#buildbackbetter: the post-Covid supply chain of the future

I first had the idea for this blog whilst sitting on the London Underground on my daily commute (remember that!) in early March. Newspaper headlines around me reported the early stages of Covid-19, and my thoughts turned to the impending impact the pandemic would have on global supply chains. I have been working in this field for the last 20 years and thought that we had been in similar situations before: Brexit, trade wars, the financial crash, the tsunami, the ash cloud.

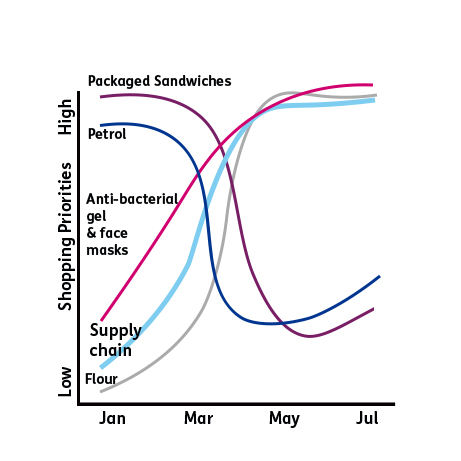

I was wrong – this crisis is very different to any before. Supply chains have become front page news stories, with reports from governments struggling to set up medical supply chains to counter a global pandemic and source masks and PPE, to the shortages on supermarket shelves as panic buying set in across Europe. While our need for flour, hair clippers and screens for home offices increased, the demand for petrol and sandwiches at lunchtime plummeted. Covid-19 has shown how reliant we are on a well-functioning global supply chain, and has made the impact of disruptions very real in everyone’s life.

As a firm, Baringa is supporting supermarkets pivoting supply chain almost overnight, manufacturers trying to keep the lights on, pharmaceutical clients considering how to distribute drugs, and the government themselves.

One of the most striking aspects of this crisis has been the level of unpreparedness of many small, medium and large organisations; despite warnings from the previous recent crises. Business continuity planning was mostly inadequate despite recent Brexit preparations and for many organisations, it’s the supply chain that has been most broken. Years of globalisation and lean mind-sets have delivered low cost bases, but stripped supply chains of their resilience. As Eric Schmidt, former Google CEO, put it, “Global supply chains might have been extraordinarily efficient. We have now learnt they are not resilient."

So what might the post-Covid supply chain of the future look like? Will there be a more balanced focus on cost, service and resilience? How will this affect the sustainability agenda that was growing in importance in supply chain circles?

There are five levers that enable us to #buildbackbetter our global supply chains and be better prepared in future:

Protect and ‘glocalize’ the core:

Supply chains in consumer goods and retail have experienced some of the most volatile demand shocks over recent months. Many have responded almost overnight and – despite years of resistance – stripped their ranges back to core SKUs and ‘cut the tail’ to protect the core. With borders restricted, many supply chains have pivoted to local sourcing or manufacturing of this core to maintain supply. Protection and glocalization of the core has been hugely successful in ensuring continuity of supply for the likes of Coca-Cola European Partners and Sainsbury’s and should form the backbone of the post-Covid supply chain and procurement strategy for companies across most sectors.

A new wave of investment into supply chain technology:

As the Covid-wave engulfed us, and CEOs started asking their supply chain execs ‘How much stock do we have, where is it, and how affected are our suppliers?’, the answer was often ‘We don’t know!’. This was often caused by under-investment in technology versus other perceived higher-value-functions, point initiatives not aligned across the end-to-end supply chain and poor data.

The frustration about the shortcomings of supply chain technology in the hour of need should lead to a new wave of investment, sponsored from the top down, to build resilience into supply chains. Track and trace, control towers, supplier collaboration and assurance technology were already in vogue before the crisis hit and uptake is likely to accelerate. Supply chain design technology for scenario planning will allow executives to ‘war game’ future impacts on their business, and a push for further automation will reduce dependence on labour.

Direct To Consumer (DTC) and eCommerce become must-have channels:

