Drive sustainable cost transformation, while delivering growth

1 November 2022

The recent macroeconomic landscape has been challenging for the financial services sector: the pandemic has tested organisations’ operational resilience; rising global inflation rates have caused market volatility; and the geo-political environment continues to be uncertain. All of this has resulted in a more cautious market, which in turn has led to less client activity and lower revenues.

With the anticipated deteriorating economic conditions and expected recession, this challenge is expected to grow more severe. As the cost of business looks set to increase, organisations need to act fast in the face of these industry headwinds to be competitive, while at the same time maintaining a focus on operational efficiencies, simplification, and cost management.

Previously, organisations have taken numerous actions to address costs, including workforce reduction and relocation; changes to the location footprint; process automation, as well as exploring vendor outsourcing and utility models. However, the cost reduction benefits realised have often been insufficient and difficult to sustain. While cost optimisation programmes have a reputation for overpromising and underdelivering, managing costs effectively can be achieved through developing a cost-conscious culture with associated behaviours, focus on sustainable, long-term solutions, and priority in-year objectives.

Our Cost Optimisation Framework

We believe there is only one way to deliver sustainable cost reduction that does not stifle the ability to grow. Our forensic data-led and holistic approach to cost management focuses on developing strong internal capabilities and addressing three key strategic imperatives:

This framework helps organisations alleviate short-term financial pressure by reducing costs and rebuilding targets, driving sustainable reduction in the cost base through a shift in accountability and ownership of costs, transforming the operating model and creating a cost-resilient business.

1. Alleviate Short Term Financial Pressure

- Identify levers that require minimum investment and time to implement

- Drive in-year cost savings to reinvest in long- term transformation

- Define transformation waves to prioritise capital reinvestment into strategic areas

2. Drive Sustainable Reduction in the Existing Cost Base

- Make operational changes to sustainably reduce operating costs

- Identify and implement levers that can also help to increase revenues

- Optimise processes and embed incentives to drive cost ownership

- Adopt a multi-year cost optimisation programme including a benefit tracking mechanism

3. Transform the Operating Model

- Prioritise more transformative change across the operating model, including locations, technology, and sourcing changes

- Deliver the new strategic ambition to enable cost agility and future resilience

- Embed a culture of continuous improvement in teams, not a “one and done” exercise

Optimisation levers

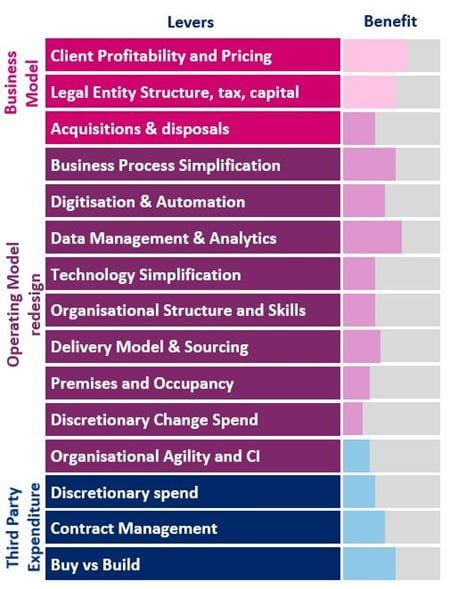

To effectively deliver on a sustainable cost transformation strategy, organisations should address short term cost targets, while future-proofing the operating model to enable profitable growth. This will require reducing the addressable cost base and increasing business revenues using a combination of optimisation levers, rather than applying levers in isolation. We categorise optimisation levers around three objectives:

- Future proof the business model by identifying underperforming business units to reduce activity and focus on profitable business units. This includes evaluating business activity across legal entities and identifying any necessary disposal of entities/units

- Streamline the operating model by focusing on levers that target the simplification of processes and technology to drive down costs. This includes adapting how you use existing technologies to create automated processes, optimising workforce strategies, and using data analytics to prioritise and remediate cost challenges

- Reduce third party expenditure through renegotiation and consolidation of third-party contracts, enforcing an increased governance on spend, and evaluating in-house or out-sourced solutions

Critical success factors

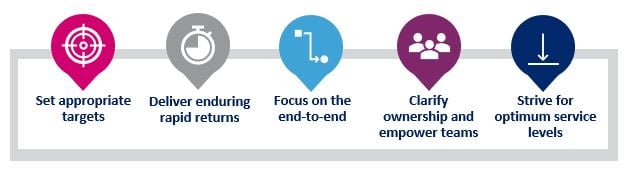

We have identified five key success factors that will drive sustainable change to a bank’s cost baseline:

- Set targets based on external data and a clearly defined vision, not arbitrary figures based on internal benchmarks. Ensure a link with business strategy – strategy must lead cost reduction targets and address drivers of cost that will not destroy value

- Balance in-year benefit levers with more transformative change. Focus on savings which can be permanently removed from the business, not just deferred, to recognise the short-term imperative.

- Focus on the end-to-end view across the value chain. Don’t track savings based on accounting treatment or a functional view – ensure total expenditure and cost reduction initiatives are tracked at an enterprise level, so that costs are eliminated rather than moved from one area to another.

- Set clear accountability from the top to ensure consistency in purpose and direction, with a focus on people empowerment and culture. Upskill teams and incentivise them to transform the enterprise cost base and maintain ongoing focus on cost management and continuous improvement

- Apply zero-based budgeting (ZBB) principles and move to a minimum viable cost base by assessing services and agreeing the appropriate service level and associated cost

At Baringa Partners we support our clients to embed sustainable cost transformation by bringing deep expertise across the optimisation levers as part of an initial diagnostic phase, as well as providing delivery execution expertise to support the full transformation lifecycle.

We work in partnership with our clients to build internal capability and drive adoption of a continuous cost and benefit management culture. Creating effective self-funding programmes that build from quick wins into sustainable mid-to-long-term transformation.

If you would like to speak to us about your cost agenda and find out how we can support you on your journey, please contact Lucine Tatulian, Ben Monks, Aghil Ameripour or Leticia Fernandez del Castillo

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?