Insights into the climate vulnerability assessment

6 December 2022

On 30 November 2022, APRA released an information paper outlining the aggregate results and key insights from the Climate Vulnerability Assessment (CVA) – Australia’s first regulator-led climate scenario analysis, carried out by the five largest Australian banks.1 The CVA, alongside APRA’s Climate Risk Guidance (CPG 229) and Climate Self-Assessment Survey, has successfully instigated broader consideration of climate risks and opportunities by the Australian financial system.

|

CVA Key Insights 1. Climate scenario analysis showed a measurable impact on lending losses; however, the participating banks are likely to be able to absorb these impacts All participating banks found that there would be a measurable impact on lending losses due to both physical and transition risks. 2. Climate risk impacts are likely to be more concentrated in specific regions or industries Pockets of climate risk exposure pose a heightened risk for non-diversified entities. 3. The banks’ response to increasing physical and transition risks under the scenarios included adjusting their risk appetite and lending approaches The CVA has helped banks identify and quantify actions they can take to mitigate their climate risk – this will help feed into business strategy development and Net Zero planning. 4. Climate scenario analysis accelerated capability development and risk awareness APRA intentionally allowed banks to interpret the modelling techniques required to respond to the CVA to force consideration of their approach to integrating climate risk into traditional risk modelling. 5. Climate-related data quality and accessibility remain a challenge, however this should not preclude financial institutions undertaking climate risk analysis now Given the importance of geographic asset locations and varying transition risk dynamics between and within sectors, the resolution of scenario and asset data plays a significant role in accurately measuring the financial impacts associated with climate risks. However, conducting climate scenario analysis builds immediate capabilities to leverage higher quality data as it becomes available over time. 6. Counterparty assessments provided complementary insights to portfolio-level modelling, but banks will benefit from developing more structured approaches Participants were able to draw out more granular insights on the credit impacts to their largest counterparties from transition and, to a lesser degree, physical risks. While this set a useful baseline, further capability development is required to effectively assess the credibility of counterparty transition plans. |

Background to the CVA

APRA initiated the CVA to better understand the potential financial impact of climate change on banks under different but plausible climate scenarios. The main CVA design phase commenced in early 2021, with a series of workshops conducted with participating banks and the Australian Banking Association to explore aspects of the CVA design. The banks commenced their analysis in June 2021 and submitted their results to APRA in mid-year 2022.

The CVA built on two internationally recognised Network for Greening the Financial System Phase II Scenarios: 2

- Delayed Transition Scenario – which explores a future with delayed policy action on climate change, followed by a rapid reduction in global emissions after 2030

- Current Policies Scenario – which explores a future with continued increase in global emissions beyond 2050

Participating entities were provided with climate scenario transition pathways and input data for physical risks to mortgages and business exposures, with some banks opting to use higher resolution data from third-party suppliers. The banks then had to overlay the scenario trends into their asset valuation models to determine the associated credit impacts. The results were aggregated to identify annualised portfolio loss rates. APRA requested that entities conduct this process once with a static balance sheet and a second time allowing for management actions.

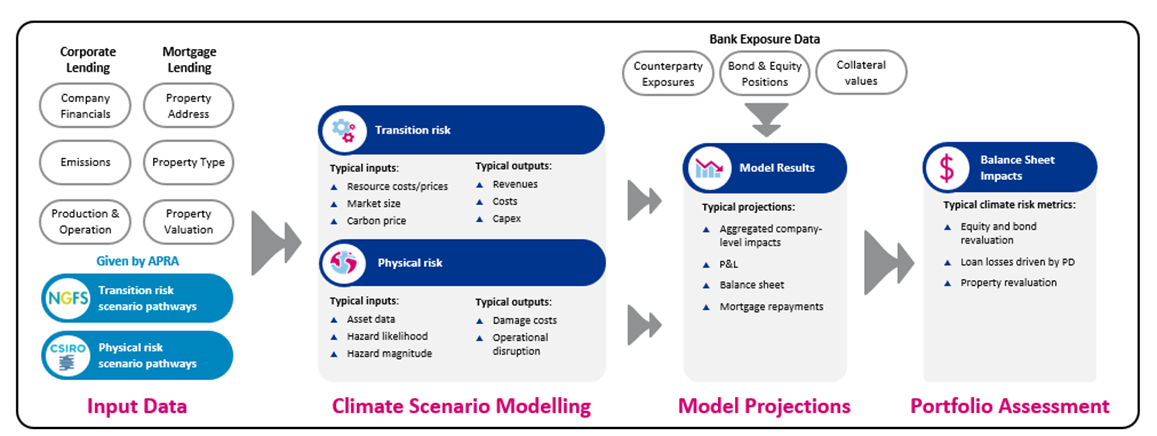

Stages of CVA Climate Risk Modelling

APRA supported banks with relevant input data and provided climate scenarios. As capabilities mature entities will be expected to acquire this internally.

