The impact of Covid-19 on the electrification of transport: a UK perspective

30 April 2020

Will the pandemic set back the work of the last 5 years another 20 years?

The global economy is facing an unprecedented downturn due to Covid-19. All major researchers and banks are forecasting global GDP drops, and the IMF is predicting the worst recession since the Great Depression. Global stock market performance indicators by sector highlight a 35% year to date drop (at time of writing) in share prices in the automotive sector, which has been hit hard by disruptions to global supply chains, the halt of factories, and the sharp drop in demand caused by the lockdown. The expected economic impact is grim, and the global economy faces some tough challenges in the coming years.

Historically, the UK’s —and indeed Europe’s— track record at driving decarbonisation and investment in future emission-reduction measures during a recession, when the focus shifts to jobs and economic recovery, has not been good.

If the EU emission targets are changed, if the automotive sector reduces their focus on Electric Vehicle (EV) production, if the Energy industry does not maintain its drive, innovation and investment to decarbonise transport and if Government scales back its spending or subsidies on EVs (like China has been considering) or delays its ambitions—all of which are possible given the challenges of the current crisis—the UK could see a significant trough in EV adoption.

There is a mounting body of breath-taking evidence indicating that nature is the real winner in this crisis. For the first time we as consumers realise what it could feel like to achieve clean air in our cities. Our perspective on working and commuting has changed as we have rapidly adjusted to working from home. This is why industry and government must not lose momentum. Investment into the electrification of transport can become a lever to stimulate our economies and industry back to life.

This article explores the conflicting influences of the pandemic on the EV transition. While we know that the other side of this lockdown is going to be tricky and unpredictable (and in some instances we have more questions than answers), we have worked through actions and recommendations for consumers, automotive OEMs, the energy industry, capital providers and investors, and the UK Government to support the electrification of transport and ensure we don’t set back the achievements of the last five years by another 20.

Without attempting to predict the range of widespread impacts, we believe that now is the time for these players to capitalise on the societal change, and to position themselves as part of the solution for economic recovery and towards a decarbonised future of transport.

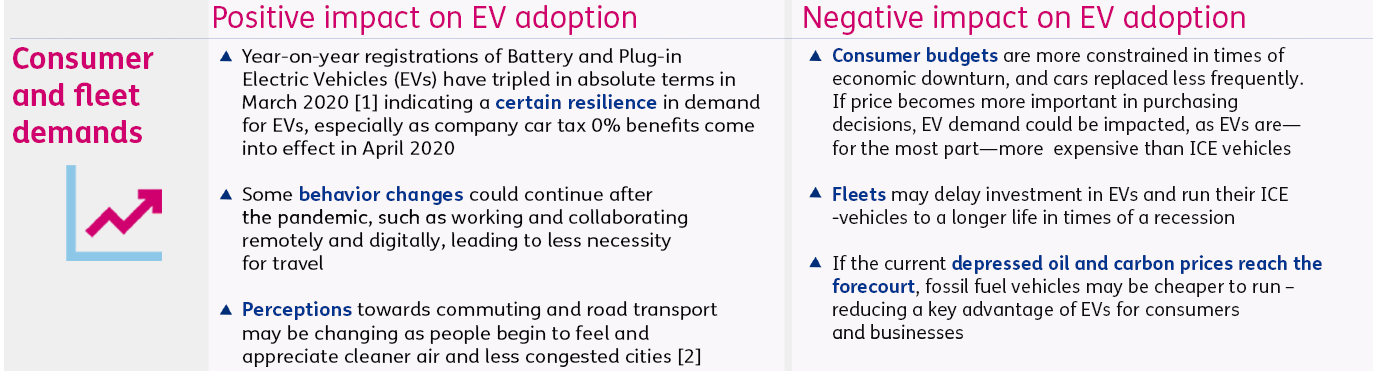

Consumer demand: EV demand may be more resilient than we think...

Reduction in travel has resulted in a record low in transport emissions (many analysts expect a ~20% decrease in transport emissions in 2020), and air quality has drastically improved in cities across the globe. We believe the changes in public perception in this regard, driven by Covid-19, are likely to be permanent.

We believe the positive impacts described above outweigh the negative ones, and that EV demand will be more resilient than overall automotive demand, due to the changes in consumer perception towards sustainable transport (and potential impact of reduced public transport). If this demand for EVs endures, OEMs, energy companies and capital providers have an opportunity to capitalise and position themselves as leaders in this space—or risk being left behind. There is a perfect opportunity to push the adoption of EVs now more than ever.

