Over the past year, our Technical Advisory team have advised on some significant energy-infrastructure transactions including advising on what will be Europe’s largest operational battery energy storage system (BESS) - AXA IM Alts enters UK battery energy storage sector; renewable energy assets across Europe; sell-side mandates for flexible power infrastructure in Great Britain; and a P2X development platform in Spain - KKR and IGNIS announce partnership to develop green hydrogen, ammonia and other green technologies in Spain. We have provided policy and strategy advice on interconnectors, the likely costs of hydrogen-to-power projects, industrial decarbonisation and helping our clients to assess the residual value of their infrastructure.

What are we seeing in the technical advisory space?

From a technical perspective, we are always focused on areas of value, to align with our clients’ interests: whether that is the assessment of life extension or repowering for onshore or offshore wind, validating the credibility of a development pipeline of renewable-energy projects, or challenging yield assessment assumptions.

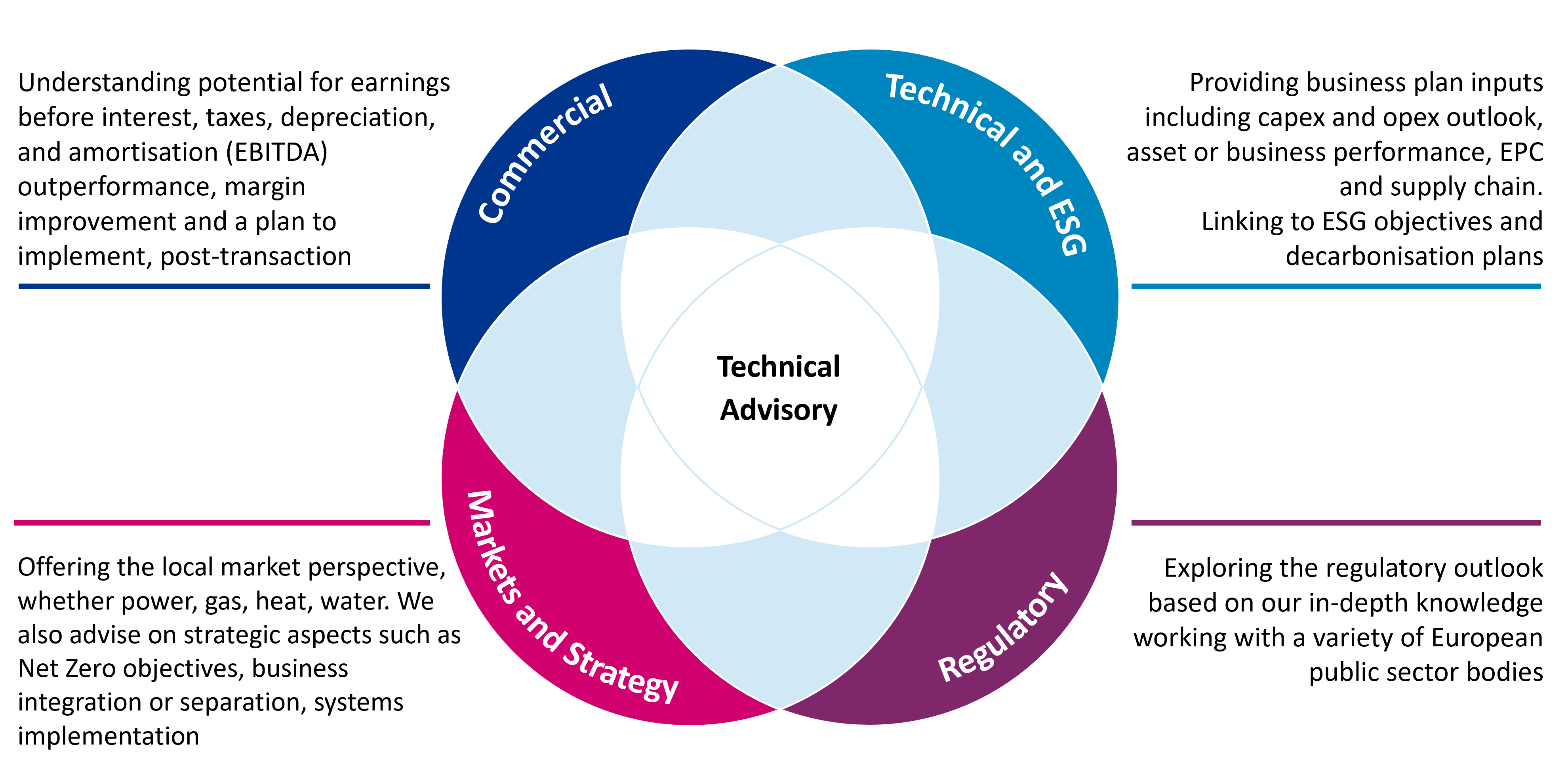

From a broader M&A perspective, in the last 2-3 years, we have been seeing developers scaling from operating assets at MW-scale to developing pipelines of GW’s. To continue to build their portfolios, developers need to access more capital and to build larger organisations. Consequently, many are looking to partnerships and M&A to scale further. This is where we come in: our integrated technical advisory capabilities, alongside our commercial and market expertise at Baringa are a key to providing value in either a sell-side or buy-side role.

From a sectoral perspective, in the past few years, there has been a move away from what was seen as core and core-plus infrastructure, particularly water and gas utility networks. Infrastructure investors are increasingly more interested in the energy transition - we are seeing many more renewable energy transactions. Notably, over the last 12 months, we have seen an uptake in transactions with batteries co-located with wind or solar – particularly in the GB energy market, but with a growing interest in other countries, for example in Spain and Germany.

There has been a recent trend back towards natural gas, which had been shunned for a while by investors, but is increasingly seen as a transition fuel, crucially important for security of supply. Infrastructure such as liquified natural gas (LNG) storage/ regasification has been a asset-class with high-interest in the past 12 months.

At Baringa, we are in the unique position to be able to offer integrated services, combing expertise across the value chain in the energy space, so you get a joined-up service.

Key clients and projects we are working on include:

- Renewables developers and IPP’s who are looking to raise capital and build capability

