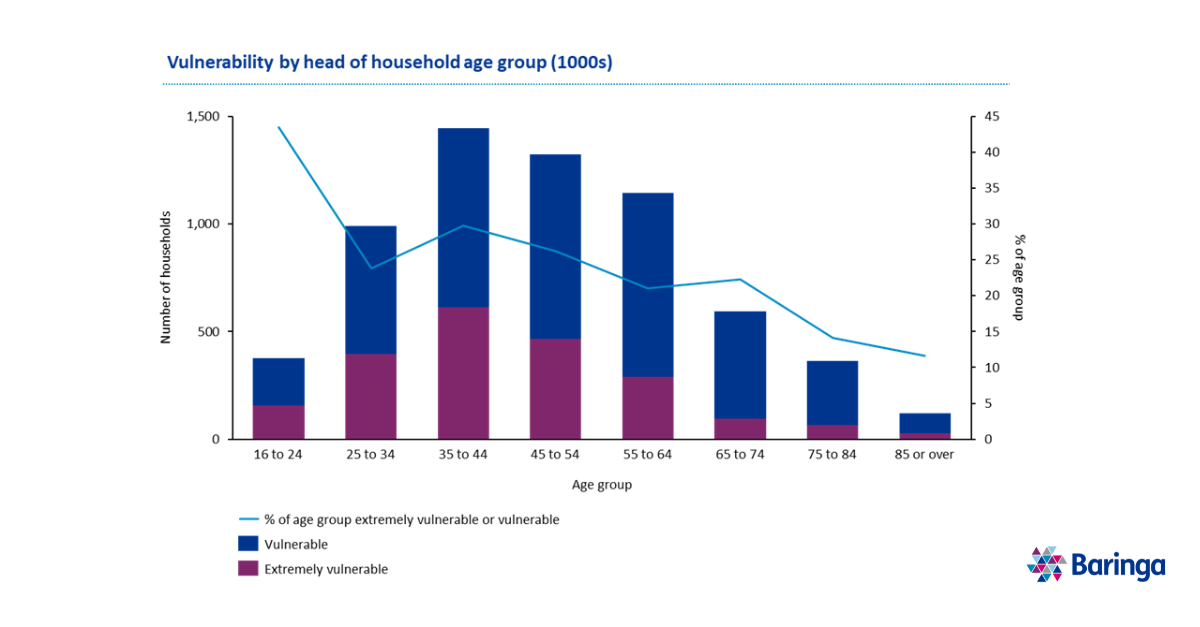

Modelling over 28 million households in the UK, Baringa’s analysis reveals five critical drivers of vulnerability, the most significant of which are intuitively low gross income and savings, followed by house type, family size, and elderly dependents.

However, the analysis also shows the crisis of housing costs in the UK with median private renter paying over 32.7% of their monthly income on housing in the UK, with rates of over 50% in London.

Family composition also plays a role. Financial vulnerability demographics have changed markedly over recent years as pensioner income has been inflation protected and older households have benefited from rising property prices. The result is that financial vulnerability is now far more concentrated in the working age population, particularly those with children. The highest rates can be found in single earner families with children.

From bad to worse: Intensifying vulnerability in winter 2025

Despite expected economic improvements in the economy overall family budgets are still reeling from the inflation and interest rates shock of the last two years. Our central winter 2025 (November 2024 to March 2025) projection estimates that up to an additional 2% of the population, equivalent to 537,000 households, will become vulnerable or extremely vulnerable, as those already showing signs of financial vulnerability fall further into distress. In the downside scenario, where inflation and rates remain far higher, this corresponds to an additional 4% of the population or over one million households becoming financially vulnerable. Whichever scenario occurs, businesses, households and government need to be proactive in raising awareness and addressing this risk. More broadly there is a clear need for a coordinated government response, looking at financial support measures which cover essential household expenditures.