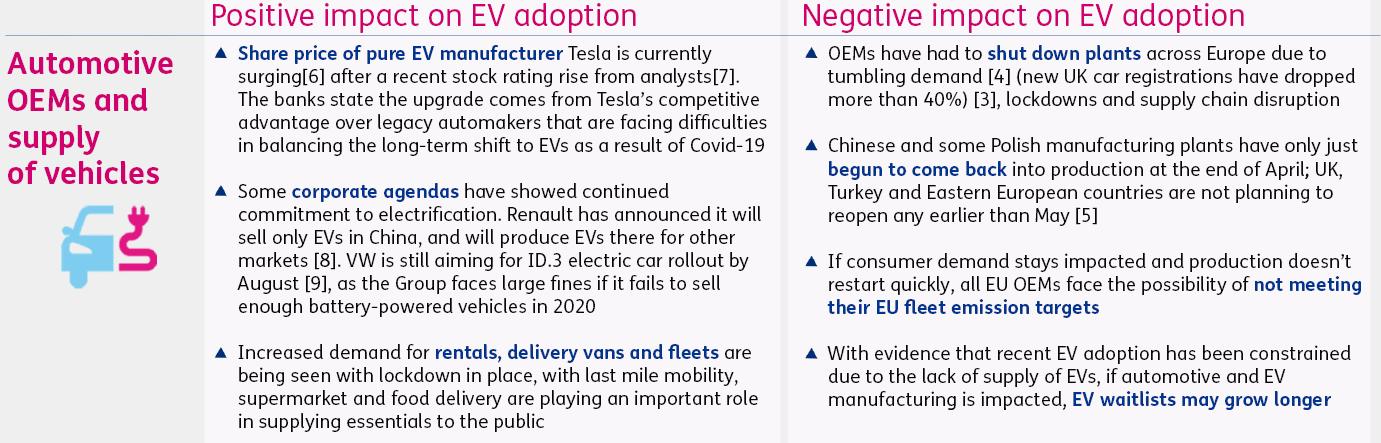

Automotive OEMs: is 2020/21 the year of waiting lists or the tipping point?

The next two years were expected to be the tipping point in the UK’s and Europe’s EV sector, driven by ambitious EV supply commitments from car manufacturers. However, Covid-19 has resulted in significant market movements which have major implications on automotive OEMs, and could alter the timeline of EV adoption:

There are strategic considerations why vehicle manufacturers should keep focused on their EV transition in the recovery:

- EVs offer both legacy and niche automotive manufacturers an opportunity to improve sales and profitability on the other side of this crisis. Some of the benefits described below have existed even before Covid-19, but are more acute now

- Legacy automotive OEMs that will remain focused on ICE production post-crisis risk being left behind as the interest in EVs from consumers (as mentioned above) and the Government remains strong

- The risks of complex global supply chains that have been relied on for decades in the production of ICE-motored vehicles have been highlighted by Covid-19 – increasing the benefits of simpler EV manufacturing

- Car manufacturers could leverage EVs as a key pillar in any Government support package-request, improving both the negotiation position as well as supporting a faster transition

Finally, if automotive OEMs are facing a greater reliance on capital markets, an enhanced transition strategy may help offset cost of capital-challenges as investors will increasingly need to demonstrate climate risk-mitigation in their portfolios. Helping investors understand the maturity of battery technologies and developing warranties that address some of the technology risk can help unlock the investor and fleet potential in the EV transition.

Energy industry: will investment in EV infrastructure and EV services decline?

Utilities and Oil & Gas players face huge challenges due to Covid-19. The electricity market, prices, and demand patterns have changed entirely and utilities have scrambled to reshape their operating model to deal with the pandemic. Oil & Gas companies face negative oil prices and depressed consumer demand, as well as an uncertainty on the ability to weather a prolonged storm. EV charge point (as well as wind, solar and smart meter) installations have stalled – with Charge Point Operators (CPOs) pausing all non-essential installations.

To date, energy players such as BP, Shell, EDF, Octopus Energy and others have been on the forefront of investing in EV infrastructure and EV propositions for consumers and fleets and driving electrification in the UK; this investment is at risk of stalling in these challenging conditions.

We believe this perfect storm presents a commercial opportunity for utilities and Oil & Gas companies: now is the time to focus on their digital and EV service propositions, and prepare themselves to take advantage of the consumer demand for EVs post Covid-19. While the opportunity is not new, capitalising on consumer demand and demonstrating leadership in the sector at this time could build the foundations for long term value.

