Four steps to prepare for CSRD and the niche challenges for wealth and asset managers

5 min read 21 November 2024

The Corporate Sustainability Reporting Directive (CSRD) is transforming sustainability reporting for the financial services industry, pushing companies to provide greater transparency on environmental, social and governance (ESG) issues.

For wealth and asset managers, however, this shift comes with a distinct set of challenges. Unlike other sectors, they manage complex, multi-asset class portfolios and investor expectations that vary widely across markets. These organisations face the challenge of having to report their direct operations and assessing and disclosing sustainability impacts, risks and opportunities (IROs) across investment portfolios. This requires detailed insights into portfolio emissions, biodiversity, social impact and governance practices – data which is typically not as accessible or standardised.

While CSRD mandates stringent standards, the lack of sector-specific guidance leaves many financial services firms navigating regulatory grey areas. Some wealth and asset managers already fall within the scope of CSRD requirements and are facing reporting deadlines as early as FY24 meaning internal teams must make critical decisions without the steer of FS sector-specific guidance.

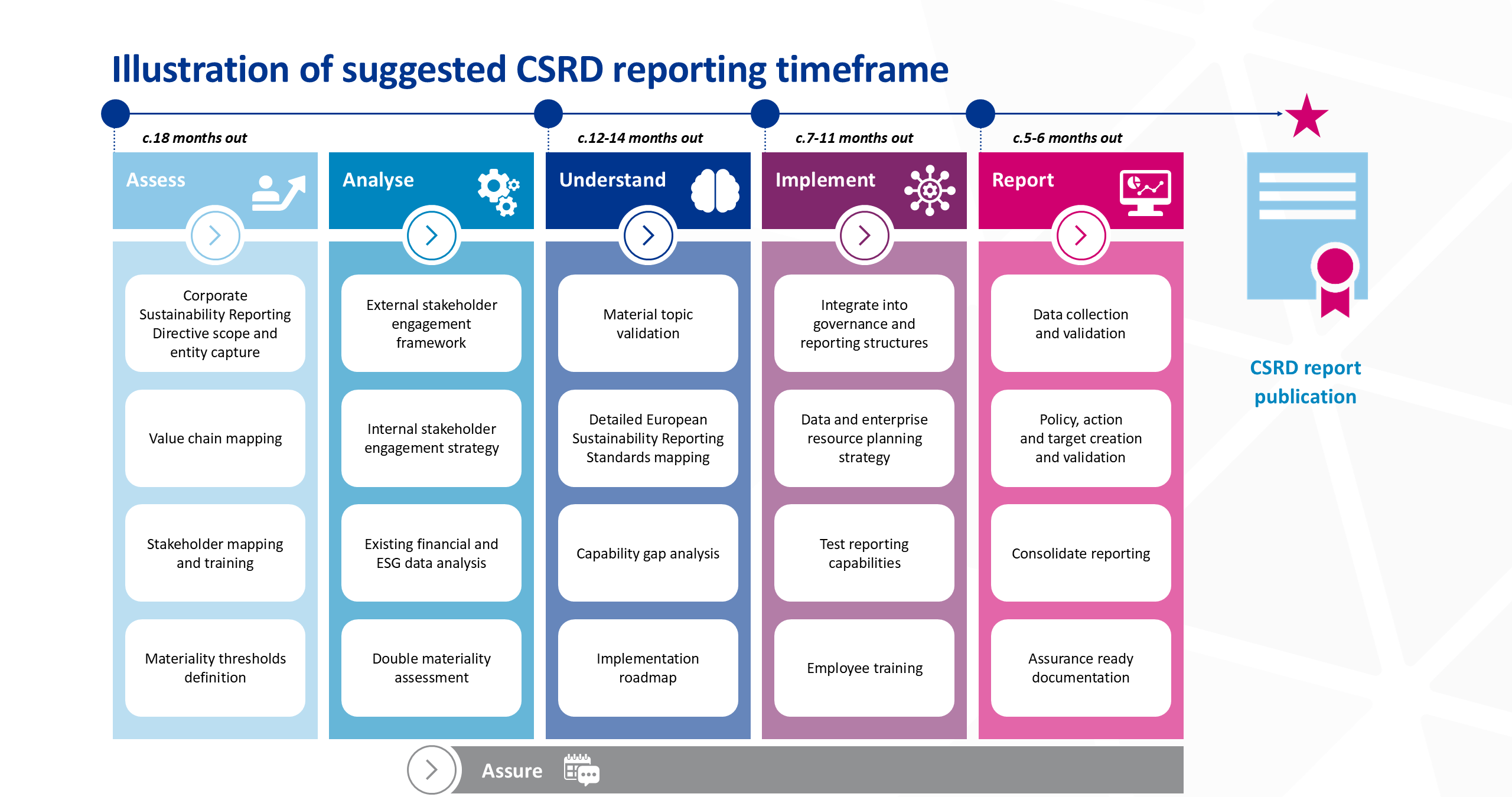

Based on our experience, we outline four key steps financial institutions should take and highlight specific considerations for wealth and asset managers to address the unique challenges CSRD reporting presents. By prioritising these actions, firms can build a strong foundation that will support an efficient and auditable CSRD reporting.

1. Drive meaningful stakeholder involvement for balanced decision-making

