What might a reformed GB national power market look like under REMA?

8 min read 1 July 2025

Three years ago, the UK Government launched the Review of Electricity Market Arrangements (REMA): a review of the case for change to futureproof Great Britain’s (GB) electricity market in the context of the energy transition.

Now a key decision is imminent. Will we move to a zonal wholesale electricity market, with different regional prices across GB, or will we retain the single national price?

The potential move to zonal has been the focus of intense debate – but a decision in favour of a national price market is not a decision in favour of the status quo.

A reformed national market is likely to include significant changes to current market arrangements, with material impacts for market participants.

Stronger locational network charges and central planning will be required to influence location of new assets

Strategic planning is due to play a more significant role regardless of the upcoming decision on REMA – but in a reformed national market, centralised strategic planning and policy, including the Strategic Spatial Energy Plan (SSEP) and connections reform, are likely to be even more important. With this comes increased regulatory risk, and projects not considered ‘strategic’ will likely find it harder to get connections and planning consent.

This is likely to be in addition to sharper locational investment signals through network charges, expected to be introduced as part of a reformed national market. Changes are expected to both connection and use of system charges:

- Charges for connecting to the network are likely to become deeper and more reflective of the related long-term network costs. Connection charges can be an effective way of influencing new investment siting decisions and avoiding impacts on existing assets, as they only apply to new assets and are fixed at the point of connection, thereby providing a stable long-term investment signal.

- Locational network ‘use of system’ charges (ie Transmission Network Use of System (TNUoS) charges) may also be strengthened, alongside reform to increase predictability such as basing charges on a more forward-looking network design. However, since TNUoS charges affect existing as well as new assets, it may be considered preferable to limit the use of TNUoS to send locational signals.

Non-firm access rights are also on the table – currently only being considered for new storage assets, but this could evolve to a broader non-firm access right regime with interruptible connections being offered as an option for other new and potentially existing assets, in exchange for a discount on higher network charges.

Location-specific ‘demand credits’ may be included in any comprehensive charging reform that sharpens locational investment signals. This may range from flat credits for demand locating in areas that help reduce network congestion to profiling the credits to explicitly reward demand that has the ability to ‘turn up’ during congested periods.

Reforms to the Balancing Mechanism and system services markets are crucial to improving operational efficiency

Redispatch volumes and costs have risen substantially over the past five years, and are likely to continue to rise as the pace of deployment of wind and solar generation is expected to exceed the growth of the transmission network.

Under a reformed national market, the system operator will continue to play a key role in re-dispatching assets through the Balancing Mechanism (and other system services markets) to manage network constraints – since these will not be reflected within the wholesale market.

Balancing Mechanism reform will therefore be required to minimise the expected increase in redispatch volumes and costs.