Utilities are in a unique position to take advantage of the EV revolution by combining their understanding of networks, consumer power demand and their relationships with end-users through home tariffs and field-based electricians. Now is the time to double down and build on their legacy tariff propositions and create more agile, consumer-led, digital and EV service focussed propositions. They are not alone in this race, and will need to fend off competition from Oil & Gas and automotive OEMs, further emphasising the need for rapid action.

Oil & Gas on the other hand has the opportunity to deploy balance sheet strength to invest in capabilities and technology, making themselves frontrunners in the EV and energy services-race, while at the same time addressing the expected drop in demand for liquid fuels.

To date, consumer perception of decarbonisation efforts by both utilities and the Oil & Gas industry has been largely uncomplimentary. Energy companies have an opportunity to firmly position themselves on the right side of the planet’s future and secure significant commercial value at the same time, however, speed, agility and bravery will be key components of success.

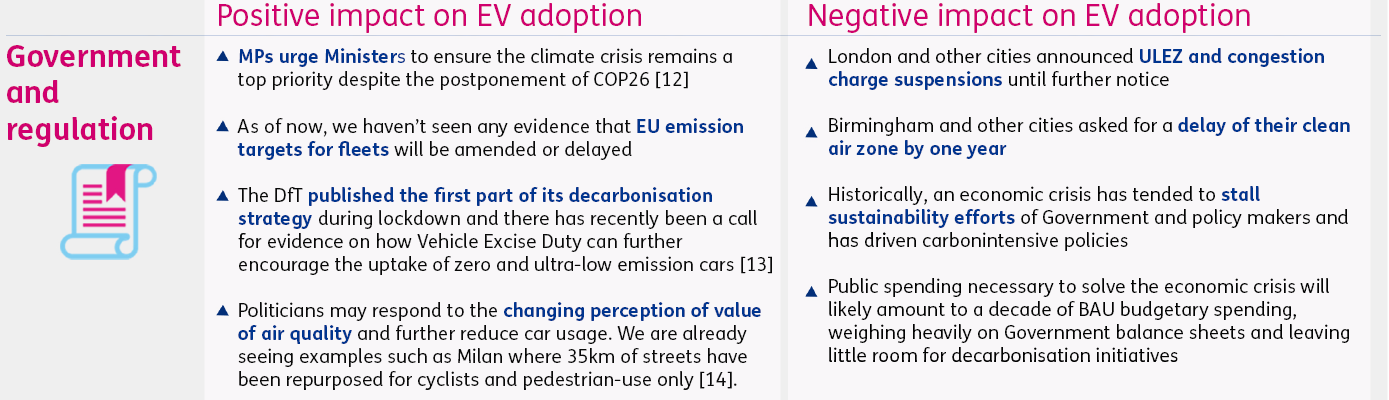

Government and regulation: decarbonising through an economic downturn

If decarbonisation is to remain a priority even through the economic crisis, it seems clear that UK Government will be required to play a leading role in promoting the electrification of transport.

The changes in behavioural patterns (as mentioned in the consumer section) and societal appreciation of the benefits of cleaner air that we experienced over the last weeks might give the Government the tailwind needed to support EVs stronger than ever before and stimulate demand for EVs.

As a minimum, the UK government need to maintain current pledges on Clean Air Zones (CAZs) and equivalent schemes, and accelerate them rather than defer their implementation. They also need to maintain momentum on critical EV charging infrastructure-roll out such as the Rapid Charging Fund (announced in the 2020 budget). Measures that alleviate merchant risk, grid constraints and technology risks could stimulate commercially attractive deals and encourage deployment of private capital into the EV supply chain, fleets and infrastructure.

Incremental incentives could include:

- A scrappage scheme, which could significantly help with fleet EV demand, ensuring that replacements are electric where possible

- Measures to “unlock” fleet electrification as part of any stimulus, eg, direct grants for infrastructure and other elements of the transition. This could help offset the potential costs of CAZs and other measures provided to businesses struggling to recover

- A stimulation of automotive sales and consumer demand toward EVs by going down the Norwegian route and exempting VAT on low emission cars, or including a purchase tax on the most polluting cars to finance incentives for zero-emission cars without any loss in tax revenues

The UK government could tie any Covid-19-related support packages for automakers and/or energy players to an increased pace of their transition such as a commitment to restructuring, reducing carbon intensive operations or investing in decarbonisation. Additionally, targeting some of the funds reserved for bailouts and economic support towards low carbon sectors could reap benefits—research suggests that a decarbonisation path totalling $110 trillion would create 'massive' socioeconomic gains. The same benefits could apply for the decarbonisation of transport.