Challenge: CSRD reporting requires a firm-wide approach to ensure accurate, consistent and meaningful disclosures, that is not isolated to sustainability teams. There needs to be a systematic way to involve both internal and external stakeholders to ensure the quality and relevance of CSRD disclosures. Defining “how much” to engage each stakeholder and deciding on the scope are central issues. For wealth and asset managers, navigating investment portfolio coverage and meeting audit requirements (step four) adds extra challenges to engaging with stakeholders.

Approach: CSRD requires firms to collect inputs from their value chain. This needs to be done both internally (eg responsible investing, finance, legal and HR teams) and externally (eg investors, suppliers and data providers).

A two-fold approach can help structure stakeholder engagement:

- Assess sentiment: Identify which stakeholders are vocal about sustainability risks and impacts associated with operations and investment activities. For wealth and asset managers specifically, this may involve identifying stakeholders from portfolio management, distribution, and corporate sustainability.

- Prioritise through material impact scoring: Use materiality assessments (step two) to determine which stakeholders have the most substantial influence and impact on the business model and sustainability outcomes. For wealth and asset managers, integrating feedback from portfolio managers and investor relations officers is particularly important, to ensure only those with a tangible role shape disclosures.

Proactive involvement across the CSRD process—from initial portfolio assessments to final disclosures—will help wealth and asset managers improve the accuracy and completeness of reporting. By focusing on the issues that matter to their business most, and aligning with auditors on portfolio coverage assumptions, firms can deliver transparent and value-driven disclosures.