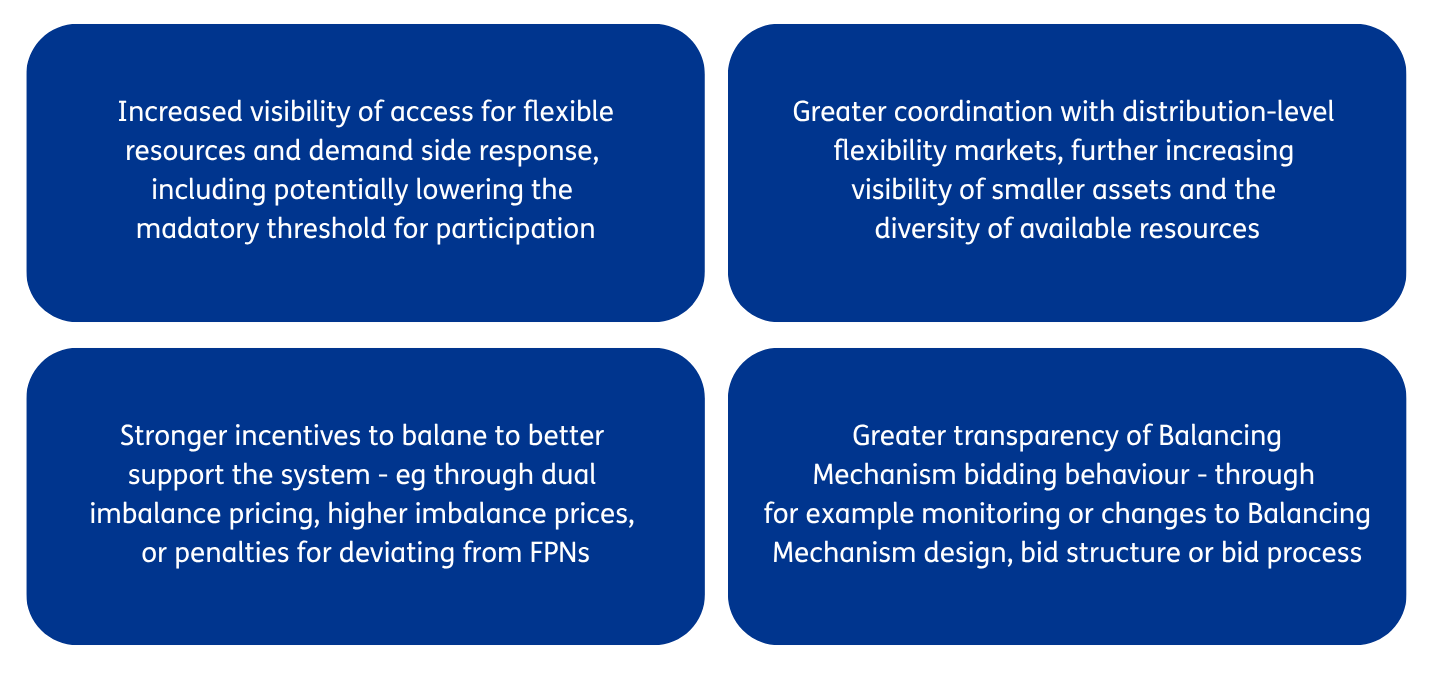

For market participants, this will likely mean:

- Incentives to balance and provide more accurate notifications strengthened where it can be demonstrated that this could improve the operational efficiency of the system. Reforms could include a return to dual imbalance prices, higher imbalance prices through changes to the pricing methodology, or penalties associated with deviation from the Final Physical Notification (FPN) position.

- Reduced ability to earn inframarginal rent (revenues above marginal cost) within the Balancing Mechanism, through greater transparency and market monitoring and changes to the design, bidding process or bid structure of the Balancing Mechanism. This includes the removal of subsidies from BM bids/offers, as proposed in the P462 code modification (further details below).

- Increased opportunity to access value for a wider range of assets, by reducing the size threshold for mandatory participation and allowing aggregators of small assets to participate in the Balancing Mechanism.

Efforts will also focus on improving system operation efficiency. This is likely to include increasing visibility of smaller assets and the diversity of available resources, as well as the use of digital technologies, AI, automation and algorithms to improve the efficiency of redispatch.

There could also be a reduction in the length of settlement periods in the wholesale market (from 30 minutes to 15 or even 5 minutes) to improve the granularity and accuracy of traded positions – especially given the reset of relations with the EU, which applies a 15 minute imbalance settlement period.

In the longer term, further reforms that seek to increase the system operator’s oversight and control of the physical market may be required if redispatch volumes and costs remain high. This may need to include re-considering a form of centralised dispatch and scheduling. While the government has effectively ruled this out under the REMA programme, the NESO has yet to publish its quantitative findings on expected cost savings from such reform. If the benefits are found to be substantial, this may become a springboard for revisiting central dispatch as a reform option in the future. However, there may be concerns that an increased role for the system operator means a reduced role for the market – and the efficiency of the system operator’s allocation may be harder to scrutinise.

Multiple interventions will be required to promote greater demand-side flexibility

An affordable energy transition will necessitate greater demand-side flexibility, and sending the right locational time-of-use signals to increasingly flexible demand will be a challenge under a national market where wholesale prices do not reflect the local supply and demand situation.

To address this, we expect several additional interventions will be required, potentially including:

- Greater procurement of demand-side services through NESO-led local constraint markets, targeting flexibility assets unable to participate in the Balancing Mechanism and using these to proactively help manage constrained boundaries across the network, implementing learnings from the current local constraint market trial focusing on the B6 Scotland-England boundary.

- Greater procurement of demand-side services through DSO-led local flexibility markets and using that flexibility to address a wider range of network and system needs as we argue in our forthcoming paper on the Future of Flexibility on the Distribution Network.