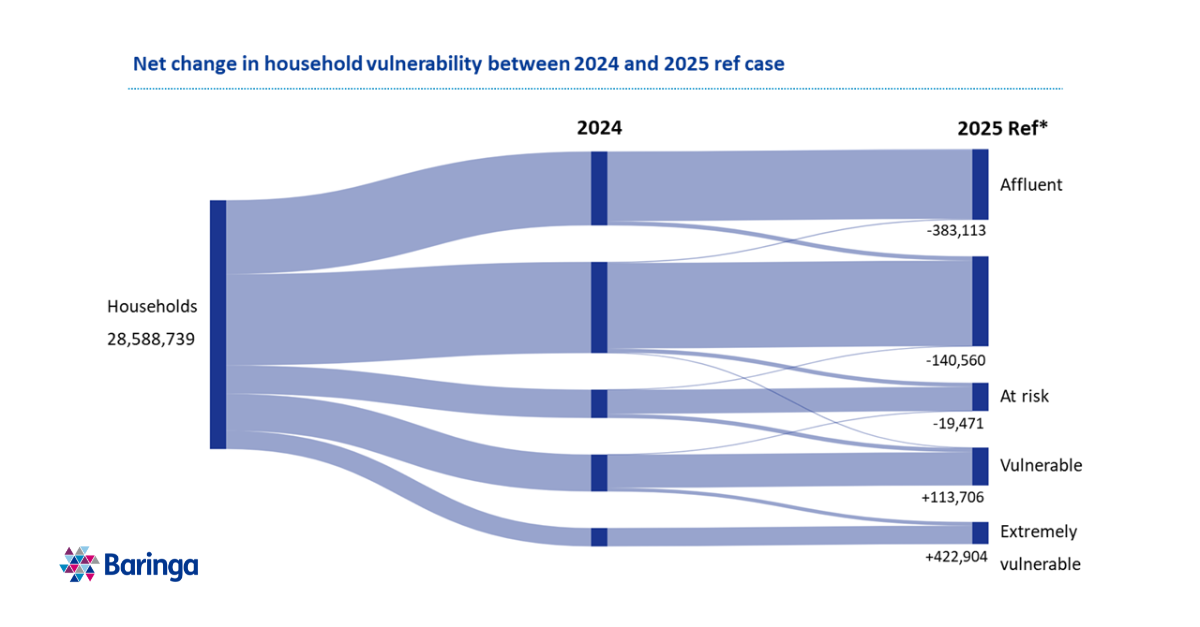

The Baringa reference case equates to circa 423,000 households moving into the extremely vulnerable segment, with extremely low discretionary income and savings, while the vulnerable cohort will increase by circa 114,000 households. As households move into the higher risk financial vulnerability segments, the affluent, non-vulnerable, and at-risk segments will all shrink, reflecting how the financial security of households is worsening.

As a result of the rising levels of financial vulnerability, late pay and default risks are expected to be elevated, increasing debt by almost half a billion pounds in the energy sector this winter.

This escalating financial vulnerability has led to a social crisis, with economy-wide energy debt becoming unsustainable and posing a significant structural risk to the energy sector, businesses, and society as a whole.

A comprehensive and urgent structural response is needed. Government and businesses should collaborate to prepare for the challenging winter of 2025. With the recent elections, the new government has a unique opportunity to take decisive action to support individuals experiencing financial vulnerability, rather than allowing this systemic issue to persist. Proactive policies are necessary to counteract the rising levels of financial vulnerability.

By openly discussing this challenge, businesses can better understand customer needs and proactively plan for potential payment defaults, fostering greater economic resilience and helping customers avoid further distress. On an individual level, understanding your financial profile and anticipating changes to your costs can facilitate better long-term financial planning and enhance financial awareness.

Contact one of our experts to find out how we can help you navigate these challenging times.

Our Experts

Related Insights

Britain’s poorest face doubling of debt to energy suppliers

According to Baringa's figures, Britain’s poorest people now owe twice as much to energy suppliers as they did during the 2022 energy crisis.

Read more

Taking a person-centred approach to managing financial vulnerability

As Australia starts to feel the impact of rising energy bills, we share our view.

Read more

Safeguarding Financial Vulnerability

Growing numbers of customers, and businesses, are more financially vulnerable than ever.

Read more

Bringing the industry together to support customers

We share an overview of the challenges, solutions and success factors highlighted by our clients and industry partners around financial vulnerability

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?