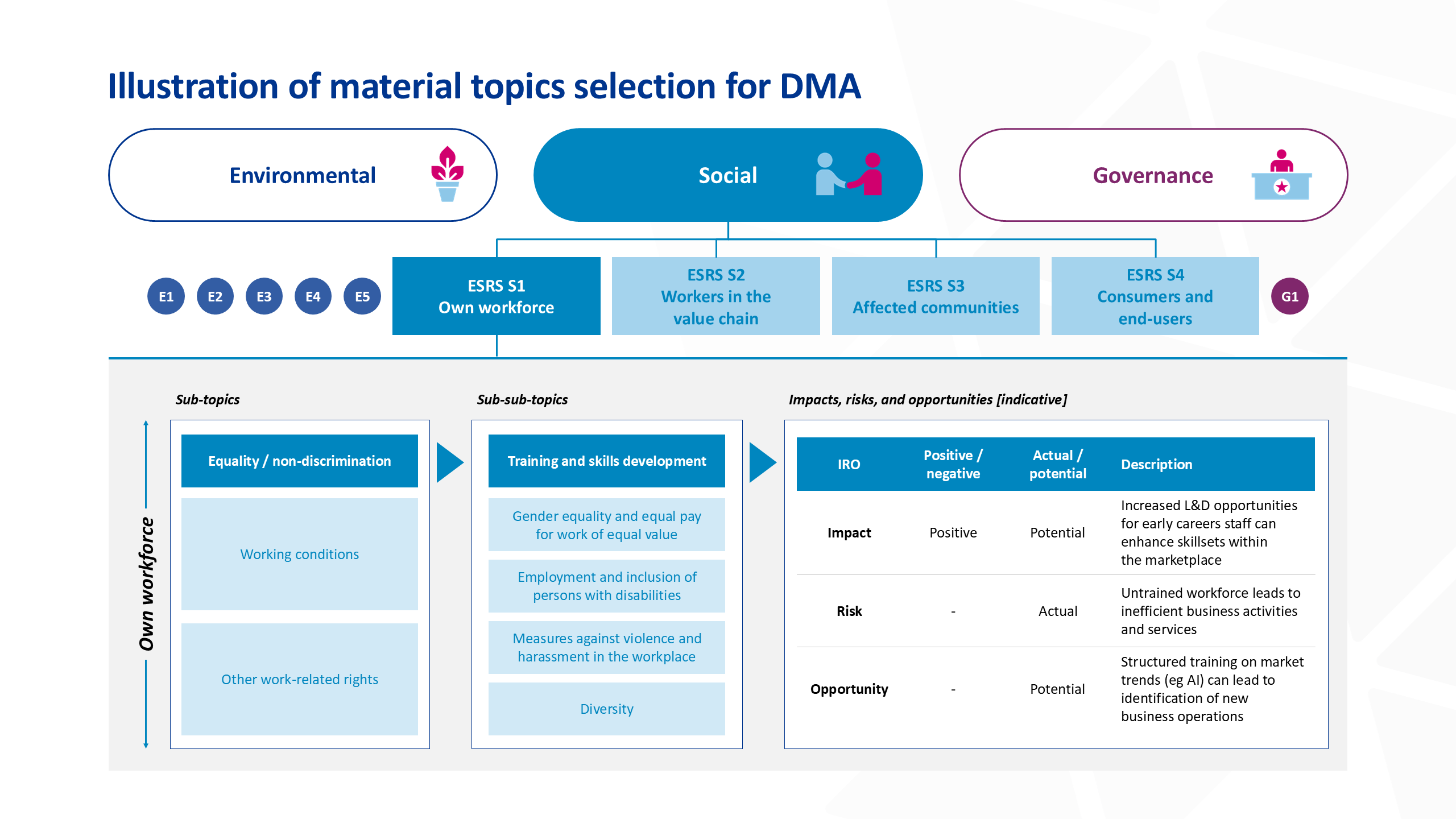

2. Map material topics with a strategic Double Materiality Assessment (DMA)

Challenge: Selecting material topics is a complex task given the need to meet regulatory expectations while ensuring that reporting remains meaningful to the business. The challenge is further compounded for wealth and asset managers by the diverse nature of the industry, where material impacts can vary widely.

Approach: DMAs are crucial for understanding the impact of environmental and social issues on a firm and the firm’s impact on these issues. Focus on a granular mapping of sub-topics within the European Sustainability Reporting Standards (ESRS) to ensure all critical areas of sustainability reporting are addressed without unnecessary duplication.

One practical approach is to leverage existing materiality thresholds, such as those used for risk management, when defining materiality for sustainability. An internal materiality assessment can support prioritisation by enabling firms to view potential material topics side-by-side, assessing them based on relevance and impact. Externally, lists of material topics aligned with the Sustainable Finance Disclosure Regulation (SFDR) Principal Adverse Impacts (PAIs) indicators allow firms to benchmark and disclose impact materiality, ensuring both CSRD and SFDR alignment. This will be particularly significant as the market anticipates that proposed “SFDR 2.0” amendments will extend the PAI requirements to all funds, regardless of their classification.