- Data centre growth, having a global impact on demand for specialist technical and commercial insights, including those related to highly resilient power supplies and grid connections

- Assessment of the availability, timing and cost of grid connections and broader grid resilience, including assessment of alternative, low-carbon options

- Offshore wind challenges: as global projects continue to see supply-chain and commercial viability challenges

- Hydrogen projects also continue to be commercially challenging, but there is still a strong policy push across Europe for hydrogen infrastructure as a long-term objective, and in biogas/ biomethane where interest in acquiring portfolios of assets has been very strong.

How can we help you?

Techno-Economic Assessment |

Business Plan Review |

Technical Due Diligence |

|

We advise on the techno-economic assessments of a wide range of energy and resource infrastructure, for investors or developers who are looking to make critical investment decisions. We inform policy makers understanding on underlying commercial decisions (capex, opex, performance), answering 'would this investment make sense for rate-payers?'

|

When you work with our market and commercial experts on the revenue and regulatory outlook for an investment, our Technical Advisory team provide you with the “ground-up” assessment. We help you understand: what will it cost to build, operate and maintain, how long it will take to build and who could do that for you.

|

We have decades of experience providing infrastructure M&A technical due diligence. We have advised on more than USD $100bn of successful transactions. We can provide you with an in-depth review at any stage, from early development or at the ready-to-build stage, operational assets, in buy-side, sell-side and take-private opportunities.

|

|

Value-Focused Insights |

Lifecycle Cost Outlook |

|

We apply a business-plan lens when advising potential investors in an M&A environment, starting with an understanding of the key revenue and value-drivers for a business. We advise on optimising asset management and O&M strategies to maximise operational performance, reduce costs, and enhance long-term asset value.

|

We add value to Baringa’s established Market Reports by providing additional technical insight for the expected costs of future energy infrastructure, supply chain constraints and other market dynamics. When considering energy-market outlook, our knowledge on levelised costs, learning rates and supply chain constraints are critical inputs to these scenarios. |

Work with us for integrated, commercially-focused energy services, with our Technical Advisory team embedded at the core:

Our experts

Is digital and AI delivering what your business needs?

Digital and AI can solve your toughest challenges and elevate your business performance. But success isn’t always straightforward. Where can you unlock opportunity? And what does it take to set the foundation for lasting success?