Dissecting the REMA decision

8 min read 11 July 2025

Three years in the making, the Review of Electricity Market Arrangements (REMA) decision has now been published: the UK Government has decided to retain the national wholesale price.

But, as we noted in our previous article on what a reformed national market might look like, a decision in favour of a national wholesale market is not a decision in favour of the status quo. Change is needed and inevitable.

Stronger locational investment signals through centralised strategic planning will be at the heart of a reformed national market

More details on the reformed national market design package and its implementation are due to follow later this year, but the Government’s vision for a reformed national market that focuses on a more coordinated and strategically planned electricity system is emerging.

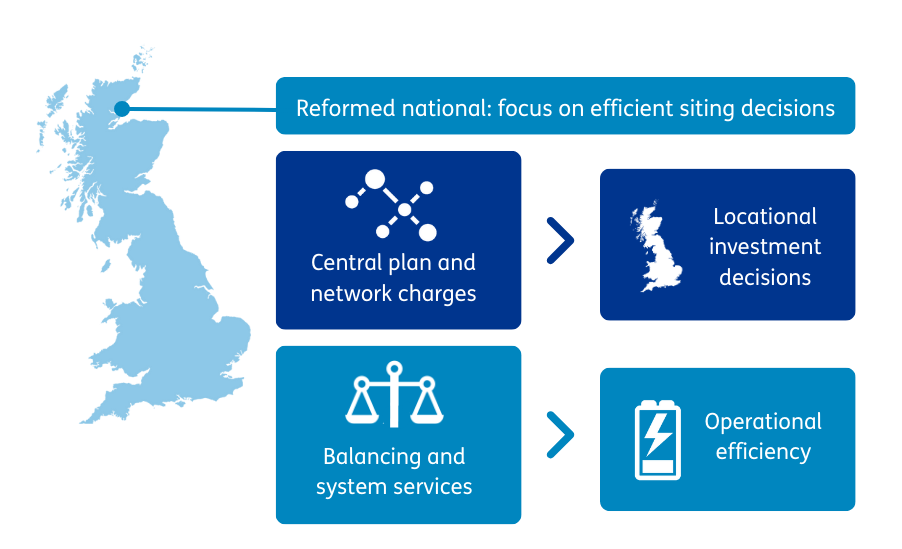

To deliver this, the reformed national market design will include:

- Stronger locational investment signals for new assets that better reflect the relative system value of investing in different locations, through a combination of network charging and centralised strategic plans that feed into policy levers such as planning permission and connection application outcomes, as outlined in our recent article 'What might a reformed GB national power market look like under REMA?'. Interactions between strategic planning and network charging will need to be ironed out – and this will require strong coordination between the government and its partners. We expect more detail on this in the upcoming delivery plan later this year

- A greater focus on providing investor certainty around locational investment signals by reforming transmission network charging to make annual ‘use of service’ (TNUoS) charges more predictable

At this stage, it is unclear how the latter will be done in practice. We understand that Ofgem intends to publish imminently to provide more clarity on the principles that they will follow in delivering charging reform – but limited detail is expected on what options are on the table. Recent public engagement from Ofgem on the topic (such as at the Charging Futures forum in June) suggests that reforms to improve TNUoS predictability will range from deepening connection charges to reduce costs socialised through use of service charges, to focus on the stability and predictability of charging model inputs as suggested by the TNUoS Taskforce – and greater alignment between charging model inputs and centralised strategic spatial plans could support this objective and help ensure that long term locational signals are stable.

More radical reforms of cost drivers in the TNUoS methodology are also likely to be on the table. Against this background, Ofgem appear minded to reject options that directly address predictability by trading-off cost reflectivity and cost recovery such as a ‘cap and floor’ on generation charges that had been proposed (see Minded-to decision on CMP444).

Improved network charging predictability is presented as a key lever for derisking investment and lowering system costs – but regardless of how this is implemented, outturn network costs and investment in network or generation/demand assets may sometimes differ from the forecasted plan and those exposed to differences between expected and outturn costs may face additional risk.