Finally, to further the UK’s ambition to be a world leader in zero emission vehicles, the Government could consider bringing a larger part of the EV and battery supply chain to the UK be eg, using business zones as its European counterparts are doing. Indeed, a gigafactory has been a recommendation of the UK BIC and the Faraday Institute since last year.

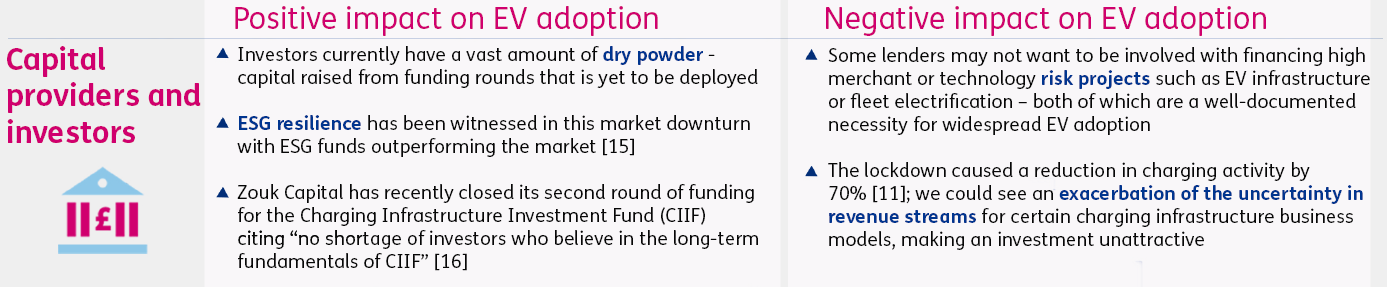

Capital providers and investors: can increased capital be deployed in the EV and related services sector?

Prior to the pandemic, investors were increasing their interest in providing project finance for EV infrastructure and fleet electrification, and deal flow was picking up. However, in an unstable economic climate, lenders typically shy away from lending because of widespread market risk.

There is one school of thought that indicates that this private capital might lead the way out of a global recession towards a more sustainable future, as investors start to value decarbonisation and sustainability positively.

Investors have the opportunity to stimulate the transition to EVs by clearly tying funding to transition-strategies, or reflecting this in the cost of capital. Further, by seeking opportunities and investing in those companies that are ramping up faster on EV production in the recovery, they could establish positions that could be lasting, as indicated by the capital market’s confidence in Tesla.

We do not underestimate the severity of the impact this pandemic will have on us as an economy and a society. However, when all we have control over are our own actions, now is not the time for industry, consumers, Governments or investors to lose focus on the decarbonisation challenge. It is critical for appropriate measures to be taken to mitigate slowing progress in a sector which has gained so much traction recently, and needs to continue at pace, if decarbonisation ambitions are to be realised.

The automotive and energy industry, the UK government and indeed we as consumers need to demonstrate ‘purpose-led leadership’, and make conscious and brave decisions to support decarbonisation and electrification of transport.

When a hurricane ravages a town, you don’t rebuild it the way it was; you rebuild it to be better. Now is the time for the automotive industry to buckle down focus on producing more EVs than ever before to meet emissions targets, for consumers to buy more EVs to maintain air quality, for the Government to deploy public spending for the most effective low carbon transport measures and for investors to deploy private capital towards the EV and EV services sector.

Finally, if one thing is clear – it is that we have never before had a chance to pause, restart and redraw the picture of the future of transport. Let’s not waste it.

Related Insights

Trump trade tariffs: Impact on the UK EV uptake

The global automotive industry is at a critical juncture, shaped by intersecting forces of electrification, geopolitical trade tensions, and national decarbonisation policy.

Read more

From early adopters to early majority: Driving the next phase of EV growth

As EVs are moving beyond the early adopter phase, what are the principles needed for mass market adoption and progressing towards net zero targets?

Read more

Commercial fleet electrification – adoption is accelerating, but barriers remain

With 50% of new car registrations in the UK being registered by businesses, it’s vital for companies to start electrifying their fleets.

Read more

We modelled the future of electric vehicles in Belgium with Synergrid

To power a switch to cleaner transport, we helped Synergrid understand what more electric vehicles on the road would do to the network.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?