Fuelling maritime decarbonisation: The role of regasification terminals in unlocking bio-LNG

8 min read 11 July 2025

The maritime sector faces growing regulatory pressures to reduce its environmental impact. FuelEU Maritime requires shipping companies in Europe to lower their GHG emissions intensity by using renewable fuels, reaching an 80% reduction by 2050, and the draft IMO framework agreed in April seeks to establish a similar mandate globally. While hydrogen-derived fuels like ammonia and e-methanol are expected to deliver deep decarbonisation in the long-term, they are high cost and limited in availability today. Biofuels present an immediate and cost-competitive solution, and regasification terminals play a critical role in making bio-LNG viable at scale.

Certification is critical for connecting biomethane producers and LNG consumers at scale

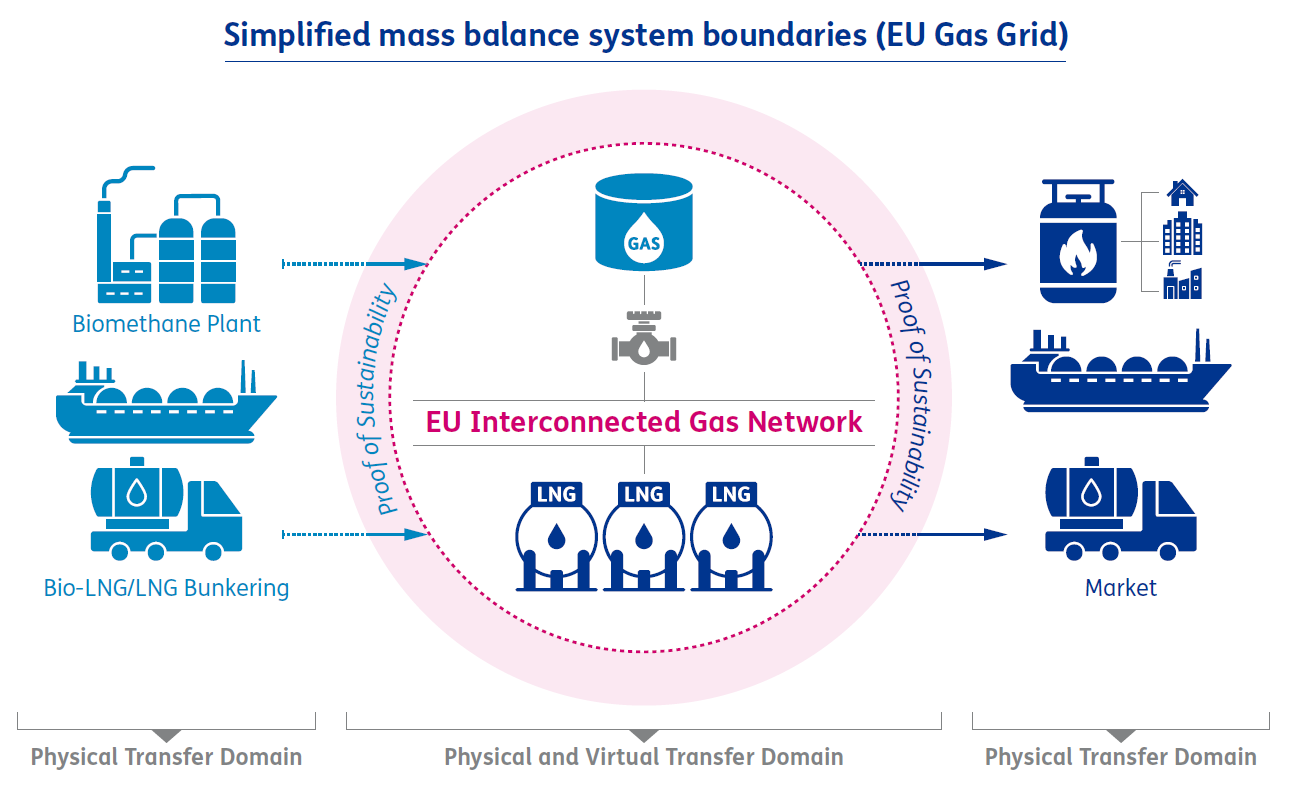

Biomethane is produced from the breakdown of organic matter (food waste, agricultural residues, animal manures etc) and is molecularly identical to natural gas. This means biomethane can utilise existing distribution infrastructure and end equipment, but typically with 80-90% lower GHG emissions1. The comparatively small and disaggregated nature of biomethane production makes direct supply of the molecule, from its source to an LNG vessel, unviable at scale. Instead, biomethane is more commonly injected into the gas network, enabling aggregation within a larger system for distribution to the end consumer.

Since biomethane is physically indistinguishable from natural gas once in the gas network, certification is required to ensure transparent and accurate tracking of green attributes throughout the value chain. Voluntary reporting standards, such as those established by the ISCC, are well established within Europe and robustness is expected to be furthered with the introduction of the Union Database (UDB). This means that producer and consumers across the EU can be connected, providing the gas is injected into and extracted from the same physically connected gas network (ie the European gas grid), without having to take direct delivery of the biomethane molecule.

This concept extends to regasification terminals, which can register to become recognised within the boundary of the EU gas grid and can virtually deliver bio-LNG to vessels without constraints2. Several terminals are already offering bio-LNG bunkering services, such as Elengy at its Fos-sur-Mer and Montoir-de-Bretagne terminals in France, as well as Enagas at Barcelona and Huelva in Spain. Further terminals are expected to follow suit in Europe, given the flexibility afforded by regulations and growing demand for bio-LNG from the maritime sector.

While LNG terminals increasingly offer bio-bunkering services in Europe, barriers remain to unlocking the global opportunity

While certification is well established in the European context, there remain some key barriers to entry for participants in other global markets. So-called 'third countries' like the UK and Ukraine, for example, are not currently able to participate with the UDB and therefore cannot supply biomethane for maritime into Europe. Moreover, in an increasingly global market, certification standards will need to become increasingly harmonised to ensure fair access to markets and cohesion between major import/export regions. While pilots are being carried out to establish and demonstrate robust tracking of green attributes between key trading hubs, close partnership between regulators and market participants will be needed to ensure success.

Baringa’s gas and clean molecules experts have a wealth of strategy, commercial and transaction advisory experience, in addition to deep analysis of market fundamentals and compliance requirements to source low carbon fuels. We address each problem using our tested commercial appraisal frameworks, in-house energy system modelling and experience supporting our clients across the whole biomethane value chain.

If you’d like to hear more about how we can help, contact Liam Langshaw or Mashal Jaffery.

1 In Europe, when produced using animal manures, it can also be considered GHG-negative, making biomethane highly competitive as a GHG abatement measure.

2 Delivery of Bio-LNG through equivalence liquefaction is limited to the send-out capacity of the LNG Regasification terminal

Related Insights

Reporting scope 2 emissions: the GHGP's new consultation

The current global standard for how companies report their emissions - set by the Greenhouse Gas Protocol - has long been criticised for enabling uncredible claims to Scope 2 emission reduction. read on to see what this means for you

Read more

The inertia challenge in renewable energy

The shift to renewables is reshaping grids, replacing traditional plants with wind, solar, and batteries. This transition challenges grid stability with lost inertia.

Read more

Progress amid uncertainty: How complex industries are driving decarbonisation

From telecoms and retail to the built environment and critical infrastructure, our vibrant discussion focused on how companies are driving forward their renewables strategies.

Read more

Navigating Germany’s inertia market evolution

Germany’s inertia market launches in 2026, opening opportunities for assets like BESS. Success depends on clearing prices, with early movers set to benefit.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?