Overall, this indicates that uncertainty around network costs still remains for renewable generation asset owners and developers bidding in the upcoming AR7 Contracts for Difference (CfD) auction. Protections are not likely to be provided, with the Government stating that “it is our view that there is no need for legacy or transitional arrangements […] ahead of AR7” – though Ofgem may consider market-wide transitional arrangements should TNUoS reform deliver significant changes.

Figure 1: The government’s reformed national package includes a strong focus on measures to promote more efficient siting decisions for new assets

Balancing and settlement reform will complement stronger locational investment signals

Stronger and more stable locational investment signals for new assets – and accelerated and coordinated anticipatory network investment in line with these signals – will take time to improve outcomes for the system and lower costs for consumers.

So alongside these measures, the envisioned reformed national design also includes a continued focus on operability and improving how generation and network assets are utilised (including technical measures for increasing the flow of electricity over network boundaries under consideration as part of the NESO’s Constraints Collaboration Project), and measures seeking to improve operational efficiency though reforms to the Balancing Mechanism (BM) and settlement.

This includes:

- Reforms that aim to improve the visibility of and access for small assets including demand-side flexibility, such as lowering the mandatory BM participation threshold

- Reforms that aim to give the NESO more certainty around final traded and notified positions such as aligning the market trading deadline with gate closure and introducing incentives to ensure that physical notifications match traded positions – and introduce stronger incentives to self-balance for market participants

- Reforms that aim to reduce the cost of BM actions, through greater transparency and market monitoring, which at the extreme may be supported through unit-level bidding in wholesale markets, as proposed in the Government’s decision document.

- A potential move to shorter settlement periods that touches upon multiple of the above objectives – aiming to reduce energy imbalance volumes managed in the BM by increasing granularity of traded positions in the wholesale markets.

We explored what these might mean for market participants in our recent article 'What might a reformed GB national power market look like under REMA?'.

These reforms are likely to be complemented by the implementation of the 'Demand for Constraints' scheme under consideration by the NESO (see the NESO’s Constraints Collaboration Project page for the latest), as well as wider interventions to promote greater demand-side flexibility.

Overall, the BM reform options under consideration are not explicitly focused on redispatch volumes and costs linked to the mismatch in the pace and location of deployment of wind and solar generation versus the growth of the transmission network that has existed historically (and is expected to persist for a period in the near term). Rather the Government decision focuses on improvements in system operation efficiency more widely – and states that “the right solution to these transitional constraints is to accelerate the pace and scale of grid build-out, and to ensure the optimal siting of new generation” rather than seeking to explicitly reform market design to address this.

In this context, reforms such as a reduction in the length of settlement periods seeking to improve the granularity and accuracy of traded positions and dispatch vis-à-vis national time of use price signals are more likely than reforms that strongly differentiate operational signals in different locations across GB.

The decision also includes a nod to measures that could improve interconnector flows, including closer cooperation with the EU on cross-border balancing. We explored what this may mean in our latest article 'What might a reformed GB national power market look like under REMA?'. Such closer cooperation may also make a move to shorter 15-minute settlement periods more likely.

CfD and Capacity Market (CM) scheme reforms are key aspects of the overall market design that will also need to be progressed in parallel

The Government’s announcement did not cover potential reforms to the CfD or CM schemes.

Retaining a national wholesale market price is likely to make reforms to these schemes more necessary: in a national market, notwithstanding BM and settlement reform, the cost of locating at the ‘wrong place’ from a system perspective is higher.

Proactive alignment between CfD and CM schemes and locational investment signals through charging and centralised planning will be critical in this context.

While this is not explicitly being considered at the moment, it remains possible that introducing locational investment signals into these schemes will become necessary if other levers are not sufficiently effective at aligning investment with system needs.

Broader reform to CfD and CM schemes is also expected – ranging from reform that addresses dispatch distortions inherent in the CfD (such as code modification P462 and highlighted in the Government’s decision) to reform addressing longer-term trends, such as the changing nature of stress events that will CM procurement will need to address.

Our Experts

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?