Rewiring supply chains for tariffs and the new world of trade uncertainty

6 min read 28 April 2025

Global trading tariffs are being upended, and companies have the choice of fight, flight or freeze.

In Baringa’s experience, many business leaders have opted to freeze, hoping that, eventually, clarity over long-term global trading arrangements will appear, after which their firm can respond.

But such freezing is a huge risk, for two reasons.

Firstly, in the short term, recent experience suggests greater clarity may not appear – and where it does, failure to plan as early as possible has resulted in higher costs. Secondly, recent volatility in the global trading environment may be a long-term trend rather than a short-term blip, meaning businesses should now be preparing supply chains for permanent agility, not just for one-off tweaks to trading arrangements.

Below we discuss the context for these changes, before giving three steps firms should take to prepare their supply chains.

Status quo bias

Baringa argues that many business leaders are suffering from a “status quo bias” – the assumption that, because their career has played out amid a stable or slowly-liberalising trade environment, any disruptions to global trade are just temporary departures from a static system, and afterwards normality will return.

This is a dangerous assumption. To understand why, it helps to take the long view.

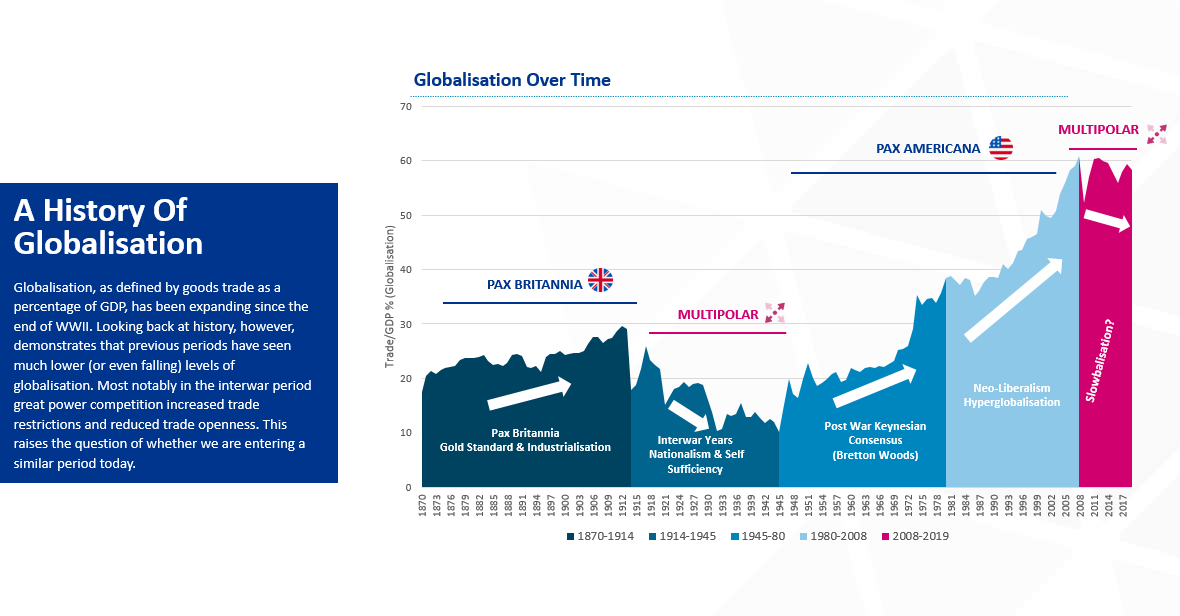

Since the late 19th century, globalisation and trade have moved through distinct phases, including at least one where international trade shrank.

History proves that global trading environments are not a steady state – or even a constant evolution. Abrupt changes and reversals are possible – and the deglobalisation and uncertainty ushered in by Brexit and Trump may either be a temporary tweak or a new long-term pattern. Smart firms should prepare now for both scenarios.

Consumers have no more to give

At the same time, firms need to deal with the tough reality that consumers can no longer bear the brunt of such changes.

Households across developed markets have experienced years, sometimes decades, of stagnant real income growth, culminating more recently in a cost of living crisis amidst high inflation and debt servicing costs. In effect – as Baringa’s Price Sensitivity Index shows - the consumer market can be considered saturated, and firms who attempt to pass on tariff costs to consumers risk losing market share. As a result, companies are now having to address inefficient and under-invested areas of their operations; starting with re-wiring their supply chains.

This has three parts: visibility, flexibility and capital.

1. Visibility Informs Agility: Build A Robust Understanding of Your Supply Chain

Tariffs have a uniquely complex effect on global supply chains. Firstly, the effects can be felt in both directions – on goods and services companies buy, and on the goods and services they sell. Secondly, the complexity of our interconnected world ensures tariff situations are equally complex – for example when a product purchased directly by one firm subject to one tariff rate contains sub-components from firms subject to another.

To develop supply chain agility – whether for single adjustments to one-off tariff, or dynamic adjustments over the long-term – the first step is supply chain visibility.