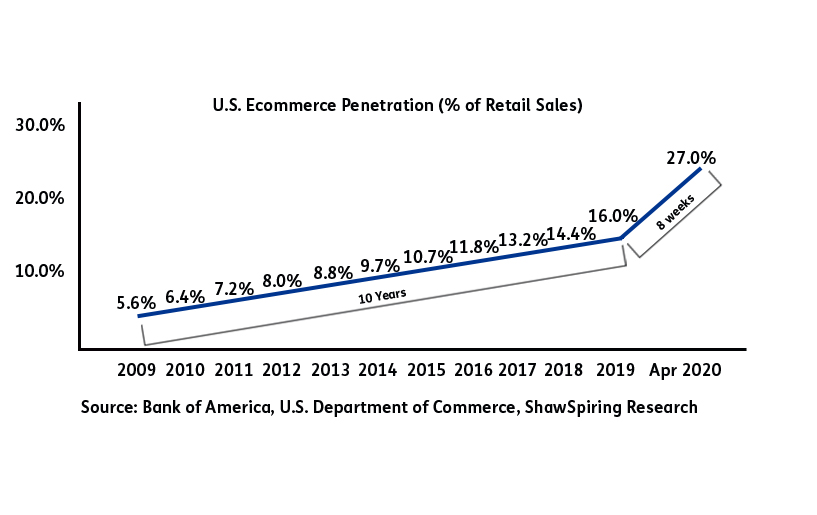

Many consumer product pioneers have been blazing a trail for DTC for years and have made their direct channels the source of up to one quarter of their sales. This is in addition to the slow steady growth retailers have seen in their ecommerce channels. When stores closed during lockdown, DTC and ecommerce volumes boomed. US eCommerce and DTC volumes increased more in the eight weeks after Covid hit, than in the ten years that preceded it; a staggering statistic.

If they weren’t already a must-have channel pre-Covid, DTC and eCommerce will be just that in the post-Covid supply chain.

Businesses without an ecommerce offering however were forced to scramble together a service or sit on the sidelines and watch sales slump. Primark for example have been losing £650m of revenue a month and had £1.3bn of stock at risk of obsolescence due to the lack of an eCommerce channel.

Innovative consumer businesses such as Unilever Ice Cream were able to switch to DTC, filling gaps that the slow-movers left behind and delighting customers stuck at home in lockdown. This was made possible because of innovative final mile supply chain models: flexible warehousing services, repurposed ‘dark’ stores, leveraging petrol station footprints and using food home delivery networks with spare capacity. We expect these trends to continue and grow, with DTC coming to new industries such as pharmaceuticals and even utility and telco networks, field engineers looking for innovation in more flexible home delivery or drop box collection points for parts and equipment.

‘JDI’ collaborations and alliances:

Supply chain alliances are not a new idea: many organisations are already sharing the fixed costs of their supply chain with non-competitive collaboration partners, or – like BT – have turned their supply chain from a cost centre to a profit centre and sell their capabilities externally to others.

Before Covid, these alliances have traditionally been big strategic decisions and taken years to materialise. Covid has made these rapid collaborations and alliances a ‘new norm’. Baringa for example helped bring together Boots and E.ON to establish a home delivery service. Boots needed drivers and a fleet to deliver medicines to customers, and E.ON could provide just that because their smart-meter installation field-engineers and their vehicles were idle due to the lockdown.

The flexibility, cost and sustainability benefits of supply chain alliances are clear – hopefully in a post-Covid world, these can be switched on and off with increased flexibility and agility.

Accelerating the sustainability agenda…eventually!

In the short to medium term, the top priority of supply chain executives will be on managing the fallout from Covid. Adopting the initiatives above will not only result in more resilient supply chains, they will also slash their carbon intensity and trigger a step change in the sustainability agenda. A ‘glocalised core’ causes less air and sea miles, technology investment can help reduce waste and manage supplier sustainability, and alliances can help utilise under-used assets and reduce transport miles. DTC and ecommerce could on the face of it be net additive, but are often the breeding ground for innovation with sustainability benefits such as low or zero emissions vehicles, supplier provenance and sustainable packaging. Governments have a role to play in this, as shown by the French government bail outs of Renault and Air France with tough sustainability targets.

We will explore each of these five levers in more detail over the coming weeks. For now, I would like to leave you with THE key consideration which will affect the speed and uptake of these #buildbackbetter supply chain themes: investment.

Given supply chain is still largely viewed as a cost centre, will the Covid crisis and the broken supply chains it leaves in its wake encourage enough CEOs and CFOs to invest in greater supply chain resilience? As John Gattorna, a prominent supply chain thought leader puts it “To cope with future volatility and major unexpected disruptions, we need to embed some degree of redundant capacity”. The question is, will a 20% cost overhead for a ‘glocalised core’ or spare ‘just in case’ capacity (a departure from just-in-time) be deemed acceptable in this new world? Can the pending wave of TCFD (Task Force for Climate-related Financial Disclosures) sustainability commitments be used in tandem with the impact of Covid, to help convince CEOs and CFOs of the need for investment?

Without investment, we can all expect supply chains to be the headline news stories once again in the run up to the next crisis, bracing ourselves for another shock to ill equipped, unsustainable supply chains. Let’s make sure we seize the opportunity and #buildbackbetter supply chains.

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?