Ultimately, this approach will enable wealth and asset managers to tailor CSRD disclosures to their unique business contexts, demonstrating relevance to investors while meeting compliance needs.

3. Establish a standardised process to enable consistent and thorough documentation

Challenge: Without establishing a standardised process and thorough documentation, CSRD programmes risk overlooking critical design decisions, compromising assurance-readiness and limiting future scalability.

Approach: Developing a standardised approach and methodology is a crucial first step. Start with a clear governance framework and a scoring methodology that is linked to the standardised process. This structure ensures that as the CSRD programme matures and additional entities fall into scope, firms can scale without overhauling their process. A well-documented, process-driven foundation today will make CSRD reporting a repeatable, reliable exercise in the years to come.

Rigorous documentation practices are a crucial component and creates an auditable trail. This includes recording the rationale behind the DMA outcome, disclosure of thresholds and scoring methodology definitions, including considerations for value chain coverage.

4. Engage auditors early

Challenge: Sustainability disclosures are now subject to mandatory limited assurance—a new experience for all firms reporting under the CSRD. Engaging auditors late in the process can result in significant last-minute revisions and possibly a less favourable limited assurance findings.

Approach: The novelty of sustainability limited assurance necessitates early and ongoing auditor involvement. Begin by collaborating with auditors as soon as possible to discuss methodological choices around value chain coverage, double materiality assessments and reporting scope. wealth and asset managers must pay particular attention to providing auditors with clear rationale and transparency on scores assigned across investments and associated weightings.

As this is generally a new concept to auditors, engaging them early on gives them time to familiarise themselves with the specificities of your reporting process. For example, if auditors review a firm’s DMA late in the process (ie, c. six months from reporting), they might recommend a more granular approach, requiring extensive rework to mapping IROs.

Early engagement mitigates this risk and allows for pre-emptive amendments, ensuring a smoother audit process and greater confidence in the audit’s outcome. This will provide valuable external feedback, helping firms refine their methodologies and control environments.

Key Terms: CSRD – Corporate Sustainability Reporting Directive, ESRS - European Sustainability Reporting Standards, ERP – Enterprise Resource Planning, EFRAG - European Financial Reporting Advisory Group

Next steps

For firms aiming to effectively navigate the shift CSRD mandates, proactive measures will help establish assurance-readiness, ensure scalability and build confidence in their disclosures.

Given the distinct challenges for wealth and asset managers, engaging a diverse range of stakeholders, setting tailored thresholds for material topics and aligning them with SFDR’s PAIs are critical steps in addressing the unique complexities for investment portfolios. By strategically tackling these sector-specific challenges, wealth and asset managers can build a strong reporting foundation that not only meets regulatory expectations but also aligns with investor priorities.

To learn more about how Baringa can guide you through your CSRD journey and help you implement robust reporting processes that seamlessly align with regulatory requirements and your investor expectations, please get in touch.

Our Experts

Related Insights

Future-proofing climate disclosures: Leveraging climate reporting for nature

Forward-thinking companies are integrating climate and nature into their strategies to drive innovation and resilience.

Read more

Transition planning in turbulent times: How financial institutions can adapt and lead

The shift to a low-carbon economy is challenging for financial institutions; we explore how they can adapt and lead in today's tough landscape.

Read more

Simplification Omnibus: what you need to know and where to go from here

We share what the Simplification Omnibus means for CSRD, CS3D and the EU Taxonomy and how you should respond.

Read more

2025 Outlook: What lies ahead for climate and sustainability in financial services?

Here's what's front of our minds for 2025 based on our dialogue with, and work for, climate and sustainability leaders across financial institutions.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?