For example, in the past year Baringa has mapped the supply chain for a Europe-based global media company. We were able to identify where they were exposed to cross-border risks from tier one US suppliers, especially whose own supply chains were subject to significant tariff impacts. Unchecked, this exposure would have translated to a 10-20% increase in their physical product costs, in turn driving down their sales. But with visibility of their cost and operational risks, they had time to generate scenario plans to switch supplier firms and locations in order to protect their market share.

As a smart starting point, we recommend companies map their current maturity in handling product classifications, navigating rules of origin regimes, and scrutinising landed costs. This assessment will tell you where you have tariff exposure across your upstream supply chain by product category, supplier geography, and end customer region.

This work should both take a snapshot of current costs, and forecast how those costs might shift under different trade scenarios – whether due to new tariffs, trade agreements, or export controls. Add product volumes, profit margins, and the strategic importance of each item, this data becomes a powerful decision-making tool. Ultimately, this helps to pinpoint where to focus first to design smarter interventions that protect both cost and continuity.

For industries like consumer goods, pharmaceuticals, and automotives where global R&D and Intellectual Property structures are common, it is essential to pair supply chain assessments with financial and legal reviews. Evaluating the location of IP, transfer pricing mechanisms, and legal entity structures can help avoid costly misalignments and ensure that financial strategies evolve in step with operational realities.

Tasks for business leaders:

|

2. Partnership for Flexibility: Pick The Partners That Allow You To React Fast

Supply chains involve partnerships. Companies rely on an ecosystem of clients, suppliers and advisors. All of these must be audited to ensure they are the right stakeholders for all realistic trade disruption scenarios.

Most obviously, chosen suppliers should be subject to the fewest possible tariffs, and ideally should have the flexibility to respond to tariffs by moving production to a different location with the minimum of fuss. The risk management benefits of such agile suppliers should often outweigh any financial premium.

Secondly, while many companies’ business models rightly prioritise developing in-house knowledge, the current (and possibly long-term) uncertainty over the world’s trading environment means fundamental changes may be required far too quickly to develop the in-house capacity required to respond. For full agility, international firms should have partners who can provide immediate advice on relevant topics, including procurement advice, sustainability advice, accountancy and tax advice and compliance.

For example, partnering with customs and international trade specialists can provide immediate value by ensuring accurate classification of goods under the Harmonised System (HS) or Harmonised Tariff Schedule of the United States (HTSUS). This is not just a compliance checkbox; getting classifications right can unlock meaningful cost savings. A single correction on a high-volume SKU could reduce exposure to double-digit tariffs, improving margins at scale. But the skillsets of such advisors is so specialised, and the speed at which they are required might be so immediate, that there is not often value from putting them onto the permanent payroll.

Tasks for business leaders:

|

3. Redirect Capital Investment Strategies with Purpose

Greater agility means less predictable capital requirements, so companies should review their capital strategies to enable faster decision-making.

As a result, companies wishing to weather the storm must have the cash reserves to pay for it. For example, a maker of international products may now face a much higher possibility of having to pay for emergency air freight or more expensive alternate routing in order to maintain stocks and customer commitments.

In turn, this means auditing all planned initiatives, and scaling back those deemed non-essential.

Others may decide to seize the moment as an opportunity to gain first-mover advantage, exploring ways to regionalize production, relocate key parts of their supply chain closer to end markets, or capitalize on government incentives for domestic manufacturing. These moves may involve significant capital outlay, but they also position the business to reduce long-term risk and increase agility in the face of ongoing trade disruptions.

Additionally, companies might opt to accept short-term cost increases (such as higher input prices) by expanding and diversifying their supplier base. This strategy sacrifices some efficiency for the sake of greater resilience, insulating operations from future shocks.

Finally, some organizations may decide to take a more structural approach and embed tariff strategy into product development cycles. This could involve conducting SKU-level range reviews or incorporating country-of-origin and cost-of-trade considerations into R&D and innovation planning from the outset. By making tariffs a core design constraint, companies can build products and portfolios that are not just competitive but also trade-resilient.

Tasks for business leaders

|

Beyond these first activities, there will be longer-term decisions needed on the redesigning of entire supply networks, shifting corporate entity structures, and investing in AI for trade automation. Whilst these may be necessary for future-proofing, they need the right thinking-through especially as premature overhauls can overwhelm or distract from existing operational priorities.

What is urgent now is improving insight, transparency and optionality. In an era of uncertainty and fast-moving policy, companies that wait and see will pay more, move slower, and risk being left behind.

Looking for more insights or advice? Contact one of our Supply Chain experts using the links below.

Our Experts

Q1 2025: Five key insights from the Baringa UK Consumer Spending Outlook: Who's gaining, getting squeezed, or treading water?

In this article, we draw on the latest insights from our model to reveal five trends that will set the tone for consumer products as well as retailers and CPGs in the year ahead.

Read more

Turbocharging the supply chain

Why network operators are investing in this capability to support the next wave of growth and innovation (and what to focus on now)…

Read more

How can a digital supply chain drive resilience in the age of the digital energy transition?

Four key areas where we believe digital technologies have the greatest potential to transform the performance, profitability and resilience of supply chains navigating the energy transition.

Read more

Going beyond carbon: sustainable value chains

Clients, thought leaders and trailblazers across multiple industries joined us for a discussion on the future of green business practices.

Read moreIs digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?