Common pitfalls when creating ESG & Sustainability strategies

5 May 2022

Over the last few years, climate change has been rising further up financial institutions’ (FI's) priorities, and subsequently the broader Sustainability agenda has recently received renewed attention and prominence under the guise of ESG. Pressure continues to grow for FIs to be clearer about how they will deliver expected economic outcomes, whilst supporting societal shifts and addressing wider environmental challenges beyond reducing their greenhouse gas emissions.

Many companies are now hastily setting ESG strategies and ambitions, for instance 90% of the UK’s largest companies are already aligned to the UN Sustainable Development goals. The pressure to do this is coming from a broad range of stakeholders:

- Governments: 120 states have already committed to a net zero target1 and more than 100 countries have pledged to reverse deforestation by 20302

- Investors/shareholders: 85% of investors are interested in sustainable investing, up from 71% in 20153 and 71% would not put their money into ‘investments which are unethical’4

- Regulators: SFDR (Sustainable Finance Disclosure Regulation) has been adopted by the EU parliament requiring enhanced transparency and a shift in focus to ESG investment risks. In the UK, the Chancellor of the Exchequer recently announced new SDR (Sustainability Disclosure Requirements) reporting requirements which will ask FIs to justify their sustainability claims5

- Customers & employees: c.7 out of 10 online consumers would stop using a brand because of its social or environmental wrongdoing6 and 98% don’t trust companies that rely on carbon offsets to tackle their emissions.7.

However, the path to build out an effective, cohesive and aligned ESG or Sustainability strategy is not always straightforward.

We regularly see these four common oversights

Working with our clients on this critical topic, we have observed four common pitfalls when creating early ESG strategies:

- Misunderstanding the scope of ESG. Many firms focus primarily on the ‘Climate’ part of Environment and fail to think more broadly about the overall impact they have on the environment, including areas such as biodiversity or water scarcity and pollution. Others see the Social aspects purely in terms of their internal outcomes (e.g. female representation within company leadership) rather than as an opportunity to create societal value more broadly through their external offerings (e.g. providing loans to female entrepreneurs).

- Focusing on point-scoring. Many firms set out with the objective of improving the ESG score ascribed to them by external ratings agencies like MSCI, rather than focusing on how they genuinely drive sustainable change. Using indices as the main driver for implementation can also create a culture of box-ticking and could draw claims of greenwashing.

- Failure to align ESG and core business strategies. Treating ESG as a bolt-on, siloed endeavour can result in it being considered secondary to other business objectives, and therefore failing to achieve lasting outcomes. Embedding ESG into your strategy and business model will enable you to drive maximum shared value for your company, society, and the planet.

- Trying to do everything at once. A key indicator of this is alignment to too many Sustainable Goals in parallel, creating a confused strategy, lacking alignment to your core business model. To achieve real and lasting impact, it is critical to narrow your focus and push deep, rather than spread yourself too thinly across too many areas.

How to drive maximum shared value

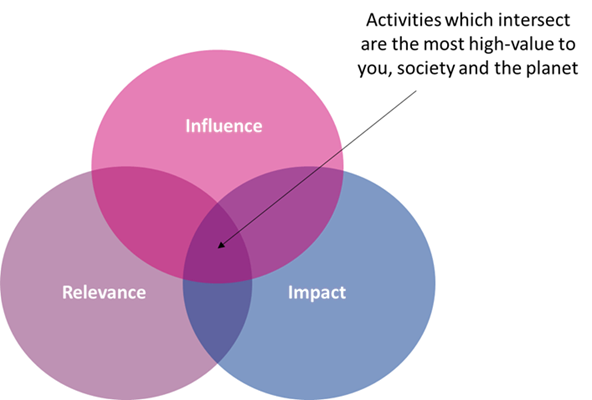

Choosing where to focus your efforts is essential for a successful ESG strategy, allowing you to achieve maximum impact and shared value across economic, environmental and societal outcomes. We have developed a framework that enables us to work with our clients to develop ESG strategies which:

- are relevant: create an ESG/sustainability strategy that is relevant to your core business model. For example, a mortgage provider should consider how to achieve ESG outcomes through their mortgage lending, looking for customer segments where they can maximise social impact.

- achieve impact: how can you impact the most people (or resources) and where could your impact be deepest? You will create higher shared value by widening the focus of your ESG and Sustainability lens to your customers rather than only focusing inwards on your employees.

- you can influence: The unique ability of financial institutions to influence customer's actions means you can genuinely drive change in the real economy. You can use your position and influence to help them make more sustainable decisions, for example, by offering grants for your mortgage customers to retrofit their homes with solar panels.

Has your organisation fallen into any of these pitfalls, or is it at risk of doing so in the future? If you want to understand how to genuinely embed ESG into your core business strategy, avoid claims of greenwashing and achieve real impact, contact us to discuss how we can help you on this journey.

Sources:

- BBC

- Cop26

- FT

- FCA

- Gov.uk

- Global Web Index

- Greenpeace

To find out more about how we can help you, please contact us.

Related Insights

Future-proofing climate disclosures: Leveraging climate reporting for nature

Forward-thinking companies are integrating climate and nature into their strategies to drive innovation and resilience.

Read more

Transition planning in turbulent times: How financial institutions can adapt and lead

The shift to a low-carbon economy is challenging for financial institutions; we explore how they can adapt and lead in today's tough landscape.

Read more

Simplification Omnibus: what you need to know and where to go from here

We share what the Simplification Omnibus means for CSRD, CS3D and the EU Taxonomy and how you should respond.

Read more

2025 Outlook: What lies ahead for climate and sustainability in financial services?

Here's what's front of our minds for 2025 based on our dialogue with, and work for, climate and sustainability leaders across financial institutions.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?