Challenges faced implementing the assessment

The CVA was a challenging undertaking for participants. APRA noted a large variance in bank submissions, driven by deviations in data quality and lack of standardised modelling approach, which demonstrates a still-maturing approach to using scenario analysis to measure climate risk.

Australian financial institutions are not alone with these challenges. They are systemic across the industry and were acknowledged in the results of stress tests from the Bank of England3 , European Central Bank4 , and Monetary Authority of Singapore5.

Baringa experienced these same challenges when performing the climate scenario modelling for 10 of the 18 participants in the Bank of England’s Climate Biennial Exploratory Scenario. We have since been working to solve these challenges in strategic partnership with BlackRock and its Aladdin Climate platform – an independent climate modelling approach, with a curated database of company emissions and transition plans, that allows for comparative modelling of climate risk across institutions.

Financial institutions have since been using BlackRock’s Aladdin Climate platform to produce real-time risk assessments which are then integrated into Disclosures, Risk Management, Business Strategy, and Target Setting. We have supported our clients in upskilling internal stakeholders in climate and establishing processes required to enable the migration of modelling practices in-house. Two driving forces have been compelling our clients to develop their capabilities and will shape the future direction of scenario testing: Regulatory Pressure and Stakeholder Expectations.

The CVA results come against a domestic and global backdrop where climate scenario analysis is evolving from a ‘better practice’ consideration into a compliance-led requirement.

Future expectations for climate scenario analysis

Regulatory Pressures

APRA announced that it will be integrating climate risk into regular supervisory activities as part of the Supervision Risk Intensity Model and is likely to expand the CVA to encompass insurers and then superannuation funds.6 This growing maturity indicates that APRA will increasingly expect entities to incorporate climate scenario analysis into their existing risk management frameworks and governance processes, as required by CPS 220 Risk Management and CPS 510 Governance.

Additionally, the International Sustainability Standards Board (ISSB) announced that companies will be required to perform climate-related scenario analysis as part of their sustainability disclosure standards. 7 This will require companies to go beyond backwards looking reporting regimes to thoroughly understand the progression of potential risks under different scenarios.

Stakeholder Expectations

The use cases for climate scenario analysis extend beyond risk management and reporting. There have been increasing pressures for financial institutions to develop Net Zero agendas, often as part of voluntary associations such as the Glasgow Financial Alliance for Net Zero. Institutions have been using climate scenario analysis to support target setting and inform long term strategy development. When done effectively, these insights identify opportunities which are being translated into targeted green product offerings that meet both customer and shareholder expectations.

Conclusion

APRA’s Climate Vulnerability Assessment has forced Australia’s big banks to reflect on their strengths and shortcomings in understanding climate risk. The primary value from the CVA has been capability building, providing learnings for institutions and the Government to identify gaps and areas of further development.

As domestic and international regulation and stakeholder expectations seek to further embed climate scenario analysis, there will be a building expectation for all regulated financial institutions to develop their capabilities.

References:

1 Information Paper - Climate Vulnerability Assessment Results

2 NGFS Phase 2 Climate Scenarios – June 2021

3 Bank of England, Results of the 2021 Climate Biennial Exploratory Scenario (CBES)

4 European Central Bank, Banking Supervision – 2022 climate risk stress test

7 IFRS - ISSB confirms requirement to use climate-related scenario analysis

For institutions that are seeking to understand the best approach to building out their climate scenario analysis capabilities, contact us for a discussion around your unique needs.

Our Experts

Related Insights

Future-proofing climate disclosures: Leveraging climate reporting for nature

Forward-thinking companies are integrating climate and nature into their strategies to drive innovation and resilience.

Read more

Transition planning in turbulent times: How financial institutions can adapt and lead

The shift to a low-carbon economy is challenging for financial institutions; we explore how they can adapt and lead in today's tough landscape.

Read more

Simplification Omnibus: what you need to know and where to go from here

We share what the Simplification Omnibus means for CSRD, CS3D and the EU Taxonomy and how you should respond.

Read more

2025 Outlook: What lies ahead for climate and sustainability in financial services?

Here's what's front of our minds for 2025 based on our dialogue with, and work for, climate and sustainability leaders across financial institutions.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?