- Incentivising demand to locate in areas of excess renewable generation via long-term availability contracts (and compensation for turn up during periods of network congestion), as envisioned through the 'Demand for Constraints' scheme under consideration by the NESO (see the NESO’s Constraints Collaboration Project page for the latest).

Effective coordination across these disparate market mechanisms will be critically important if they are to deliver positive outcomes.

Stronger locational investment and operational signals may be needed in low carbon support schemes

Ambitious targets for renewable and low carbon generation investment under Clean Power 2030 risk increasing costs of procurement through the Contracts for Difference (CfD) and other schemes if projects in ‘unfavourable’ system locations with higher connection and use of service network charging set the price in scheme auctions providing inframarginal gains for cheaper projects.

Introducing locational elements into renewable and low carbon support schemes might be necessary – for example, having separate CfD pots for different regions, or changing the clearing algorithm to reflect system value rather than purely strike price – further reinforcing the move towards greater centralisation in system planning.

Reform that aims to reduce market distortions associated with renewable generation procured through the CfD will also likely be needed.

The current CfD design distorts various markets – day ahead, intraday, Balancing Mechanism and ancillary services – due to the strong incentive to maximise output at all times except when day ahead prices are negative.

Under a reformed national market, changes are likely to be required to reduce these distortions. These could include:

- Removing CfD top-up payments from Balancing Mechanism bids for CfD-supported generators, as proposed under code modification P462.

- De-linking CfD payments from output at times of high renewable generation, to avoid distortions between the forward, day ahead and intraday markets and ensure that dispatch and provision of system services reflects genuine short-run marginal costs. This could be achieved through a range of mechanisms, such as ‘deemed’ CfDs (ie top-up payments calculated based on available rather than actual generation volumes), capacity-based CfDs, partial CfDs, or reference price reform (eg using forward or average power prices, as is being considered in Denmark, which would also support market liquidity).

Regardless of the immediate direction of reform, flexibility around the location and timing of generation will become increasingly valuable – as we argue in our previous post on REMA and investing in the GB power market under uncertainty.

Closer cooperation with the EU on cross-border balancing may be the key to more efficient interconnector flows

Under the current interconnector trading and operation arrangements, national price signals often lead to interconnector flows that exacerbate system stress and increase balancing costs – such as imports into GB regions with excess renewable supply (where a high national price doesn’t reflect a local excess of renewable generation), or exports from regions with high thermal generation (where a low national price does not reflect a local shortage of renewable generation).

The Government’s initial review focused on strengthening current tools (such as counter-trading by the GB system operator) for managing the impacts of interconnector flows on constraints and constraint costs – though in its REMA autumn update, the Government stated that the potential of these tools to improve interconnector flows is likely to be limited.

However, at the UK-EU summit in May 2025, the Government announced it had agreed to closer co-operation with the EU on energy, including exploring participation in EU electricity trading platforms. This may end up limiting the effectiveness of current tools but could open up participation in cross-border balancing platforms, helping to reduce the cost of managing network constraints.

This, alongside linking the UK and EU Emissions Trading Schemes, could help unlock more of the benefits of interconnector flexibility for the GB system. But, this is less likely to be effective than locational price signals reflecting network constraints and regional fundamentals, as cross-border balancing needs to consider system needs in neighbouring markets as well as GB and as such is rarely able to support full reversal of interconnector flows in practice – and cross-border balancing actions still incur a cost.

Reform will be an ongoing process and will require strong coordination

Given the wide-ranging nature of reforms required and the need for coherence and efficient implementation to give investors confidence, coordination will be necessary and could benefit from the oversight of a central ‘design authority’.

As highlighted in our previous post on REMA and investing in the GB power market under uncertainty, we expect market and policy reforms to continue as the power system becomes increasingly dominated by weather-dependent generation. Continual reform is more likely to be the norm under a reformed national market.

In the long run, if reforms are not able to deliver an affordable and secure decarbonised system on an enduring basis, more radical reforms such as zonal pricing or centralised dispatch and scheduling may need to be revisited.

Baringa is best placed to help you understand the impacts of a reformed national market on your business and investment strategy. Contact Alex Weir, Sarah Keay-Bright or Chris Kavanagh to find out more about REMA, what it means for you, and how Baringa can help.

Our Experts

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?